Individual application to provide form: A comprehensive guide

Understanding the individual application process

An individual application refers to a formal request submitted by a person for specific approvals or services across different domains, such as government services or educational enrollments. Understanding the importance of individual applications is vital—without them, individuals miss opportunities to access critical services or rights. For example, the Internal Revenue Service (IRS) requires individual applications for tax-related services, and educational institutions often mandate them for admissions.

Common scenarios where individual applications are necessary include applying for a driver's license, filing income tax returns, or enrolling in schools. Each context has particular forms and criteria that applicants must follow.

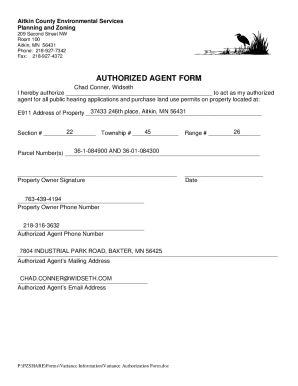

Forms for obtaining permits or licenses.

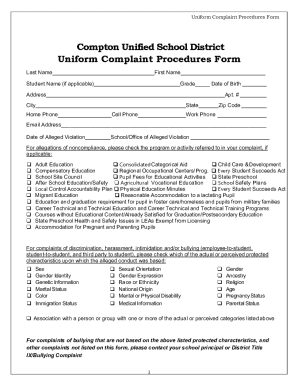

Enrollment applications for schools and colleges.

Forms required by the Department of Revenue for tax filings.

Key terminology explained

Understanding key terms can clarify the individual application process. For instance, 'eligibility criteria' refer to the specific requirements an individual must meet to qualify for the benefit or service requested. 'Submission methods' detail how applicants can send their forms—either online through portals, via mail, or in person at designated offices. Additionally, 'tracking' relates to monitoring the status of an submitted application post-application.

Preparing your individual application

The first step in preparing your individual application is identifying its purpose, as different types of forms have unique requirements. Whether you are applying for income tax returns or seeking educational enrollment, knowing why you need the application will streamline the process.

It's also crucial to gather the necessary documentation. Generally, applications require identification proof (like a driver's license), proof of residency (such as utility bills), and specific social information pertaining to the application type. Having these documents organized will enhance accuracy and efficiency.

Such as a driver's license or passport.

Documents like utility bills or lease agreements.

W-2 forms or pay stubs for tax applications.

Step-by-step guide to completing the form

To access an individual application form, you can choose between obtaining it online or through physical offices. For most forms, especially those from the Department of Revenue or IRS, online access is often more efficient, ensuring you have the most updated version.

As you fill out the form, pay careful attention to each section. Typically, personal information is required first. Next, you’ll need to confirm your eligibility criteria—this could include age, residency status, or tax filing requirements. Make sure to follow specific instructions regarding additional details that may be unique to the application type.

Includes your name, address, and date of birth.

Confirm your qualifications relevant to the application.

Often required for tax-related applications like income verification.

Editing, signing, and finalizing your application

Once you've completed your application, ensuring it’s error-free is crucial. Utilizing tools like pdfFiller allows you to edit your document online, making corrections simple and straightforward. This platform also supports eSigning, enabling you to add a digital signature directly within the document, which is often acceptable across various submitting agencies.

When reviewing your application, cross-check each section against a checklist. Verify that all required fields are filled out accurately, and check for common mistakes often found in applications such as incorrect dates or missing signatures. Taking the time to double-check can save you from future complications.

Ensure nothing is left blank inadvertently.

These can lead to misunderstandings in processing.

Digital signatures should be placed according to guidelines.

Submitting your individual application

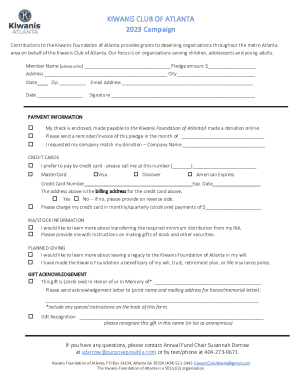

Understanding how to submit your completed application is as important as filling it out correctly. Many agencies offer multiple submission options—online, by mail, or in person. Each method has its pros and cons; for instance, submitting online can yield faster processing times, while mailing gives you a record of submission.

Once submitted, tracking the application status is essential. Many platforms or agencies provide tracking numbers or online status checks. Expect varied timelines for processing; these can range from a few days to several weeks depending on the application type and agency involved.

Typically the fastest method; requires account creation for trackability.

Allows you to keep hard copies for your records.

Useful for applications requiring immediate assistance or questions.

Managing your application documents

After submitting your application, managing your documents effectively can save you time and stress down the line. Employing a cloud-based solution like pdfFiller helps keep your completed forms accessible from anywhere. Search functionalities can also make it easier to locate specific documents when needed.

If collaborating with team members is necessary—whether for a group application or for joint tax filings—pdfFiller features support collaboration. This allows multiple users to access, edit, and comment on documents in real time, streamlining the process.

Stay organized with easily accessible documentation.

Collaborate with team members effectively.

Monitor changes made by collaborators.

FAQs about individual applications

Navigating the individual application process can result in numerous questions. One common concern is what to do if your application is denied. In such cases, understanding the appeals process is crucial; many agencies offer a structured way to contest their decisions.

Furthermore, if you need to amend a submitted application, agencies often allow corrections to be made up until a certain point in the review process. Lastly, don’t hesitate to contact support services if you need assistance—most organizations have dedicated teams to address individual application inquiries.

Understand the appeal process and requirements.

Follow agency-specific guidelines for changes.

Reach out via provided channels for help.

Real-life applications of individual forms

Understanding how real individuals have succeeded with their individual applications can provide motivation and insights. Many individuals have utilized platforms like pdfFiller for various applications, yielding positive results and experiences. For instance, someone in Arizona may have successfully filed their income tax returns online through the IRS portal, simplifying their documentation and ensuring timely filing.

Examining different examples of individual applications, you will notice that while forms vary greatly, each has specific requirements. For example, an application for a small business loan will differ essentially from an application for healthcare services, yet both necessitate clear, comprehensive information.

Stories from individuals who utilized pdfFiller's services effectively.

Insights into applications for loans, education, and more.

Each application has different documents and criteria.

Interactive tools and resources for enhanced document management

pdfFiller offers a suite of interactive tools designed to streamline your individual application process. Features like document editing, eSigning, and tracking capabilities allow users to manage their forms efficiently. These tools not only enhance productivity but also ensure that you remain organized throughout the application journey.

Integrating pdfFiller with your current workflow can significantly improve how you handle document management tasks. Whether you’re an individual submitting tax filings or part of a team working on collaborative projects, using a cloud-based solution helps maintain control over your applications.

Make last-minute changes to your application easily.

Add a digital signature directly within the document, facilitating faster processing.

Monitor the status of submitted applications efficiently.

Industry insights and best practices

Staying informed about trends in application processes is crucial for all users. Regulatory changes occur frequently, affecting forms and submission protocols. Understanding these trends means that you will be better prepared to adapt your application strategies accordingly.

Best practices discovered by experts can improve your chances of success. For instance, ensuring all your documents are prepped ahead of time can save significant headaches when deadlines approach. Another tip is to keep abreast of any announcements from the IRS or relevant departments, especially during tax season when the criteria may shift.

Stay informed about requirements for various forms.

Prepare documents ahead of time to avoid last-minute issues.

Gather insights from professionals who understand application processes.