Get the free Modification No. 369

Get, Create, Make and Sign modification no 369

Editing modification no 369 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out modification no 369

How to fill out modification no 369

Who needs modification no 369?

A Comprehensive Guide to the Modification No 369 Form

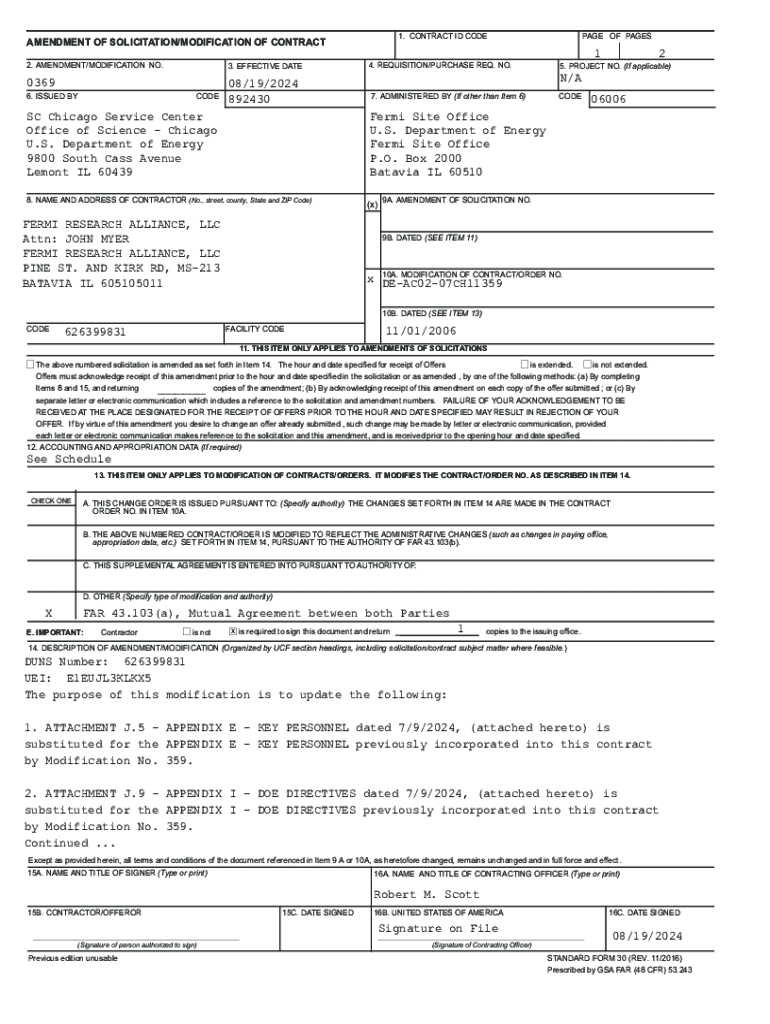

Understanding Modification No 369 Form

The Modification No 369 Form is a specialized document used primarily for requests related to modifications in financial and tax circumstances. This form is crucial in the context of tax adjustments, allowing individuals and businesses to formally request changes based on their unique situations.

It serves several purposes, including adjusting incomes for the calculation of tax liabilities, reassessing eligibility for tax credits, and relaying significant changes in financial conditions that may affect the payment of taxes. The Modification No 369 Form streamlines the process of communicating such changes to tax authorities.

The benefit of using the Modification No 369 Form lies in its clarity and completeness, reducing the likelihood of errors that could result from informal communication methods.

Who needs to complete the Modification No 369 Form?

Eligibility to complete the Modification No 369 Form typically includes a wide range of individuals and businesses, particularly those who have undergone significant financial changes over the previous tax year. Employees who have received bonuses, self-employed individuals who have faced income fluctuations, and e-commerce businesses that report varying sales figures may find themselves needing this form.

Common scenarios requiring the Modification No 369 Form include changes in employment status, reductions in income due to business downturns, or even unexpected increases in deductible expenses. In such cases, proactive communication with tax authorities via this form can mitigate potential complications.

Special cases might include individuals retiring, filing for bankruptcy, or experiencing marital status changes. Each situation can distinctly alter one's tax responsibilities, warranting the use of the Modification No 369 Form.

Important filing dates and deadlines

Filing deadlines for the Modification No 369 Form can vary based on local tax regulations and individual circumstances. It is crucial to keep track of key dates to avoid penalties and ensure compliance. Generally, submissions of modifications should occur before final tax filings.

Individuals and businesses should also be aware that annual reviews and updates may require filing this form more than once a year, especially in cases where ongoing financial adjustments are necessary. Missing these deadlines can lead to late fees or rejected requests, complicating future financial obligations.

Understanding these dates is essential to effectively manage your financial obligations and maintain proactive communication with tax authorities.

Step-by-step guide to completing the Modification No 369 Form

Completing the Modification No 369 Form may initially appear daunting, but breaking down the process into manageable steps simplifies it significantly. Start by gathering all necessary information, which typically includes personal identification, financial documents, and relevant tax information. Collecting these ahead of time prepares you for a smoother experience.

Preparing necessary information and documentation

Detailed instructions for each section of the form

The form is typically divided into multiple sections, including:

Filling out each section meticulously ensures a better chance of acceptance. Avoid common mistakes, such as omitting required fields or entering incorrect details, which can easily delay processing times.

Interactive tools for assisting with the Modification No 369 Form

Utilizing online tools such as those offered by pdfFiller can significantly enhance the efficiency of completing the Modification No 369 Form. The platform offers interactive features that guide you through the filling out of the form step-by-step.

Accessing these tools is straightforward, with a user-friendly interface that allows individuals and teams to collaborate seamlessly on document creation. You can fill in, edit, and sign directly within your browser, making it ideal for users who require accessibility from multiple locations.

Document management and storage

Once you have completed your Modification No 369 Form, proper document management and storage are essential. Utilizing pdfFiller ensures that your completed forms are stored securely, accessible on demand, and easily retrievable when needed for future reference.

The platform also supports digital signatures and eSigning options, making it both convenient and reliable for formal submissions. Collaborating with team members on the document is enhanced by the ability to share access and edit collectively, ensuring that all touches are accounted for.

Troubleshooting tips for common issues

While the process of completing the Modification No 369 Form is straightforward, complications may occasionally arise. If you encounter issues, such as errors during filling or discrepancies in the information provided, steps can be taken to resolve them.

Start by reviewing the completed form for accuracy and completeness, ensuring all necessary fields have been filled correctly. If discrepancies are found, consider reaching out to a tax professional or utilizing customer support from pdfFiller for guidance.

Real-life applications and case studies

Many users have successfully navigated the complexities of the Modification No 369 Form, using it to their advantage. Case studies illustrate the effectiveness of timely modifications in improving financial situations and maintaining compliance with tax obligations.

Accounts from users highlight how pdfFiller’s features have streamlined the submission process, allowing for faster processing times and fewer errors. Testimonials from satisfied users reinforce the platform's role in enhancing document management efficiency.

Final reminders and key takeaways

To ensure a successful filing experience with the Modification No 369 Form, adhere to a checklist of critical steps. Be diligent in preparing documentation, verifying information, and managing deadlines. Keeping a copy of your submitted form is vital for record-keeping and future reference.

Engaging with pdfFiller for continuous support can further simplify the management of your forms. This cloud-based solution empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents without hassle, ensuring that you can focus on what truly matters in your financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my modification no 369 directly from Gmail?

How do I edit modification no 369 in Chrome?

How do I complete modification no 369 on an Android device?

What is modification no 369?

Who is required to file modification no 369?

How to fill out modification no 369?

What is the purpose of modification no 369?

What information must be reported on modification no 369?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.