Get the free 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR ...

Get, Create, Make and Sign 10-k annual report pursuant

How to edit 10-k annual report pursuant online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10-k annual report pursuant

How to fill out 10-k annual report pursuant

Who needs 10-k annual report pursuant?

10-K Annual Report Pursuant Form: A Comprehensive How-to Guide

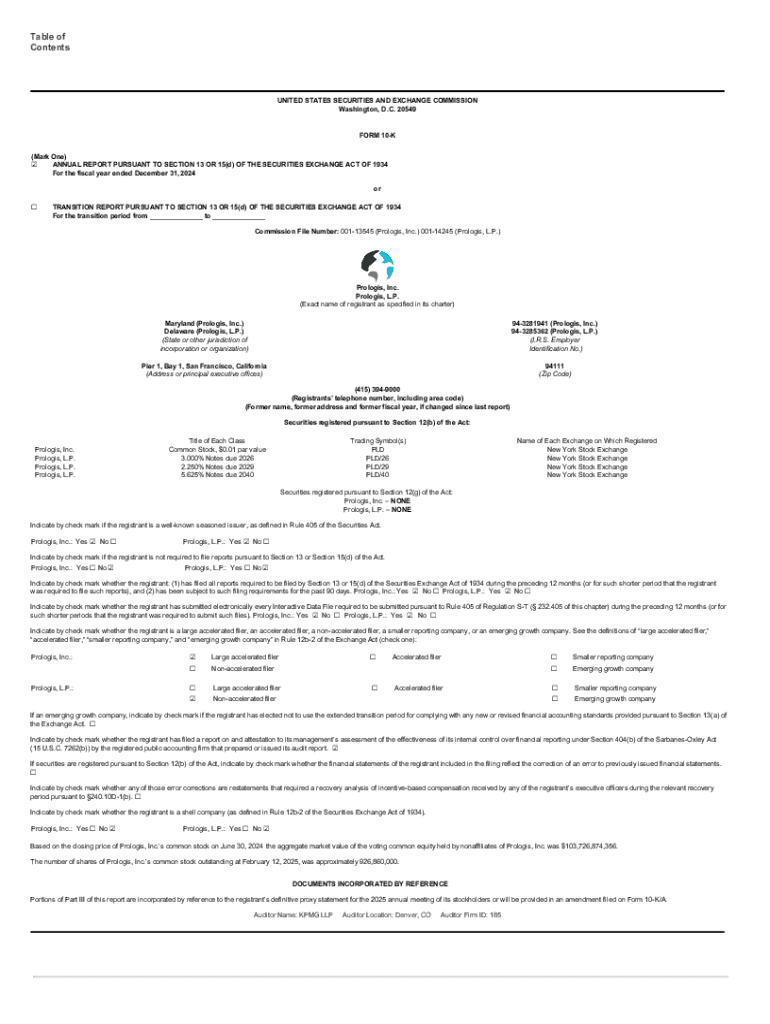

Understanding the 10-K annual report

The 10-K annual report is a detailed document mandated by the Securities and Exchange Commission (SEC) that publicly traded companies must file annually. It provides comprehensive information about a company's financial performance, operational strategies, and inherent risks, making it an invaluable resource for investors, analysts, and stakeholders. Unlike regular reports, the 10-K contains audited financial statements and extensive qualitative and quantitative disclosures, crucial for assessing a company's health.

The importance of the 10-K cannot be understated. It offers insights into a company's financial results, management strategies, and future projections, allowing investors to make informed decisions. Stakeholders can analyze risk factors and other key data to understand better the business environment that a company's operations take place in.

Legal requirements for filing the 10-K

Filing the 10-K is governed by a comprehensive framework established by the SEC. Companies must ensure compliance with various regulations, which include specific guidelines on what information must be disclosed and how it should be presented. The deadlines for submission are strict: companies have 60 to 90 days after the end of their fiscal year to file their 10-K, depending on their size and market status.

Additionally, understanding how the 10-K differs from other SEC filings, such as the quarterly 10-Q and the current report 8-K, is crucial. The 10-Q provides less detailed information every quarter, while the 8-K is used for reporting unscheduled events that are material to shareholders.

The structure of the 10-K annual report

The 10-K report typically features several key sections that collectively present the company's overall performance. Each section is designed to provide specific types of information essential to shareholders and analysts. The structured format not only facilitates better readability but also enables the extraction of critical data efficiently.

Preparing for the 10-K filing process

Preparation is key when it comes to filing the 10-K. Companies should first gather all necessary financial information, ensuring that financial statements are prepared and all management commentary aligns with disclosed insights. Supporting schedules and notes complement these documents and must be appropriately formatted.

Establishing a clear timeline for completion is crucial. A well-defined schedule should allow for internal reviews and adjustments before the deadline. Moreover, assembling a cross-functional team that includes finance, legal, and compliance experts ensures that all areas are covered adequately, leading to a more comprehensive report.

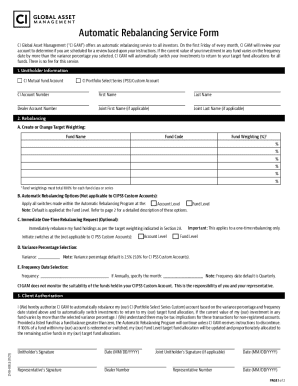

Using pdfFiller for efficient 10-K form management

Utilizing pdfFiller provides a seamless approach to creating and managing the 10-K report. The platform offers a variety of features that enable companies to edit their PDFs while incorporating financial data directly into their documents without hassle. Furthermore, pdfFiller includes collaborative tools that allow for team input, ensuring everyone involved in the process can contribute effectively.

Users can easily import standard disclosure templates into pdfFiller, which streamlines the reporting process. Step-by-step instructions guide users through filling out the 10-K form accurately, utilizing interactive tools designed for data entry and customization to enhance clarity and align with unique reporting needs.

Editing and reviewing the 10-K report

Reviewing the 10-K is an essential phase that cannot be overlooked. Best practices for self-review involve cross-verifying the document against financial data to ensure accuracy. Companies must also ensure compliance with SEC guidelines, which will help mitigate potential challenges post-filing.

Peer review is another effective strategy, allowing teams to leverage feedback from various departments. Utilizing pdfFiller for document collaboration and version control is advantageous, as it helps maintain an organized approach while preventing miscommunication and errors.

eSigning the 10-K report

Authentication of signatures in the 10-K filing process is paramount. Regulatory standards require that reports be certified as accurate, necessitating the use of e-signatures when filing electronically. pdfFiller’s eSignature functionality simplifies this aspect, making it easy for authorized personnel to sign documents securely.

Ensuring compliance with electronic signature laws is crucial to avoid any complications during submission. It is advisable to familiarize oneself with the specific requirements in your jurisdiction, as variations may exist. Using electronic signatures through pdfFiller not only enhances efficiency but also helps maintain a secure and legally compliant filing process.

Submitting the 10-K report

Understanding the submission process is vital for a successful filing via the SEC's EDGAR system. Companies must ensure that all elements of their report meet the guidelines before submission. Common pitfalls include last-minute errors or failing to adhere to formatting instructions, which can lead to delays or rejections.

Post-submission, companies should track and confirm their filing status. This step is crucial, as it ensures that the 10-K has been successfully processed and is publicly available. Keeping an eye on submission confirmations can help companies address any issues swiftly.

Post-filing considerations

Once the 10-K has been filed, managing feedback and comments from the SEC becomes an important task. Companies must proactively monitor any communications to address concerns or clarifications as needed. Understanding the procedures for amendments and corrections is also crucial, as errors may require timely adjustments to maintain compliance.

Additionally, companies should prepare for potential investor questions following the release of the 10-K. This preparation can streamline the communication process and ensure that executives are well-equipped to provide clear explanations concerning the company’s performance and outlook.

Keeping your 10-K records organized

Establishing a systematic approach to document management is vital for preserving 10-K filings and related materials. Successful companies often utilize document management strategies that allow for easy retrieval and reference. Proper organization facilitates compliance during future audits or additional filings.

pdfFiller offers effective solutions for long-term record keeping, empowering users to store documents securely in the cloud. Leveraging cloud solutions not only provides easy access from anywhere but also ensures that records are kept safe and well-organized for future references.

Further support with pdfFiller

pdfFiller provides vast customer support resources designed to assist users navigating the complexities of the 10-K filing process. From webinars and tutorials focused on document management to community forums for collaborative learning, users can find valuable information catering to their specific needs.

These resources ensure that individuals and teams are well-equipped to handle the document creation and management aspects of their 10-K reporting, thus enhancing their overall efficiency and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 10-k annual report pursuant for eSignature?

How do I edit 10-k annual report pursuant straight from my smartphone?

Can I edit 10-k annual report pursuant on an Android device?

What is 10-k annual report pursuant?

Who is required to file 10-k annual report pursuant?

How to fill out 10-k annual report pursuant?

What is the purpose of 10-k annual report pursuant?

What information must be reported on 10-k annual report pursuant?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.