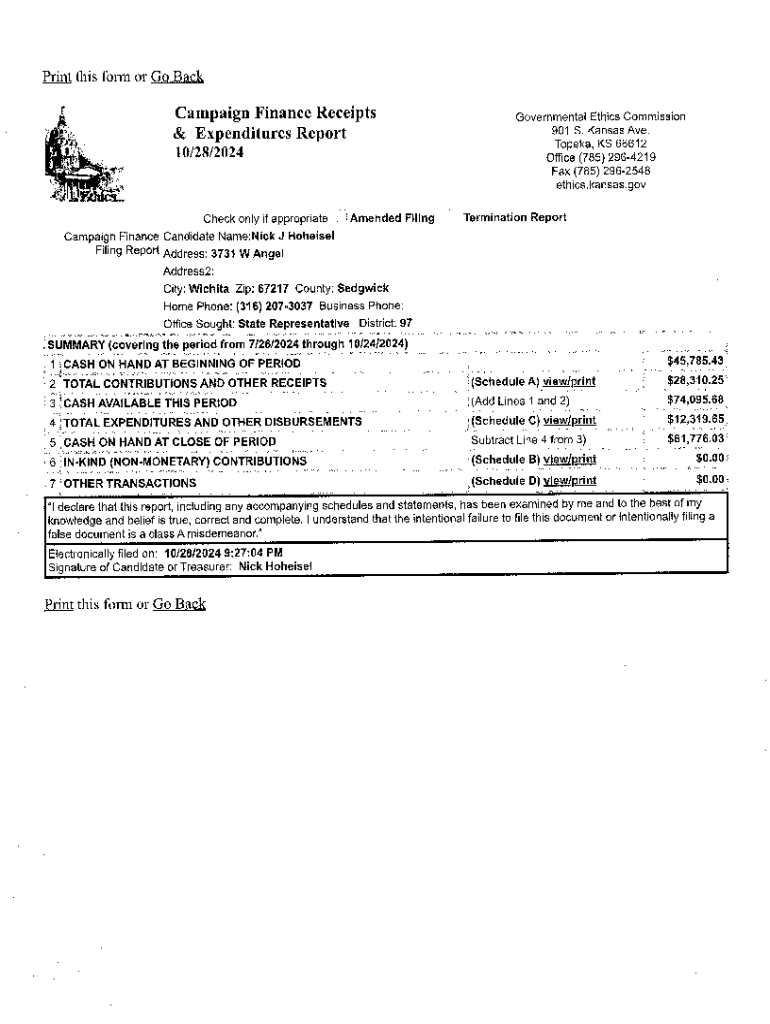

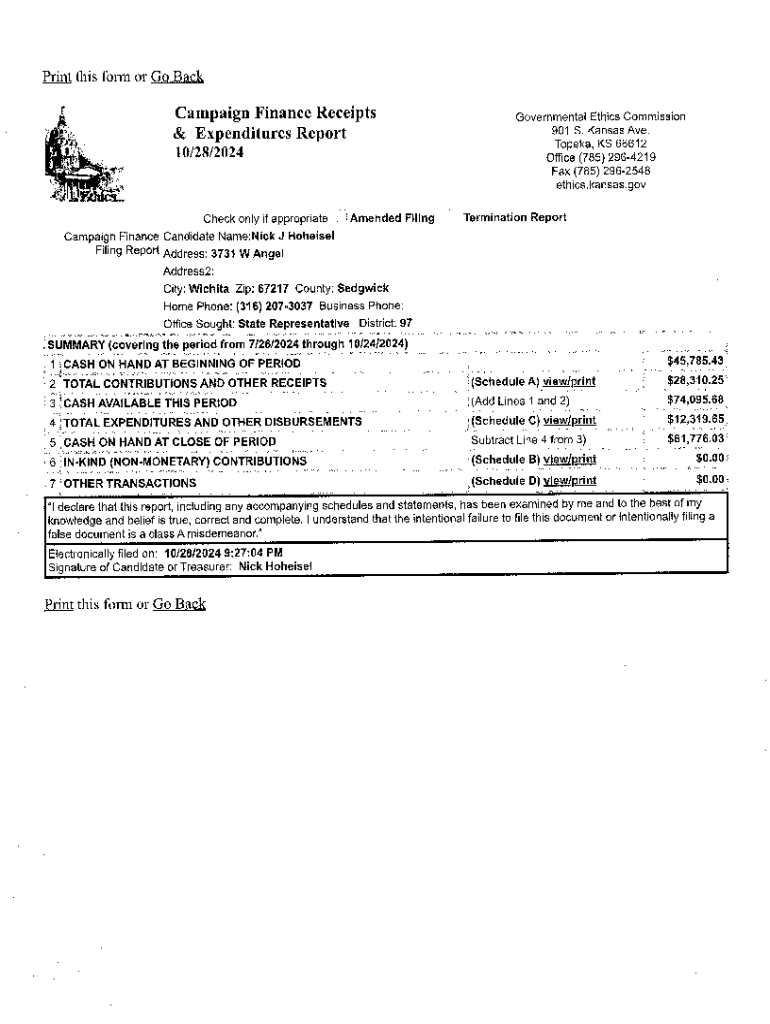

Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

The Comprehensive Guide to Campaign Finance Receipts Expenditures Form

Overview of campaign finance forms

Campaign finance forms play a critical role in maintaining transparency and accountability in the election process. These forms allow candidates and political committees to report all financial contributions and expenditures, ensuring compliance with legal regulations. Understanding campaign finance regulations not only helps in lawful operation but also builds trust with voters. The backbone of these regulations rests on a few key terminologies, including 'receipts,' which represent funds received, and 'expenditures,' indicating money spent. Moreover, timely and accurate reporting through the campaign finance receipts expenditures form is essential to avoid legal repercussions and foster transparency.

Types of campaign finance forms

Navigating through campaign finance forms can be overwhelming due to the differences between federal and state requirements. Federal forms are governed by the Federal Election Commission (FEC), while state forms vary according to state laws and are supervised by state election offices. Understanding the distinctions in requirements is crucial for compliance and successful fundraising.

When it comes to specific forms, Form 1, the Statement of Organization, is necessary for establishing a campaign. Form 3, the Report of Receipts and Disbursements, provides a detailed account of all money flowing into and out of the campaign. Additionally, candidates should be aware of various other forms, such as those related to special contributions, loans, and independent expenditures that may be required based on their unique campaign circumstances.

Preparing to fill out the forms

Proper preparation before diving into the form-filling process can save candidates time and potential headaches. Begin by gathering all necessary financial records, including bank statements, donation receipts, and invoices related to campaign expenditures. Inaccurate or incomplete data is one of the most common pitfalls during this phase, which can lead to significant reporting errors, ultimately affecting compliance.

Utilizing the right software tools can further streamline this process. pdfFiller is an excellent option, offering robust features to help candidates fill out, edit, and manage their campaign finance receipts expenditures forms. By leveraging an online document platform, you can automate portions of the process, which leads to increased efficiency and reduced chances for errors.

Step-by-step guide to completing the campaign finance receipts expenditures form

Completing the campaign finance receipts expenditures form requires careful attention to detail and organization. First, focus on Section 1, which involves reporting receipts. It’s essential to understand what qualifies as a receipt; this includes any monetary contributions, loans, donations, and other income sources. When entering data, ensure contributions are itemized correctly.

Next, in Section 2, you will report expenditures. Expenditures include all costs incurred during the campaign – from operating costs, such as rent and utilities, to fundraising expenses and advertisements. Breaking these down into categories not only simplifies the reporting process but also ensures clarity in documentation.

In Section 3, you will find itemization requirements for both receipts and expenditures. Be sure to create an itemization list when contributions or expenditures exceed the designated limits. Utilizing tools available within pdfFiller will allow you to easily generate these itemization lists, helping you comply with state and federal laws.

Editing and finishing touches

Once the initial completion of the campaign finance receipts expenditures form is done, it’s time to make sure everything is accurate and polished. Collaborative features provided by platforms like pdfFiller allow your campaign team to work together in real-time, reducing the chances of errors or miscommunications. Make sure to utilize the review and edit functions to catch any last-minute inaccuracies.

Additionally, consider the eSignature feature that enables you to sign documents digitally. This ensures that forms are submitted promptly, meeting any tight deadlines your campaign may face. Timely submission not only is crucial for compliance but also enhances your credibility with stakeholders.

Managing your filed documents

After filing your campaign finance receipts expenditures form, it is essential to remain organized. Proper document organization drastically simplifies retrieval in the future, should the need arise for audits or reviews. pdfFiller offers efficient storage solutions, allowing you to categorize and retrieve your forms with ease.

Equally important is tracking any changes or amendments made post-filing. This practice ensures ongoing compliance and can safeguard your campaign from potential issues down the line. Using pdfFiller’s version tracking features gives a holistic view of all modifications, ensuring you stay on the right side of the law.

Common errors to avoid

Creating a comprehensive and compliant campaign finance receipts expenditures form requires diligence, but several common errors can trip you up. One prevalent mistake includes the omission of required information, often due to rushed reporting or miscommunication within the campaign team. Additionally, misclassifying expenditures can lead to legal issues, making it crucial to categorize every expense accurately.

The consequences of non-compliance can be severe, including fines, audits, or in extreme cases, disqualification from running for office. Therefore, remaining vigilant during each step of the form-filling process is vital to ensure that your campaign adheres to all legal requirements.

FAQs about campaign finance forms

Navigating campaign finance forms can pose numerous questions for candidates. For instance, many candidates wonder about the process for filing extensions, the legal obligations regarding deadline adherence, and the impact of contributions from various sources. Seeking out comprehensive FAQs helps clarify these confusing aspects.

In general, candidates are required to familiarize themselves with the specific obligations of their state and federal laws. Consulting the FEC or state election websites can provide valuable guidance to ensure compliance. Being informed is the first step to successful campaign finance management.

State-specific considerations

Campaign finance regulations can vary widely from state to state. Each state has its own laws regarding contribution limits, reporting deadlines, and forms required beyond the federal ones. Therefore, it’s crucial for candidates to understand their state’s specific requirements and stay updated on any changes.

Local agencies can provide guidance and are excellent resources for queries relating to state laws. Keeping close contact with such organizations can help safeguard your campaign against potential legal pitfalls, ensuring adherence to state-specific campaign finance regulations.

Conclusion: Simplifying your campaign finance reporting

Effectively managing your campaign finance receipts expenditures form can seem daunting, but with the right approach and tools, it can be streamlined. Using pdfFiller's features not only simplifies the process but also ensures compliance through organized document management. The benefits of leveraging technology for your campaign finance reporting extend beyond efficiency; it also enhances your campaign’s transparency and credibility.

As campaigns grow more complex, adopting effective document management technologies becomes vital for maintaining integrity and trust. By utilizing solutions like pdfFiller, candidates can navigate the intricate landscape of campaign finance effortlessly, allowing them to focus more on their campaign and less on administrative headaches.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send campaign finance receipts expenditures for eSignature?

How do I complete campaign finance receipts expenditures online?

How can I edit campaign finance receipts expenditures on a smartphone?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.