Get the free Carroll County Senior Property Tax Relief Program 2025 Application

Get, Create, Make and Sign carroll county senior property

How to edit carroll county senior property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out carroll county senior property

How to fill out carroll county senior property

Who needs carroll county senior property?

Comprehensive Guide to the Carroll County Senior Property Form

Understanding the Carroll County Senior Property Form

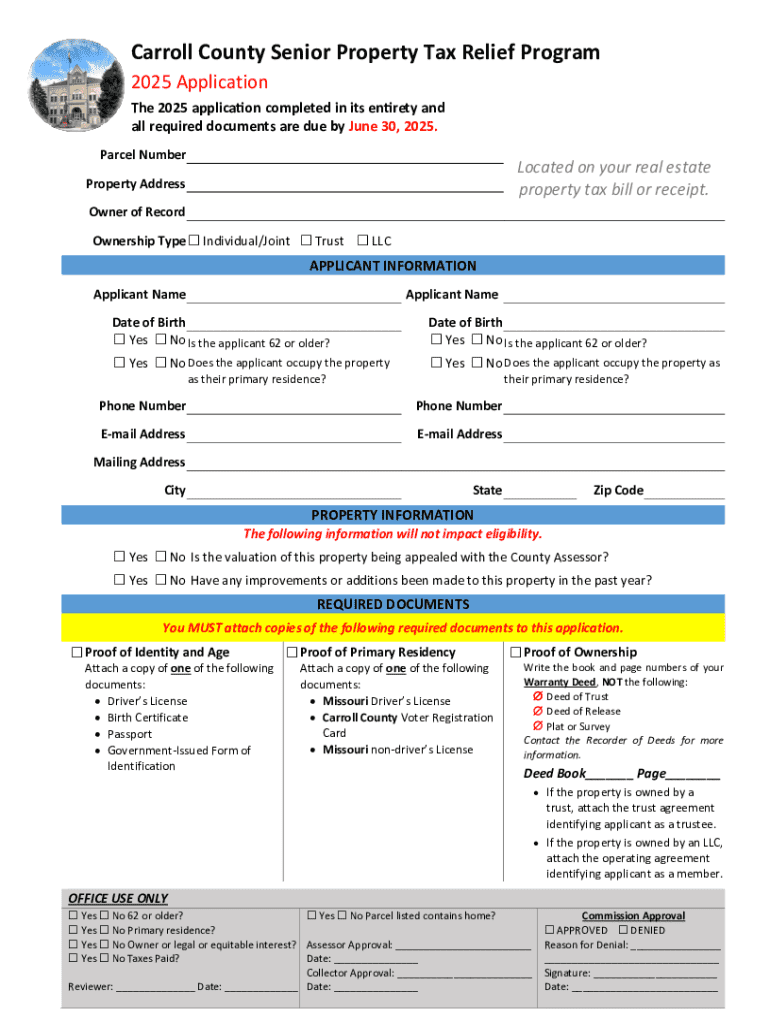

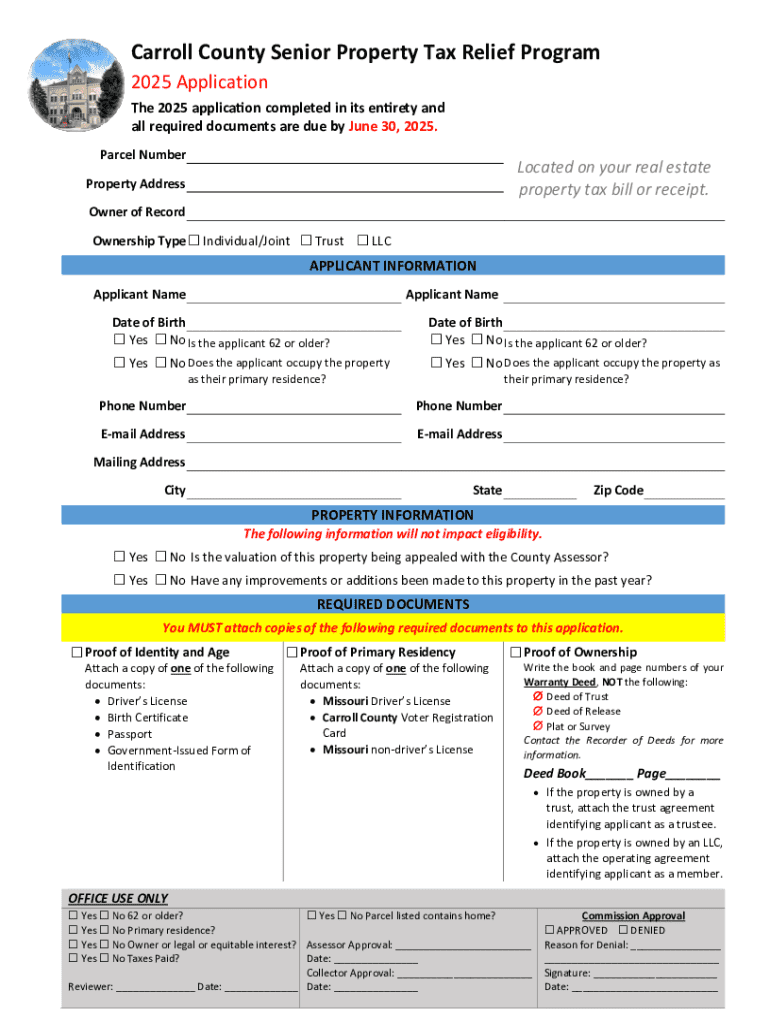

The Carroll County Senior Property Form is vital for seniors seeking tax relief in their property taxes. This form facilitates financial assistance, intended to lessen the financial burden imposed by property tax obligations for eligible seniors in Carroll County. With many seniors living on fixed incomes, having access to tax benefits can significantly enhance their quality of life.

Eligibility criteria for applying for these benefits generally include age restrictions, income limitations, and residential requirements that must be met. Applicants often need to provide proof of age, residency, and financial status when completing the form.

Accessing the Carroll County Senior Property Form

To access the Carroll County Senior Property Form, residents can visit the Carroll County government's official website. The form is available for download in PDF format or can be filled out online through platforms like pdfFiller. This ensures that seniors have multiple options for how they can handle their document needs.

For convenience, here are quick links to access the Carroll County Senior Property Form: the official county site provides the standardized version while pdfFiller offers editable templates, streamlining the completion process.

Instructions for completing the Carroll County Senior Property Form

When filling out the Carroll County Senior Property Form, it's essential to follow a step-by-step approach to ensure accuracy and completeness. Begin with the personal information section, including details like your name, address, and date of birth. Next, move to the property information section, providing specifics regarding the property in question, such as ownership type and valuation.

The financial disclosure section is equally critical as it outlines your income sources and amounts. Finally, the signature section requires your approval. Remember, a careful review of the completed form can prevent common mistakes such as missing signatures or incorrect data entry.

Common mistakes to avoid

Avoiding common mistakes can make a significant difference in the approval process. One frequent error is omitting critical information, such as proof of income or residency, which can lead to delays. Additionally, misunderstanding questions can lead to incorrect answers, potentially disqualifying applicants from receiving benefits.

Double-checking details, ensuring all necessary documents are attached, and using resources for clarification can help in successfully completing the form.

Editing and customizing the Carroll County Senior Property Form

One of the advantages of using pdfFiller is its extensive editing tools, allowing users to fill out, customize, and modify the Carroll County Senior Property Form with ease. Once downloaded, users can add notes, comments, or corrections directly to the document. This functionality proves essential, especially when collaborating with family members or advisors who may want to review the information before final submission.

The platform also features collaborative editing options, which allow multiple users to work on the form simultaneously or share it for feedback. This is particularly valuable for seniors who may require assistance completing the form.

Signing the Carroll County Senior Property Form

After filling out the form, signing it correctly is a critical step. PdfFiller offers convenient eSigning options that allow users to electronically sign documents without the need for printing and scanning. The eSigning process is straightforward, requiring only a few clicks to complete. Importantly, these electronic signatures comply with legal standards, ensuring validity.

For those who prefer traditional methods, completing the form physically and signing it is still an option. Once signed, the next step is to follow the appropriate guidance for returning the completed forms to the county.

Submitting the Carroll County Senior Property Form

Submitting the Carroll County Senior Property Form can occur through various channels, including mail and in-person delivery to designated county offices. Electronic submission options are also available, enhancing convenience for seniors. It's crucial to be aware of important deadlines associated with the submission to ensure timely processing.

After submission, tracking the status of your application can provide peace of mind. Applicants should follow up directly with the county office, understanding the expected processing times and any possible next steps in the procedure.

Managing your senior property tax benefits

Once you have submitted your Carroll County Senior Property Form and received approval, it's essential to stay informed about managing your benefits. The approval process generally involves a notification from the county regarding the status of your application. Applicants should keep an eye on any communications from the county office for updates.

Maintaining your benefits requires annual renewal, and seniors should keep abreast of any changes to eligibility criteria. Situations such as an increase in income or change in residency could affect your ongoing qualifications for property tax benefits.

Frequently asked questions (FAQs)

It's natural for seniors or their family members to have questions during the process of applying for property tax benefits. Common questions might pertain to eligibility, required documents, and how often the form needs to be submitted.

For further assistance, a direct line of communication with county offices can provide clarity. Many organizations offer support to seniors on navigating forms and benefits, ensuring applicants receive the guidance they need.

Conclusion: Making the most of your senior property tax benefits

Completing the Carroll County Senior Property Form can enable seniors to access essential tax benefits that can ease their financial burden. Understanding the form's requirements and following through with proper procedures ensures that eligible applicants can reap the benefits. Staying informed about renewals and changes in eligibility is crucial for maintaining these benefits over time.

PdfFiller's robust platform significantly streamlines the process of document management, allowing seniors to efficiently edit, sign, and submit forms like the Carroll County Senior Property Form. Leveraging these tools makes the journey to securing property tax benefits significantly more manageable.

User experiences and testimonials

Seniors across Carroll County have shared positive experiences regarding their applications for property tax benefits. Many report feeling relieved and empowered, knowing that financial assistance is available to offset their property expenses. Real-life testimonials highlight that the implementation of these tax benefits has positively impacted their ability to remain in their homes.

Additionally, users of pdfFiller have praised its functionality and ease of use, often citing how the platform enables users to manage their documents effectively. Successful experiences reveal that digital tools improve the overall efficiency of the application process, making it accessible for all seniors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit carroll county senior property on a smartphone?

How do I fill out the carroll county senior property form on my smartphone?

Can I edit carroll county senior property on an Android device?

What is carroll county senior property?

Who is required to file carroll county senior property?

How to fill out carroll county senior property?

What is the purpose of carroll county senior property?

What information must be reported on carroll county senior property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.