Get the free No Claim Certificate

Get, Create, Make and Sign no claim certificate

Editing no claim certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out no claim certificate

How to fill out no claim certificate

Who needs no claim certificate?

No Claim Certificate Form - How-to Guide Long-read

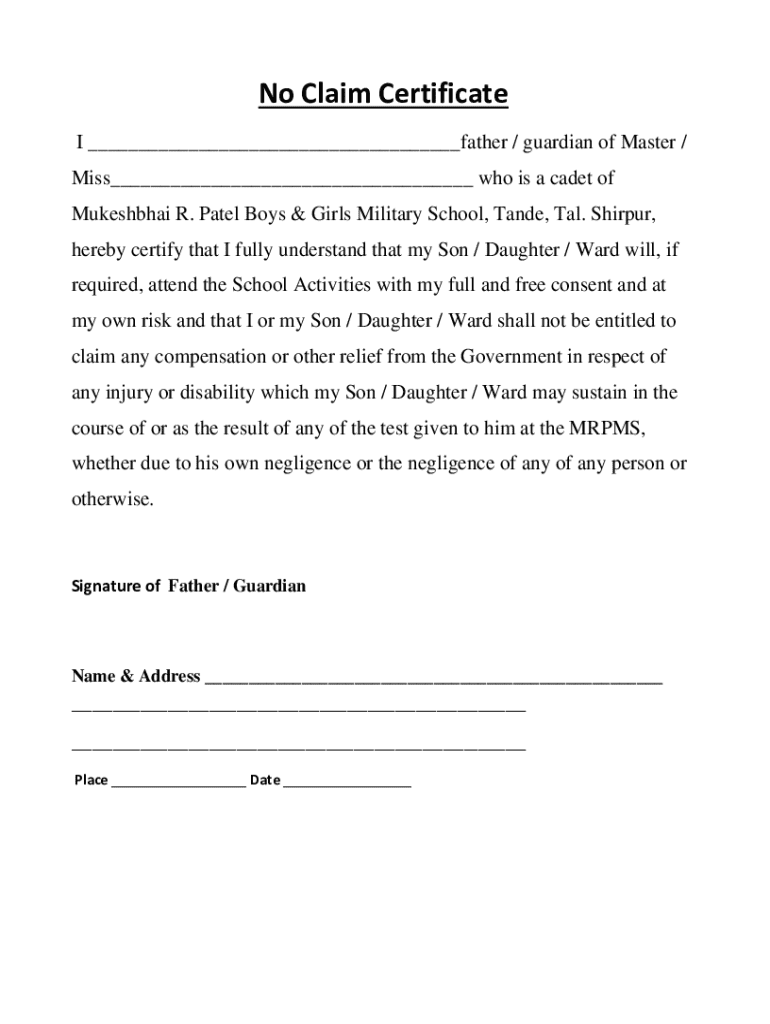

Understanding the no claim certificate

A no claim certificate is an official document provided by an insurance company to a policyholder who has not made any claims during a specific period. Its primary purpose is to signify that the insured has maintained a claim-free record, which can lead to benefits such as premium discounts on future insurance policies. For policyholders, obtaining this certificate can be crucial in demonstrating responsible insurance management, which many providers reward.

The importance of a no claim certificate cannot be overstated; it serves as a proof point for insurance buyers who seek lower premiums or enhanced coverage terms. Common scenarios that might prompt a policyholder to request a no claim certificate include renewing an existing insurance policy, applying for a different type of coverage, or even attempting to secure a loan that necessitates a clean insurance history.

Key features of a no claim certificate

A no claim certificate typically includes important details relevant to the policyholder. This information often encompasses the policyholder's name, policy number, coverage dates, and confirmation of zero claims filed. Depending on the insurance provider, there can be variations in the specifics included in the certificate, but the core elements will remain consistent.

The certification process usually involves the policyholder submitting a request to their insurance provider, who will then verify the claim history and issue the certificate. Some insurers might require additional documentation or a nominal fee for processing, making it essential to check the specific requirements and processes associated with the provider.

Filling out the no claim certificate form

Completing the no claim certificate form can seem daunting, but it can be simplified into a step-by-step process. Start by gathering relevant information about your personal details and your insurance policy. Each section requires specific entries that need to be filled out accurately to avoid delays in processing.

To ensure accuracy, double-check all entries before submission. Common mistakes include typos in the policy number, incorrect personal details, and omitting required sections. These errors can lead to processing delays or denials.

Editing and customizing your no claim certificate form

Once you have the no claim certificate form completed, you may want to edit or customize it for further applications or personalized records. Utilizing platforms like pdfFiller can provide easy editing tools that allow you to add, remove, or adjust any information as necessary. It is beneficial to maintain multiple copies for future reference.

When inserting additional information, ensure it matches the data already provided in previous submissions. Furthermore, adding a digital signature is essential for verification and submission, enabling the certificate to be treated as legally binding without the need for printing or physical signatures.

Submitting your no claim certificate

The submission process for your no claim certificate can vary significantly between insurance providers. However, certain best practices can help ensure your submission is successful. Depending on the accepted submission methods, you can choose to send it digitally or via physical mail.

Each insurance provider will have a designated address or email for submitting the form, so check your provider's guidelines to avoid any issues.

Tracking the status of your no claim certificate request

Once you have submitted your no claim certificate, staying informed about its status is vital. Many insurance companies offer online tracking options through their portals, allowing customers to check the status of their requests easily.

Be mindful that delays in processing can happen due to various reasons, including high volumes of requests or missing information. If you encounter significant waiting periods, don't hesitate to reach out to your insurance provider for clarification.

Frequently asked questions (FAQs)

As with any bureaucratic process, numerous questions may arise about no claim certificates. Common queries often revolve around the validity of the certificate, and whether it is possible to expedite the process. Addressing misconceptions is vital, especially regarding eligibility for a no claim certificate. Some might assume that any lapse in coverage can nullify eligibility, but many insurance providers offer grace periods under specific conditions.

Related documents and forms

Understanding the no claim certificate also involves familiarity with other insurance-related documentation. It's beneficial to know how these certificates compare with various other forms such as proof of insurance, policy summaries, and those that outline claims made on previous policies. Each document can play a crucial role in demonstrating your insurance history.

Success stories and case studies

Real-life examples illustrate how acquiring a no claim certificate can significantly benefit individuals. For instance, a young couple looking to purchase their first home benefited immensely when their no claim certificate allowed them to obtain a lower interest rate on their mortgage, thus saving thousands over the life of the loan. These anecdotes showcase the tangible benefits of having a clean claim history in contexts beyond just insurance renewals.

Another case involved an individual applying for a new car insurance policy; they managed to secure a significant discount on their premium solely based on their no claim certificate. Learning from these situations can equip potential applicants with strategies that enhance their chances of successful applications and better terms in their future insurance dealings.

Conclusion

The no claim certificate is an essential tool for policyholders, serving not only as proof of a clean history but also as a pathway to better insurance terms and savings. By utilizing platforms like pdfFiller, you can simplify the process of managing all required documentation, ensuring you stay organized and prepared. The benefits of managing documents through a cloud-based solution cannot be overstated— it promotes efficiency and eases accessibility.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send no claim certificate for eSignature?

Where do I find no claim certificate?

How do I fill out the no claim certificate form on my smartphone?

What is no claim certificate?

Who is required to file no claim certificate?

How to fill out no claim certificate?

What is the purpose of no claim certificate?

What information must be reported on no claim certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.