Get the free New Account Information Sheet

Get, Create, Make and Sign new account information sheet

Editing new account information sheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new account information sheet

How to fill out new account information sheet

Who needs new account information sheet?

New account information sheet form: A comprehensive how-to guide

Understanding the new account information sheet form

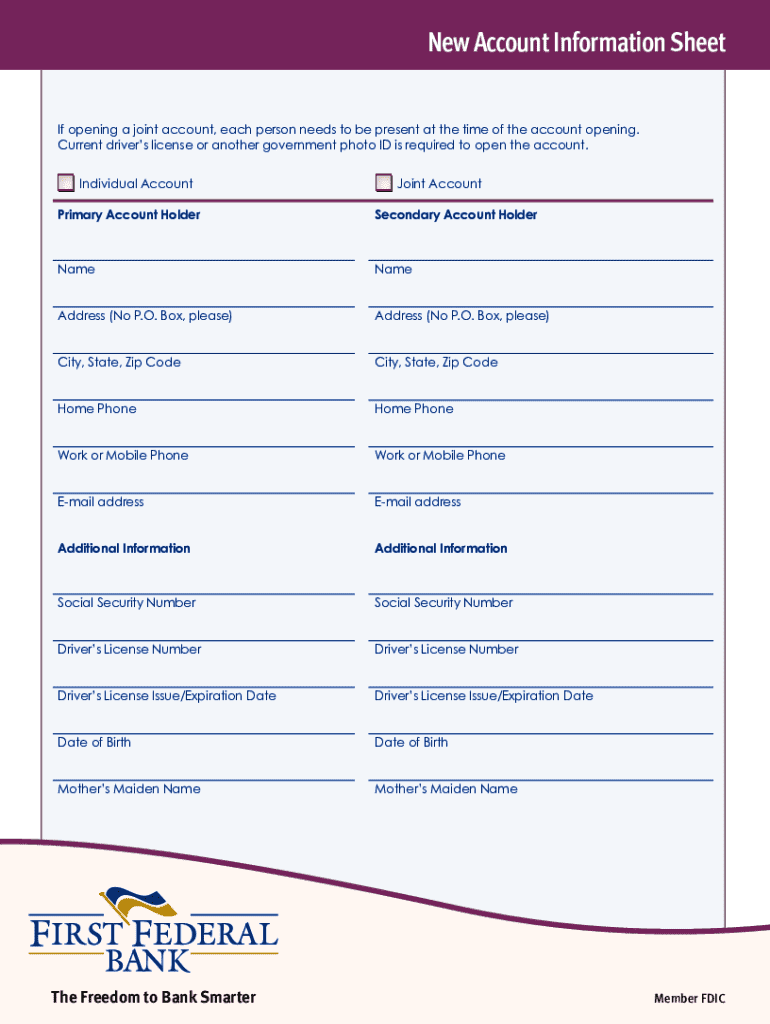

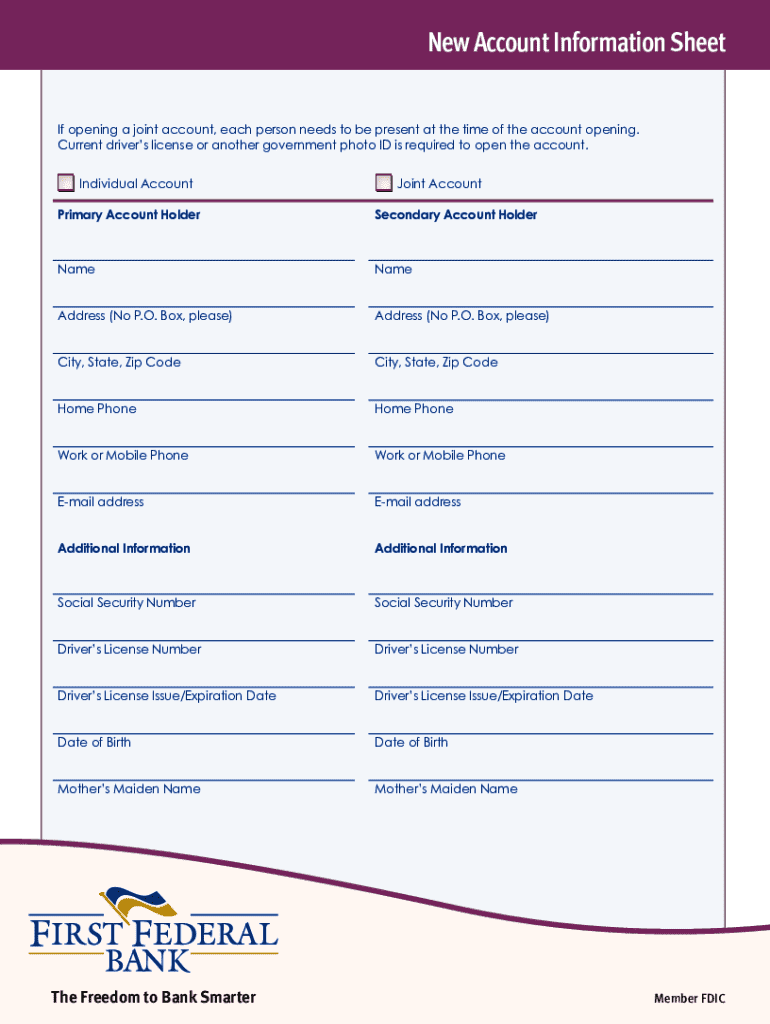

The new account information sheet form is a critical document used to establish a formal relationship between an individual or team and a financial institution, business, or service provider. This form is designed to collect essential information, which not only helps in creating the account but also ensures compliance with legal and regulatory requirements. Providing accurate information is crucial since it can affect services, account management, and even eligibility for various offerings.

The importance of using the new account information sheet cannot be overstated. It serves as a foundational document that influences nearly every interaction a client has with a provider, from communications to the personalization of services. Ensuring that the information is comprehensive and accurate enhances user experience and fosters trust and accountability.

Key components of the form

Various fields comprise the new account information sheet, and each serves a specific purpose. Firstly, the personal information fields typically require your name, address, and contact details. Accurately filling these out allows the entity to reach you and provide necessary updates or communications. Secondly, it's important to select account preferences, such as the type of account you wish to open, whether it's individual or joint, and how you prefer to receive correspondences.

Lastly, financial information is requested by the form. Fields for income, employment status, and identification are crucial for assessing eligibility and risk. Financial institutions may use this information to tailor services and offer more relevant financial products.

Preparing to fill out the new account information sheet

Before diving into the details of the new account information sheet, it’s essential to prepare adequately. This includes gathering all necessary documents that will support the information you provide. A comprehensive list of required documents may include a valid ID, proof of income, and possibly proof of residence. Taking the time to collect these documents can prevent delays during the account setup process.

Organizing these documents efficiently can save time and stress. Consider using a folder or digital file to keep everything readily accessible when you sit down to fill out the form. Ensuring you have everything on hand will allow for a smoother documentation process.

Understanding privacy and security

Given the sensitive nature of the information on a new account information sheet form, understanding privacy and security features is paramount. Most institutions employ stringent data protection measures, complying with regulations like GDPR or VCCPA to safeguard your personal and financial data against unauthorized access. Familiarize yourself with these measures; knowing how your information is protected gives peace of mind during the submission process.

Confidentiality is a priority when submitting your information. Ensure you're using secure internet connections and avoid sharing personal details in public spaces where unauthorized individuals might overhear or intercept your data.

Step-by-step guide to completing the form

Section 1: Personal information

Starting with the personal information section, it's crucial to understand what details are being sought. Common fields include full name, residential address, phone number, and email address. When filling these out, ensure that you spell everything correctly— typos could lead to issues when the entity attempts to contact you or when it cross-references your information.

One common mistake is failing to use your legal name or providing an outdated address. Always double-check this section and look for any additional guidance or examples provided on the form itself.

Section 2: Account preferences

Next, navigate to the account preferences section. Here, you’ll typically scenario of choosing between different types of accounts, such as individual accounts, joint accounts, or even specialized accounts for specific types of services. Assess which option aligns with your needs to make an informed decision.

Additionally, you’ll be asked about your communication preferences. It’s important to specify how you wish to receive updates—whether through email, text, or traditional mail. Consider your lifestyle and how you prefer to stay informed when making this choice.

Section 3: Financial information

Lastly, the financial information section is crucial as it often dictates the services you’ll be offered. Here, you’ll input your income levels, employment status, and sometimes identification numbers. Be prepared to provide a realistic overview of your income, as you may need to calculate your earnings based on pay stubs or tax records.

Offering accurate financial information helps institutions assess your risk profile and tailor their services to your needs, ultimately benefiting you in the long run.

Editing and reviewing your new account information sheet

Using pdfFiller’s editing tools

Once you’ve filled out the form, it’s crucial to review and edit it if necessary. pdfFiller's editing tools allow users to adjust any part of their forms effortlessly. You can easily make updates, correct mistakes, or enhance sections to ensure that everything is accurate. Collaboration tools allow you to share the document with others, such as team members or advisors, who can provide feedback.

Editing your document on pdfFiller helps streamline the submission process as it allows for real-time collaboration, reducing the back-and-forth that often accompanies document approval.

Importance of reviewing your form

Taking the time to review your form thoroughly is vital to avoid common errors. A checklist can help ensure that you've covered everything, from personal information to the signature section. Common errors often include missing signatures or incorrect figures in financial sections, which can lead to delays in processing your account.

It’s beneficial to have another pair of eyes look at your submission, especially when it concerns something as important as financial information. Final reviews ensure that your form is error-free and ready for submission.

Signing and submitting your new account information sheet

Understanding eSigning

The digital age has paved the way for eSigning, which is not only convenient but also secure. Adding an electronic signature through pdfFiller allows for a quicker submission process. eSigning means you can finalize your document from anywhere, at any time, eliminating the need for physical paperwork.

The benefits of using electronic signatures extend beyond convenience; they also provide a trail of accountability, as the platforms typically log who signed and when.

Submission methods

Once you have signed your new account information sheet, various submission methods are available. Typically, you can submit your form electronically via email or through an online portal. Some institutions may also accept postal submissions. If your document is particularly sensitive, ensure you choose a submission method that provides tracking or confirmation, ensuring peace of mind.

After submission, the next steps often involve a confirmation of receipt and a review process. Keep an eye on your inbox for any follow-up communications regarding your account status.

Managing your account information post-submission

How to access your submitted information

After finalizing your new account information sheet and submitting it, managing your documents is essential. With pdfFiller, accessing your submitted information is straightforward. The platform allows you to navigate easily, retrieving copies of your documents or checking the status of your submission.

You can also download and print your form for personal records. Keeping a copy serves as a safeguard for future references and interactions with the institution.

Making updates after initial submission

Once your new account information sheet has been submitted, you may find that your details require updates. Perhaps your income changes, or your contact information is no longer accurate. Understanding the process for updating your personal or financial information is crucial in maintaining an active and efficient account. Institutions typically allow you to resubmit the form or provide an alternative method to communicate these updates.

Be proactive about your documentation to ensure your records reflect your current situation, thus avoiding potential service interruptions.

Frequently asked questions (FAQs)

Common issues when filling out the form

When filling out your new account information sheet, it's normal to encounter a few roadblocks. Common issues include not knowing how to provide accurate financial details or being unclear on what personal information is mandatory. Keeping a guide handy can help clarify these fields and prevent any submission delays.

Consider leveraging support channels, like customer service or FAQs from the institution, which can often provide insight to address common concerns.

Clarifications on information requirements

Clarity on what is required in the new account information sheet tends to vary between institutions. Each entity may have distinct requirements based on the type of services they offer. For example, financial institutions may necessitate additional identification or verification for complex financial products. It's best to consult directly with the organization if you find discrepancies or need further clarification.

Always err on the side of caution—if in doubt, ask questions to ensure your submission is complete.

How to seek assistance with the form

If you experience difficulties while filling out your new account information sheet, don’t hesitate to seek assistance. Many organizations have dedicated support teams, online chat features, or detailed guides that can help simplify the process. Using resources such as videos or step-by-step instructions from pdfFiller can also demystify the process.

Engagement with support resources can alleviate confusion and ensure your information is accurate. Remember, it’s far better to ask than to submit incomplete or incorrect information.

Additional features of pdfFiller relevant to the new account information sheet

Document storage and retrieval

One of the standout features of pdfFiller is its ability to store and manage documents securely in one place. This feature is invaluable for any individual or team navigating multiple client forms or account information submissions. You can easily categorize and save different versions of documents, ensuring that you can easily retrieve important papers when needed.

Document retrieval is streamlined through pdfFiller, allowing users to search and access their documents effortlessly—perfect for maintaining organized records of client information forms, including the initial new account information sheet.

Collaborating with team members or advisors

pdfFiller shines in its collaboration capabilities, enabling teams to work together efficiently on the new account information sheet. You can invite colleagues to edit or review the form, fostering teamwork and improving the document's overall accuracy. This collaborative approach is particularly beneficial for sales organizations that often need to coordinate over numerous client information forms.

The collaboration tools not only enhance efficiency but also allow for quick feedback, ensuring that any pertinent changes are made swiftly and uniformly.

Integrating with other tools for comprehensive document management

pdfFiller offers various integrations with other software tools, enhancing your document management capabilities further. Whether you’re using CRM systems or project management tools, integrating them with pdfFiller can streamline your workflow and ensure that your new account information sheets and related documentation are seamlessly managed across platforms.

These integrations ultimately provide a holistic approach to managing client information forms and maintaining up-to-date records, enhancing the effectiveness of your organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in new account information sheet?

How do I edit new account information sheet in Chrome?

How do I edit new account information sheet on an Android device?

What is new account information sheet?

Who is required to file new account information sheet?

How to fill out new account information sheet?

What is the purpose of new account information sheet?

What information must be reported on new account information sheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.