Get the free Form 10-q

Get, Create, Make and Sign form 10-q

How to edit form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

How to Complete and Manage a Form 10-Q

Understanding the importance of Form 10-Q

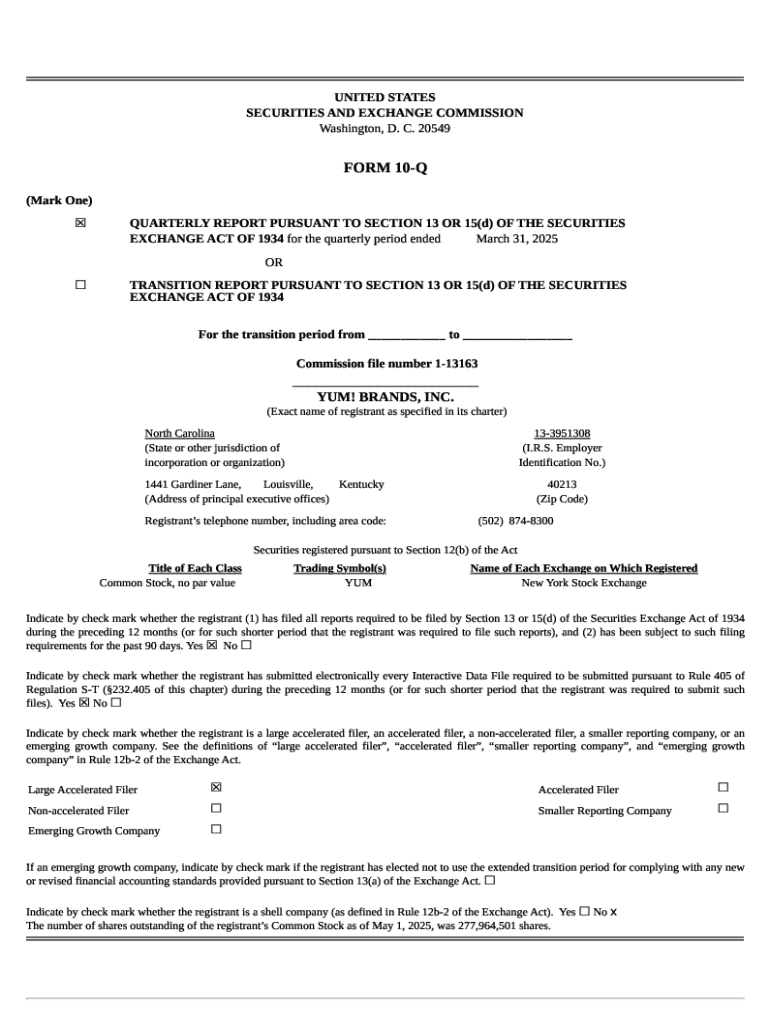

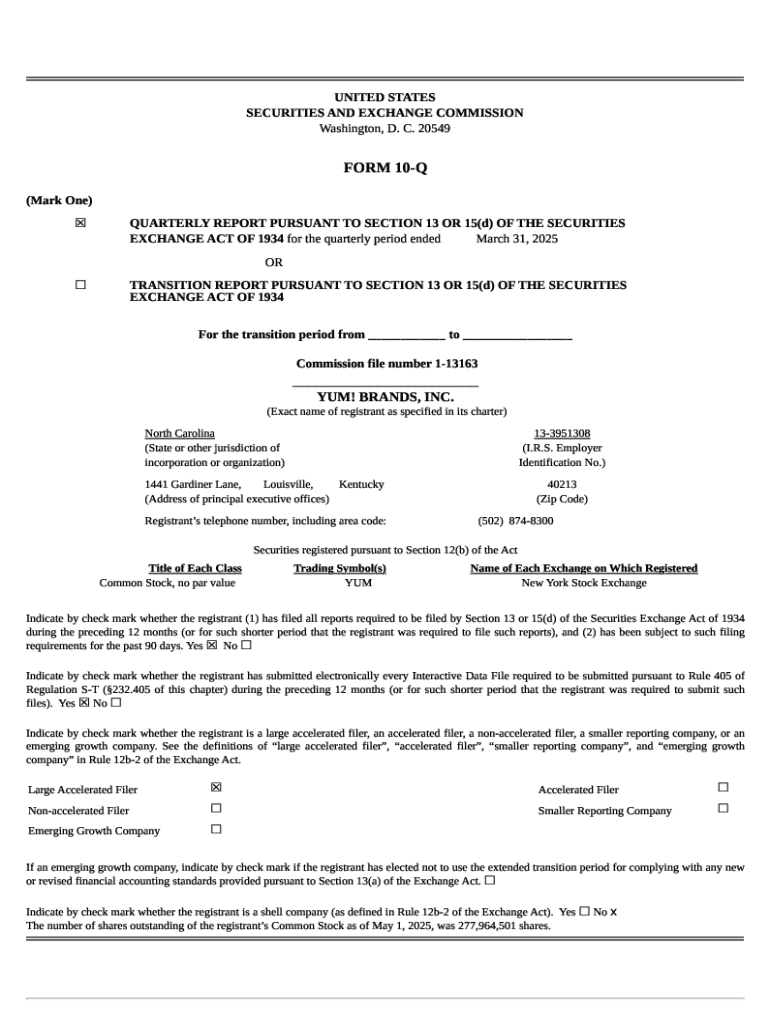

Form 10-Q is a crucial financial reporting tool for publicly traded companies in the United States, serving as a quarterly financial update submitted to the SEC. This form is significant in assessing a company’s performance over the fiscal year, highlighting monthly fluctuations, trends, and significant developments. Compared to the annual Form 10-K, which provides comprehensive insights into a company's financial health and operational results, the Form 10-Q is less extensive yet vital for ongoing transparency with shareholders and stakeholders.

Publicly traded companies are legally obligated to file Form 10-Q within 40 to 45 days after the end of each fiscal quarter, depending on their public float. Keeping up with these requirements not only ensures compliance with SEC regulations but also fosters investor trust, making it easier to attract equity research professionals and investors. Thus, understanding Form 10-Q is essential for a company’s strategic communication and compliance processes.

What is a Form 10-Q?

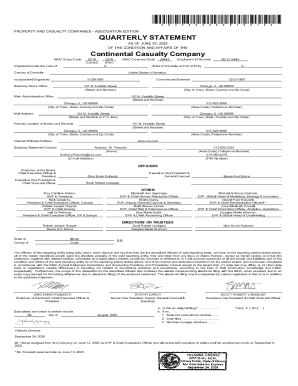

A Form 10-Q is a quarterly report mandated by the Securities and Exchange Commission (SEC), which provides a comprehensive overview of a company's financial status and operations during the fiscal quarter. The form encompasses crucial financial statements including balance sheets, income statements, and cash flow statements, which help stakeholders evaluate the company's performance over a shorter timeframe than the annual Form 10-K.

Disclosures within the form cover various aspects of the company's financial health, operational risks, and management discussions. The filing frequency—quarterly—places a time-sensitive demand on companies to regularly assess and report their financial standing, thereby keeping investors informed every quarter about their investments. These reports strengthen the transparency between the company and the investors, ultimately leading to informed decision-making.

Key components of a Form 10-Q

Each Form 10-Q includes critical sections that together provide a full picture of a company's financial situation. Firstly, the Financial Statements section includes detailed reports such as balance sheets, income statements, and cash flow statements, which reflect the company's earnings, expenses, and overall financial health in that quarter.

Secondly, the Management’s Discussion and Analysis (MD&A) offers context to the financial data presented, explaining the factors influencing the company's performance, trends in revenue and expenses, and future expectations. This section empowers management to communicate vital information directly to investors, providing insights that raw numbers alone may not convey.

Other vital components include Quantitative and Qualitative Disclosures About Market Risk, which inform about potential risks impacting operations, and Internal Controls and Procedures, where companies must acknowledge the effectiveness of their internal control systems for financial reporting accuracy.

Detailed breakdown of 10-Q items

Each of these items plays a critical role in conveying a transparent, comprehensive account of the company’s financial health and regulatory compliance. Companies must navigate specific regulatory requirements for these sections to ensure that all relevant information is disclosed.

Step-by-step guide to filling out a Form 10-Q

To complete the Form 10-Q process effectively, companies should begin by gathering all necessary financial data. This data can be sourced from various internal procedures such as accounting software, previous financial reports, and operational metrics. The accuracy of this data is paramount as it forms the basis of the financial statements presented in the 10-Q.

Next, structure the document according to SEC guidelines. This includes clearly labeling all sections, ensuring that the data presented is concise and within the required format specified by the SEC. To enhance accuracy and compliance, companies should cross-verify their data against previous filings and incorporate best practices regarding clarity and transparency. The goal is to provide a clear narrative of the company’s financial operations, promoting confidence among investors.

Filing a Form 10-Q: Procedures and best practices

Filing a Form 10-Q with the SEC requires adherence to specific protocols to maintain compliance. Companies must be aware of their filing deadlines, which typically range from 40 to 45 days following the end of a fiscal quarter. Missing these deadlines can have serious consequences, including penalties and reputational damage. Therefore, it is advisable for organizations to establish a timeline that includes all aspects of preparation and filing, ensuring everything is completed ahead of schedule.

Utilizing digital submission tools enhances both efficiency and accuracy. For instance, platforms like pdfFiller can streamline the process by allowing easy document edits, providing eSign functionality, and facilitating faster approvals. This efficient use of technology can lead to quicker turnaround times and a reduction in human error during the filing process.

Managing and accessing filed Form 10-Qs

Once a Form 10-Q is filed, companies must manage their documentation diligently. Organizing quarterly reports in a well-structured system is vital for long-term tracking and analysis. Companies should consider cloud-based document management solutions to enhance accessibility, enabling both financial teams and stakeholders to access filings from anywhere.

Accessing previously filed Form 10-Qs allows for performance comparisons and strategic adjustments. Investors, equity research professionals, and management teams often utilize these documents to inform their decisions and strategies. Ensuring that filed documents are easily interpretable and sortable aids in aligning corporate operations with its financial disclosures.

Common challenges in completing Form 10-Q

Completing a Form 10-Q isn’t without its challenges. Frequent pitfalls include the misrepresentation of financial data, which can lead to severe regulatory penalties, and inadequate disclosures that may mislead investors. Recognizing these common issues early in the filing process can dramatically reduce risks. Techniques such as employing comprehensive cross-checking methods and involving multiple teams during the review phase could mitigate these potential problems.

Moreover, establishing a comprehensive checklist that addresses all essential components of the filing can prevent oversights regarding crucial disclosures. Regular training sessions for the finance and compliance teams will ensure ongoing alignment with SEC regulations and improve the quality of the filed reports.

Regulatory review and compliance considerations

The SEC conducts routine reviews of submitted Form 10-Qs to ensure compliance with current regulations. Therefore, it is essential for companies to have a strong understanding of these procedures. An organization should prioritize ongoing compliance, closely monitoring changes in reporting requirements and regulations that may affect their filings.

Suppose the SEC raises inquiries regarding filed Form 10-Qs. In that case, companies must respond promptly and accurately to maintain their compliance standing. This proactive approach to regulatory engagement not only avoids potential fines but also builds confidence in the company’s commitment to transparency and ethical reporting.

Leveraging technology for Form 10-Q completion

Technology is revolutionizing how companies approach the preparation and filing of Form 10-Q. Leveraging platforms like pdfFiller allows organizations to edit PDFs seamlessly, enabling fast updates to documents. The eSigning functionalities speed up approvals, streamlining the overall process and ensuring timely submissions.

Additionally, collaboration features enable team members to work together efficiently on the Form 10-Q, regardless of their physical location. Utilizing interactive tools to manage financial reporting processes not only fosters a culture of accuracy and compliance but also enhances operational efficiency, reflecting positively in the quality of financial reporting.

Staying informed: Resources on Form 10-Q regulations

Companies must remain vigilant about regulatory updates affecting Form 10-Q filings. Engaging in networking and tapping into professional organizations focused on financial compliance and reporting can provide a wealth of knowledge regarding best practices. Additionally, attending webinars and training sessions pertaining to SEC filings offers valuable insights and an opportunity to learn from experts in the field.

By fostering a culture of continuous learning, companies can better navigate the complexities of Form 10-Q and ensure their financial reports remain transparent and accurate. This level of diligence not only pays off in terms of compliance but also enhances the organization's overall reputation in the marketplace.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 10-q online?

Can I create an electronic signature for the form 10-q in Chrome?

How do I complete form 10-q on an iOS device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.