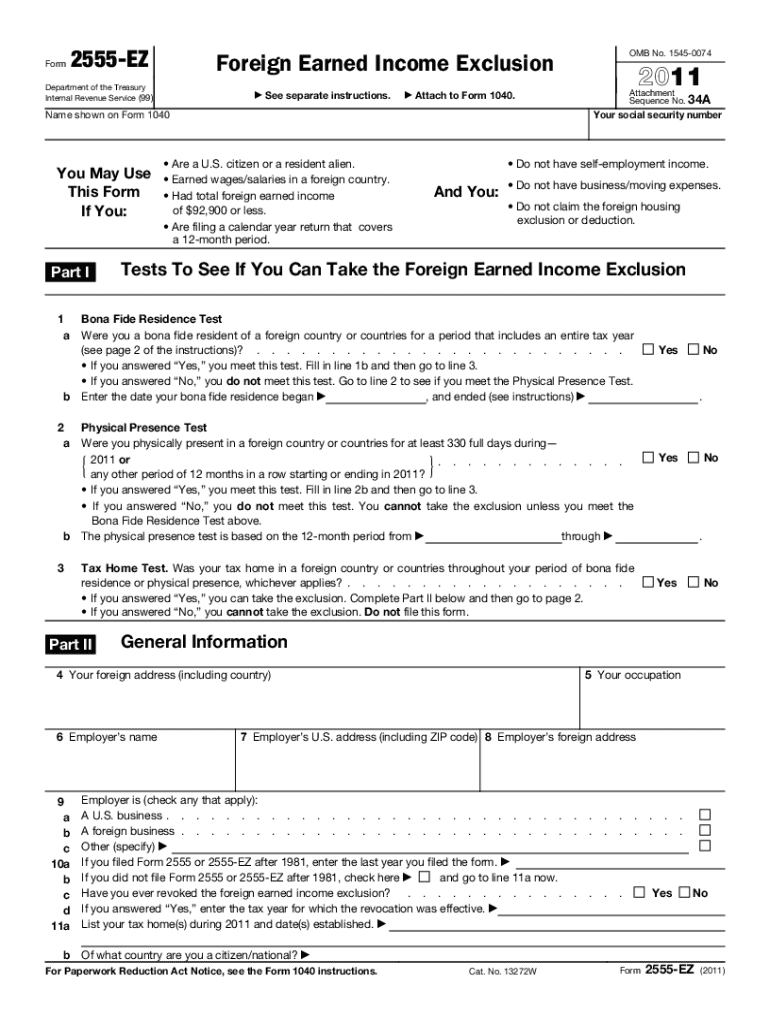

Get the free 2555-ez

Get, Create, Make and Sign 2555-ez

How to edit 2555-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2555-ez

How to fill out 2555-ez

Who needs 2555-ez?

2555-ez form: A Comprehensive Guide for Streamlined Tax Filing

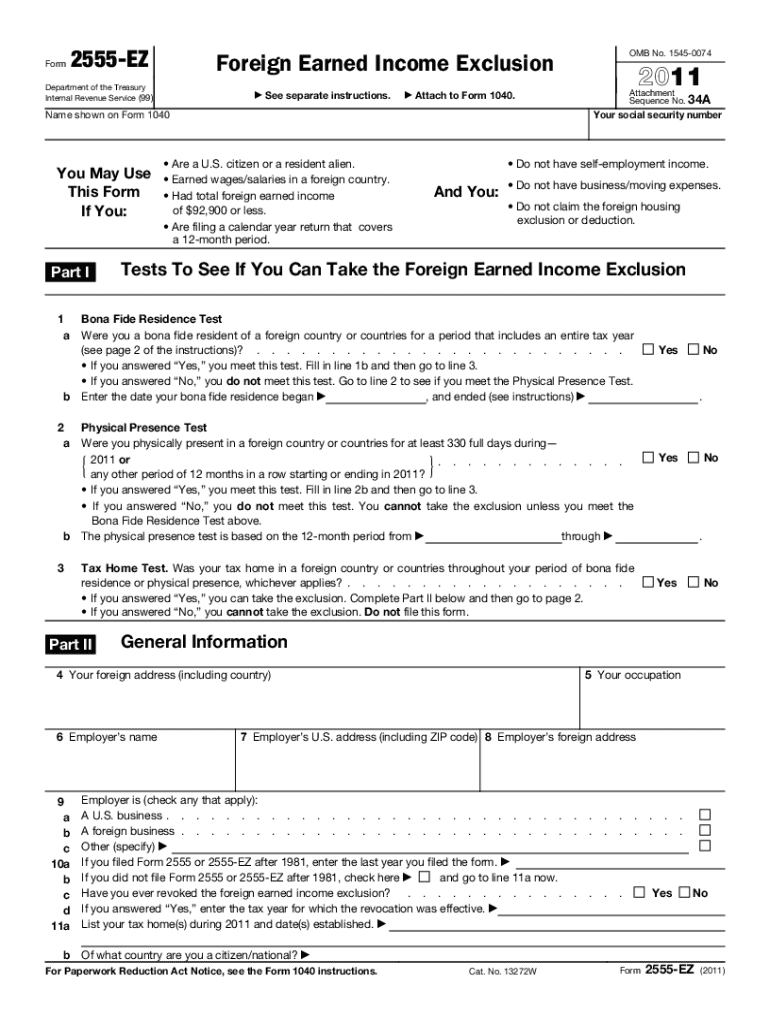

Understanding the 2555-ez Form

The 2555-ez form simplifies the tax filing process for U.S. expatriates by allowing them to claim the Foreign Earned Income Exclusion (FEIE) without the complexities of additional requirements. This form is particularly beneficial for Americans who live and work abroad and earn income that qualifies for exclusion under IRS regulations.

One of the key benefits of using the 2555-ez form is its streamlined design, making it easier for filers to navigate through the tax code without the burden of excessive documentation. Taxpayers that meet specific criteria can leverage this form to exclude a portion of their foreign-earned income from U.S. taxation.

The primary difference between Form 2555 and the 2555-ez lies in the eligibility requirements. Form 2555 requires more detailed information and is aimed at complicated situations, while 2555-ez restricts itself to simpler cases, making it suitable for individuals with straightforward foreign income and residency.

Who should use the 2555-ez form?

To determine whether you should use the 2555-ez form, it's vital to assess your eligibility. You must be a U.S. citizen or resident alien who works outside the U.S. and meets specific criteria relating to your foreign residency and earned income. If you are single and your foreign-earned income does not exceed the maximum exclusion limit, then the 2555-ez form is likely your best option.

Eligible income types include wages, salaries, professional fees, and other remuneration for personal services rendered in a foreign country. Scenarios for utilizing the 2555-ez form commonly involve expatriates like teachers, engineers, or consultants working abroad and aiming to simplify their tax obligations.

Step-by-step instructions for filling out the 2555-ez form

Filing the 2555-ez form requires careful attention to detail to ensure accuracy and compliance. Follow these steps to complete the process efficiently.

Step 1: Gather essential information before you start. You need to collect crucial documentation, including your Passport, W-2s, or a record of your earnings from foreign employers, as well as your foreign residency proof. Keep track of key dates, such as the due date for your tax return, to avoid penalties.

Step 2: Completing each section of the form begins with entering your personal information, such as your name and Social Security number. In the income section, you should report your foreign-earned income accurately. Determine what income qualifies and calculate your total foreign-earned income to claim the exclusion.

Lastly, sign and date the form, ensuring that all provided information is accurate. Missing signatures or incorrect details could result in delays or disputes.

Tips for efficiently filling out the 2555-ez form

To facilitate a smoother experience when filling out the 2555-ez form, follow these best practices. Begin by completing the form online, where tools can help prevent errors. pdfFiller offers user-friendly features to enhance the efficiency of the process, simplifying edits and ensuring compliance.

Common pitfalls include misreporting foreign income and failing to sign the submission. To avoid these, double-check eligibility requirements and make sure your income calculations are accurate. Consider keeping a checklist to guide you through the filing process, which can help ensure accuracy in reporting.

Real-life case studies: Utilizing the 2555-ez form

Exploring real-life scenarios can provide useful insights. For instance, a teacher living in Spain earned a salary of $60,000 during her time abroad. By filing the 2555-ez form, she managed to exclude this income from her taxable base entirely.

In another example, an IT professional based in Germany earned a $120,000 annual salary. Initially unsure about whether he qualified for the exclusion, he learned that as long as his foreign-earned income didn't exceed the threshold and he maintained his residency, he could use the 2555-ez form.

Common mistakes include underestimating foreign income and failing to gather necessary documentation ahead of time. Those who learn from these cases can better navigate their own filing processes, avoiding errors in future submissions.

Managing extensions and deadlines for the 2555-ez form

Understanding important deadlines is crucial for expats. Generally, the due date for filing the 2555-ez form coincides with the annual tax deadline, usually April 15th. However, expats are granted an automatic two-month extension to June 15th.

If you need more time to gather necessary documents or resolve issues, you may apply for additional extensions. This can be done by filing Form 4868, extending your time to file until October 15th. If you miss the deadline altogether, you may face penalties or interest, which can be avoided with timely requests.

Common challenges and solutions with the 2555-ez form

When utilizing the 2555-ez form, expats often face common challenges such as understanding eligibility and maintaining compliance with IRS regulations. Frequently asked questions may arise regarding the types of income that qualify for exclusion and how to handle disputes with the IRS.

Addressing issues promptly by maintaining organized records can significantly ease conflicts. For those facing audits or disputes, understanding the documentation that verifies your claims—such as employment contracts and wage records—can provide necessary support in cases of IRS inquiries.

Leveraging pdfFiller for your 2555-ez form needs

Utilizing pdfFiller can greatly enhance your form completion experience. The platform offers tools designed for efficient tax documentation management, allowing users to fill out and edit the 2555-ez form seamlessly from anywhere. This level of accessibility is especially beneficial for busy expatriates.

Built-in signature tools ensure that signing the document is effortless, again reducing the likelihood of errors. The collaboration features on pdfFiller enable teams to manage their expatriate tax documentation easily, ensuring that all necessary forms are accurately completed and submitted.

The importance of staying up-to-date with tax regulations

Tax regulations are constantly evolving, impacting the 2555-ez form and its requirements. Recent changes may adjust the maximum exclusion limits or the criteria for qualified foreign income. Staying informed about these updates is essential for compliance and maximization of benefits.

Resources such as the IRS website, expatriate tax blogs, and financial advising platforms can provide crucial insights into ongoing developments affecting your tax obligations as a U.S. expatriate. Regular engagement with these sources ensures you remain compliant and can optimize your filing strategies.

Conclusion: Embrace the ease of form filing with the right tools

Accurate tax documentation is vital for every expatriate, particularly when filing the 2555-ez form. Engaging with tools like pdfFiller not only simplifies the process but also enhances the accuracy of your submissions. By leveraging cloud-based platforms, you ensure efficient document management while focusing on your work abroad.

Final thoughts emphasize the necessity of staying vigilant regarding tax documentation and the role it plays in your financial well-being as an expat. With the right knowledge and tools, navigating expatriate tax filings can be more manageable, allowing you to focus on your international endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2555-ez without leaving Google Drive?

How do I execute 2555-ez online?

How do I fill out 2555-ez using my mobile device?

What is 2555-ez?

Who is required to file 2555-ez?

How to fill out 2555-ez?

What is the purpose of 2555-ez?

What information must be reported on 2555-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.