Get the free Arizona Extra-curricular Tax Credit

Get, Create, Make and Sign arizona extra-curricular tax credit

Editing arizona extra-curricular tax credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out arizona extra-curricular tax credit

How to fill out arizona extra-curricular tax credit

Who needs arizona extra-curricular tax credit?

Arizona Extra-Curricular Tax Credit Form: A Comprehensive Guide

Understanding the Arizona Extra-Curricular Tax Credit

The Arizona Extra-Curricular Tax Credit is a program established by Arizona law that allows taxpayers to make contributions to extra-curricular activities in public schools. This initiative aims to bolster funding for non-academic programs, enhancing the educational experience for students. By participating, taxpayers not only support important school activities but also benefit from a tax credit against their state income tax.

Supporting extra-curricular activities is paramount in fostering a well-rounded education. These programs play a crucial role in character development, teamwork, and creativity. Further emphasizing the importance of this tax credit, it encourages community involvement and investment in local schools, which leads to thriving educational environments.

Eligibility for this tax credit is fairly broad, allowing individuals and couples filing jointly to participate. You must file a state income tax return and have a tax liability to claim the credit. The maximum contribution limits must be adhered to, ensuring that all participants stay within legal parameters.

Key benefits of the Arizona Extra-Curricular Tax Credit

One of the primary benefits of the Arizona Extra-Curricular Tax Credit is the financial incentive it provides to taxpayers. Contributions made are eligible for dollar-for-dollar tax credits, meaning you can directly offset your tax liability while simultaneously supporting your local public schools. This creates a win-win situation where your contributions go to enriching the educational experience for students.

The impact on the community is significant. Schools rely on these funds to support a variety of essential programs, including sports teams, drama clubs, and music programs. When taxpayers contribute, they actively participate in creating a richer educational landscape which promotes not only student development but also community engagement and pride.

Types of expenses covered by the tax credit

The Arizona Extra-Curricular Tax Credit covers a plethora of activities and programs that enhance the educational journey for students. Eligible expenses typically include fees for sports, clubs, and character education programs that promote skill development outside the core curriculum. For example, contributions can cover the costs for student participation in events such as drama productions or music competitions.

However, there are limitations to what can be covered. Contributions should be directed specifically towards fees associated with extra-curricular activities and cannot be used for academic fees. It is essential to verify that the activity qualifies to ensure that your contributions are eligible for the tax credit.

How to obtain the Arizona Extra-Curricular Tax Credit Form

Obtaining the Arizona Extra-Curricular Tax Credit Form is an easy process. First, you can visit the official Arizona Department of Revenue website, where all necessary forms are readily available for download. Alternatively, pdfFiller offers a user-friendly platform for accessing and editing various tax-related documents, including this specific form.

For those comfortable with digital formats, pdfFiller allows users to access, download, and print the form directly from their website, making the process seamless.

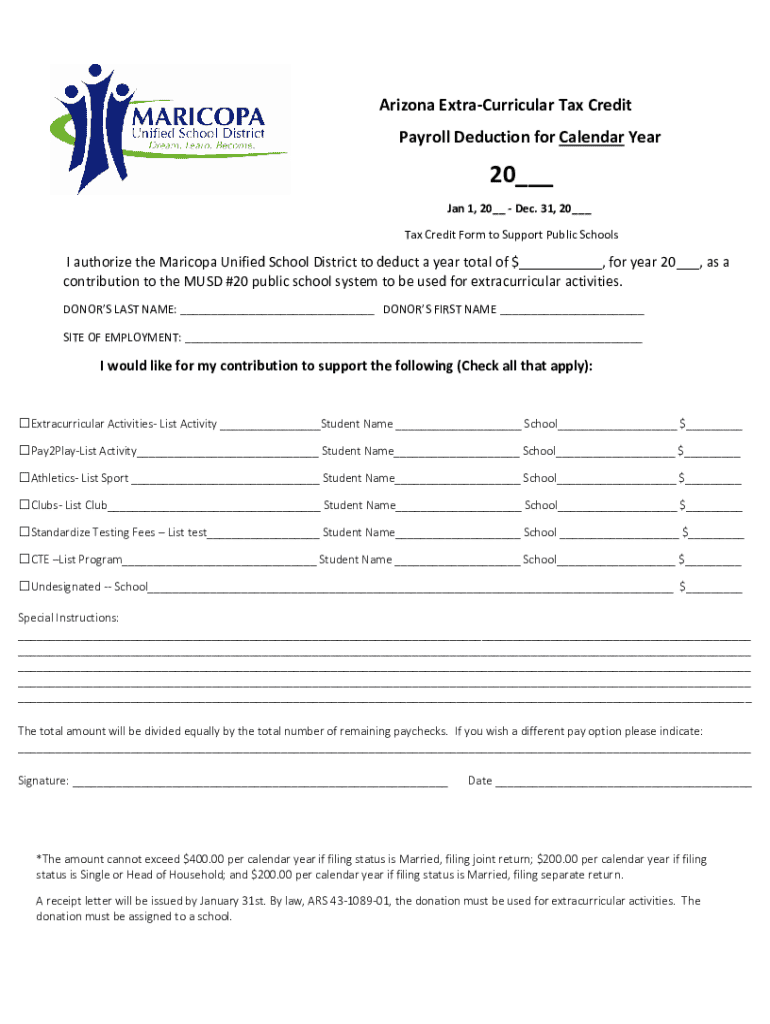

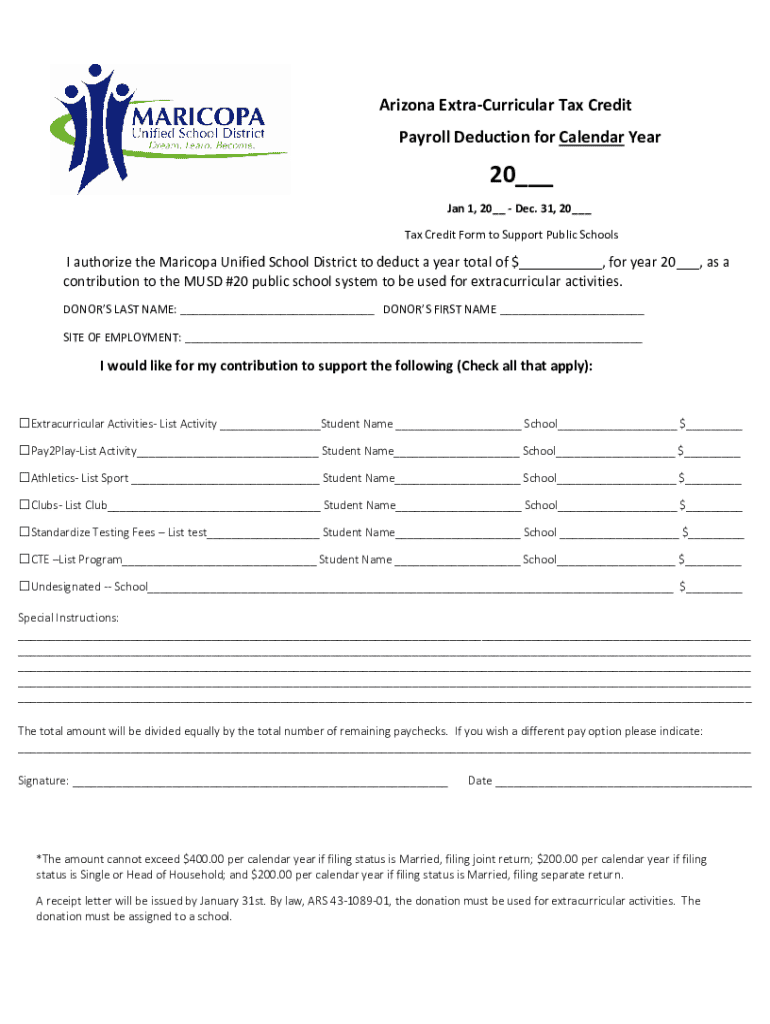

Completing the Arizona Extra-Curricular Tax Credit Form

Filling out the Arizona Extra-Curricular Tax Credit Form requires attention to detail. Begin with entering your personal information accurately at the top of the form. This includes your name, address, and taxpayer identification number. Next, the form outlines sections for accounting the specific contributions you’ve made. Ensure you provide precise figures and identify the school or program to which you donated.

To avoid common mistakes, double-check all entries before submission. Many people overlook important details such as signing the form and entering the correct tax year. Retaining documentation, such as receipts for contributions, is also advisable, as you may need them for verification purposes should the Department of Revenue request further information.

Submitting the form: What you need to know

After completing the Arizona Extra-Curricular Tax Credit Form, you’ll need to submit it properly to receive credit. You can submit the form via mail, on the web, or in person. Each method has its own set of instructions, so be sure to follow them closely to avoid delays or discrepancies.

Importantly, be aware of submission deadlines. Typically, forms must be filed by the same date as your state income tax return, which is generally April 15th. To track the status of your submission, you can contact the Department of Revenue directly or check their online portal for updates.

Editing and managing the form with pdfFiller

pdfFiller provides a robust platform for managing the Arizona Extra-Curricular Tax Credit Form. Users can utilize interactive tools to edit the PDF directly in their browser. This means no more hassles with printing and scanning documents, as everything can be done digitally.

Moreover, pdfFiller's e-sign feature allows users to sign their forms electronically, making the submission process even swifter. Furthermore, teams working together on submissions can collaborate in real-time, thanks to pdfFiller's cloud-based editing capabilities. Users can effectively store all relevant documents for easy access in the future, ensuring that they are always prepared for any necessary follow-up.

Frequently asked questions (FAQ) about the Arizona Extra-Curricular Tax Credit

Many taxpayers have inquiries regarding the Arizona Extra-Curricular Tax Credit. Common concerns include understanding eligibility criteria, qualifying activities, and how to handle audits or verification requests regarding their claims. Familiarizing yourself with the guidelines set by the Department of Revenue can alleviate anxiety around these topics.

Additionally, keeping abreast of updates in the tax credit process is important. Changes can occur from year to year, and being aware of these can help you maximize your contributions and benefit from available credits. Regularly checking the Arizona Department of Revenue website or subscribing to email updates can help ensure you are informed.

Real-life impact: Success stories from Arizona taxpayers

The Arizona Extra-Curricular Tax Credit has transformed the educational landscape for many schools and communities. Numerous taxpayers have shared testimonials of their positive experiences, highlighting how their contributions supported specific programs or even funded entire sports teams. One local high school observed a marked increase in student participation in drama classes and theater productions, thanks to the financial support received through the tax credit.

Such case studies underscore the substantial benefits of this initiative. Schools have reported enhanced community engagement and pride, fostering an environment where students are more likely to flourish. The stories of students finding their passions through funded extra-curricular activities showcase the profound impact of taxpayer contributions.

Contact information for support

For any questions or need for assistance regarding the Arizona Extra-Curricular Tax Credit Form, the Arizona Department of Revenue is available for support. Taxpayers can reach out via email or phone for personalized assistance. Furthermore, if you are using pdfFiller and encounter challenges, their customer support team is also equipped to provide help through various contact points, including live chat options.

Footer links for additional information

To expand your understanding of the Arizona Extra-Curricular Tax Credit, several resources are available. The Arizona Department of Revenue offers official forms and detailed guidance. Additionally, pdfFiller provides comprehensive support and tutorials for managing your tax documents effectively. Explore these links to ensure you have all the information you need to navigate your tax credit claims smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arizona extra-curricular tax credit to be eSigned by others?

How do I execute arizona extra-curricular tax credit online?

How do I make edits in arizona extra-curricular tax credit without leaving Chrome?

What is arizona extra-curricular tax credit?

Who is required to file arizona extra-curricular tax credit?

How to fill out arizona extra-curricular tax credit?

What is the purpose of arizona extra-curricular tax credit?

What information must be reported on arizona extra-curricular tax credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.