Get the free 2025-2026 Independent Verification Worksheet

Get, Create, Make and Sign 2025-2026 independent verification worksheet

Editing 2025-2026 independent verification worksheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 independent verification worksheet

How to fill out 2025-2026 independent verification worksheet

Who needs 2025-2026 independent verification worksheet?

Comprehensive Guide to the 2 Independent Verification Worksheet Form

Understanding the 2 independent verification worksheet form

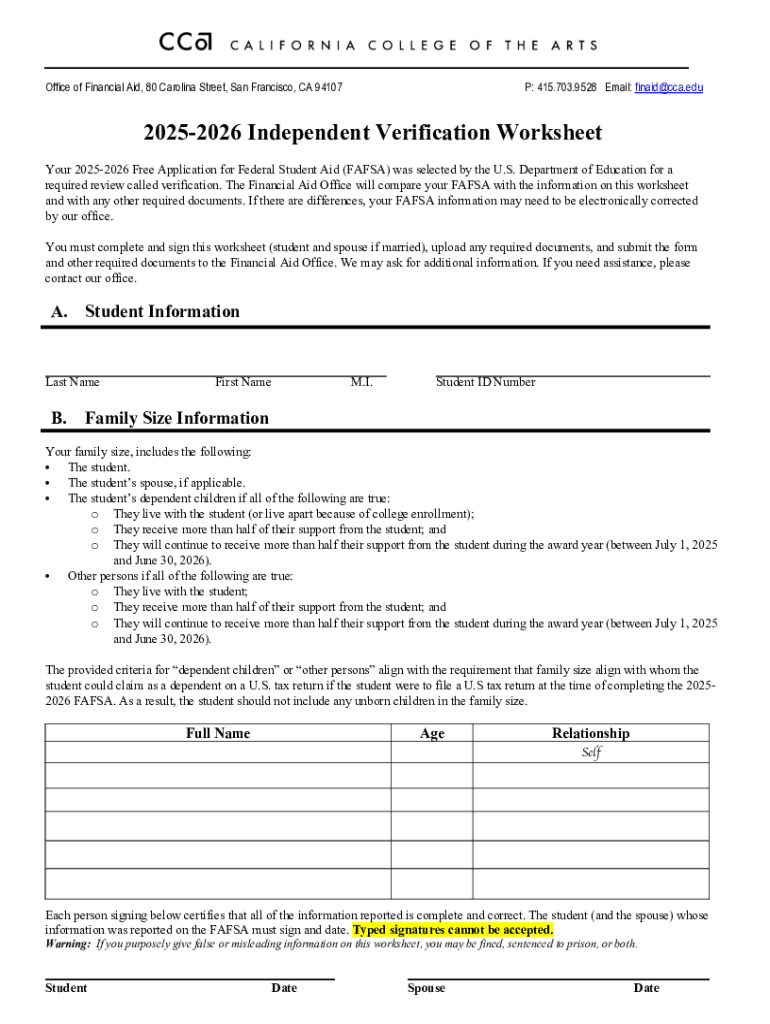

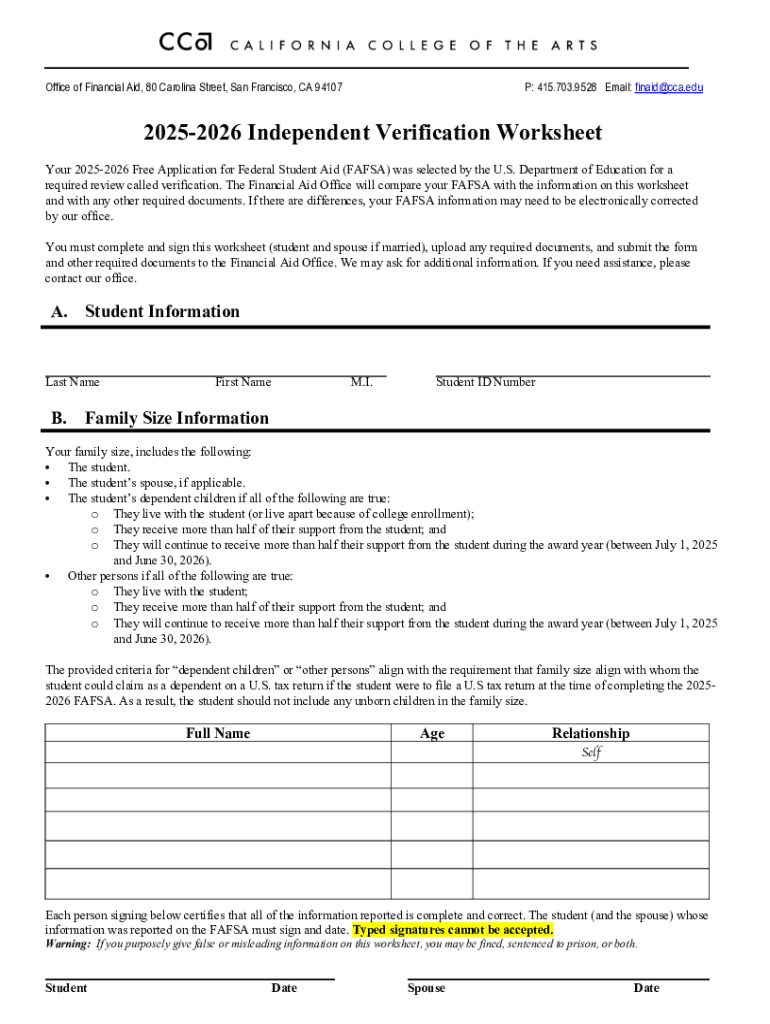

The 2 Independent Verification Worksheet Form is a crucial document for students applying for federal financial aid. This form serves as a means of verifying the information provided on the Free Application for Federal Student Aid (FAFSA). Verification is a federal requirement intended to ensure the accuracy of information, helping institutions prevent fraud and assist students in receiving appropriate financial assistance.

The importance of verification cannot be overstated. It acts as a safeguard, ensuring only eligible students receive aid based on accurate information. Particularly for the 2 academic year, key updates in the verification process reflect recent legislative changes and improvements in digital document management.

Interactive tools for verification

To streamline the verification process, various interactive tools are available. A step-by-step interactive tool for completing the worksheet walks users through each section, highlighting necessary data and offering prompts to ensure nothing is overlooked. This function is particularly useful for first-time applicants or those unfamiliar with the process.

Additionally, a calculator for estimating the Expected Family Contribution (EFC) provides families with an overview of financial aid expectations. To top it off, the system allows users to edit forms directly in PDF format, leveraging features like text boxes, checkmarks, and signatures, making it easier to manage important documents on-the-go.

Filling out the 2 verification worksheet

Filling out the 2 Independent Verification Worksheet involves several key sections that collect personal and financial information. The primary segments include student information and family information, each requiring detailed inputs. Accurate reporting is critical; any discrepancies can lead to delays in financial aid disbursement.

Taking care while filling out these sections helps minimize errors. Common mistakes include incorrect Social Security numbers and misreporting income, which can lead to complications in the financial aid process.

Document management and submissions

When filling out the 2 Independent Verification Worksheet, it’s essential to attach acceptable documentation. This includes various financial records that institutions require to complete the verification process.

Uploading documents securely via pdfFiller ensures confidentiality and compliance with regulatory standards. Best practices for document organization include maintaining clear labels and maintaining copies in your records to avoid confusion later.

Collaborating on verification with teams

In cases where multiple individuals are involved in the verification process, collaborating effectively is essential. Utilizing shared access through pdfFiller allows teams to work more efficiently. Everyone involved can view, edit, or comment on the worksheet in real-time, ensuring that collaborative efforts do not result in conflicting information.

Managing permissions and access levels becomes crucial when handling sensitive information. Assign roles appropriately to limit access to personal details while still enabling teams to perform their verification tasks.

Corrections and updates to the worksheet

After submitting the 2 Independent Verification Worksheet, changes might be necessary. If you discover errors after submission, it's critical to understand the procedures for correcting them efficiently. Most institutions provide guidance for updates, asking students to submit corrected information promptly.

Understanding these elements can significantly alleviate stress during the verification process, allowing students to maintain their focus on education.

Verification policies and procedures

Each institution has its own verification policies, which are often aligned with federal aid program guidelines. Understanding these policies can help students navigate the verification landscape more successfully. Familiarize yourself with key steps and what documentation is required by your specific institution to avoid pitfalls.

It is also beneficial to be aware of appeals processes for unusual circumstances. If there are extenuating factors affecting financial circumstances, institutions may have protocols in place to support students in these situations.

Exclusions and special situations in verification

Certain groups are excluded from the verification process. Understanding who might not need to verify can save time and resources. For example, applicants who are selected for verification that is part of specific exemptions may not need to complete the 2 Independent Verification Worksheet.

Navigating unique financial situations can be tricky, and institutions are often willing to help students understand their specific circumstances.

Income and tax documentation guidelines

Providing accurate and complete income documentation is essential when completing the 2 Independent Verification Worksheet. Acceptable forms of documentation include W-2 forms, tax returns, and, for those who have not filed taxes, alternative income statements.

Strategies for international students involve checking with financial aid offices to understand the unique forms of documentation they may require.

Family size verification details

Accurately reporting household size on the 2 Independent Verification Worksheet can affect the amount of financial aid a student receives. To do this correctly, students must report all individuals living in their household who will be attending college, as well as family members who financially support them.

The accuracy of this section can be crucial in determining the overall aid package, so careful attention is warranted.

Final review before submission

Before submitting the 2 Independent Verification Worksheet, conducting a final review is essential. Utilizing checklists can help ensure completeness, spotting common pitfalls that commonly occur during submissions.

Finalizing and submitting the worksheet with attention boosts the chances of a smooth verification process and getting financial aid on time.

Post-submission actions

After submission of the 2 Independent Verification Worksheet, it's important to know what to expect. Tracking the status of your verification request can typically be done through an online financial aid portal provided by the institution.

By being proactive and organized in your approach, the post-submission phase can be navigated smoothly, ensuring financial assistance is received when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2025-2026 independent verification worksheet without leaving Google Drive?

How do I make changes in 2025-2026 independent verification worksheet?

How do I complete 2025-2026 independent verification worksheet on an iOS device?

What is 2026 independent verification worksheet?

Who is required to file 2026 independent verification worksheet?

How to fill out 2026 independent verification worksheet?

What is the purpose of 2026 independent verification worksheet?

What information must be reported on 2026 independent verification worksheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.