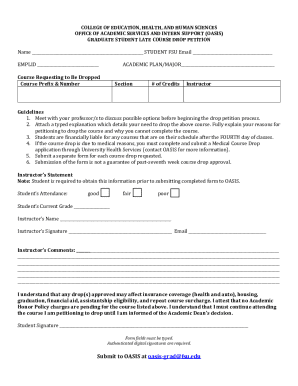

Get the free Gst Drc- 05

Get, Create, Make and Sign gst drc- 05

How to edit gst drc- 05 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gst drc- 05

How to fill out gst drc- 05

Who needs gst drc- 05?

Complete Guide to GST DRC-05 Form: Filing, Benefits, and Best Practices

What is DRC-05 in GST?

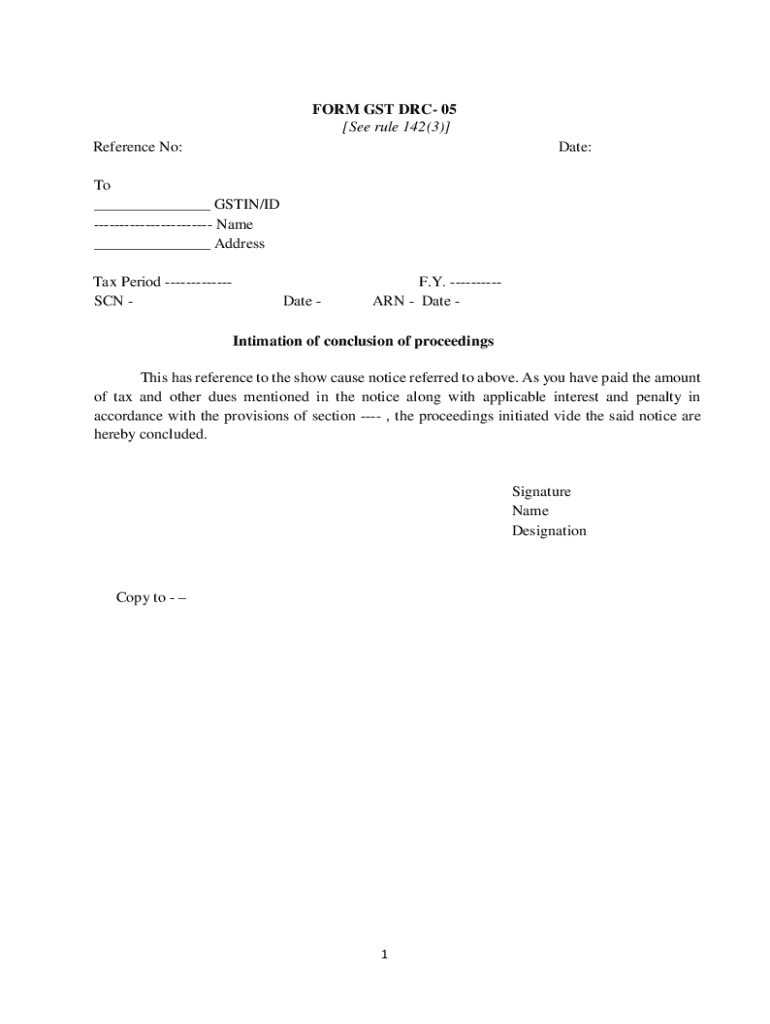

DRC-05 is a specific form under the Goods and Services Tax (GST) framework in India, designed for taxpayers to intimate the conclusion of proceedings. This is a crucial step within the GST compliance process, as it reflects a taxpayer's response or situation regarding any pending disputes or notices. The primary purpose of DRC-05 is to formally communicate to the relevant tax authorities that proceedings related to a particular issue have been concluded, either through resolution, a tax officer's decision, or due to a show cause notice being addressed.

The significance of filing DRC-05 lies in its ability to facilitate effective communication between taxpayers and the tax authorities, ensuring that any grievances or disputes can be resolved promptly. Taxpayers including individuals and institutions, particularly in the finance sector, are required to file this form whenever there is a conclusion to any process requiring their attention.

Understanding the context: Intimation of conclusion of proceedings

The term 'conclusion of proceedings' refers to the finalization of any inquiries, assessments, or disputes concerning GST matters. It may imply either the successful resolution of an issue or the determination made by a tax officer after a show cause notice has been issued. Understanding this context is critical because DRC-05 acts as a bridge to formally close such discussions, thus preventing escalation into further penalties or legal obligations.

The importance of DRC-05 is accentuated during disputes or pending assessments. It contributes to the streamlined process of closing an assessment cycle, which is particularly beneficial for the taxpayer's compliance history. DRC-05 interconnects with other forms such as DRC-01A and processes that include responding to notices under the GST regime established in various reports. Filing this form not only aids in maintaining good standing with tax authorities but also fosters a sense of reliability in taxpayer conduct.

When and why is DRC-05 applicable?

DRC-05 is applicable in various scenarios which warrant the need for taxpayers to inform the tax authorities of the conclusion of proceedings. Some of the common situations that necessitate filing DRC-05 include during GST assessment or verification processes, where taxpayers need to provide responses to notices issued by the tax authorities. Rectification of previous filings is also a significant reason to submit DRC-05, especially when discrepancies have arisen that need to be officially recognized to maintain compliance.

The consequences of failing to submit DRC-05 can be severe as legal implications may arise, leading to penalties or complications in compliance ratings. Not submitting this form can signal non-compliance, thus impacting a taxpayer's reputation with GST authorities. Maintaining a clean record ultimately benefits the taxpayer’s standing in the finance sector.

Step-by-step guide: How to file DRC-05 in GST

Filing DRC-05 accurately is essential for ensuring that the forms are processed without hitches. Here's a step-by-step guide on how to do it successfully:

1. Gather required information:

Before starting the filing process, ensure you have all necessary documents and data. This includes your GSTIN, reference notice (if applicable), details of the proceedings, and any supporting documents that strengthen your submission.

2. Access the GST portal:

To file DRC-05, log into the GST portal using your credentials. Upon successful login, navigate to the services menu to locate the DRC-05 filing section. Here you’ll find the option to initiate the filing process.

3. Filling out the form:

Once you access DRC-05, fill out the necessary fields. Each section demands specific information about the concluded proceedings. Be thorough yet concise. Common fields include your GST registration details and the particulars surrounding the notice.

4. Submitting the form:

After filling out the required sections, review your input to ensure accuracy. Then proceed to submit the form. Upon successful submission, a confirmation message will appear indicating that your filing is complete.

How to check DRC-05 status in the GST portal?

After submitting DRC-05, it’s essential to track its status. To do this, revisit the GST portal and navigate to the DRC-05 status tracking section. Enter your GSTIN and other required details to view the status of your DRC-05 filing. This will help you stay updated on whether the authorities have accepted or are processing your form.

Understanding the status updates is crucial; they can indicate various outcomes—be it accepted, pending, or rejected. Knowing where your filing stands can help you take further action if necessary.

How to download DRC-05 for reference?

Keeping a record of all your filings is critical for compliance and future reference. To download a copy of DRC-05 from the GST portal, log in, navigate to your filed forms history, locate DRC-05, and click the download option. This will provide you with a PDF version for your records.

Maintaining a digital record ensures that you have access to historical filings, which is essential in case of future audits or inquiries by the tax authorities.

Common challenges in filing DRC-05 and solutions

While filing DRC-05 can seem straightforward, users often encounter common challenges. Frequent issues include errors in filling out forms, misunderstanding the requirements, or technical glitches on the GST portal.

To overcome these challenges, ensure that you thoroughly read the filing instructions available on the portal. In case of persistent technical problems, contacting GST support is advisable. Regular practice of filling forms can also mitigate errors.

Penalties for failure to file DRC-05

Failing to file DRC-05 can lead to significant penalties and legal repercussions. Such consequences are not just limited to financial penalties; they can affect the compliance rating of businesses and individuals. This can lead to further scrutiny from tax officers, as maintaining compliance is a vital aspect of operating within the GST regime.

Key scenarios leading to penalties involve non-response to notices and failure to communicate the conclusion of any collection or assessment proceedings. Knowing these risks can help taxpayers prioritize their filings and maintain a clean compliance history.

Unique benefits of using pdfFiller for DRC-05

Using pdfFiller for filling DRC-05 enhances the filing experience significantly. With its seamless editing capabilities, users can modify forms directly within the platform without worrying about formats or changes lost in conversion.

Furthermore, integrated eSignature functionality speeds up the approval process, allowing for a more efficient paperwork flow, especially for businesses managing multiple submissions and teams. It also fosters collaboration, enabling teams to work on the DRC-05 forms collectively and ensure accuracy.

Success stories: Real-life examples of DRC-05 filings

Numerous users have benefitted from effectively utilizing DRC-05 through platforms like pdfFiller. Case studies demonstrate how businesses have streamlined their compliance processes, avoiding penalties and ensuring thorough management of their tax obligations.

Testimonials capture the experience of users like Saurabh Agrawal, who highlights how pdfFiller simplified his document management, providing efficiency that transformed his handling of GST forms.

Key takeaways on filing DRC-05 efficiently

Filing DRC-05 consistently and accurately is fundamental for maintaining compliance within the GST framework. By gathering necessary information beforehand, accessing the GST portal adeptly, and utilizing tools like pdfFiller, taxpayers can optimize their experience.

Staying informed about form updates, following step-by-step guides, and leveraging quality platforms for document management can enhance filing efficiency and mitigate risks associated with non-compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify gst drc- 05 without leaving Google Drive?

Can I create an electronic signature for signing my gst drc- 05 in Gmail?

How do I edit gst drc- 05 on an Android device?

What is gst drc- 05?

Who is required to file gst drc- 05?

How to fill out gst drc- 05?

What is the purpose of gst drc- 05?

What information must be reported on gst drc- 05?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.