Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Campaign Finance Receipts Expenditures Form: A Complete Guide

Understanding campaign finance regulations

Campaign finance laws and regulations are crucial components of democratic governance in many countries. These rules govern how candidates and political parties raise and spend money during election campaigns, ensuring that the process remains transparent and fair. Transparency in campaign finances is essential in maintaining public trust. Without it, there could be significant risks of corruption, favoritism, and the undue influence of money in politics. Key organizations like the Federal Election Commission (FEC) in the U.S., as well as various state-level election boards, oversee compliance with these laws.

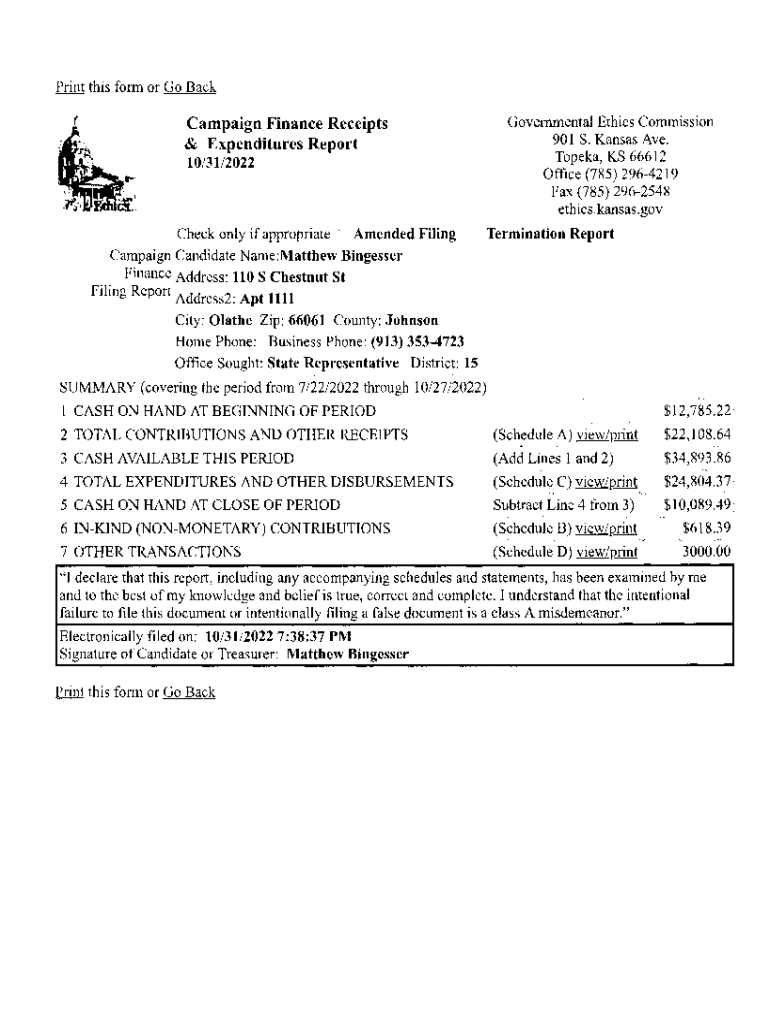

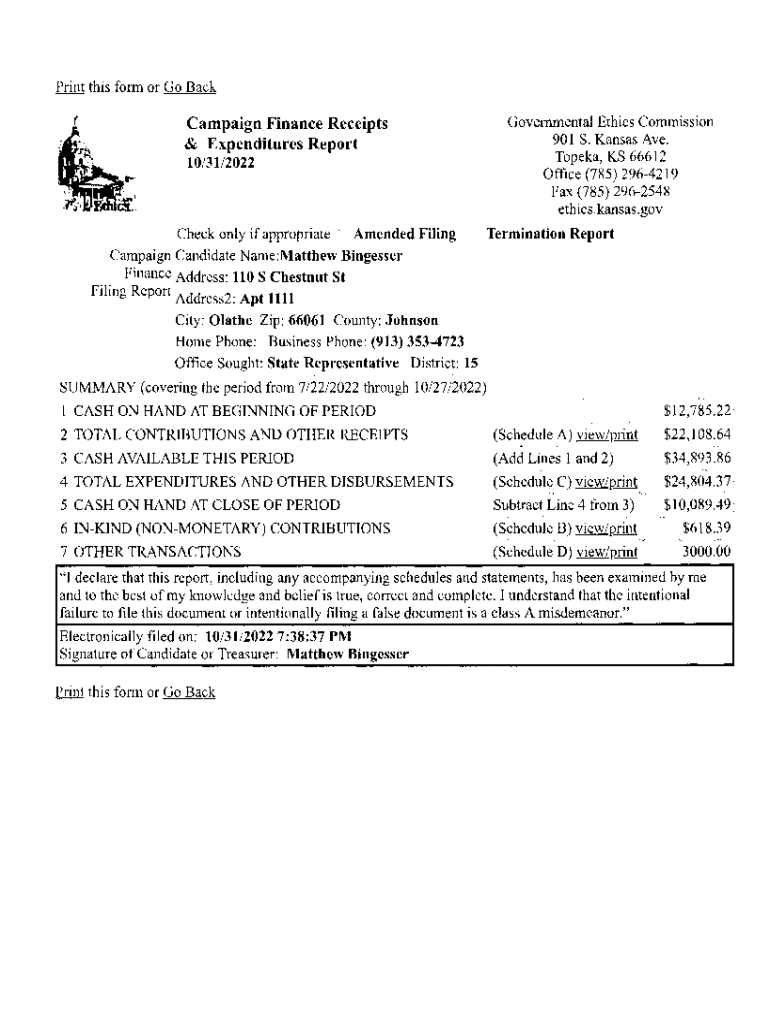

Introduction to receipts and expenditures

The terms 'campaign finance receipts' and 'expenditures' are fundamental in the context of political fundraising and spending. Receipts refer to all the money that a campaign collects; this could include contributions from individuals, organizations, loans, and even in-kind donations. On the other hand, expenditures are the funds spent by a campaign, allocated towards various aspects such as advertising, staff salaries, and event organizing. Understanding the difference between these two concepts is pivotal for effective campaign management.

Importance of accurate reporting

Accurate reporting of both receipts and expenditures is crucial for compliance with campaign finance laws. Failing to report either can lead to serious consequences, including fines or even criminal charges against individuals responsible for program oversight. Legal implications such as penalties or a loss of campaign funds can severely undermine a campaign's viability. Furthermore, meticulous record-keeping not only aids in compliance but also builds trust with supporters and potential donors, as it demonstrates a commitment to transparency.

Step-by-step guide to completing the campaign finance receipts expenditures form

Filling out the campaign finance receipts expenditures form can feel overwhelming, but by breaking it down into manageable steps, you can simplify the process.

Gather necessary documents

Start by collecting all necessary financial documents. This includes financial statements, donor information, and records of expenditures. Proper organization of your financial documents can save valuable time. Here are some tips to help streamline this process:

Accessing the campaign finance form

Next, navigate to the official campaign finance form. pdfFiller offers a user-friendly platform to access this form. You can either download it or fill it out directly online, which ensures ease and efficiency.

Completing the receipts section

While filling out the receipts section, be detailed. You should report various types of receipts such as contributions from individual donors, loans taken out by the campaign, or any in-kind contributions. Categorizing and totaling these receipts accurately is essential. It’s crucial to avoid common mistakes, such as underreporting contributions or failing to take into account certain transactions.

Completing the expenditures section

Similarly, when filling out the expenditures section, you'll need to list all campaign spending. Types of expenditures to report include advertising costs, salaries for staff, and venue rentals for events. The accuracy in categorizing expenditures can prevent issues down the line. Common pitfalls include failing to distinguish between personal and campaign expenditures, so it's vital to establish clear boundaries.

Adding additional supporting documentation

Including proof of receipts and expenditures is not just good practice; it's often a requirement. Attaching relevant documents like invoices, receipts, and contracts provides additional assurance of compliance with financial regulations. Ensure that you utilize recommended file formats, such as PDF or JPG, and keep everything organized to facilitate easy review.

Using interactive tools for efficient report management

pdfFiller’s interactive tools can greatly enhance your document management experience. This platform provides features that simplify the editing and eSigning processes for the campaign finance receipts expenditures form. Moreover, it allows for collaborative functionalities, enabling teams managing campaign finances to work together seamlessly, even from remote locations.

Submitting the form

Once you have completed the campaign finance receipts expenditures form, understanding how to formally submit it is crucial to ensure compliance.

Understanding submission requirements

There are different methods for submission, including online, by mail, or by fax, depending on your local regulations. Each submission method may have specific deadlines that you must adhere to in order to remain compliant with campaign finance laws.

Post-submission checks

After submission, verify that your form was received successfully. It’s important to track any issues or feedback from regulatory bodies for timely resolution, which may involve providing additional information or corrections. Keeping an eye on your submission can prevent potential compliance problems down the line.

Best practices for ongoing campaign finance management

During the course of your campaign, maintaining accurate financial records is vital. Regular reviews of your receipts and expenditures will help identify discrepancies early and keep your financial activities on track. Utilizing tools available on pdfFiller can support ongoing documentation, ensuring that your campaign adheres to compliance needs while also facilitating efficient financial management.

Frequently asked questions

Many individuals have common misconceptions when it comes to campaign finance reporting. Questions often include clarifications on reporting thresholds, required documentation, and the implications of failing to comply with regulations. Addressing these queries can clear up confusion and promote better adherence to financial laws, which is essential for all campaign teams.

Resources for further learning

For those interested in delving deeper into campaign finance management, various resources are available online. Regulatory guidelines provide essential information about legal requirements, while online courses and webinars can offer comprehensive overviews of campaign finance laws and best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my campaign finance receipts expenditures directly from Gmail?

How can I send campaign finance receipts expenditures to be eSigned by others?

Can I create an eSignature for the campaign finance receipts expenditures in Gmail?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.