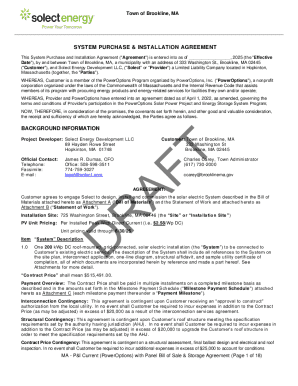

Get the free Resolution 8888

Get, Create, Make and Sign resolution 8888

How to edit resolution 8888 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out resolution 8888

How to fill out resolution 8888

Who needs resolution 8888?

How-to Guide: Resolution 8888 Form

Understanding Form 8888: Overview and Importance

Form 8888 is a crucial document designed to guide taxpayers in managing their tax refunds efficiently. It allows individuals to direct their refunds into multiple accounts, providing a streamlined approach to financial planning. By using this form, taxpayers can specify exactly where they want their refund to be deposited, thereby optimizing their financial resources.

The importance of Form 8888 lies in its ability to help taxpayers allocate their tax refunds effectively. This can facilitate savings goals by directing funds towards savings accounts or U.S. savings bonds. Understanding how to utilize Form 8888 ensures that taxpayers can maximize their financial stability and set long-term goals for their money.

Key features of Form 8888

Form 8888 consists of several sections, each serving a specific purpose. These sections include personal information about the taxpayer, instructions for selecting direct deposit options, and fields for designating funds for purchases like U.S. savings bonds. It is essential for taxpayers to understand each part fully to ensure accurate completion.

To be eligible to file Form 8888, taxpayers must be receiving a refund. Additionally, there are no significant restrictions on filing; it can be used by individuals filing Form 1040, 1040A, and 1040EZ. The main advantage is the ability to split refunds easily, aiding in personal financial management.

Using pdfFiller for Form 8888

pdfFiller streamlines the process of creating and accessing Form 8888. To begin, users can easily find the form within the pdfFiller platform. By selecting the appropriate template, individuals can access a user-friendly interface that simplifies the completion of their necessary documents.

Editing Form 8888 via pdfFiller is straightforward. Users can add text, checkboxes, and even digital signatures. Maintaining document integrity while modifying is paramount; avoiding unnecessary alterations outside the specified fields guarantees the form's authenticity.

Detailed instructions for filling out Form 8888

Step 1 involves entering personal information. Ensure accurate input of your identification details, including your legal name and Social Security number. This information is crucial for matching your refund with your tax records. Using pdfFiller can help minimize errors through its guided prompts.

Step 2 focuses on selecting your direct deposit choices. Taxpayers can specify up to three different accounts for receiving their refund. Ensure that the account numbers and routing numbers are correct to avoid any processing issues. By directing your funds to multiple accounts, you can allocate funds to savings efficiently.

Step 3 recommends designating a portion of your refund towards purchasing U.S. savings bonds. This step can help boost your savings while ensuring the money is put towards a secure investment option. Make sure to specify the amount clearly in the form.

Submitting Form 8888

Before submission, a review checklist is essential to ensure all information is accurate. Confirm that your personal details are correct and that you have designated the right account numbers for direct deposit. Failing to double-check your submission can lead to delays in receiving your refund.

Understanding the pros and cons of each submission method can help taxpayers choose the best approach for their situation. Digital submissions through platforms like pdfFiller ensure a quicker turnaround time for processing refunds.

Troubleshooting common issues with Form 8888

Mistakes during the filing process can delay the refund significantly. Common errors include incorrect account information or omitting the signature. Avoiding these pitfalls requires careful review and awareness of your submission's specifics.

If issues arise during submission, immediately check for IRS notices regarding processing delays. Understanding the reasons behind such delays will aid in navigating the problem effectively.

Tracking your refund after using Form 8888

Once you have submitted Form 8888, tracking your tax refund becomes vital. The IRS provides an online tool for checking the status of your tax refund, allowing you to monitor processing times easily.

After submitting Form 8888, patience is key. Many factors can affect the timeline for receiving your refund, including IRS processing times and the volume of submissions during tax season. Utilize resources available for additional help if delays extend beyond the anticipated timeframe.

FAQs about Form 8888

One of the most common questions is whether individuals can file Form 8888 if they have an outstanding tax liability. The answer is yes; however, the refund may be applied to settle any outstanding liabilities. Additionally, if banking information changes after submission, it is imperative to contact the IRS immediately.

Having these FAQs on hand can assist taxpayers in making informed decisions when utilizing Form 8888.

Financial strategies utilizing your tax refund

Tax refunds present a valuable opportunity for financial growth. One effective strategy is to turn refunds into long-term savings goals. For instance, consider allocating a portion of your tax refund into a high-yield savings account or retirement fund. This approach fosters stability and prepares you for future financial needs.

Effective utilization of tax refunds not only enhances savings but can also pave the way for increased financial independence by leveraging the opportunities available to you.

Conclusion: Maximizing the benefits of Form 8888 with pdfFiller

Using pdfFiller to complete Form 8888 simplifies the process significantly. The platform’s tools facilitate easy editing, signing, and collaboration, providing a comprehensive solution for tax refund management. By understanding how to maximize the benefits of your tax filings, you can take control of your finances and optimize your tax refund strategy.

Through Form 8888, individuals can set themselves on a path toward greater financial security and long-term planning, ultimately making their tax refunds work harder for them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find resolution 8888?

How do I complete resolution 8888 online?

Can I edit resolution 8888 on an iOS device?

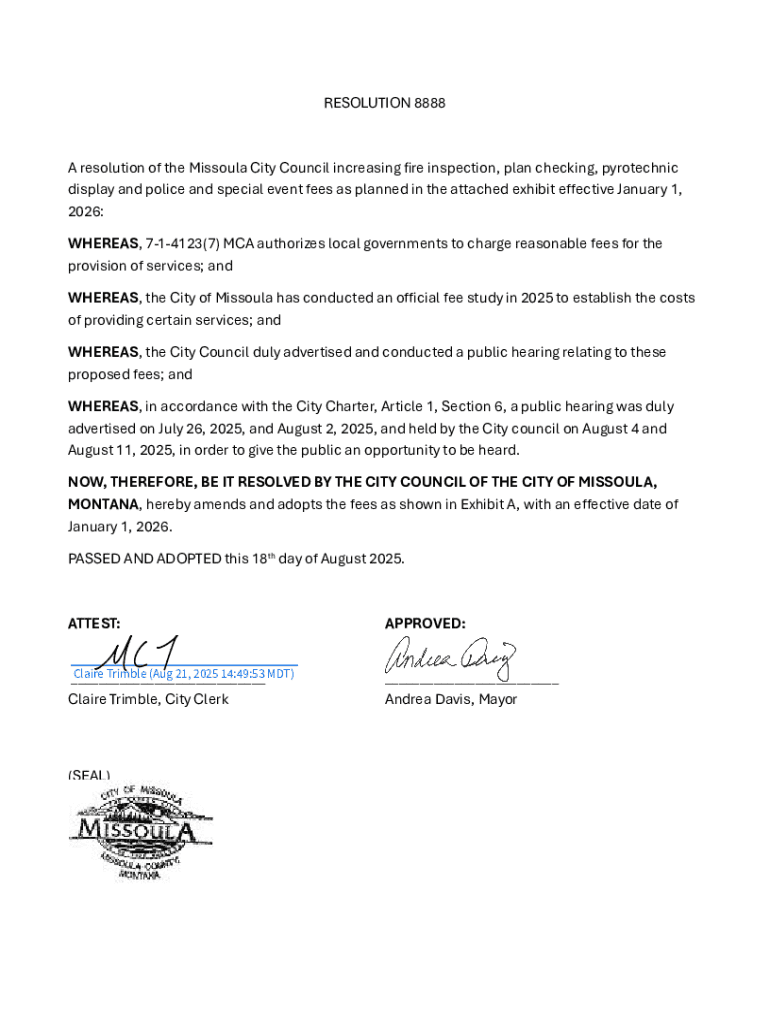

What is resolution 8888?

Who is required to file resolution 8888?

How to fill out resolution 8888?

What is the purpose of resolution 8888?

What information must be reported on resolution 8888?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.