Get the free Mo-8826

Get, Create, Make and Sign mo-8826

Editing mo-8826 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo-8826

How to fill out mo-8826

Who needs mo-8826?

Complete Guide to the mo-8826 Form

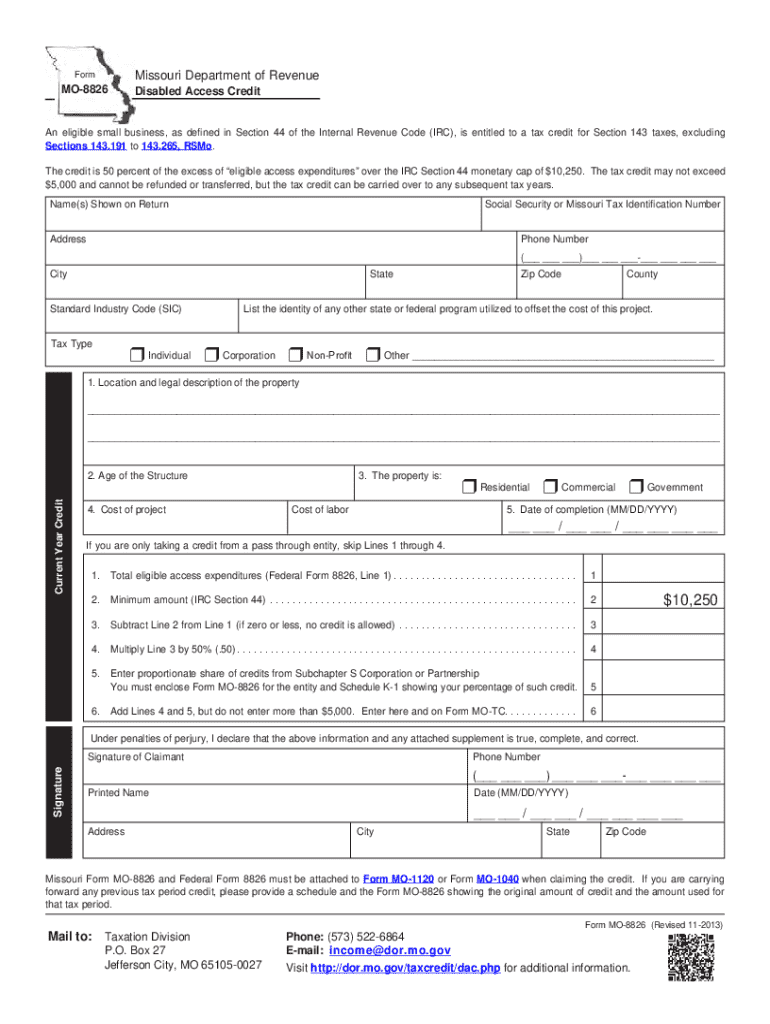

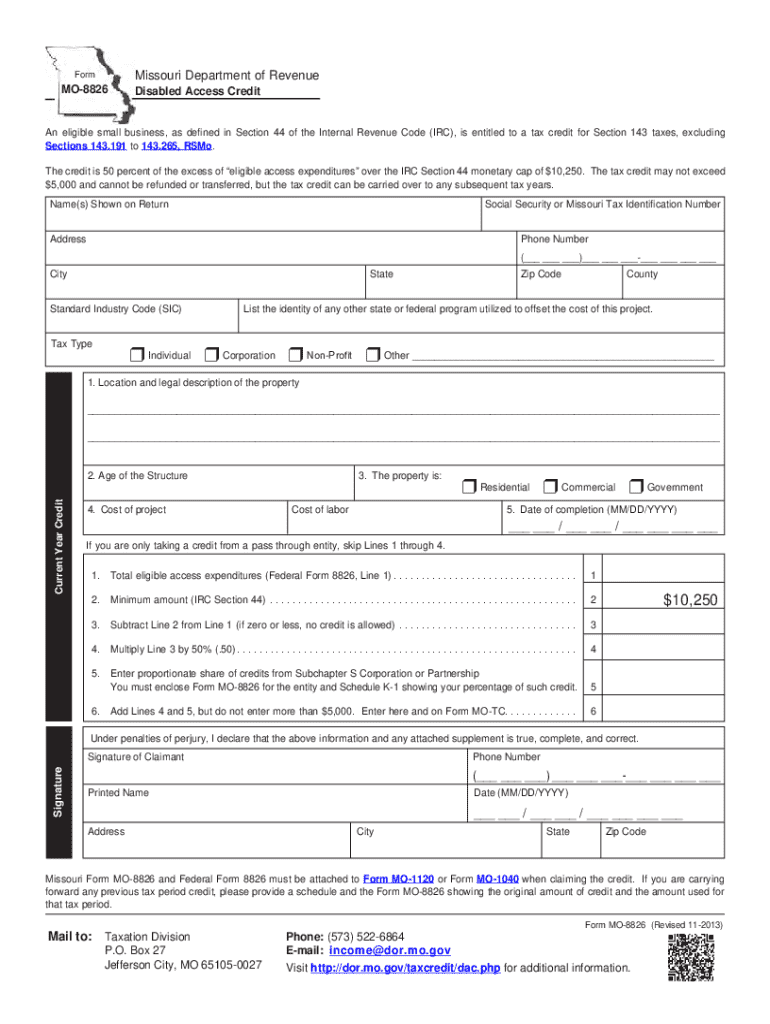

Understanding the mo-8826 form

The mo-8826 form is a specialized document used for specific purposes within formal applications or submissions. It acts as an official request for various administrative processes, making it a crucial tool in document management.

This form is vital for ensuring compliance with regulatory frameworks or organizational policies, paving the way for smoother operations and avoiding potential bottlenecks in procedural workflows.

Eligibility criteria for using the mo-8826 form

Only individuals or organizations that meet specific criteria can utilize the mo-8826 form. It is typically applicable to those engaged in activities regulated by instructions outlined in the accompanying guidelines.

Common eligibility factors include the type of entity submitting the form, the purpose for which it is being submitted, and adherence to any stipulated requirements. Misunderstandings regarding these criteria can often lead to confusion in application.

Detailed insights into mo-8826 form processes

Filing the mo-8826 form involves understanding the processes associated with its completion. Initially, the most critical step is gathering relevant information and documentation that supports the claims or requests made in the form.

Accuracy is paramount; errors can lead to delays or rejections. Utilizing resources such as PDFs, manuals, and guides simplifies this process.

Essential components of the mo-8826 form

The mo-8826 form consists of various sections, each requiring specific personal and financial details. Key components typically include identification information, description of the request, and any necessary attachments.

Understanding what each section calls for is crucial to ensure your submission is both complete and compliant with required standards.

Practical steps to complete the mo-8826 form

To effectively fill out the mo-8826 form, start by preparing all necessary documents ahead of time. This includes personal identification, financial records, and any applicable prior correspondence.

Next, carefully follow the guidelines for entering information. Precision in filling out the form enhances clarity and improves the chances of acceptance.

Editing and refining your mo-8826 form

If you need to make corrections to your form, it is crucial to do so promptly and accurately. Mistakes should be amended clearly to avoid misunderstandings when the form is reviewed.

Tools like pdfFiller can assist in making these updates efficiently, enabling you to adjust entries without starting from scratch.

Signing and submitting the mo-8826 form

Options for signing the mo-8826 form include traditional ink signatures or electronic signatures through platforms like pdfFiller. Ensure that your signature meets the submission requirements.

Timeliness is crucial when submitting forms, as deadlines often dictate compliance issues. Familiarize yourself with the specific submission channels and adhere strictly to them.

Tracking your mo-8826 form submission

After submitting the mo-8826 form, tracking the status of your submission is essential. Knowing when to expect feedback can alleviate potential anxieties.

Using tools like the tracking features of pdfFiller provides real-time updates on your submission status, ensuring you're always informed.

Common FAQs about the mo-8826 form

Many users have questions regarding the mo-8826 form. Frequently asked concerns include the process for amending a submitted form and what steps to take if the form is rejected.

It is advisable to keep track of previous filings, as this information aids in future submissions and amendments.

Benefits of using pdfFiller for mo-8826 form management

pdfFiller provides a robust platform for managing all aspects of the mo-8826 form. Its features facilitate document creation, editing, and collaboration, making the process smoother.

Cloud access allows users to work from anywhere, making pdfFiller an ideal solution for teams who need to collaborate on submissions efficiently.

Real-world scenarios: Case studies involving the mo-8826 form

Several individuals and teams have successfully navigated the mo-8826 form with the aid of best practices derived from prior experiences. Learning from these case studies can offer valuable insights.

For instance, a small business submitted the mo-8826 form for a grant application. By carefully reading the instructions and using pdfFiller, they secured their funding successfully.

Summary of key points about the mo-8826 form

In conclusion, understanding the mo-8826 form extends beyond mere completion. Familiarity with its requirements, processes, and editing tools like pdfFiller is crucial for maximizing the benefits of your submissions.

Equipping yourself with the right tools and knowledge not only enhances compliance but also elevates your overall experience in managing the mo-8826 form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mo-8826 from Google Drive?

How do I make changes in mo-8826?

How do I fill out mo-8826 on an Android device?

What is mo-8826?

Who is required to file mo-8826?

How to fill out mo-8826?

What is the purpose of mo-8826?

What information must be reported on mo-8826?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.