Get the free Form 10-k

Get, Create, Make and Sign form 10-k

Editing form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Form 10-K: A Comprehensive Guide

Understanding Form 10-K

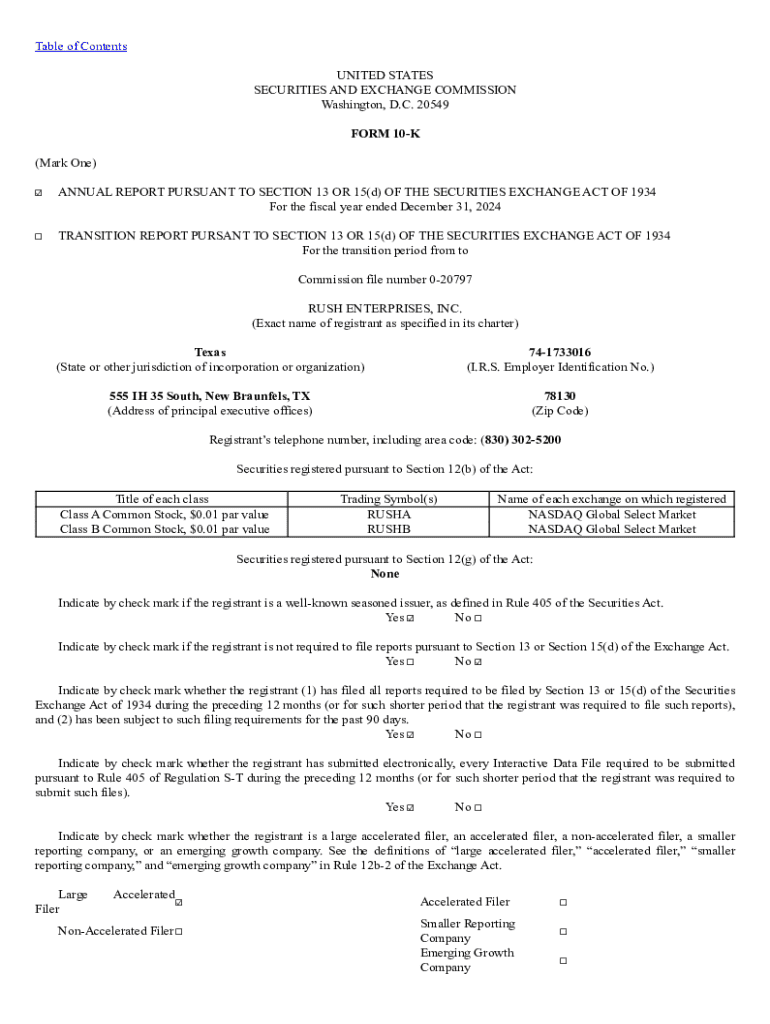

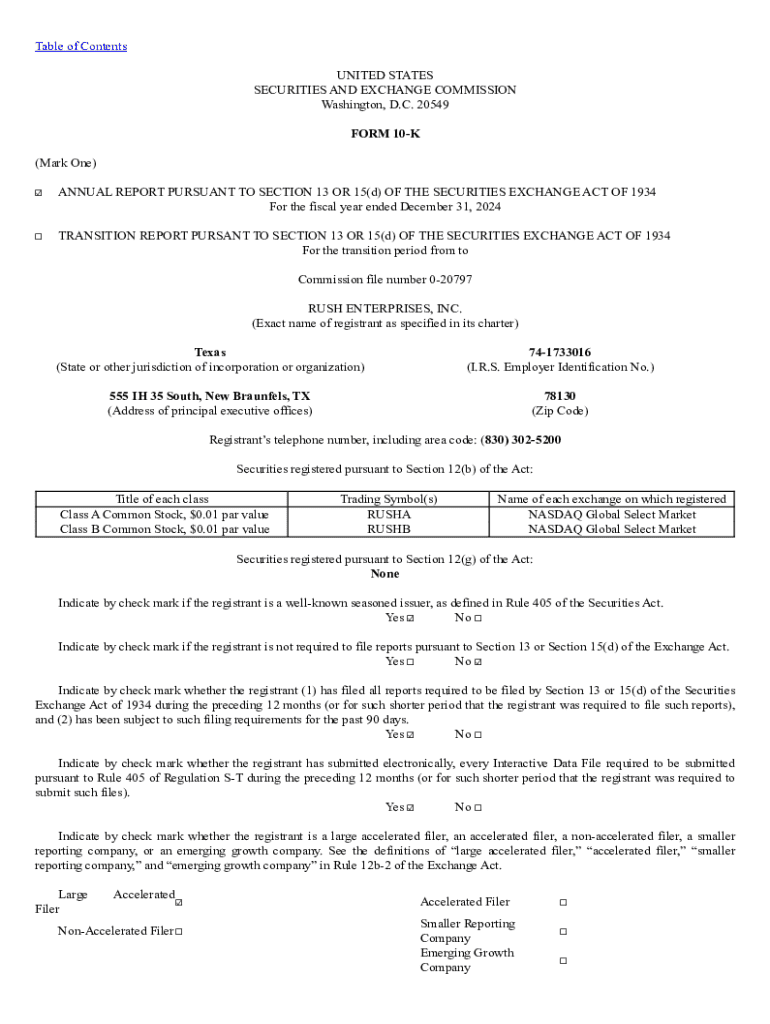

Form 10-K is a comprehensive annual report that publicly-traded companies in the United States are required to file with the Securities and Exchange Commission (SEC). This form provides a detailed overview of the company's financial performance, including its income statement, balance sheet, and cash flow statement. The importance of Form 10-K extends beyond mere compliance; it serves as a crucial tool for investors, regulators, and stakeholders who seek transparency and accountability in a company's financial reporting.

The Form 10-K offers a deep dive into the financial health, operational performance, and risk factors associated with a company, allowing stakeholders to make informed decisions. This form represents a key aspect of corporate governance and acts as a historical record that substantiates a company's claims and projections made throughout the fiscal year.

Components of Form 10-K

A typical Form 10-K includes several core sections that provide vital financial data and context about the company and its operations. These components include:

The purpose of filing a Form 10-K

Filing a Form 10-K is a fundamental requirement for any business that seeks to operate transparently within the boundaries of U.S. financial regulations. The Securities and Exchange Commission mandates this filing to ensure that companies provide full disclosure of their financial status and operations, effectively making the process of financial reporting a regulatory standard.

Regulatory compliance through the 10-K form helps enhance trust among investors and the general public. Companies are obligated to present accurate and timely financial information to protect the interests of shareholders while also contributing to fair market practices. Upholding these standards of transparency is essential for fostering investor confidence and maintaining market integrity.

Stakeholder communication

Form 10-K functions as a vital communication tool for stakeholders including shareholders, potential investors, analysts, and even employees. It provides a structured narrative that explains the company's financial results, management strategies, and future outlook, which are critical for investors looking to make educated decisions regarding their investments.

Moreover, by responsibly sharing insights about risks and future strategies, companies build credibility and establish a trustworthy relationship with their stakeholders. Effective communication through this form can foster goodwill and reinforce investor loyalty, offering a competitive edge in today's fast-paced business environment.

Who must file and why?

The responsibility to file Form 10-K primarily falls on publicly-traded companies listed on stock exchanges in the United States. This includes a diverse range of entities, from small-cap companies to multinational corporations, encompassing both U.S.-domiciled companies and foreign firms that trade on U.S. exchanges. The regulatory framework mandates that these companies file annually, providing a consolidated view of their operations.

Non-compliance with Form 10-K filing requirements can result in severe consequences, including legal penalties and the potential delisting of a company’s stock from exchanges. Such repercussions can result in diminished investor confidence and significant impacts on business operations. Consequently, timely and accurate filings are not only a regulatory obligation but also a best practice for maintaining a reputable corporate image.

Preparing to file a 10-K

Preparing to file a Form 10-K involves systematic data gathering and meticulous preparation. Companies must collect comprehensive financial data and disclosures from various departments, including accounting, finance, legal, and compliance teams. This requires coordination and a clear strategy to ensure all necessary information is accurate and complete for submission.

Utilizing technology can streamline this process—many companies turn to tools and software specifically designed for financial reporting and document management. These solutions simplify data collection, maintain version control, and facilitate collaboration across departments, which is crucial for a collective review of the filing.

Collaborating with teams

Collaboration is paramount in the preparation of Form 10-K, and engaging cross-department teams ensures a holistic view of the company's operations and financial health. Regular meetings and open channels of communication between finance, legal, and operational departments contribute to more accurate reporting.

To facilitate effective teamwork, companies may establish definitive roles and responsibilities that clarify who is accountable for each section of the filing. Using project management tools to track progress and deadlines can also enhance communication. Working synergistically helps avoid last-minute rushes and errors, allowing for a comprehensive review before final submission.

Detailed steps to file a Form 10-K

The process of completing and filing a Form 10-K can be complex, but breaking it down into detailed steps can simplify the workload. Companies should focus on the following essential sections:

While preparing these sections, it is critical to be vigilant about common pitfalls such as vague disclosures, unverified data, or incomplete narratives that could mislead stakeholders. Engaging external auditors for reviews can be a valuable step in enhancing the quality and reliability of the information being reported.

Filing process: step-by-step

Once the Form 10-K is thoroughly prepared, the next step is to electronically file the document with the SEC. This process utilizes the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system, which is designed to make the submission process efficient and maintain public access to corporate filings.

Companies must ensure they are familiar with the EDGAR platform and follow the specific instructions for filing. Each submission requires adherence to prescribed deadlines, which are typically aligned with the end of the company’s fiscal year. Depending on the company’s market capitalization, the deadlines can vary, usually falling between 60 to 90 days post fiscal year-end.

Deadlines and timelines

Understanding and adhering to deadlines is crucial for compliance. Companies are categorically required to file their Form 10-K within the specified timeline based on their classification as large, accelerated filers, accelerated filers, or non-accelerated filers. Missing these deadlines can not only incur penalties but also adversely affect shareholder trust.

For instance, as per SEC rules, large accelerated filers must submit their 10-K within 60 days after the end of their fiscal year, while accelerated filers have 75 days. Non-accelerated filers must file within 90 days, making it imperative for companies to remain vigilant about their filing dates and prepare in advance.

Navigating 10-K FAQs

Navigating the complexities of Form 10-K can raise several queries for companies and stakeholders alike. Some common questions include what information is mandatory, how to effectively draft the risk factors section, and the implications of filing late. Gaining clarity around these questions is crucial for maintaining compliance and trust.

Another frequent point of confusion stems from the differences between Form 10-K and other financial filings. Understanding the distinctions between forms such as the 10-Q and 8-K can assist companies in accurately meeting their reporting obligations and ensuring timely communication with investors.

Clarifying misconceptions

Many misconceptions surround the purpose and contents of Form 10-K. One common misunderstanding is that this form is merely a repetition of the financial statements presented to shareholders. In reality, the 10-K encompasses a broader scope, providing narratives, risk disclosures, and management insights that are integral to understanding the company's operational context.

By addressing these misconceptions and clearly communicating the intent behind the Form 10-K, companies can improve stakeholder relations and uphold transparency in their reporting.

The relationship between Form 10-K and other reports

Understanding the relationship between Form 10-K and other related reports is essential for coherent financial communication. While the Form 10-K serves as the comprehensive annual report, it is distinct from the annual report that companies provide to shareholders. The latter often includes a more narrative-driven presentation of business performance and is designed for broader distribution to build corporate image.

Additionally, companies must also consider other filings such as Form 10-Q, which reports quarterly financial updates, and Form 8-K, required for reporting unscheduled events. Each of these reports serves a specific function and collectively contributes to the complete picture of the company's financial health and operational status.

Utilizing pdfFiller for Form 10-K

pdfFiller offers invaluable support during the preparation and filing process of Form 10-K. With its user-friendly platform, teams can efficiently edit their PDF reports, ensuring that the final document adheres to all compliance standards. The platform provides ample features for collaboration, including eSigning capabilities, facilitating seamless teamwork and communication among departments.

Utilizing a cloud-based solution like pdfFiller also offers benefits such as easy access to documents from anywhere, which is particularly advantageous for teams that may be working remotely or across multiple locations. In addition, pdfFiller emphasizes security and compliance features that safeguard sensitive data and contribute to maintaining overall regulatory compliance.

Benefits of a cloud-based document solution

The advantages of utilizing a cloud-based document management solution like pdfFiller extend beyond access convenience. By centralizing document storage and management, companies can effectively streamline collaborations during the preparation of Form 10-K. This leads to a more organized approach, where teams can track changes and share real-time updates, ultimately improving the accuracy of filings.

Moreover, the platform’s security measures ensure compliance with industry standards while providing a user-friendly experience tailored for those who work within the financial reporting landscape. By integrating pdfFiller, organizations can modernize their document management, further bolstering their preparedness for rigorous financial reporting.

Best practices for managing Form 10-K compliance

To ensure ongoing compliance with Form 10-K filing requirements, companies should implement routine checks and updates. Establishing a clear calendar that outlines important deadlines for filing and internal review processes is fundamental for a proactive approach to compliance. Keeping all teams informed through regular updates ensures that necessary adjustments can be made before deadlines.

Additionally, investing in training and resources for teams is critical. Developing a culture of continuous learning ensures that employees are well-versed in regulatory standards and internal practices regarding document preparation. This capacity-building approach fosters a knowledgeable workforce adept at managing the complexities associated with Form 10-K compliance, further minimizing the risk of errors and enhancing the overall quality of filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 10-k from Google Drive?

How do I edit form 10-k on an iOS device?

How do I fill out form 10-k on an Android device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.