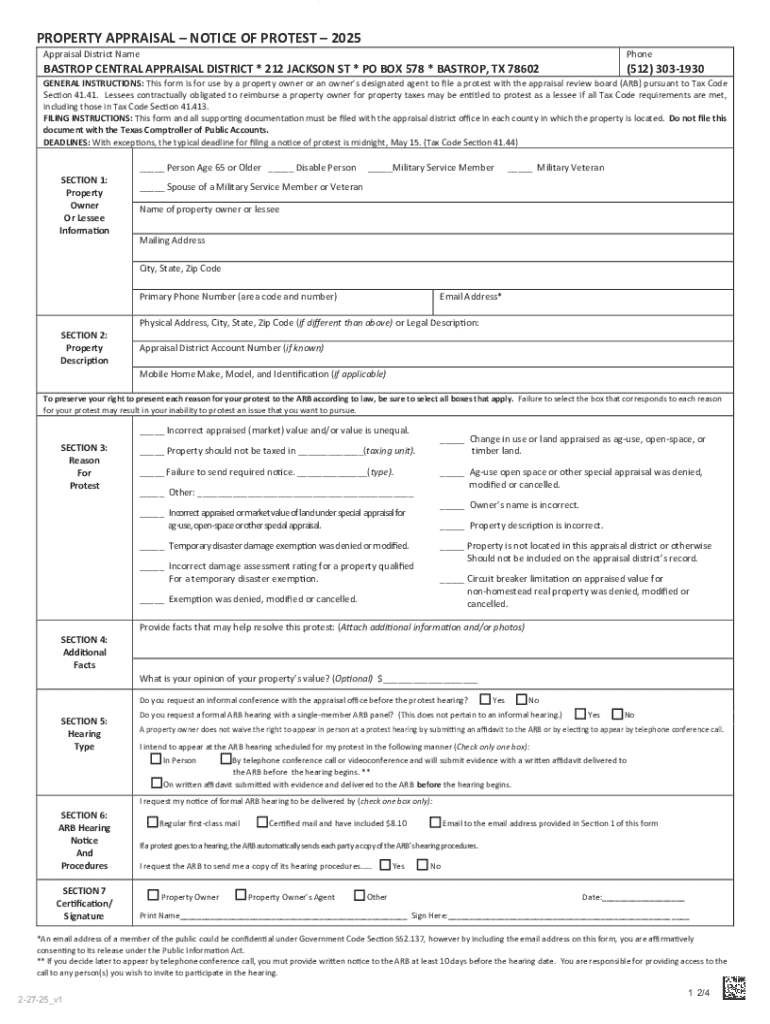

Get the free Property Appraisal – Notice of Protest – 2025

Get, Create, Make and Sign property appraisal notice of

How to edit property appraisal notice of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out property appraisal notice of

How to fill out property appraisal notice of

Who needs property appraisal notice of?

Everything You Need to Know About Property Appraisal Notice of Form

Understanding the Property Appraisal Notice

A property appraisal notice is an official document sent to property owners indicating the assessed value of their property. This notice plays a crucial role in aligning property values with market trends, thereby ensuring fair taxation and local budget funding. Without it, property owners may not understand how their property values are determined and could face unexpected financial repercussions.

Property appraisal notices are generally issued annually or bi-annually, depending on local regulations. They are typically sent after a routine assessment conducted by county or municipal assessors, who evaluate properties and adjust their values. Understanding when a property appraisal notice is issued can help homeowners stay informed and ready for any financial implications.

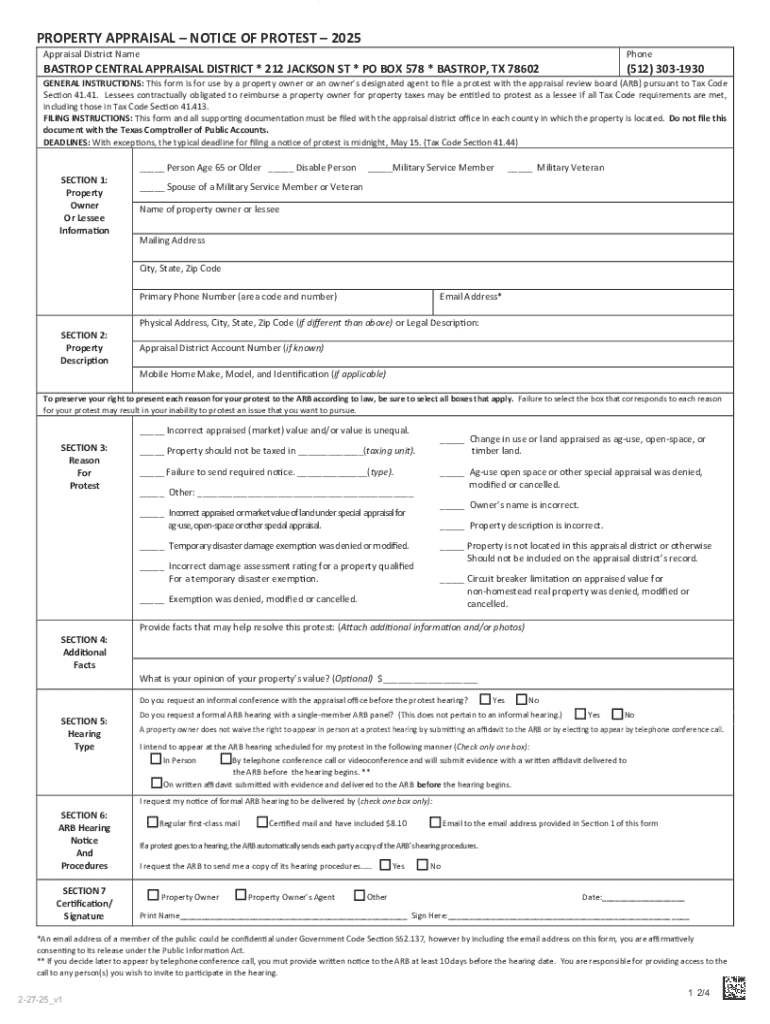

Components of the Property Appraisal Notice Form

The property appraisal notice form includes multiple key sections that detail specifics about the property, the owner, and the property’s assessed value. It's essential for property owners to review these components carefully to ensure accuracy.

Navigating through technical terminology can be daunting. Common terms include 'market value,' the estimated price a property would fetch in the marketplace, and 'assessed value,' which is often a percentage of the market value used to calculate property taxes. Understanding these terminologies is vital for interpreting the appraisal notice accurately.

Steps for completing the property appraisal notice

Completing the property appraisal notice form accurately is critical. Begin by filling in your personal information: full name, contact address, and any alternate addresses if applicable. Next, provide detailed property information, ensuring the description matches what is in local records.

Utilizing tools like pdfFiller can significantly streamline this process. The platform offers features such as auto-fill for repeating data entries, customizable templates to fit your needs, and collaborative editing capabilities that allow multiple parties to contribute efficiently.

Common mistakes to avoid

Filling out the property appraisal notice can be straightforward, but several common mistakes can complicate matters. Inaccuracies in personal information, neglecting to declare all property characteristics, and miscalculating the property's total area are frequent errors.

Mistakes may lead to inflated property tax assessments or hinder your ability to appeal if you disagree with the assessment result. Staying attentive while completing the form is crucial.

The importance of timely submission

Filing your property appraisal notice form within the required timeframe is essential. Usually, these deadlines vary by state and municipality, but missing them can have lasting consequences, such as penalties or an inability to challenge your property’s assessed value.

Being proactive about submission timelines can save property owners from headaches and unexpected financial demands.

Appeals process for property appraisal

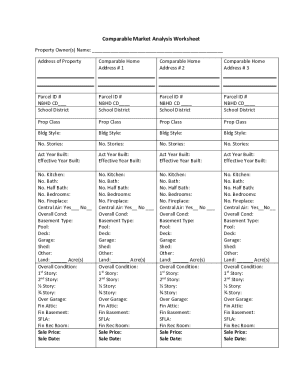

If you disagree with the assessment, you may initiate an appeal. The process typically begins by reviewing the notice and gathering supporting evidence, such as recent comparable sales in your neighborhood that justify a lower property value.

Understanding the local appeals process helps in preparing an effective challenge. Each municipality has different timelines and procedural norms to follow during this process.

Managing your property appraisal records

Organizing property appraisal records is crucial for seamless future transactions or appeals. Utilizing a platform like pdfFiller not only allows you to store your documents easily but also manage them efficiently.

The ability to access these documents from anywhere through cloud solutions is invaluable. With your documents readily available on any device, you can ensure timely responses to inquiries and maintain thorough documentation for your property.

Frequently asked questions about property appraisal notices

Many property owners have questions regarding the appraisal notice. One common inquiry is what to do if no notice is received. In such cases, contacting your local assessor's office is advisable to ensure your property is included in their evaluations.

Diving deeper into these questions can help mitigate any concerns or confusion when it comes to managing your property and understanding its value.

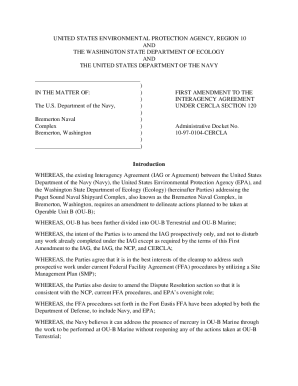

Alternative forms related to property appraisals

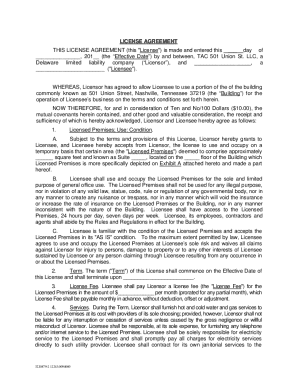

Besides property appraisal notices, there are various related forms homeowners might encounter. For instances when you need to provide additional information or documentation, it's crucial to know which forms are relevant and when to use them.

pdfFiller offers easy access to these forms, streamlining the process of property tax management for homeowners.

Conclusion for continuous learning

Staying informed about property appraisals is vital for homeowners. Continuous learning through available resources can empower property owners to make informed decisions regarding their investments and property value management.

Taking advantage of these resources allows homeowners to navigate the complexities of property appraisals with confidence and clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify property appraisal notice of without leaving Google Drive?

How do I complete property appraisal notice of online?

How do I fill out property appraisal notice of on an Android device?

What is property appraisal notice of?

Who is required to file property appraisal notice of?

How to fill out property appraisal notice of?

What is the purpose of property appraisal notice of?

What information must be reported on property appraisal notice of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.