Get the free 10 q form check

Get, Create, Make and Sign 10 q form check

How to edit 10 q form check online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 10 q form check

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q: A Comprehensive How-to Guide

Understanding Form 10-Q: A vital disclosure document

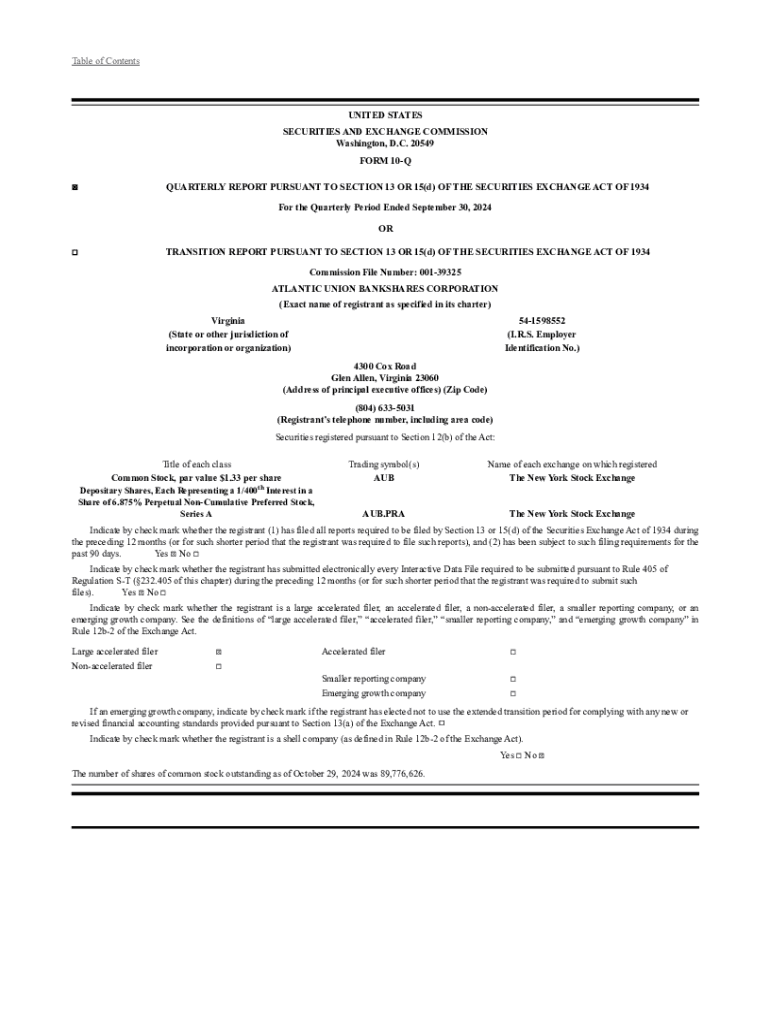

Form 10-Q is a comprehensive financial disclosure document that public companies in the United States are required to file quarterly with the Securities and Exchange Commission (SEC). This form provides a detailed account of a company’s financial performance, allowing investors and stakeholders to assess its quarterly progress.

The importance of Form 10-Q lies in its ability to offer timely updates on a company's financial health and operational performance. Unlike the Annual Report on Form 10-K, which provides an in-depth yearly analysis, the Form 10-Q presents a snapshot of the company’s progress over the last three months, often affecting investors' decisions.

Who is required to file?

Publicly traded companies in the U.S. must file Form 10-Q. This requirement stretches across various sectors, including those listed on major stock exchanges such as the NYSE and NASDAQ. The filing frequency and detail levels may vary between large corporations and smaller firms, albeit all must adhere to SEC mandates.

Regulatory requirements necessitate that these companies submit their Form 10-Q within 40 to 45 days after the end of each fiscal quarter. This timeframe underscores the necessity for timely financial disclosure and creates a level playing field for all investors.

Components of a Form 10-Q

The Form 10-Q is multifaceted, featuring several key sections that serve crucial functions. The three essential components include:

Each of these sections plays a vital role in painting a clear picture of the company's financial health.

List of specific items included

Form 10-Q includes several specific items such as:

Navigating the filing process

Filing the Form 10-Q involves several steps to ensure compliance and accuracy. This process starts with gathering the necessary financial information and documentation relevant to the quarterly report.

Utilizing digital tools can streamline the completion of Form 10-Q. For instance, pdfFiller offers PDF editing tools that allow users to easily fill out the form electronically, ensuring accuracy while saving time.

Filing deadlines and compliance expectations

Understanding filing timelines is crucial for compliance. Companies typically must file their Form 10-Q within 40 to 45 days of the end of each fiscal quarter. Missing this deadline can lead to penalties, including fines and increased scrutiny from the SEC.

In addition to timely filing, it is also important for companies to maintain ongoing compliance with SEC regulations. This ensures transparency and instills confidence among investors in the company's financial reporting.

Common challenges and how to overcome them

Completing Form 10-Q can present several pitfalls if not executed carefully. Common mistakes include missing disclosures, inaccurate data, or not adhering to the required formats.

To avoid these challenges, implement strategies that promote accuracy and compliance, such as detailed checklists and employing collaborative tools. Tools like pdfFiller facilitate teamwork, allowing multiple stakeholders to review and edit the form simultaneously.

Key highlights and best practices

Efficiently managing the Form 10-Q requires regular updates to financial data and compliance checks. Best practices involve maintaining a structured approach to data management and using a cloud-based solution to enhance filing efficiency.

Leveraging technology enhances the filing experience. With pdfFiller, users can access their forms from anywhere, edit them seamlessly, and collaborate in real time with their teams.

Understanding the implications of Form 10-Q

The implications of Form 10-Q extend beyond just compliance and submission. The information disclosed can significantly impact investor perceptions, as quarterly reports provide insights into the company’s financial trajectory.

Additionally, management can utilize the insights gleaned from Form 10-Q for internal assessments and strategic decision-making. Trends and discrepancies highlighted in the report can inform operational adjustments and future financial strategies.

Seeking additional support and resources

While many organizations can handle Form 10-Q filings internally, some may benefit from external support. Consulting with financial experts or legal advisors is recommended, especially when uncertain about regulatory requirements or best practices.

Moreover, using pdfFiller not only aids in Form 10-Q management but also supports ongoing document management needs. The platform’s robust features facilitate an efficient and organized approach to all forms and documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in 10 q form check?

Can I sign the 10 q form check electronically in Chrome?

Can I edit 10 q form check on an iOS device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.