Get the free Mgt-7

Get, Create, Make and Sign mgt-7

How to edit mgt-7 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mgt-7

How to fill out mgt-7

Who needs mgt-7?

Understanding the MGT-7 Form: A Comprehensive Guide

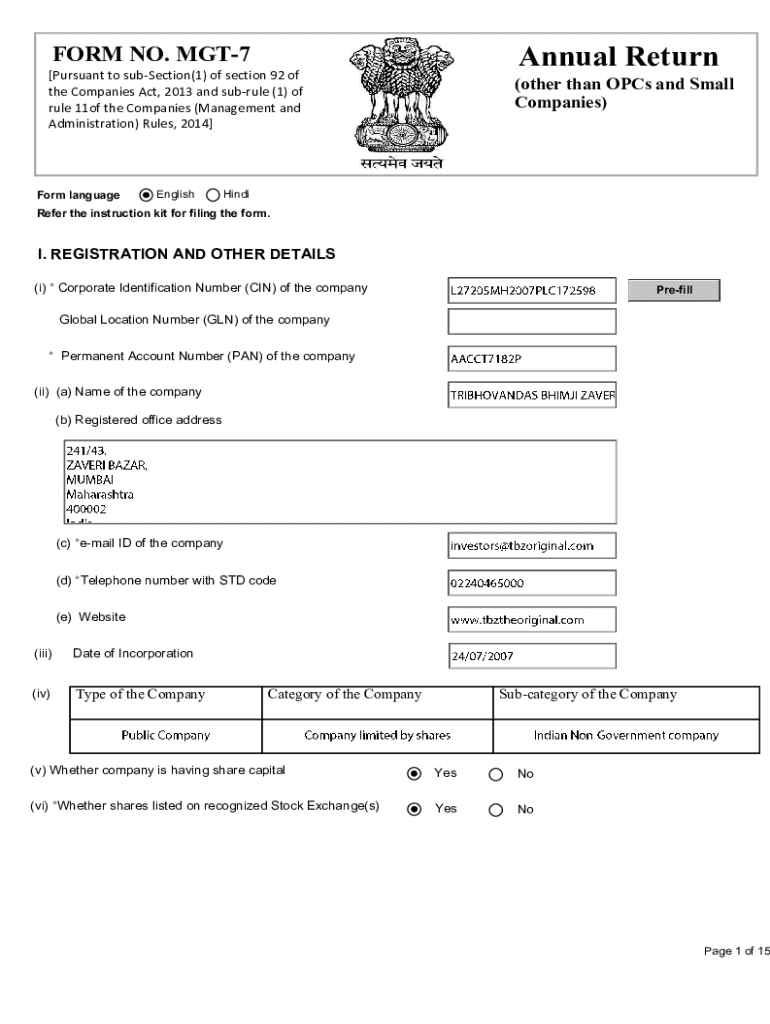

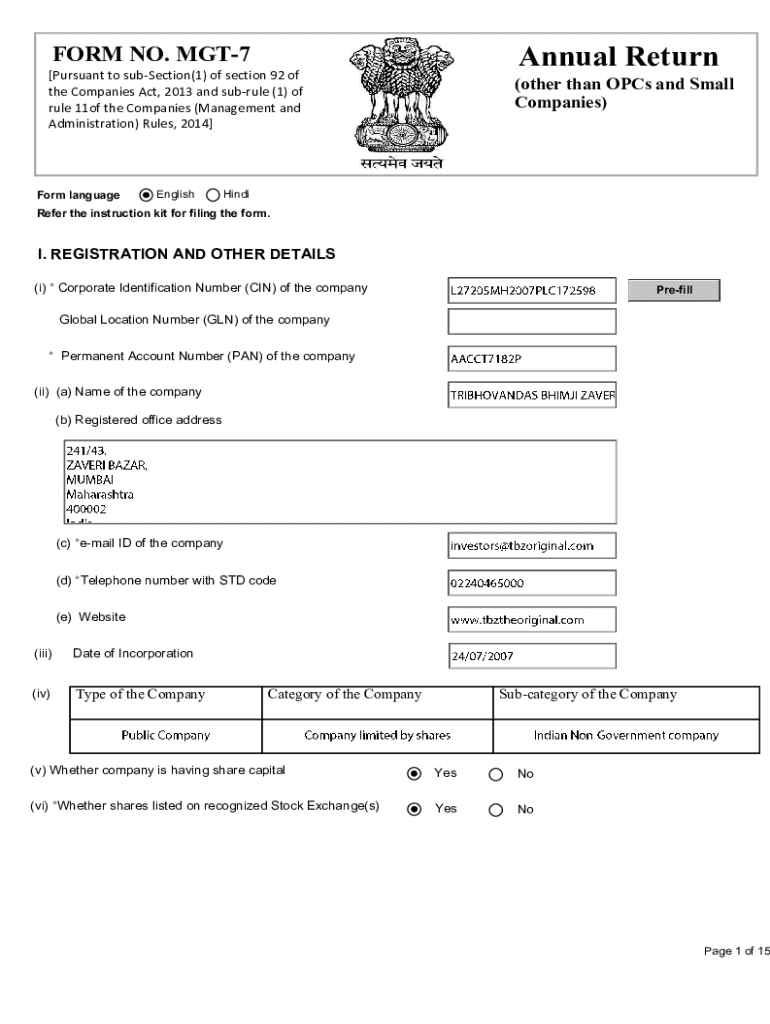

Overview of the MGT-7 form

The MGT-7 form is a critical document in the realm of corporate governance. It serves as the filing form for the annual return of a company registered in India, essentially providing a snapshot of the company's activities and structure over the previous year. The primary purpose of this form is to ensure compliance with the Companies Act, 2013, and to maintain transparency in company operations.

The importance of MGT-7 cannot be overstated as it plays a vital role in corporate compliance. Filing this form accurately and on time ensures that companies remain in good standing and meet regulatory requirements. Failure to do so can result in penalties and a loss of credibility in the business community.

The MGT-7 form is primarily used by various entities, including private companies and public companies that are required to maintain an annual return. Understanding who needs to use this form is essential for any company looking to fulfill legal obligations.

Applicability of the MGT-7 Form

Not all businesses are required to file the MGT-7 form. Typically, it is mandatory for every company registered under the Companies Act, 2013, with the exception of One Person Companies (OPC). To determine whether your company is required to file the MGT-7, check if it meets the criteria of having a minimum threshold of paid-up capital or turnover.

For instance, companies with a share capital of more than ₹1 crore or a turnover above ₹10 crores must file the MGT-7 form annually. It is essential to confirm the specifics related to your jurisdiction to ensure compliance.

Moreover, certain public companies and larger private companies have different filing requirements. Exceptions exist for certain non-profit organizations and small companies, which may have different procedures in place.

Key components of the MGT-7 form

The MGT-7 form comprises several sections that need careful completion to ensure accuracy. Let's break down the key components:

Understanding each section is vital for filling out the form correctly. Hovering over parts of the form in platforms like pdfFiller can provide additional tips for completion.

Filling out the MGT-7 form

Filling out the MGT-7 form doesn’t have to be a daunting task. Here are step-by-step instructions:

Best practices for data entry include double-checking the information, keeping the format consistent, and saving a copy of the filled form for future reference.

An interactive checklist tool available on pdfFiller can assist in tracking required information and ensuring nothing is overlooked.

Editing and customizing the MGT-7 form

Editing the MGT-7 form is straightforward when using pdfFiller’s features. Users can easily make modifications to the document as needed, ensuring all information is up to date before submission.

Additionally, signing the MGT-7 document electronically through pdfFiller is a breeze. The platform supports secure e-signatures, enabling quick turnaround times and ensuring that documents can be finalized without the hassle of printing.

Collaborating with team members on the form is also simplified. Users can share the document directly within the platform, allowing for effective team input before finalizing the submission.

Submission process for the MGT-7 form

Once the MGT-7 form is completed, understanding the submission process is critical. Companies must file the form with the Registrar of Companies (RoC) relevant to their location. The submission can typically be done online through the Ministry of Corporate Affairs (MCA) portal.

It is vital to adhere to the submission timeline to avoid penalties. After completing the form, users should keep track of the filing date and confirm it through the RoC portal. Any applicable fees must be paid at the time of submission, which can vary based on the company's share capital and status.

After successful submission, companies will receive a confirmation, which should be retained for records to ensure future compliance.

After submission: What to expect

After submitting the MGT-7 form, companies should be proactive in tracking their submission status. The MCA portal provides functionalities to check the status of filings, allowing users to stay informed about any needed follow-up actions.

Common follow-up actions may include clarifications requested by the RoC or additional submissions if discrepancies are noted. Troubleshooting issues during the submission process can also be streamlined by consulting the help resources available on the MCA portal.

Managing your MGT-7 documents

Secure storage of the MGT-7 form and other related documents is essential for any company’s records. Using pdfFiller, users can keep their filled forms stored safely in the cloud, making retrieval straightforward at any time.

Moreover, pdfFiller aids in future filings by providing templates and tools that simplify repeat submissions. Document retrieval becomes easier with its search functionality, allowing companies to keep track of their compliance history efficiently.

Special scenarios involving the MGT-7 form

There might be instances where amendments or corrections to the MGT-7 form are necessary post-submission. Companies need to follow specific protocols to make these changes effectively and timely, ensuring compliance.

Jurisdictional differences can also affect how the MGT-7 is filed, particularly when dealing with cross-state operations in India. Each jurisdiction may impose specific guidelines or documentation requirements, adding a layer of complexity that companies must navigate.

Reporting changes in company structure such as mergers or acquisitions similarly requires completing additional forms or amendments to the MGT-7, further complicating the compliance landscape.

Engaging with experts for complex filings

For complex cases involving the MGT-7 form, it's advisable to consult with professionals. Engaging with experts ensures that companies navigate their filing obligations correctly and efficiently, particularly when facing unique circumstances.

Resources available through pdfFiller include expert guidance to assist users in understanding legal nuances and filing procedures. The platform even offers an interactive Q&A session feature that addresses user queries in real-time, alleviating uncertainties.

Importance of timely filing

Timely filing of the MGT-7 form is crucial. Late submissions can attract penalties, which can significantly impact a company's financial health and reputation. Companies should prioritize deadlines and utilize the reminders and alerts from pdfFiller to stay on track.

Maintaining compliance not only helps avoid penalties but also bolsters a company's credibility. The robust features of pdfFiller can assist in setting up reminders to ensure that businesses remain proactive about their filing obligations.

Enhancing document management with pdfFiller

Beyond the MGT-7 itself, pdfFiller offers a suite of other forms and templates that enhance overall document management for businesses. The features provided simplify document creation, editing, and collaboration, streamlining workflow significantly.

User testimonials reveal how pdfFiller has transformed document handling, with many highlighting the ease of access and user-friendly interface that enhances productivity. Whether for forms, contracts, or compliance documents, pdfFiller is designed to empower users.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mgt-7 without leaving Google Drive?

How do I edit mgt-7 online?

How do I make edits in mgt-7 without leaving Chrome?

What is mgt-7?

Who is required to file mgt-7?

How to fill out mgt-7?

What is the purpose of mgt-7?

What information must be reported on mgt-7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.