Get the free Form S-3 Registration Statement

Get, Create, Make and Sign form s-3 registration statement

Editing form s-3 registration statement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form s-3 registration statement

How to fill out form s-3 registration statement

Who needs form s-3 registration statement?

A Comprehensive Guide to the Form S-3 Registration Statement Form

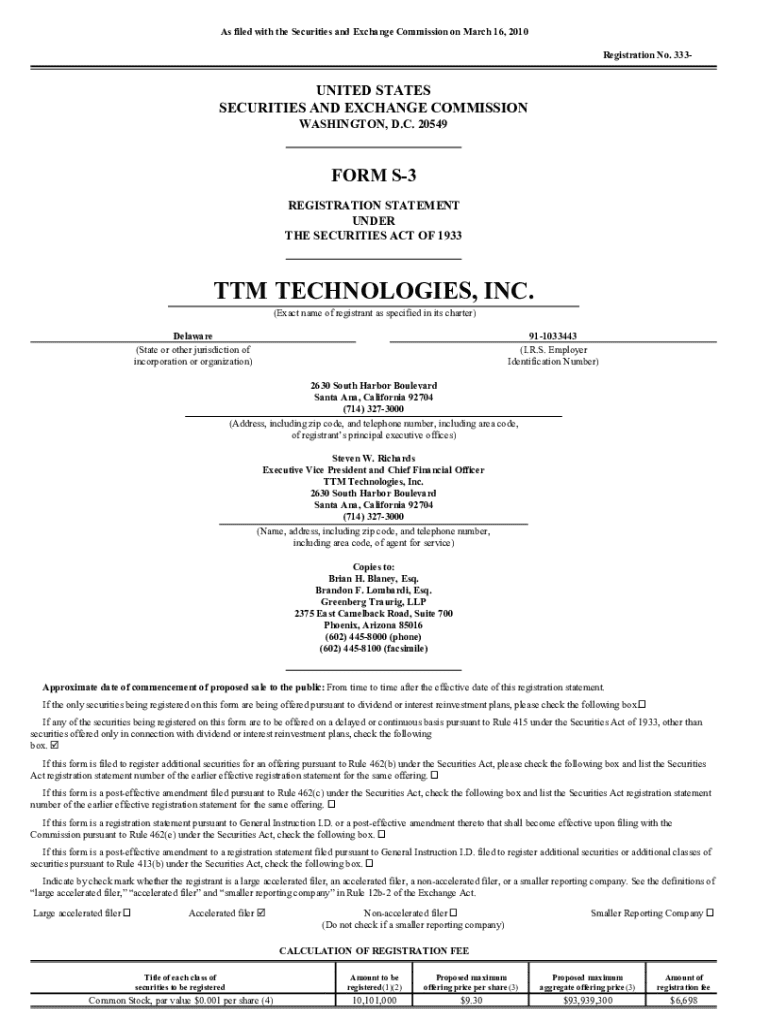

Understanding the Form S-3 Registration Statement

The Form S-3 is a streamlined registration statement utilized by the U.S. Securities and Exchange Commission (SEC). It allows eligible companies to register securities with less extensive disclosure requirements compared to other forms. Specifically, this form facilitates capital raising by seasoned issuers, offering a more efficient route through federal securities regulations.

The Form S-3 is particularly relevant for established companies looking to issue securities such as stocks and bonds. It supports quicker access to the capital markets, enabling businesses to secure funding without undergoing the more rigorous requirements imposed by forms like S-1.

Purpose and benefits of the Form S-3

The primary purpose of Form S-3 is to simplify the registration process for seasoned issuers. Eligible companies include those that meet specific financial thresholds, such as having a public float of at least $75 million, and have filed all necessary reports under the Exchange Act for at least 12 months. The streamlined nature of this form benefits companies looking to quickly access capital markets.

Filing Form S-3 brings several advantages. It enables firms to avoid the extensive disclosures that forms like S-1 necessitate, thus reducing both time and costs associated with filing. Additionally, companies can also incorporate various forms of securities offerings under one file, enhancing flexibility during capital raises.

Filing requirements and criteria

Form S-3 is primarily used when a company has an immediate need to register securities for a public offering or resale. Eligible companies must be current in their SEC reporting and have met certain criteria, including timely filing of all required reports and possessing sufficient publicly-traded securities.

The eligibility criteria for filing Form S-3 are stringent. Companies must demonstrate compliance with specific financial and operational benchmarks, which typically include a market capitalization that exceeds the minimum threshold and a consistent reporting history without any filing violations. This ensures that only reputable entities utilize this simplified form.

The filing process: step-by-step guide

Filing Form S-3 involves several critical steps. First, adequate preparation of necessary information is vital. This includes compiling company details, a comprehensive business description, and recent financial statements that comply with SEC regulations.

The second step is to accurately complete the form. This requires careful attention to detail in each section to ensure all information is correct and complete. Companies must be wary of common pitfalls such as omitting required disclosures or misrepresenting financial data.

Once completed, the next step is submission. Companies file electronically with the SEC, adhering strictly to the submission protocols outlined by the SEC. Post-filing, monitoring the status of the submission is crucial, as companies may receive feedback or requests for additional information from the SEC.

Comparing Form S-3 with other SEC forms

Form S-3 is distinct from Form S-1 mainly in terms of eligibility and complexity. The S-1 form is generally used by companies that are new to the public markets and have not yet established an SEC reporting history. In contrast, the S-3 is accessible to seasoned issuers who meet all regulatory compliance requirements and have a proven track record of timely financial reporting.

Other related forms worth noting are Forms S-2 and S-4. Form S-2 is an older version that is now less commonly utilized, while Form S-4 is typically used in connection with mergers and acquisitions or when offering securities as part of a business combination. Understanding these nuances is crucial for selecting the appropriate follow-up form.

Tips for a successful Form S-3 filing

To ensure a successful filing of the Form S-3, best practices for document preparation are essential. It is critical for companies to perform due diligence in ensuring that all documents required for the filing are complete and compliant with SEC guidelines. This can prevent unnecessary delays and focus a company’s resources efficiently.

Utilizing technology such as pdfFiller can significantly streamline the process. Features like easy editing, document signing, collaboration tools, and secure storage on its cloud platform can assist teams in ensuring that their filings are error-free and submitted on time.

Common questions about Form S-3

Many companies have questions regarding the filing and compliance issues associated with Form S-3. Common concerns include timeline expectations for processing, amendment procedures after submitting the form, and how changes in company status may affect filings. Understanding these aspects can greatly enhance compliance and promote a smoother filing process.

To delve deeper, resources are available through the SEC's official website as well as consulting professional services that specialize in SEC regulations and compliance. Companies should actively seek this guidance to ensure they remain informed about best practices and evolving regulatory standards.

Related products and solutions

As companies navigate the complexities of SEC compliance, exploring additional tools for document management becomes critical. Other services and software can support various aspects of the filing process, such as compliance tracking, audit trails, and secure sharing of sensitive document types.

Integrating tools like pdfFiller enhances not only the Form S-3 process but also streamlines other documentation needs within a company. By employing a cloud-based platform, teams can manage their documents efficiently while ensuring they remain compliant with SEC regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form s-3 registration statement?

How do I edit form s-3 registration statement in Chrome?

How do I fill out form s-3 registration statement using my mobile device?

What is form s-3 registration statement?

Who is required to file form s-3 registration statement?

How to fill out form s-3 registration statement?

What is the purpose of form s-3 registration statement?

What information must be reported on form s-3 registration statement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.