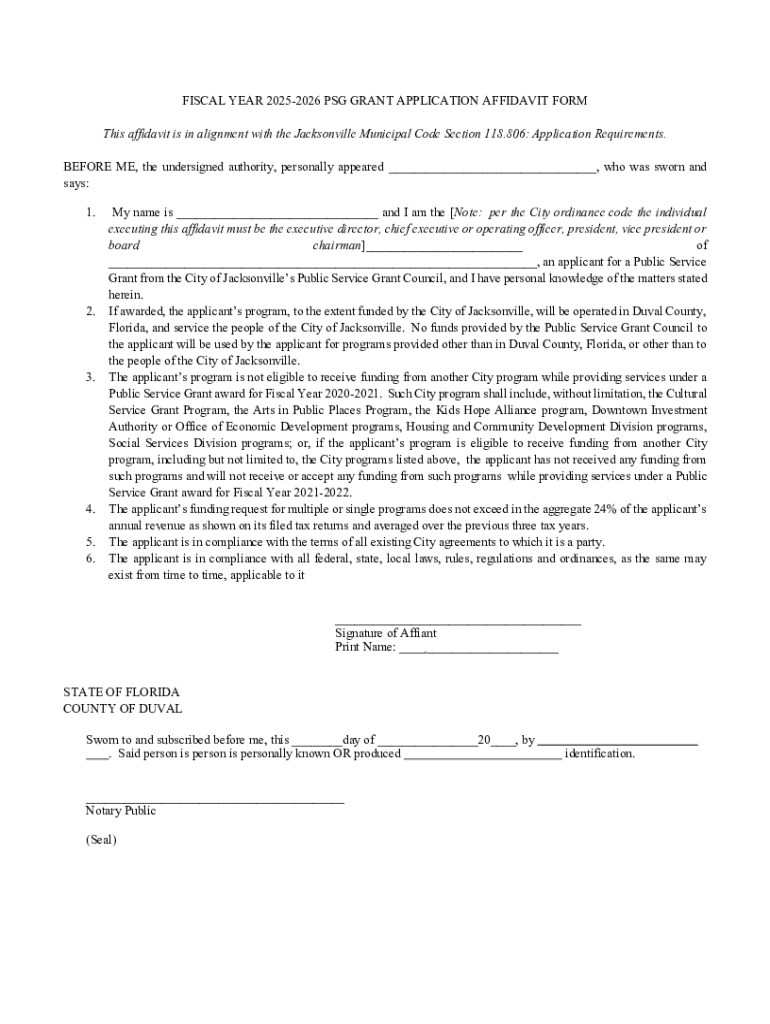

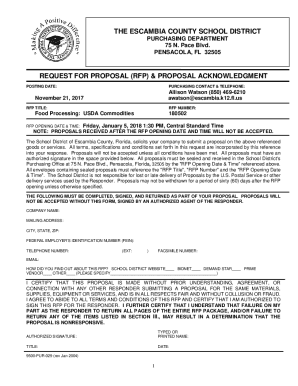

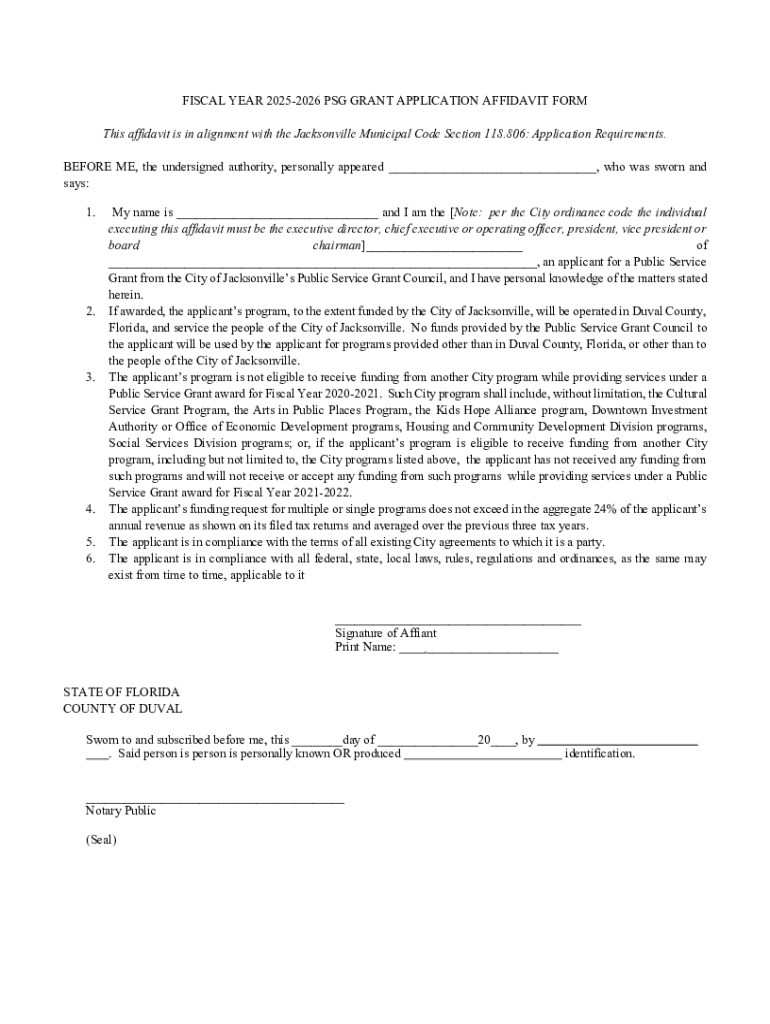

Get the free Fiscal Year 2025-2026 Psg Grant Application Affidavit Form

Get, Create, Make and Sign fiscal year 2025-2026 psg

Editing fiscal year 2025-2026 psg online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fiscal year 2025-2026 psg

How to fill out fiscal year 2025-2026 psg

Who needs fiscal year 2025-2026 psg?

Fiscal Year 2 PSG Form: Your Complete Guide

Understanding the Fiscal Year 2 PSG Form

The fiscal year 2 PSG form, or Personal Spending Guide form, is a critical document used for financial reporting and planning within organizations. Its primary purpose is to provide a comprehensive overview of an individual or entity's financial health. By accurately completing the PSG form, users can assess their current financial standing, project future expenditures, and ensure the sustainability of their financial commitments. Filing this form is especially vital in the second fiscal year as it helps integrate changes that may impact financial forecasting.

The importance of timely and accurate filing in the fiscal year cannot be overstated. Proper reporting not only helps organizations comply with regulatory requirements but also enables them to make informed decisions. During this period, any inaccuracies can lead to significant financial repercussions, making it crucial for individuals and teams to be meticulous when filling out the fiscal year 2 PSG form.

Key components of the fiscal year 2 PSG form

Completing the fiscal year 2 PSG form requires gathering essential information that outlines your financial landscape. This includes personal information that identifies the individual or the organization submitting the form. Additionally, a breakdown of financial assets and liabilities must be provided to illustrate the overall net worth. It’s also necessary to include detailed income statements that report cash flows and expenses.

When drafting responses for the fiscal year 2 PSG form, accuracy and completeness are paramount. To ensure this, users should cross-reference values with existing financial documents and take the time to double-check numerical entries. Utilizing tools like spell check can also help prevent misinterpretations and errors that could lead to compliance issues or financial misreporting.

Step-by-step guide to filling out the PSG form

Filling out the fiscal year 2 PSG form does not have to be a daunting task. Follow this structured approach to simplify the process.

Editing and modifying your PSG form efficiently

Mistakes happen, but modern tools can help you correct them seamlessly. With pdfFiller, editing tools are at your disposal, which allows you to make adjustments efficiently. Utilize features like text boxes, annotations, or formatting options to enhance clarity and comprehension of your PSG form.

One invaluable feature is the ability to make real-time changes without having to restart from scratch. This ensures that you retain all previously entered data while simply updating the necessary sections. Moreover, keeping track of version control allows users to reference past submissions easily, fostering a more organized approach to document management.

eSigning the PSG form

The importance of electronic signatures in today's financial landscape cannot be understated. eSigning your fiscal year 2 PSG form not only speeds up the approval process but also enhances security. By using pdfFiller, users can confidently sign their forms electronically, ensuring that all signatures meet legal requirements.

Ensuring the validity and security of your eSignature is critical for maintaining the integrity of your submission. All documents signed electronically through pdfFiller are encrypted and secure, protecting your sensitive information.

Collaboration and document management

Working as a team when filling out the fiscal year 2 PSG form can enhance accuracy and efficiency. Sharing your form with relevant stakeholders is easily accomplished through pdfFiller’s collaboration features. This can include review settings whereby multiple users can annotate, suggest edits, and propose changes in real-time.

Best practices for feedback and revisions include setting clear deadlines, creating a checklist for necessary changes, and ensuring every contributor has the necessary documentation to make informed contributions.

Common mistakes to avoid when completing the PSG form

As you approach the completion of the fiscal year 2 PSG form, it is crucial to be aware of common pitfalls that can undermine your efforts. One major error is misinterpreting requirements specific to financial reporting. The guidelines may change annually, so staying updated is critical to ensure that all information is formatted correctly.

These oversights can not only delay your submission but could also lead to financial discrepancies later on. Always take the time to thoroughly review your work before submission.

Frequently asked questions about the fiscal year 2 PSG form

After submitting your fiscal year 2 PSG form, you may have questions about the process. Typically, depending on the guidelines, you will receive confirmation of receipt within a certain timeframe, often by email. It’s essential to maintain records of both submission and confirmation for your files.

Being proactive about these questions can save you headache later on. Familiarizing yourself with the guidelines and keeping communication lines open will also provide clarity.

Advanced tools for managing your PSG form

Given the complexities involved in financial reporting, integrating advanced tools can significantly ease the management of the fiscal year 2 PSG form. mplementing software that ties into your existing financial systems can create a more streamlined process, allowing you to generate accurate figures quickly.

Leveraging these advanced tools ensures that your fiscal year 2 PSG form is not only compliant but also up-to-date with real-time data for accurate financial reporting.

Preparing for revisions: what to expect in the 2 fiscal cycle

As you approach the next fiscal cycle, anticipate changes in regulations and guidelines. Changes can range from minor updates to significant shifts in reporting requirements, making it crucial to stay informed. Registering for updates from financial regulatory bodies can provide fresh insights and updates that aid in successful submissions.

By proactively planning for these revisions, you’ll streamline your approach and ensure that your fiscal year 2 PSG form continues to meet all necessary standards.

Testimonials and success stories using pdfFiller for PSG forms

Feedback from users highlights the transformative impact pdfFiller has on managing their fiscal year 2 PSG form. Many enjoy the platform’s user-friendly interface and the ability to collaborate in real-time, which drastically decreases the time spent on document management.

These testimonials underscore that integrating tools like pdfFiller not only enhances efficiency but can also lead to improved financial outcomes.

Exploring additional support resources

pdfFiller offers extensive support for users navigating the fiscal year 2 PSG form. Customer support can usually provide immediate assistance with any issues you encounter while filling out your form, helping you get back on track without significant delays.

By leveraging these support resources, you’re not just filling out the fiscal year 2 PSG form; you’re empowering yourself with knowledge and confidence for future submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fiscal year 2025-2026 psg directly from Gmail?

How do I edit fiscal year 2025-2026 psg online?

How can I edit fiscal year 2025-2026 psg on a smartphone?

What is fiscal year 2026 psg?

Who is required to file fiscal year 2026 psg?

How to fill out fiscal year 2026 psg?

What is the purpose of fiscal year 2026 psg?

What information must be reported on fiscal year 2026 psg?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.