Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: A Comprehensive How-To Guide

Understanding Form 10-Q: Purpose and Importance

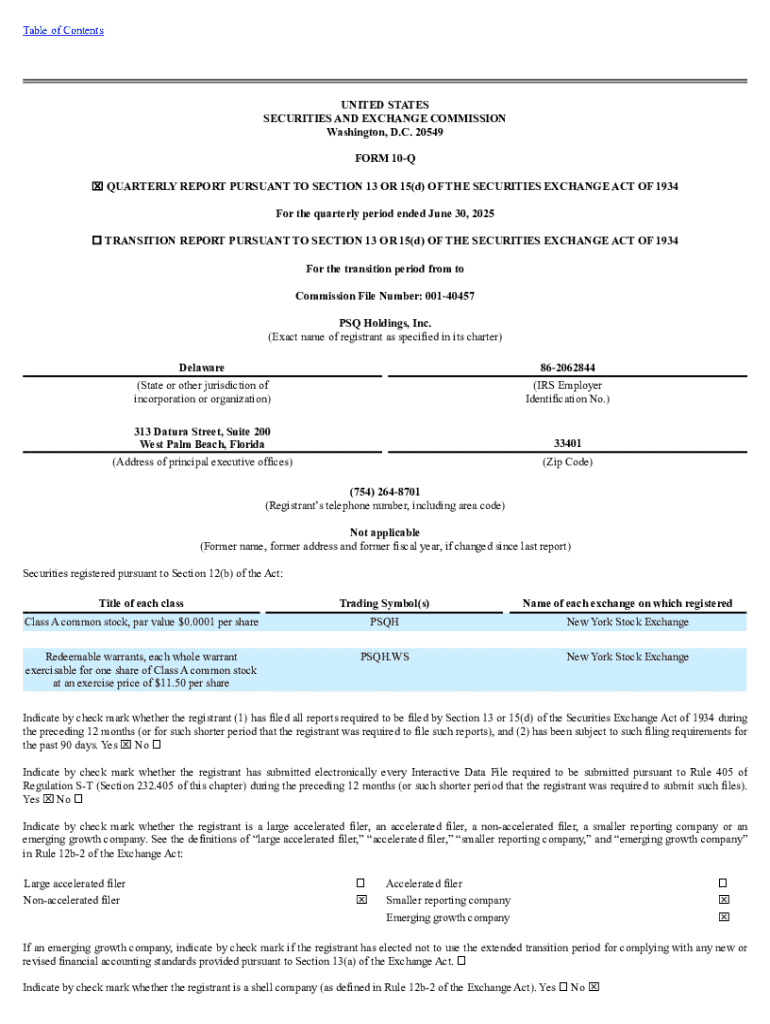

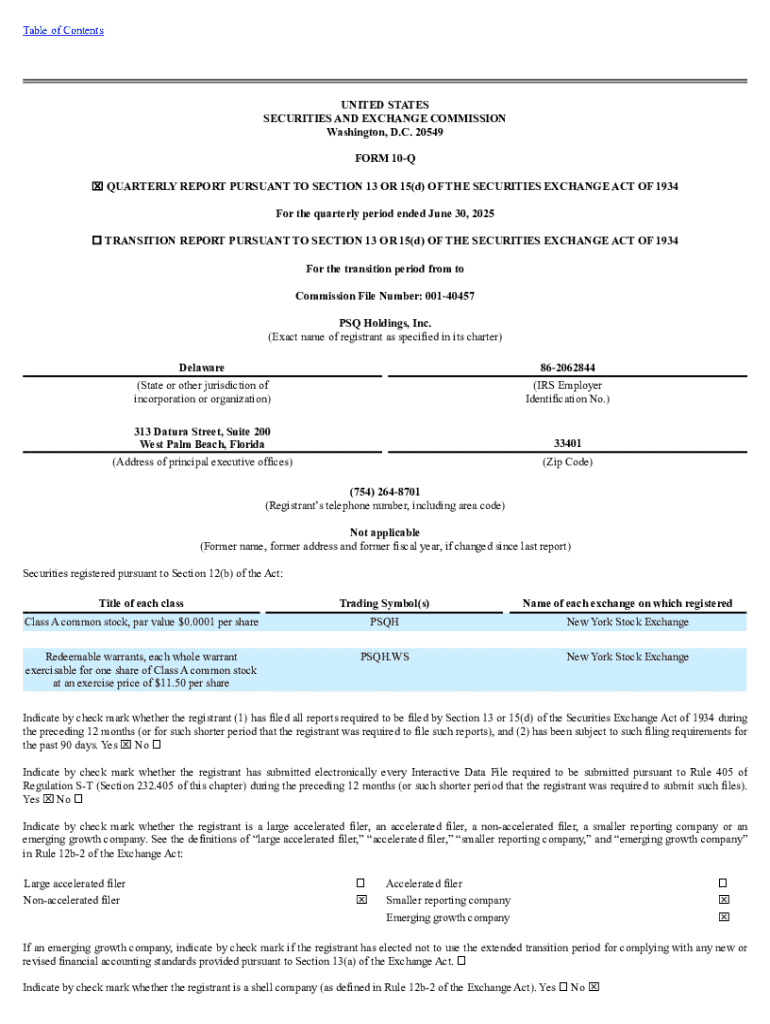

Form 10-Q is a critical document that publicly traded companies are required to file with the Securities and Exchange Commission (SEC) every quarter. This form provides a snapshot of a company's financial performance and operations during the reporting period, offering essential insights that bridge the gap between the more comprehensive annual report known as Form 10-K.

For investors and regulatory authorities, Form 10-Q holds immense significance. It enables stakeholders to analyze a company’s ongoing financial status, evaluate risks, and make informed investment decisions. Without this timely information, investors would miss crucial updates that could affect their portfolios.

When comparing Form 10-Q to Form 10-K, the most notable differences lie in the depth and frequency of reporting. While the 10-K is a detailed annual report including comprehensive financial statements and a variety of disclosures, the 10-Q is more succinct, focusing on a quarter’s financials and operational updates.

Components of Form 10-Q: A Breakdown

Understanding the structure of Form 10-Q is crucial for accurate reporting. It comprises several key sections tailored to address different facets of a company's operations and financial health. Each segment of the form provides vital information that investors should examine closely.

The major components of Form 10-Q include:

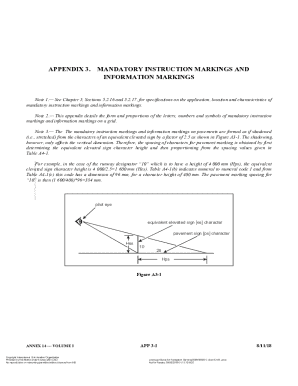

Filing Form 10-Q: Step-by-Step Instructions

Before filing Form 10-Q, companies must prepare by gathering all necessary documents and data. This includes financial statements, management reports, and disclosures of significant events. Using tools like pdfFiller can greatly facilitate the creation and editing of the required documents.

The actual process of filling out the Form 10-Q can be broken down into several steps:

After drafting, it's vital to have the content reviewed. Review tools offered by pdfFiller can significantly streamline this process, allowing for easy collaboration with team members to ensure every detail is precise.

Signing and Submitting Form 10-Q

Filing Form 10-Q isn't complete without securing the necessary signatures. Digital options enhance this process significantly. Using electronic signature capabilities via pdfFiller, companies can streamline compliance and shorten the turnaround time for approvals.

The process of submitting Form 10-Q involves:

Tracking and Managing Your Filing Timeline

Maintaining a strict timeline for 10-Q filings is paramount. Jurisdictions have different deadlines; typically, public companies must submit their 10-Q forms within 40 to 45 days after the end of the fiscal quarter.

Understanding specific deadlines for different industries is also crucial to avoid any lapses. Staying informed about the repercussions of late filings can help mitigate risks. Key consequences include:

Accessing Previously Filed Form 10-Qs

For researchers and analysts looking to access previously filed Form 10-Qs, the SEC’s EDGAR database provides a comprehensive repository. This platform allows users to search for filings by company name, date, or other relevant parameters.

Using pdfFiller, stakeholders can keep track of filings efficiently. By utilizing features that allow for easy organization of documents, users can analyze historical data on companies to identify trends, compare performance, and make strategic investment decisions.

Leveraging pdfFiller for document management

The power of pdfFiller extends beyond simply filing Form 10-Q; it streamlines collaboration among team members. Using the platform, multiple stakeholders can work concurrently on document creation, significantly enhancing productivity.

pdfFiller’s capabilities also include:

Key takeaways

Successfully managing Form 10-Q requires careful organization, attention to detail, and adherence to regulatory standards. By utilizing advanced document management solutions such as pdfFiller, companies can immensely streamline their filing processes. Key practices include maintaining organized documentation, staying aware of deadlines, and leveraging collaborative tools to enhance accuracy and compliance.

Incorporating technological solutions not only simplifies the filing process but also aids in comprehensive document management. pdfFiller’s features empower teams to focus on strategy and growth while ensuring compliance with necessary regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 10-q?

How do I edit form 10-q online?

How do I complete form 10-q on an iOS device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.