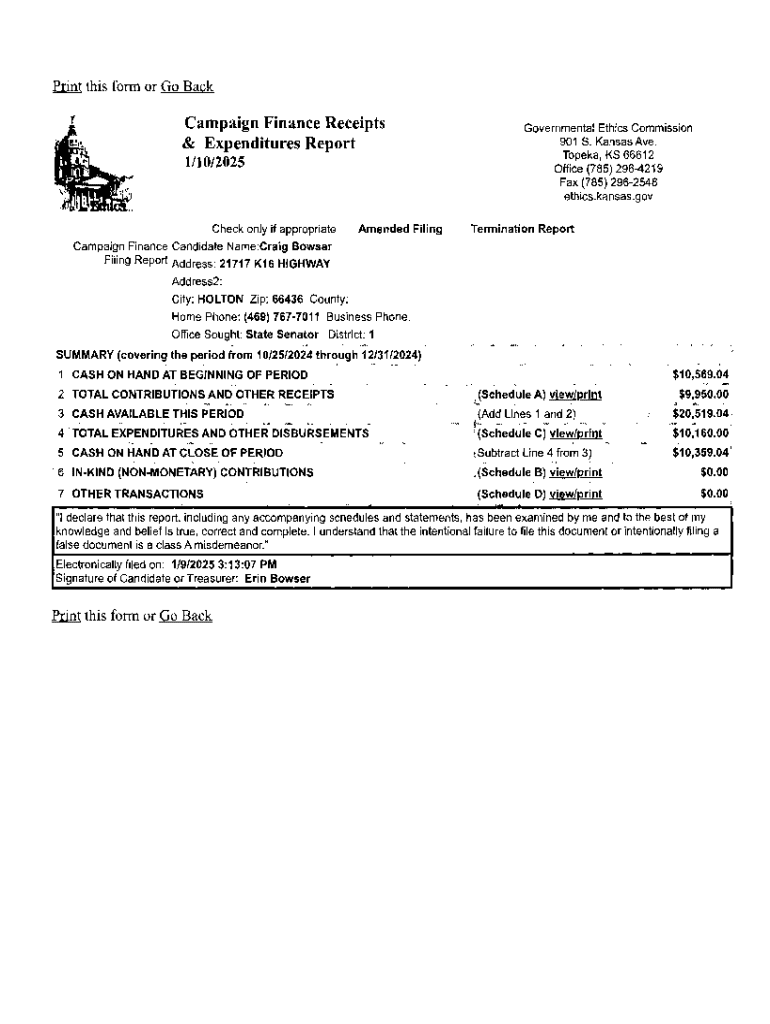

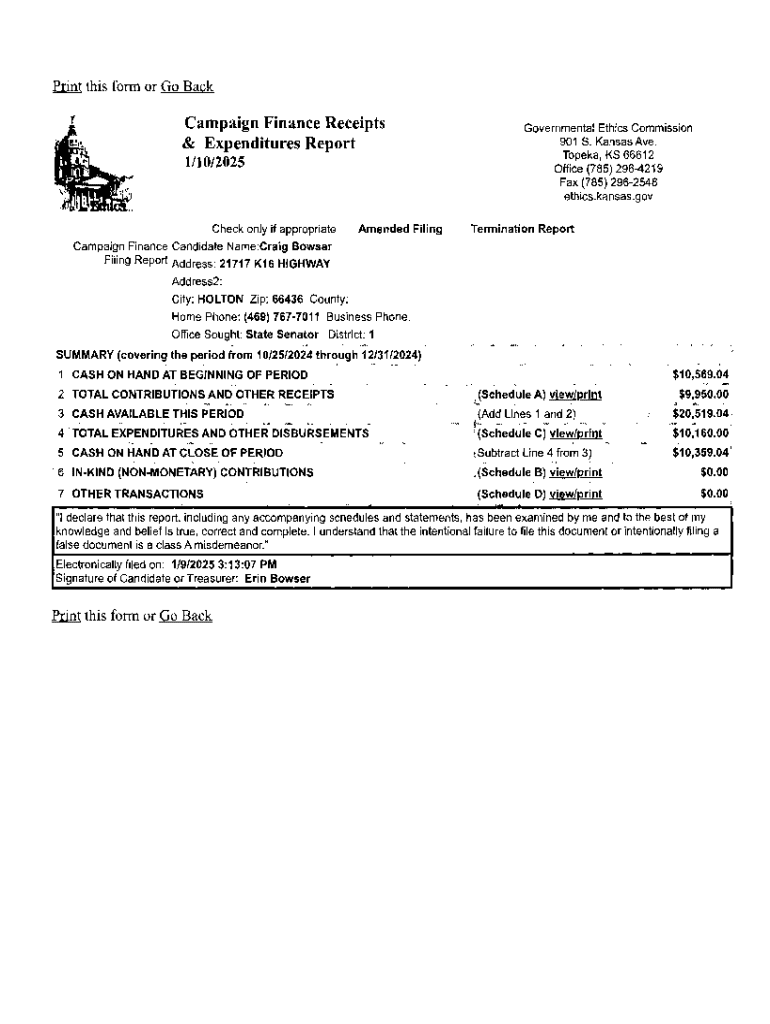

Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

Editing campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Mastering the Campaign Finance Receipts Expenditures Form

Understanding the campaign finance landscape

Campaign finance plays a critical role in shaping the political landscape, particularly in democratic societies. It encompasses the funding necessary for political campaigns, which can include everything from grassroots fundraising to major donations from corporations and special interest groups. The significance of campaign finance lies in its capacity to influence electoral outcomes and policy decisions. In many countries, various regulations and laws govern how campaigns can raise and spend money, aimed at ensuring transparency and preventing corruption.

The regulatory framework surrounding campaign finance varies by jurisdiction but typically involves strict guidelines about contribution limits, disclosure requirements, and reporting mandates. Compliance with these laws is essential not only for the integrity of the election process but also for maintaining public trust in democratic institutions. Failure to adhere to these financial regulations can lead to severe penalties, including fines and disqualification from participating in elections.

Campaign finance receipts

Receipts form the backbone of campaign finances, categorizing the money received by a campaign during its operation. This includes various types of contributions, such as individual donations, organizational contributions, and in-kind support, all critical for the campaign's success. Understanding what constitutes a campaign finance receipt is crucial for precise financial reporting.

A key aspect is differentiating between individual and organizational contributions. Individual contributions are funds from private citizens, often subject to lower limits than those imposed on organizations, which can include political action committees (PACs) or corporations. Accurate documentation of these receipts is vital; it not only aids in compliance but also enhances transparency with voters.

Utilizing tools like pdfFiller can significantly enhance the management of receipts. This platform allows for seamless editing and sharing of documents among campaign team members, ensuring everyone is on the same page regarding financial status.

Campaign finance expenditures

Expenditures in a campaign refer to the money spent on various activities and services necessary for running a successful electoral campaign. These expenditures generally fall into several categories, including operational costs, advertising, and pay for campaign staff. Differentiating between direct and indirect costs is vital. Direct costs are directly attributable to the campaign efforts, while indirect costs could include overhead expenses like office rent or utilities.

When it comes to reporting expenditures, key components must be included. This typically involves documenting the purpose of each expense, the date it was incurred, and the amount spent. Maintaining compliance is crucial, as improper reporting can lead to penalties or audits, jeopardizing a campaign's integrity.

Utilizing pdfFiller can streamline the expenditure tracking process, as it offers interactive tools for managing expenditures in real-time and permits cloud-based access for collaborative efforts among team members.

Step-by-step guide to completing the campaign finance receipts and expenditures form

Completing the campaign finance receipts and expenditures form is a meticulous task requiring attention to detail. The first step involves preparing by gathering all necessary documentation and information, including bank statements, receipts, and contribution records. Setting up the online environment on pdfFiller can facilitate this process, allowing easy access and management of the form in one place.

When filling out the receipts section, follow line-by-line instructions. Accurately entering each piece of information, such as the amount of the contribution and the donor's details, is critical. Common mistakes to avoid include failing to list all contributors or not providing required information for each receipt.

The expenditures section requires similarly detailed attention. Each type of expenditure must be documented correctly, including the purpose of the spending and receipt information. Reviewing for accuracy is crucial to avoid potential audits or penalties down the line.

Common challenges and solutions

Successfully managing campaign finances can be fraught with challenges. One major hurdle is navigating regulatory changes, as these can significantly impact how campaigns report finances. Therefore, staying informed about the latest developments in campaign finance laws is vital. Resources such as the Federal Election Commission (FEC) website, legal advisors, and reputable political organizations can provide updated frameworks and guidance.

Addressing gaps in record-keeping is another common issue. Incomplete or missing receipts can pose problems during audits or reporting processes. Strategies to overcome this include maintaining organized digital records, such as using pdfFiller's digital storage capabilities to centralize all financial documentation and minimize discrepancies.

Effective team collaboration is vital for managing financial documents and ensuring compliance. Leveraging pdfFiller's collaborative tools can enhance communication and facilitate input from various team members, mitigating risks associated with inaccurate reporting.

Frequently asked questions (FAQs)

Many misconceptions exist surrounding campaign finance reporting. One common myth is that only large contributions need to be reported; in reality, all contributions may have to be disclosed depending on local regulations. Understanding these nuances is fundamental for compliance and transparency.

Technical issues when filling out the campaign finance receipts expenditures form can also arise. Users may encounter problems with document uploads or submission errors. Troubleshooting tips include ensuring that files are compatible with the platform and checking internet connectivity. For specific campaign finance queries, resources such as state election offices, campaign finance experts, and legal advisors are invaluable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the campaign finance receipts expenditures in Chrome?

Can I create an electronic signature for signing my campaign finance receipts expenditures in Gmail?

How do I fill out the campaign finance receipts expenditures form on my smartphone?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.