Get the free Emergency Loan Deferment Request

Get, Create, Make and Sign emergency loan deferment request

How to edit emergency loan deferment request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out emergency loan deferment request

How to fill out emergency loan deferment request

Who needs emergency loan deferment request?

Emergency Loan Deferment Request Form - How-to Guide Long-Read

Understanding emergency loan deferment

Emergency loan deferment is a financial option that allows borrowers to temporarily postpone their loan payments during unforeseen circumstances, such as job loss, medical emergencies, or other financial hardships. This solution is particularly beneficial as it provides immediate relief, preventing borrowers from defaulting on their loans and protecting their credit scores.

The purpose of deferment is to provide a safety net for borrowers facing unexpected financial challenges. By availing deferment, borrowers can restructure their finances without the stress of monthly loan payments. It is crucial, however, to understand the implications of deferment, including any accrued interest that may increase the total amount due once the deferment period ends.

Eligibility criteria for emergency loan deferment

Eligibility for an emergency loan deferment largely hinges on the terms set forth by the loan provider. Different loan types, such as federal student loans or personal loans, may have varying requirements. Generally, borrowers must demonstrate a valid reason for requesting deferment, backed by documentation that clearly outlines their current financial situation.

Typical eligibility criteria may require borrowers to be in good standing on their loans prior to the deferment request. This means that borrowers should not have any delinquent payments. Furthermore, documentation proving the cause for deferment—such as medical records for health-related issues or unemployment letters—could be necessary to support the claim.

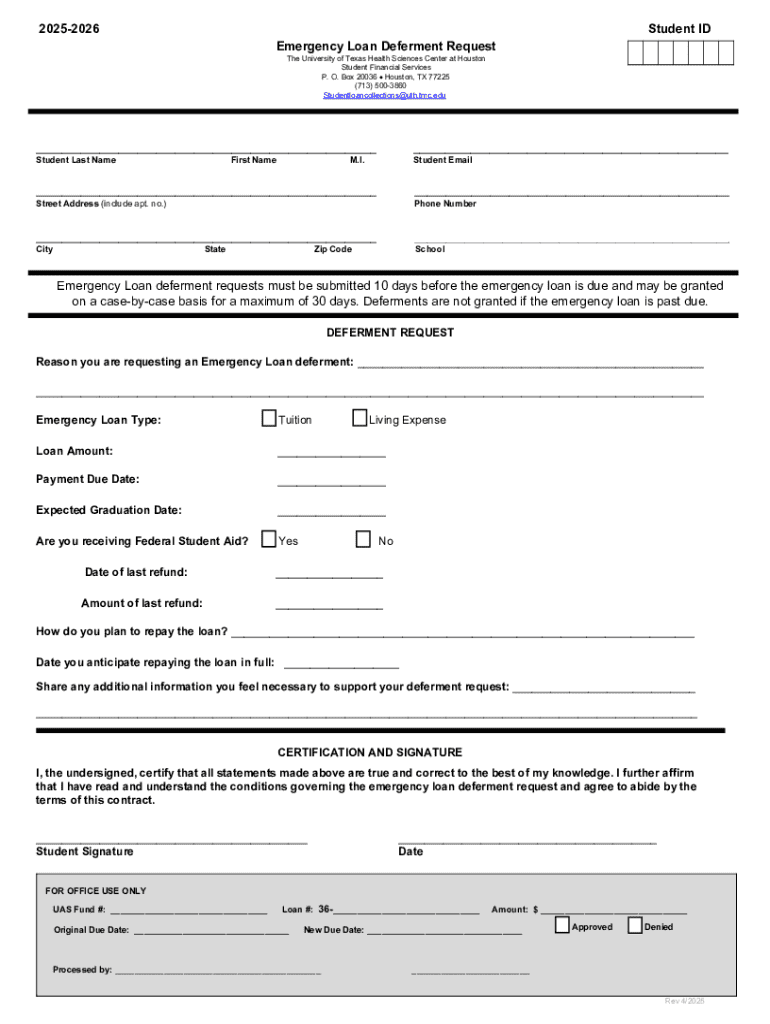

Preparing your emergency loan deferment request

Before you fill out the emergency loan deferment request form, ensure you have identified the correct form based on your loan type. Most lenders provide a standardized request form that outlines the necessary details and steps involved in the process. Having the right form will make the rest of the process smoother.

Gathering the relevant information prior to filling out the form is critical. You will need to include personal details, such as your name and address, alongside specific information about the loan, including the loan number and payment history. Furthermore, clearly outline your current financial situation with supporting documents such as bank statements, income statements, or bills. This will bolster your request and provide the lender with a complete picture of your circumstances.

Step-by-step guide to filling out the emergency loan deferment request form

To access the emergency loan deferment request form, look for it on the pdfFiller website or your lender’s official site. Once located, download it in a format that suits your needs, whether PDF or other compatible formats. Being familiar with pdfFiller’s platform will provide added advantages when filling out your form.

After obtaining the form, navigate through its sections carefully. Each part will require specific information, from your personal details to financial disclosures. Ensuring accuracy is vital; each piece of information should match with the accompanying documentation to avoid delays in processing your request. Be conscious of common mistakes, such as incomplete fields or misspellings, which can hinder your application.

Editing and signing your deferment request

Using pdfFiller's editing tools can simplify the process of completing your emergency loan deferment request form. The platform allows you to insert text, images, or annotations seamlessly, ensuring your form looks professional and legible. This is especially valuable when emphasizing critical information that supports your request.

eSigning your form is equally important, and pdfFiller offers various options for this. You can digitally sign your document from any device, making it more convenient and secure. Ensure that you have followed all electronic signature laws applicable in your jurisdiction to avoid any compliance issues.

Submitting your request

Once your emergency loan deferment request form is complete and signed, it's time to submit it. Ensure you review the submission methods available. Many lenders offer an online submission process, streamlining your request. However, you may also have the option to mail a physical copy if that is more convenient.

Following submission, you should expect to receive a confirmation from your lender. This could come in the form of an email or a written correspondence. Knowing how to track your application status will help you stay informed. Maintain your documentation in case you need to follow up with your lender regarding the progress of your request.

Managing your loan deferment status

Checking your deferment status after submission is an essential part of the process. Your lender will typically provide a method to track your application, whether through an online portal or customer support. Stay proactive in communicating with your lender to address any questions or concerns regarding your deferment status.

During the deferment period, be prepared for potential requests for additional information from your lender. This could include updates on your financial situation or verification of the circumstances leading to your deferment request. Understanding your rights during this time is crucial; for example, you may have the right to contest any requirements that seem unreasonable.

FAQs about emergency loan deferment

Addressing common questions about emergency loan deferment is essential for demystifying the process. One prevalent inquiry is what happens if a request is denied. In such cases, borrowers should assess the reasons for denial carefully, often seeking clarification from the lender. Many lenders allow appeals, providing an avenue for reconsideration.

Another frequent question involves the duration of deferment. The timeframe can vary based on the lender’s policies and the borrower’s situation. Generally, deferment may last anywhere from a few months to over a year, depending on the circumstances. It's advisable to inquire about specific limits when you submit your request.

Additional tools and resources on pdfFiller

pdfFiller offers a variety of tools that can aid in managing your documentation. From templates specifically designed for financial forms to interactive document management features, users can streamline their workflow effectively. Customers can take advantage of services like customer support for additional guidance during the deferment application process.

Additionally, pdfFiller provides templates for other aspects of loan management and financial planning. These resources can be invaluable for individuals looking to maintain their finances effectively while navigating emergencies.

Final thoughts on managing your emergency loans

Effectively managing an emergency loan deferment can significantly relieve financial stress. Best practices include keeping thorough records of all communications and documents related to your deferment. Using pdfFiller to organize these documents can create a seamless tracking process, allowing you to focus on recovering from your financial hardship.

As your deferment period comes to an end, plan ahead for resuming payments. Consider your financial situation in advance, and be proactive in setting up any necessary budgeting strategies. Planning your next steps after deferment can assist in ensuring that your financial journey progresses smoothly, minimizing the risk of returning to an emergency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my emergency loan deferment request in Gmail?

How do I edit emergency loan deferment request online?

Can I edit emergency loan deferment request on an iOS device?

What is emergency loan deferment request?

Who is required to file emergency loan deferment request?

How to fill out emergency loan deferment request?

What is the purpose of emergency loan deferment request?

What information must be reported on emergency loan deferment request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.