Get the free Mobile Tax Customer Information Questionaire

Get, Create, Make and Sign mobile tax customer information

Editing mobile tax customer information online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mobile tax customer information

How to fill out mobile tax customer information

Who needs mobile tax customer information?

Mobile Tax Customer Information Form: A Comprehensive How-to Guide

Understanding the Mobile Tax Customer Information Form

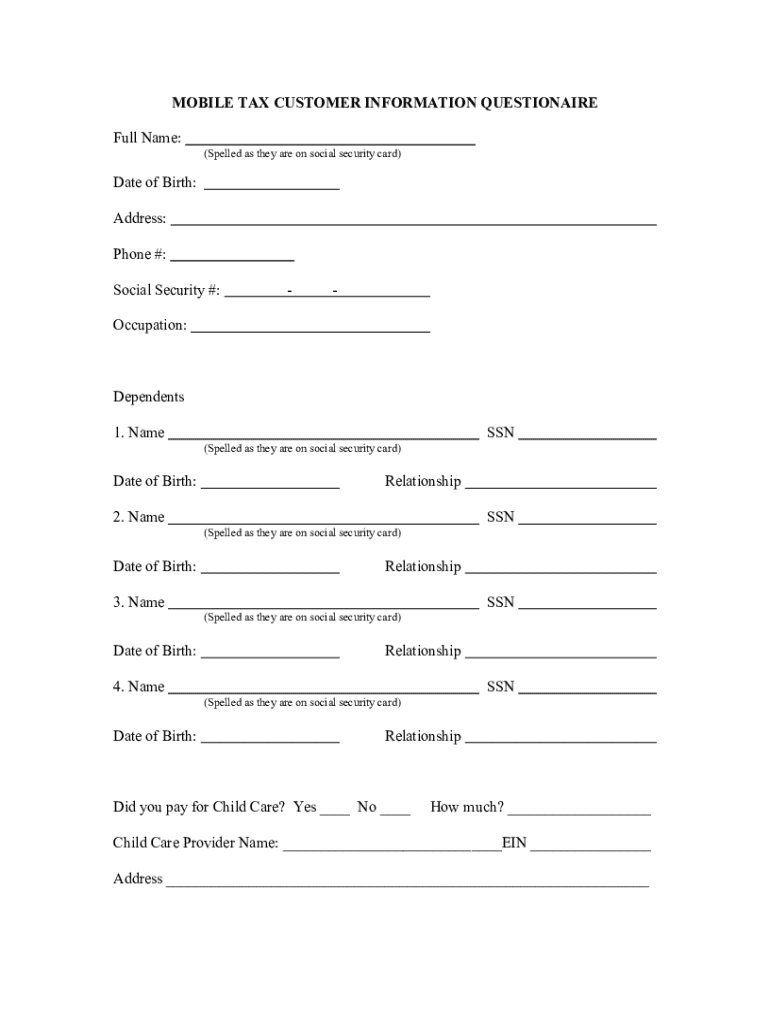

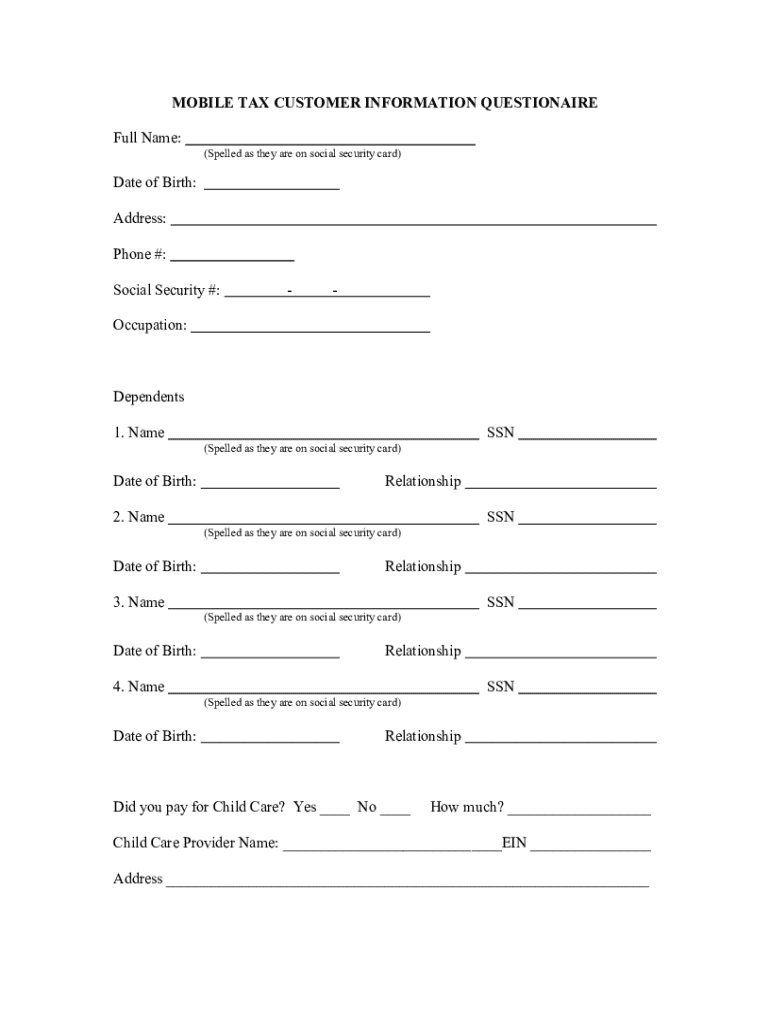

A Mobile Tax Customer Information Form is a specialized document designed to collect necessary information from individuals or businesses for tax purposes. This form is crucial in the tax filing process, facilitating accurate filings and compliance with tax regulations. The submission of this form ensures that tax authorities have the correct personal and financial data to process tax returns. Its importance cannot be overstated, as filling it out incorrectly can lead to delays or problems with tax refunds.

Who typically needs this form? Individuals filing personal income tax returns, small businesses reporting earnings, and tax professionals assisting clients all require access to this form. Each of these users will need to provide varying levels of detail depending on their unique tax situations. Tailoring the information they provide can enhance their filing accuracy and tax efficiency.

Key components of the mobile tax customer information form

The structure of the Mobile Tax Customer Information Form consists of several key sections. These sections guide users to input all pertinent details accurately. Typically, the form starts with identifying information, such as the taxpayer's name, address, Social Security number, and tax reference number. Following this, financial sections require details regarding income from various sources, including W-2s from employers and 1099s for other income.

Essential information needed includes personal identification details, which ensure the form is linked to the correct individual or business. Additionally, it's crucial to include comprehensive financial information, such as total income, expenses, and potential deductions. Understanding your eligibility for tax deductions and credits is vital, as it can significantly impact your overall tax liability.

Step-by-step instructions for completing the mobile tax customer information form

Step 1: Gather Required Documents. Before diving into filling out the Mobile Tax Customer Information Form, it’s essential to compile all relevant documents. This includes tax forms such as W-2s from employers, 1099s for additional income, and any receipts for deductions. Organizing these documents can save time and help ensure all necessary information is included.

Step 2: Accessing the Form through pdfFiller. Users can easily find the Mobile Tax Customer Information Form on pdfFiller’s website. If you don’t have an account, it’s simple to create one, or you can log in if you're an existing user. The user-friendly interface makes navigation straightforward, allowing easy access to the forms you need.

Step 3: Filling Out the Form. As you begin to fill out the form, pay close attention to each section. Each part of the form requires specific information; make sure to double-check for accuracy. Common pitfalls include typos in Social Security numbers and incorrect tax reference numbers, which can delay filing. Maintain a steadiness to avoid mistakes.

Step 4: Editing the Form for Accuracy. Utilize pdfFiller’s editing tools to ensure all information is correct. These tools allow you to review your form thoroughly, making corrections where necessary. This step is critical to avoiding unwanted tax headaches come filing time.

Step 5: eSigning the Form. After you’ve filled out and confirmed the accuracy of the Mobile Tax Customer Information Form, the next step is electronic signing. pdfFiller provides a straightforward eSigning process that's legally binding, allowing you to sign the document securely from anywhere.

Step 6: Submitting the Form. Finally, you can submit your form through various channels. Whether opting for online submission via e-filing or mailing it directly to the tax authorities, confirm your submission has been received. Some systems offer tracking capabilities, giving you peace of mind.

Enhancing your experience with interactive tools

pdfFiller’s platform offers unique features that enhance your experience with tax preparation. Alongside the Mobile Tax Customer Information Form, there are templates designed for different tax scenarios, streamlining submissions for specific situations like self-employment or home office deductions. Additionally, collaboration features allow teams to work together seamlessly on tax documents, ensuring accuracy and compliance.

Interactive tools, such as tax calculators and decision trees, can effectively guide taxpayers through the nuances of tax management. These tools assist in verifying eligibility for tax deductions and making informed decisions. For instance, knowing which deductions you qualify for before filling out the form can optimize your filings and minimize your tax liability.

Troubleshooting common issues

Tax forms are prone to errors, especially when filling out the Mobile Tax Customer Information Form. Common mistakes can include missing information or incorrect figures. Identifying these errors quickly is essential, and pdfFiller’s tools make it easy to spot inaccuracies for timely corrections.

If your form submission is rejected or you receive notices from tax authorities, it’s crucial to know the next steps. Guidance on what needs to be corrected or resubmitted can often be found through the document support available via pdfFiller’s online resources. Furthermore, the customer service options offered allow users to connect with specialists who can assist in resolving any issues.

Best practices for managing your tax documents

Proper organization of tax documents is paramount for efficient filing and future reference. Creating a digital filing system organizes and stores your documents securely. This can be achieved by categorizing files by year or type of income to streamline access when needed.

Keeping personal information secure is also essential. Utilizing pdfFiller’s security features can help protect sensitive data, especially in an online environment. Regularly updating your information and reviewing your files ensures that nothing important is overlooked, allowing for a hassle-free filing experience come tax season.

The benefits of using pdfFiller for your tax needs

One of the most significant advantages of using pdfFiller is the cloud-based convenience it provides. Users can access their Mobile Tax Customer Information Form from anywhere at any time, eliminating the hassle of physical paperwork. This feature proves extremely beneficial for those with dynamic work environments or those who travel often.

The platform also allows for comprehensive document management, consolidating all your tax paperwork in one location. By staying updated with tax law changes, pdfFiller prepares you for seamless future filings. Utilizing this platform optimizes efficiency while maximizing your potential cost savings through effective tax management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mobile tax customer information directly from Gmail?

Where do I find mobile tax customer information?

How do I edit mobile tax customer information on an Android device?

What is mobile tax customer information?

Who is required to file mobile tax customer information?

How to fill out mobile tax customer information?

What is the purpose of mobile tax customer information?

What information must be reported on mobile tax customer information?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.