Get the free Employee Salary and Benefits Manual 2017-2018

Get, Create, Make and Sign employee salary and benefits

Editing employee salary and benefits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out employee salary and benefits

How to fill out employee salary and benefits

Who needs employee salary and benefits?

A Comprehensive Guide to Employee Salary and Benefits Form

Understanding the employee salary and benefits form

The employee salary and benefits form is a crucial document for both employees and HR departments. It captures essential information regarding an employee's compensation package and the benefits they are entitled to. This form serves not just as a record but as a guiding document to ensure that employees receive their correct compensation, thereby playing a vital role in HR management.

By having a standardized format, the employee salary and benefits form enables HR to streamline processes related to payroll and benefits management. It facilitates clarity and transparency in salary discussions and provides employees with essential information to help them make informed decisions regarding their financial and health-related options.

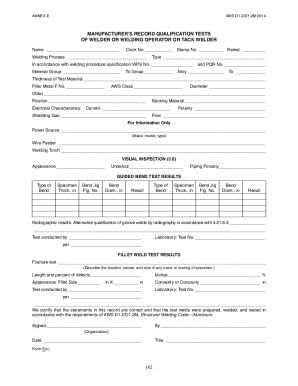

Components of the employee salary and benefits form

Each employee salary and benefits form typically consists of several core components that allow for comprehensive data collection. First and foremost, detailed employee identification information must be included; this ensures that HR can accurately associate the form with the correct individual.

Following identification, the salary information segment is crucial. This part includes base salary, overtime pay, and any bonuses or incentives. Employees can also expect a breakdown of benefits provided by the employer, such as available health insurance options, retirement plans like 401(k) or pensions, and the specifics of paid time off (PTO). Finally, tax withholding information is collected to ensure compliance with taxation laws.

Step-by-step guide to filling out the form

Filling out the employee salary and benefits form may seem daunting, but breaking it down into steps can simplify the process. Begin by gathering necessary documents such as tax forms, previous salary information, and a detailed list of available benefits.

Once you have all documents ready, the first step is to enter accurate employee identification information. Ensuring this detail is correct helps avoid unnecessary delays during payroll processing. After that, detail the salary components accurately, specifying base salary, regular hours, overtime, and any bonuses.

Next, assess your personal needs against the available benefits. Choose from health insurance options, retirement plans, and paid time off based on relevancy to your lifestyle. Once everything is entered, review the tax withholding section to confirm correctness before moving on to the submission process.

Common mistakes to avoid

When completing the employee salary and benefits form, common pitfalls can lead to complications down the road. Inaccurate employee information can result in payroll errors and misunderstandings. It is also essential to avoid underreporting overtime or bonuses, as failing to capture the full picture of an employee's compensation can lead to dissatisfaction and potential legal issues.

Furthermore, overlooking available benefits can be counterproductive. Employees may miss out on valuable health plans or retirement options that would have significantly benefited them. Lastly, remember to update your information periodically, especially after major life occurrences, to keep the form relevant and accurate.

Managing and modifying the employee salary and benefits form

Updating your employee salary and benefits form is essential after experiencing significant life events, such as marriage, childbirth, or career changes. Each of these events can lead to changes in your financial responsibilities or insurance needs, and keeping the document updated ensures that HR has the latest information when processing benefits.

In terms of practicality, activities like accessing and editing your form can be made easier using platforms like pdfFiller. With cloud-based tools, you can make real-time edits, ensuring that all relevant parties have access to the most current information. Additionally, electronic signing features allow for quicker approvals, significantly speeding up the process.

Using interactivity for a better experience

Today's digital forms come equipped with interactive features that enhance the user experience. For instance, in-app highlights can offer instant tips during the completion of the employee salary and benefits form, guiding users through each section with ease. These features not only assist in filling out the form but also improve overall understanding of the components involved.

Furthermore, collaboration tools integrated within platforms like pdfFiller facilitate effective communication with HR teams. Employees can easily reach out for clarifications, ensuring every detail is addressed promptly, thus reducing the risk of errors.

Legal considerations regarding salary and benefits information

Understanding the legal framework surrounding employee salary and benefits is vital for both employees and employers. Compliance with labor laws ensures fair practice and protects both parties from legal repercussions. It’s critical that employees are aware of their rights, especially when engaged in discussions about salary adjustments or benefit alterations.

Additionally, confidentiality is paramount when handling sensitive information regarding salary and benefits. Employers must comply with regulations that ensure payroll information is kept secure, protecting employee privacy. This also promotes trust between employees and the company, fostering a positive work environment.

Integrating the employee salary and benefits form into your workflow

Integrating the employee salary and benefits form into your organizational workflow can significantly enhance efficiency. Utilizing tools like pdfFiller for document management simplifies tracking and updates related to these forms, reducing administrative burden. The platform offers automation tips for regular updates, ensuring that employee records remain current and accurate.

Moreover, accessing historical versions of the form allows for better oversight of changes and trends in compensation and benefits over time. This is particularly useful during annual reviews or audits, providing a comprehensive view of an employee's record without the hassle of manual documentation.

Frequently asked questions (FAQs)

Individuals often have questions after filling out the employee salary and benefits form. A common inquiry is, 'What should I do if I forget to include a benefit?' In such cases, it's advisable to reach out to your HR department immediately to see if you can correct the error before submission.

Another frequently asked question relates to accessing already submitted forms. You should be able to retrieve your form via the cloud-based platform used by your organization. In addition, changes to benefits can generally be made during open enrollment periods, giving employees the opportunity to fine-tune their selections.

Additional tools and resources for employees

A plethora of additional tools and resources can support employees in handling their salary and benefits more effectively. For instance, there are various online platforms that provide salary comparison tools to help employees understand how their compensation stacks up against industry standards.

Moreover, resources for benefits enrollment can guide employees through available options and assist them in making informed decisions. Lastly, budgeting tools for benefits and salary planning can help individuals manage finances wisely, taking full advantage of their benefits while ensuring sound financial health.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit employee salary and benefits online?

Can I create an eSignature for the employee salary and benefits in Gmail?

How can I fill out employee salary and benefits on an iOS device?

What is employee salary and benefits?

Who is required to file employee salary and benefits?

How to fill out employee salary and benefits?

What is the purpose of employee salary and benefits?

What information must be reported on employee salary and benefits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.