Get the free irs form 8869

Get, Create, Make and Sign irs form 8869

Editing irs form 8869 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form 8869

How to fill out form 8869

Who needs form 8869?

A Comprehensive Guide to Form 8869: Election and Compliance

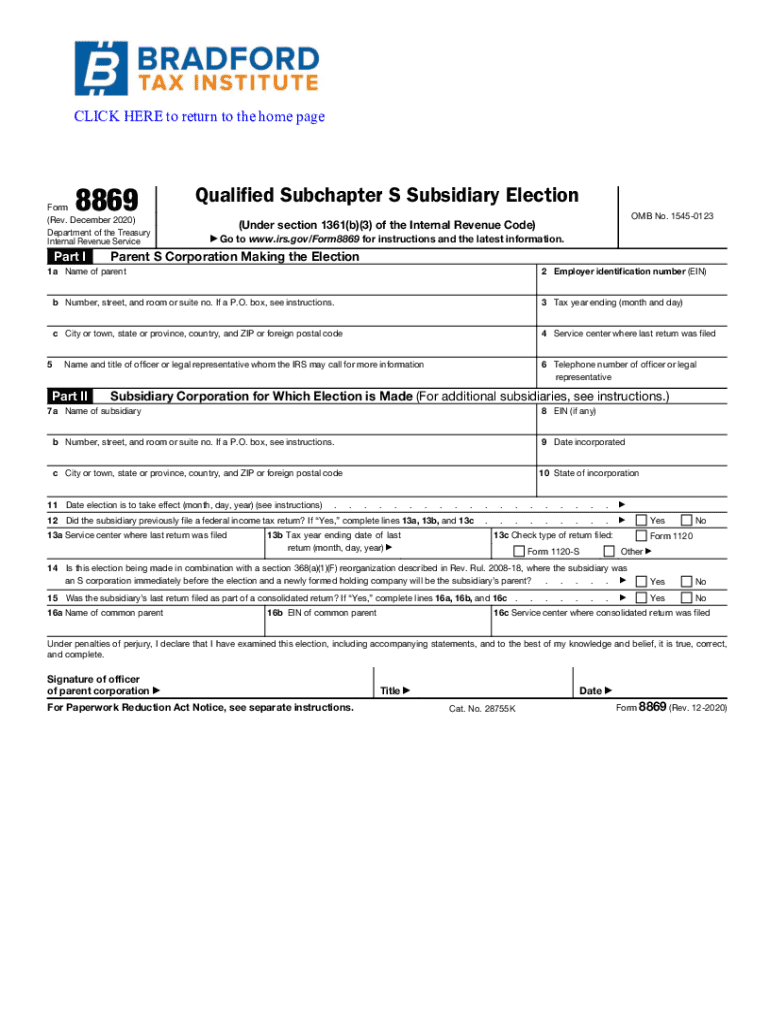

Overview of Form 8869

Form 8869 is a crucial tax document used by eligible entities to elect to be treated as a disregarded entity for federal tax purposes. It is essential for entities that plan to avoid corporate tax implications, especially when it comes to income taxation. Filing this form with the IRS ensures that the tax structure aligns with ownership and management decisions, making it a pivotal tool in structured tax compliance.

This form holds significant importance, as it allows companies like subsidiaries and partnerships to properly document their tax status. Completing the Form 8869 accurately is fundamental for avoiding tax penalties that may arise from misclassifications. Understanding how to navigate this form is vital for any corporate entity that seeks to manage their tax obligations effectively.

Who needs to file Form 8869?

The filing of Form 8869 is necessary for various business entities, including partnerships, corporations, and limited liability companies (LLCs). Specifically, entities that qualify under Subchapter S of the Internal Revenue Code are often required to file this form to affirm their election status. This election can enhance the tax efficiency of a business, allowing owners to receive distributions without facing corporate tax.

Filing Form 8869 not only simplifies income reporting but may also prevent higher tax rates that larger corporate structures could invoke. Eligible entities, such as those formed as a subsidiary under a parent corporation, should consult tax professionals to ensure accurate application for adherence to IRS guidelines. Ultimately, the benefits of filing create a framework for better tax planning and compliance.

Key dates and deadlines

To maintain compliance, it’s crucial to adhere to specific filing deadlines for Form 8869. The primary deadline is typically aligned with the entity's tax return due date for the year in which the election is effective. Filing it late can lead to unnecessary penalties, making timeliness paramount.

For most entities, this means submitting Form 8869 by the 15th day of the third month after the end of the tax year or alongside the income tax return if applicable. Failing to submit Form 8869 by the prescribed deadline can result in a rejection of the election, leading to potential liabilities that would not be present had the form been filed on time.

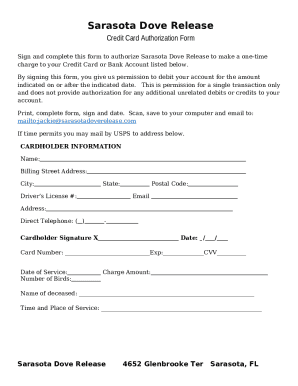

Sections of Form 8869

Form 8869 is split into two main sections—Part I and Part II—each serving distinctive purposes. Part I focuses on Election Information, asking for fundamental data concerning the entity making the election, while Part II gathers Additional Information for more in-depth documentation.

In Part I, precise election details are documented, which is essential for IRS processing. Part II requires supplementary information that enhances an understanding of the election context. Both parts are critical in ensuring a thorough understanding of how the filing entity operates under its chosen tax structure.

Part : Election information

In Part I of Form 8869, specific election details must be reported. This includes identifying the parent corporation, associated EIN numbers, and the effective date of the election. It’s vital that any data recorded here is accurate to prevent any unnecessary complications during processing.

Detailed and correct information in Part I removes ambiguity and allows for seamless processing by the IRS, which aids in avoiding potential issues such as rejection of the election. It’s essential that business owners take the time to ensure all information is filled out clearly and correctly.

Part : Additional information

Part II gathers additional details that provide further context for the election. This includes information about partnerships, distributions, and ties with the parent corporation. Accurate completion of this section is pivotal as it gives the IRS a clearer picture of the entity's structure and intention behind filing.

Incorporating all relevant details can significantly affect how the IRS views the election, influencing compliance status and future tax obligations. Therefore, each entry in Part II should be taken seriously, ensuring it's reflective of the actual business practices and organizational structure.

Step-by-step instructions to complete Form 8869

Completing Form 8869 requires careful attention to detail and a systematic approach. To begin, filers should gather requisite information such as the parent corporation's name, the entity's EIN, and financial data pertinent to the election year. Ensuring that all documentation is readily available eliminates unnecessary delays in filling out the form.

Next, focus on completing Part I with absolute accuracy, ensuring that all fields are filled as per guidance from the IRS instructions. Once Part I is thoroughly detailed, proceed to Part II. In this section, elaborate on any intricate details about relationships with parent companies or associated partners, providing a comprehensive overview to support the election being claimed.

Lastly, review each entry for potential errors or omissions to avoid complications later. Double-checking the work and verifying against the IRS guidelines can greatly enhance the reliability of the filing.

Common mistakes to avoid

Even minor mistakes in Form 8869 can lead to major complications, including delays in processing or rejection of the marriage election. Some common errors include incorrect EINs, missing fields, or improper signatures. Failing to provide adequate descriptions in the additional information can also lead to difficulties.

Filers should maintain a checklist to ensure completeness, and review the form multiple times before submission. Consulting with tax professionals can provide insights to mitigate risks, helping entities to navigate complexities related to IRS regulations efficiently.

How to file Form 8869

Form 8869 can be filed in two primary ways: electronically or through paper submission. Electronic filing may offer quicker processing times and is encouraged by the IRS. To file electronically, you generally must have access to compatible IRS e-filing software or services that integrate directly with IRS systems.

On the other hand, paper filing necessitates careful mailing to the appropriate IRS service center. Ensure you keep a copy of the completed form for your records. In either method, it’s important to include any necessary accompanying fees or payment details to avoid delays.

Payment of fees

When filing Form 8869, you may need to include payment for the associated fees, particularly if it involves certain classifications. The payment methods accepted by the IRS typically include checks or electronic payments through the IRS Direct Pay system.

Be sure to clearly indicate the purpose of the payment and reference your entity's EIN to ensure proper processing. Special attention to this could potentially speed up your filing’s acceptance and prevent unnecessary inquiries from the IRS.

Video walkthrough for completing Form 8869

For a visual guide on completing Form 8869, we have provided a video walkthrough that illustrates each step in the process. The video covers the essential segments of the form, detailing exactly what information is needed and how to accurately complete each section.

This walkthrough aims to demystify the process and provides practical examples, helping users feel more confident in their application. Watch the video to supplement the text-based guide for a more comprehensive understanding of the form.

Frequently asked questions about Form 8869

As inquiries often arise regarding Form 8869, here’s a compilation of frequently asked questions. One common question is regarding the need for an EIN when filing; generally, it is required as it identifies your business entity.

Another prevalent concern pertains to the specifics around deadlines, which can vary depending on the entity type and election year. Ensuring you adhere to proper timelines is vital to maintaining your entity’s tax compliance.

Related forms and documents

Form 8869 is often interconnected with various other IRS forms. For entities making elections for Subchapter S status, Form 2553 may also be relevant as it deals with eligibility for S corporation tax status. Understanding these relationships offers a more integrated approach to tax compliance.

Other related forms may include Form 1120-S for S Corporations, which must be filed in conjunction with Form 8869 in many cases. Familiarizing yourself with these related documents can help streamline the filing process, ensuring that all pertinent information is correctly reported across forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my irs form 8869 in Gmail?

How do I make edits in irs form 8869 without leaving Chrome?

How can I edit irs form 8869 on a smartphone?

What is form 8869?

Who is required to file form 8869?

How to fill out form 8869?

What is the purpose of form 8869?

What information must be reported on form 8869?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.