Get the free Campaign Finance Receipts & Expenditures Report

Get, Create, Make and Sign campaign finance receipts expenditures

How to edit campaign finance receipts expenditures online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts expenditures

How to fill out campaign finance receipts expenditures

Who needs campaign finance receipts expenditures?

Understanding and Managing Campaign Finance Receipts and Expenditures Forms

Understanding campaign finance forms

Campaign finance plays a crucial role in the electoral process, serving as a mechanism through which candidates raise and spend money to influence voters. In essence, it is the financial backbone of political campaigns, impacting everything from advertising strategies to the outreach programs candidates deploy. The significance of campaign finance cannot be overstated, as it affects the fairness and competitiveness of elections.

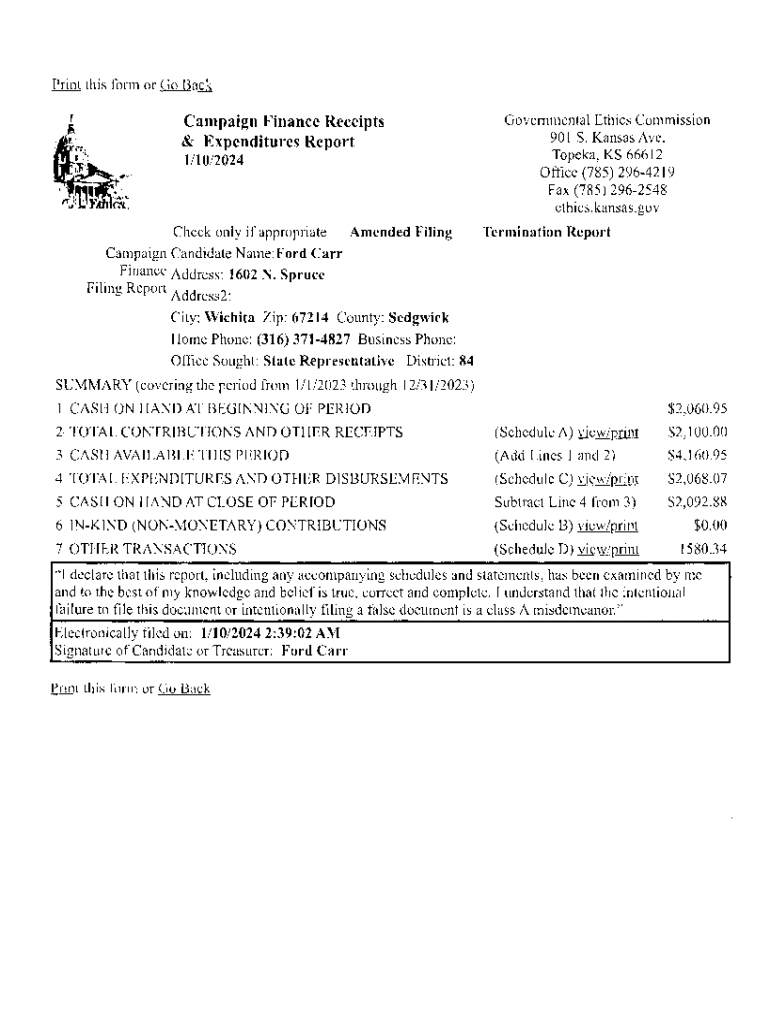

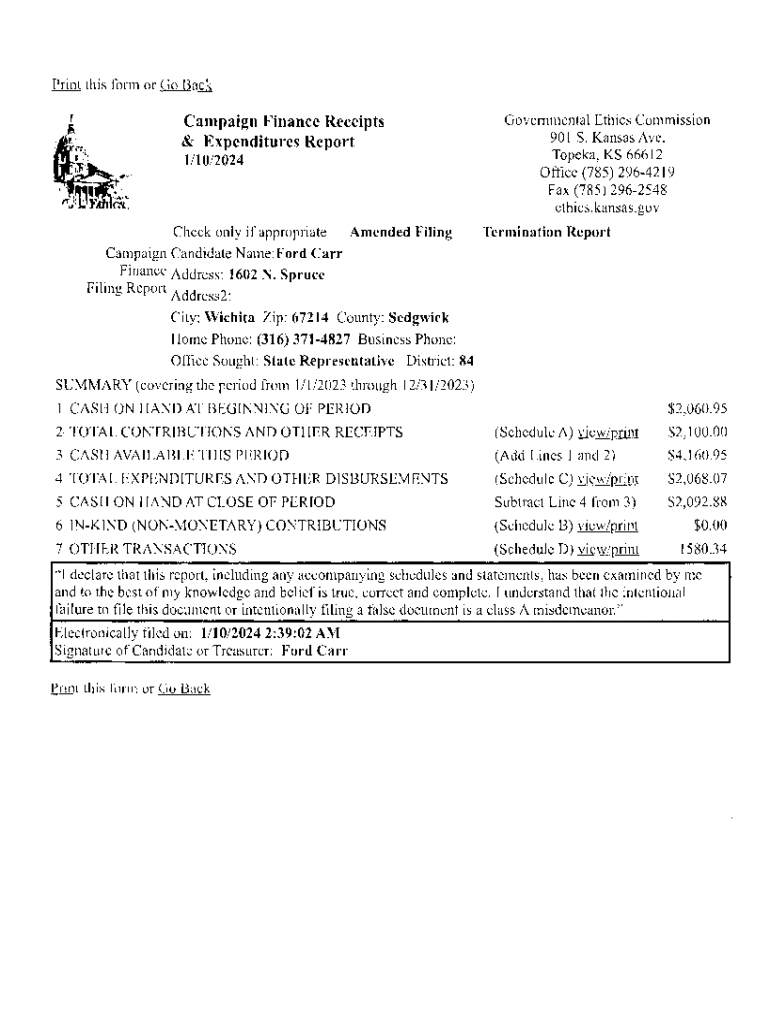

The receipts and expenditures forms are essential components of campaign finance, providing a transparent account of financial inflows and outflows. These documents are vital for both candidates and regulators to ensure compliance with legal standards and promote accountability among candidates. By accurately reporting these figures, candidates uphold the integrity of the electoral system and foster trust amongst constituents.

Types of campaign finance forms

Campaign finance forms can vary significantly across jurisdictions but generally fall into a few common categories. Each type serves a specific purpose in the overall financial documentation of a campaign, promoting data integrity and public trust.

Links to specific forms vary by state; it's important for campaign teams to familiarize themselves with local regulations to ensure compliance.

Filling out campaign finance receipts expenditures forms

Completing campaign finance forms can seem daunting, but following a structured approach can simplify the process. Here’s a detailed step-by-step guide on how to effectively fill out these forms.

Filling out receipts

When completing contribution receipts, specific details must be included to ensure accuracy and compliance. Key elements include the donor’s name, the amount received, and the date of contribution. In some jurisdictions, additional disclosures may be required, such as occupation or employer information, particularly if the donor is an entity.

Documenting expenditures

Expenses must be meticulously reported. This involves categorizing expenditures into distinct types — such as advertising, event hosting, and staff salaries — and providing thorough details regarding each transaction. For instance, if you purchased ads, you need to specify the type of media, amounts spent, and dates of the expenses.

Editing and managing campaign finance forms

Once you’ve filled out the forms, managing these documents efficiently is crucial. pdfFiller offers a variety of features that make it easy to edit, sign, and store documentation securely. These include real-time collaboration options that enable multiple team members to access and work on forms simultaneously.

An invaluable feature of pdfFiller is its version control function, which tracks changes made to documents. This ensures that any updates to campaign finance receipts and expenditures forms can be monitored over time, helping maintain an audit trail.

Tips for ensuring accuracy

Filling out forms correctly is paramount in campaign finance. Here are some strategies to avoid common mistakes: first, double-check all figures and ensure consistency in reporting. Every contribution and expenditure should align with receipts and invoices kept on file for verification. This practice not only bolsters accuracy but also supports compliance with regulatory audits.

Another helpful tip is to establish clear protocols within your team to ensure that documentation processes are standardized and thorough, minimizing the potential for discrepancies.

Compliance considerations

Understanding the legal requirements around campaign finance reports is integral to any campaign's success. Both federal and state regulations outline specific reporting standards, including deadlines for submissions which must be strictly adhered to. Failure to comply can lead to significant consequences, including fines and legal sanctions.

To stay compliant, it’s essential to remain informed about changes in regulations. Regular consultations with legal counsel specializing in election law can help ensure that you remain up to date with the current legal landscape.

Resources for compliance

Numerous resources are available to assist campaign managers in navigating the intricacies of campaign finance law. Websites maintained by state election offices often serve as key information hubs regarding submission requirements, deadlines, and best practices.

Frequently asked questions

Common questions often arise when dealing with campaign finance forms. A popular concern is what happens if a filing deadline is missed; generally, this can lead to penalties, making timely submission imperative. Additionally, many ask how to report in-kind contributions. Such contributions should be documented similarly to cash donations, including their fair market value.

For users who have specific questions or need assistance while using pdfFiller, the platform provides robust support. Customer service can assist with technical issues or clarifications about specific forms.

Advanced tips for campaign managers

Understanding and analyzing the data from filed campaign finance receipts and expenditures forms can significantly inform campaign strategies. By reviewing these forms closely, you can identify trends in funding sources and expenditure patterns, which can enhance future fundraising strategies or budget allocations.

Furthermore, leveraging the data from these forms not only aids in planning but also streamlines decision-making processes — ensuring that your campaign operates efficiently and effectively as it competes for voter attention.

Conclusion of the guide

Staying informed about updates to campaign finance forms is crucial for all candidates and campaign teams. Platforms such as pdfFiller not only facilitate form management but also assist in maintaining compliance with evolving standards, empowering users to seamlessly edit PDFs, eSign, collaborate, and manage documents efficiently. Utilizing such resources effectively can aid in building a successful campaign that adheres to the necessary legal frameworks while maximizing outreach efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my campaign finance receipts expenditures directly from Gmail?

How do I make changes in campaign finance receipts expenditures?

How do I complete campaign finance receipts expenditures on an iOS device?

What is campaign finance receipts expenditures?

Who is required to file campaign finance receipts expenditures?

How to fill out campaign finance receipts expenditures?

What is the purpose of campaign finance receipts expenditures?

What information must be reported on campaign finance receipts expenditures?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.