Get the free 10-k

Get, Create, Make and Sign 10-k

Editing 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10-k

How to fill out 10-k

Who needs 10-k?

10-K Form: A Comprehensive How-to Guide

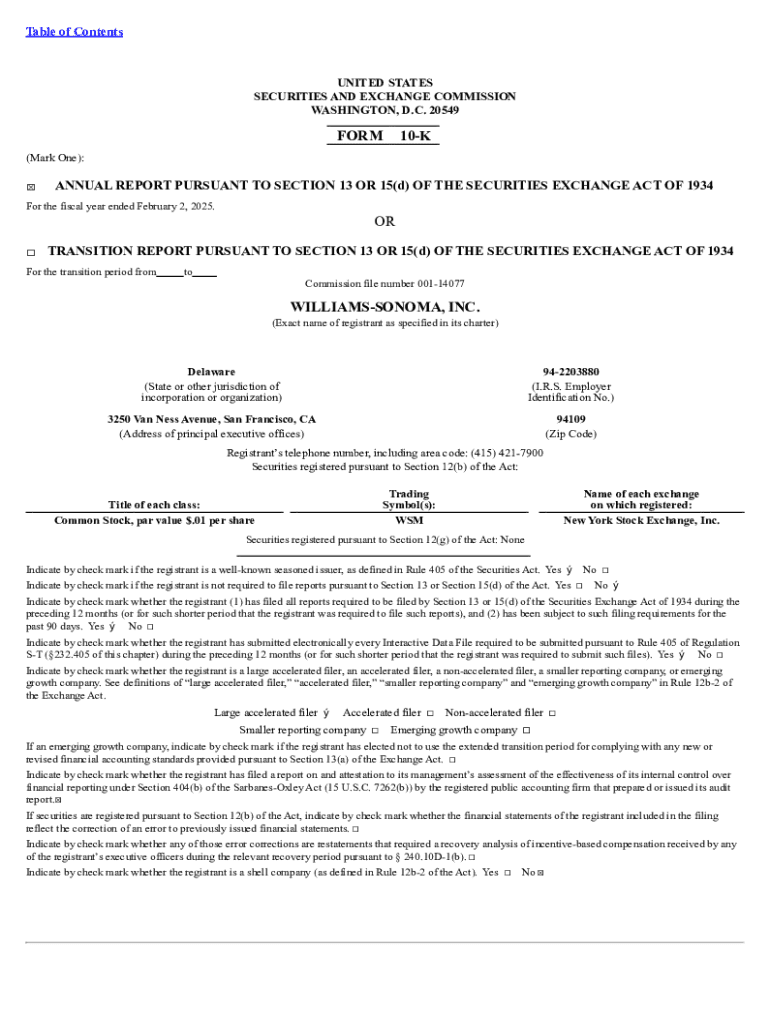

Understanding the 10-K form

The 10-K filing is a crucial document for investors, analysts, and regulators alike, providing a comprehensive overview of a company's financial performance over the last fiscal year. This in-depth annual report serves as a key source of information regarding a company's business operations and financial health.

Designed to deliver transparency, the 10-K form comprises detailed financial statements and a variety of other essential information. It enables stakeholders to assess the company's past performance, profitability, and future risks that could affect its operational trajectory.

Filing a 10-K form

Filing a 10-K form is a structured process that involves multiple steps to ensure accuracy and compliance with SEC regulations. The first step involves gathering all necessary financial data and relevant reports, including quarterly and annual financial statements.

Next, you complete several key sections of the report, such as the business overview, financial statements, and risk analysis. Before submission, a thorough review for compliance with SEC regulations is essential to avoid penalties or delays. Finally, the 10-K must be submitted electronically through the EDGAR system.

Who must file and why?

Specific entities are obligated to file a 10-K form, primarily public companies that meet the SEC's reporting requirements. This includes practically all multinational companies listed on major U.S. stock exchanges. Startups that reach a certain threshold in assets or shareholders must also comply with these regulations.

Failure to file a 10-K can lead to severe consequences, including fines, legal repercussions, and damage to investor relations. Transparency and timely reporting are not just regulatory obligations but also critical elements in maintaining stakeholder trust.

Navigating financial reporting requirements

Understanding the key sections of the 10-K is essential for effective financial reporting. The Business Overview provides context about the company's operations and market position, while the Risk Factors section details potential challenges that may not be immediately apparent.

Another vital component, Management’s Discussion and Analysis (MD&A), allows management to interpret financial results in their context, enabling stakeholders to appreciate strategic planning. Financial Statements and accompanying Notes to Financial Statements offer confirmed numerical data crucial for analysis.

10-K frequently asked questions (FAQs)

Understanding common queries related to the 10-K form is crucial for anyone involved in corporate finance. Typically, a 10-K report includes the company's performance metrics, risk assessments, and management discussions. It is an annual requirement, with companies expected to file within a specific timeframe after the fiscal year.

For companies that fail to submit their 10-K on time, repercussions can range from administrative fines to more severe scrutiny from regulators, which could adversely affect stock prices. Anyone wishing to access another company’s 10-K report can do so via the SEC's EDGAR database, which allows public access to these documents.

The relationship between 10-Ks and annual reports

While both the 10-K form and annual reports serve the purpose of informing stakeholders, they are quite different in content and intent. A 10-K is a formal requirement governed by SEC regulations, whereas an annual report to shareholders is often more of a marketing tool used to enhance the company's image.

Additionally, the 10-K is much more detailed, including in-depth discussions of risks, while the annual report may summarize outcomes and achievements in a visually appealing layout. Both documents play essential roles in corporate communication and investor relations.

Utilizing technology in the 10-K filing process

The advancement of technology has dramatically simplified the 10-K filing process. Tools like pdfFiller enable companies to streamline the preparation and submission of the 10-K form, facilitating easier editing, signing, and management of essential documents. With its intuitive interface and cloud-based capabilities, pdfFiller helps teams collaborate effectively, even remotely.

Moreover, features like intelligent templates, automated reminders, and cloud storage reduce the risk of errors while improving efficiency. By consolidating all necessary functionalities within one platform, pdfFiller empowers users to handle their documentation needs seamlessly.

Advanced tips for mastery over 10-K filings

For those seeking to master the intricacies of 10-K filings, leveraging data analytics for enhanced reporting can provide significant insights into corporate performance. Utilizing these tools can help forecast trends over time, facilitating informed decision-making based on historical data and performance metrics.

Additionally, using collaborative tools that connect executives, finance teams, and legal departments can ensure compliance while streamlining the process. Integrated communication and document-sharing platforms are invaluable in maintaining a single source of truth throughout the reporting season.

Key takeaways for effective 10-K management

Consistent and accurate 10-K management practices are vital for ongoing compliance. Establishing a schedule for regular updates and integrity checks on data can significantly mitigate risks associated with underreporting or misrepresentation. Continuous learning is essential to stay abreast of regulatory changes and industry best practices.

Investing in educational resources or workshops can help finance and legal teams enhance their understanding of filing requirements, enabling them to navigate the complexities of financial reporting with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the 10-k in Gmail?

How do I edit 10-k on an iOS device?

How do I fill out 10-k on an Android device?

What is 10-k?

Who is required to file 10-k?

How to fill out 10-k?

What is the purpose of 10-k?

What information must be reported on 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.