Get the free Campaign Finance Receipts and Expenditures Report

Get, Create, Make and Sign campaign finance receipts and

Editing campaign finance receipts and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out campaign finance receipts and

How to fill out campaign finance receipts and

Who needs campaign finance receipts and?

Campaign finance receipts and form: A comprehensive guide

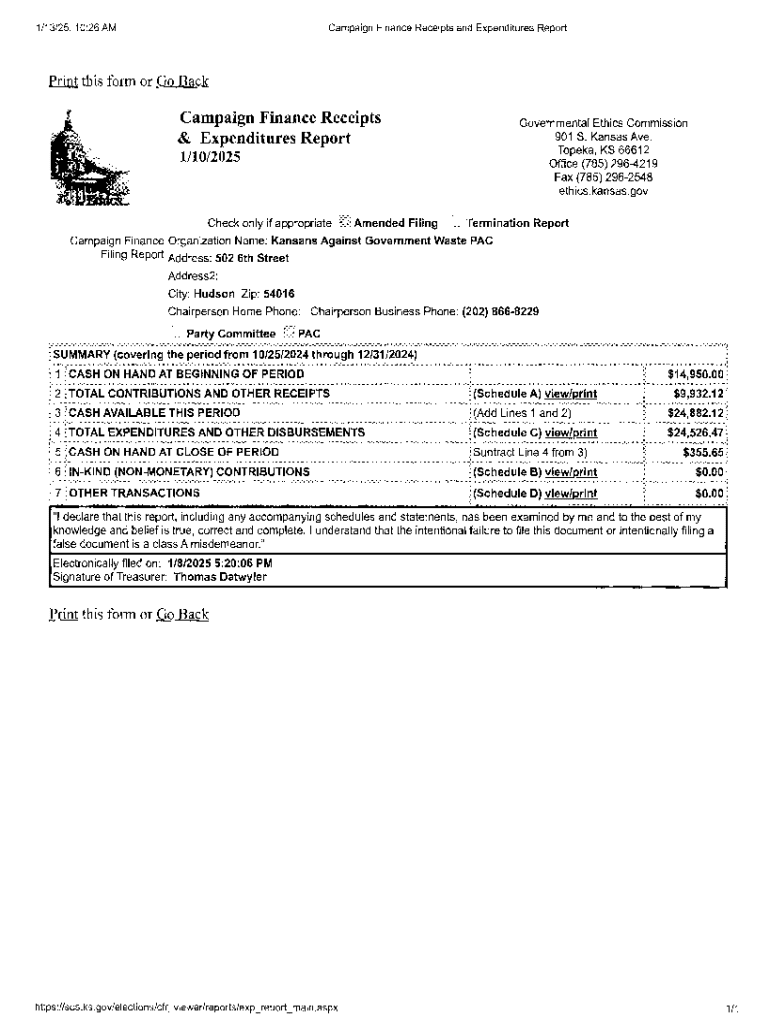

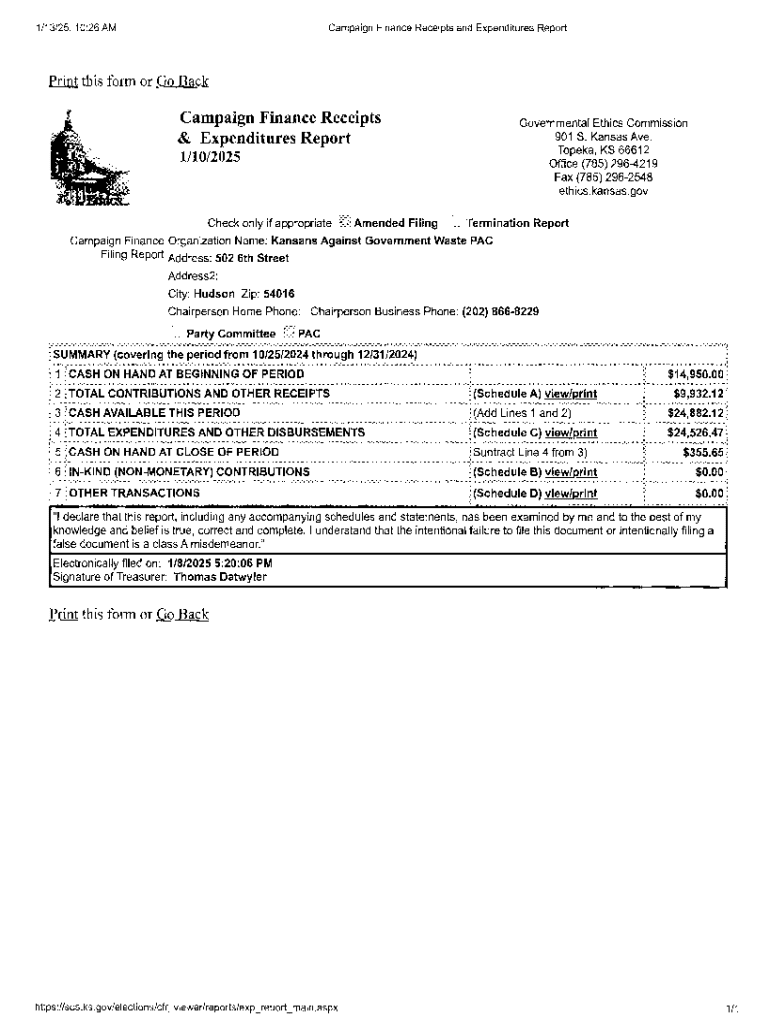

Understanding campaign finance

Campaign finance refers to the funds raised and spent to participate in political campaigns. Its crucial role in democratic processes includes facilitating the ability of candidates and parties to communicate with voters and influence policy. The transparency and regulation of campaign finance help combat corruption and ensure a level playing field in elections.

Regulatory bodies oversee the rules and practices surrounding campaign finance. The Federal Election Commission (FEC) is the primary federal entity, enforcing rules that govern federal elections. State election offices also play significant roles, ensuring compliance with state-specific laws and regulations. Other agencies may contribute depending on local jurisdictions.

Types of campaign finance forms

There are various forms designed to meet the needs of different types of campaigns at the federal, state, and local levels. Each form is tailored to specific requirements for contributions, disclosures, and reporting. Understanding which forms apply to your campaign is vital for compliance. Common forms include the FEC Form 1 for federal candidates and various state-specific versions for local campaigns.

Key components of these forms typically include required information related to contributions and expenditures, along with detailed categories. For instance, contributions can be categorized as individual donations, PAC contributions, or in-kind donations.

The campaign finance receipt form

The campaign finance receipt form serves as an essential document that records contributions made to a campaign. This form encapsulates the essence of transparency, ensuring that every donation is properly logged and accountable. Accurate record-keeping is not just best practice; it is a legal requirement intended to uphold the integrity of the democratic process.

The receipt form includes several critical sections: donor information such as name and address, the contribution date, and detailed contribution specifics, including the amount, type, and intended purpose of the donation. Properly completed forms can protect candidates from compliance issues and enhance trust with their supporters.

Filling out the campaign finance receipt form

Successfully completing a campaign finance receipt form requires precision. Start by collecting necessary donor information, ensuring you have accurate names, addresses, and contribution dates. Next, determine the type of contribution, whether it’s cash, check, or in-kind. Once you have the details, accurately fill out the form, paying attention to the specific amounts and contributions.

After completion, review the form for completeness and compliance, checking that no donor information is missing, and amount reporting is accurate. Common mistakes to avoid include inaccurate reporting of contribution amounts, missing donor information, or neglecting to keep copies of completed forms for your records.

Utilizing interactive tools for campaign finance management

In the age of digital transformation, technology plays a vital role in streamlining campaign finance management. Online forms and digital data management systems enhance efficiency, allowing campaigns to track finances in real-time. These tools reduce the administrative burden and help avoid compliance issues through automated reminders and alerts.

pdfFiller, a leader in document management, provides functionalities that simplify form creation and management. Users can easily create, edit, and collaborate on campaign finance forms, ensuring all information is accurate and up-to-date within a single, cloud-based platform. Features such as e-signing and easy sharing boost collaboration among team members, enhancing the process.

Compliance and submission of campaign finance receipts

Timely submission of forms to regulatory bodies is critical in campaign finance management. Each jurisdiction has its own deadlines for submitting receipts, which must be adhered to avoid penalties. Knowing state-specific filing requirements also ensures compliance, as violations can lead to audits and fines that could jeopardize a campaign.

Additionally, maintaining organized records is paramount. The duration for retaining campaign finance documents varies but generally spans several years after the election. Best practices for organization include maintaining digital files and backups and creating a systematic filing system to safeguard these important records against loss or damage.

Interactive tools and resources

Having access to forms and templates significantly eases the campaign finance process. Various online archives offer necessary forms for download, streamlining the paperwork required for compliance. Customizable options using pdfFiller can enhance adaptability, transforming standard templates into tailored resources that meet specific campaign needs.

Moreover, a comprehensive FAQ section addressing common questions around campaign finance receipts can be invaluable. It provides insight on troubleshooting frequent filing problems, covering a range of queries from how to correct errors in submissions to what to do if a form is lost or misplaced.

Best practices in campaign finance management

Effective record-keeping is integral to successful campaign finance management. Regular updates to records can avoid complications, while setting reminders for filing deadlines aids in compliance. These simple practices create an organized approach that can save campaigns from unnecessary stress.

Using collaborative tools like pdfFiller enhances team management, allowing campaign staff to work together seamlessly on documentation. Sharing access to forms and receipts with finance managers ensures everyone is up-to-date and helps in keeping all vital information on track within the campaign.

Case studies and real-life examples

Highlighting successful campaigns can provide useful lessons in effective campaign finance management. For instance, several candidates have thrived by adopting transparent practices and meticulous record-keeping, resulting in increased trust and support from their constituents.

Conversely, examining compliance failures reveals how they can lead to significant repercussions. Analyzing instances where campaigns faced fines or legal challenges due to improper reporting highlights the importance of diligence in adhering to finance regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify campaign finance receipts and without leaving Google Drive?

How do I execute campaign finance receipts and online?

How do I complete campaign finance receipts and on an Android device?

What is campaign finance receipts?

Who is required to file campaign finance receipts?

How to fill out campaign finance receipts?

What is the purpose of campaign finance receipts?

What information must be reported on campaign finance receipts?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.