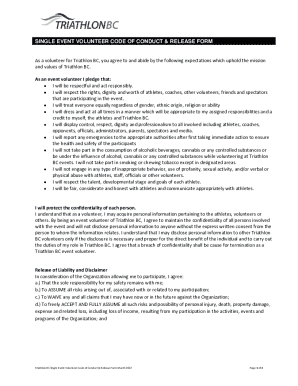

Get the free 2023 Ks

Get, Create, Make and Sign 2023 ks

How to edit 2023 ks online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2023 ks

How to fill out 2023 ks

Who needs 2023 ks?

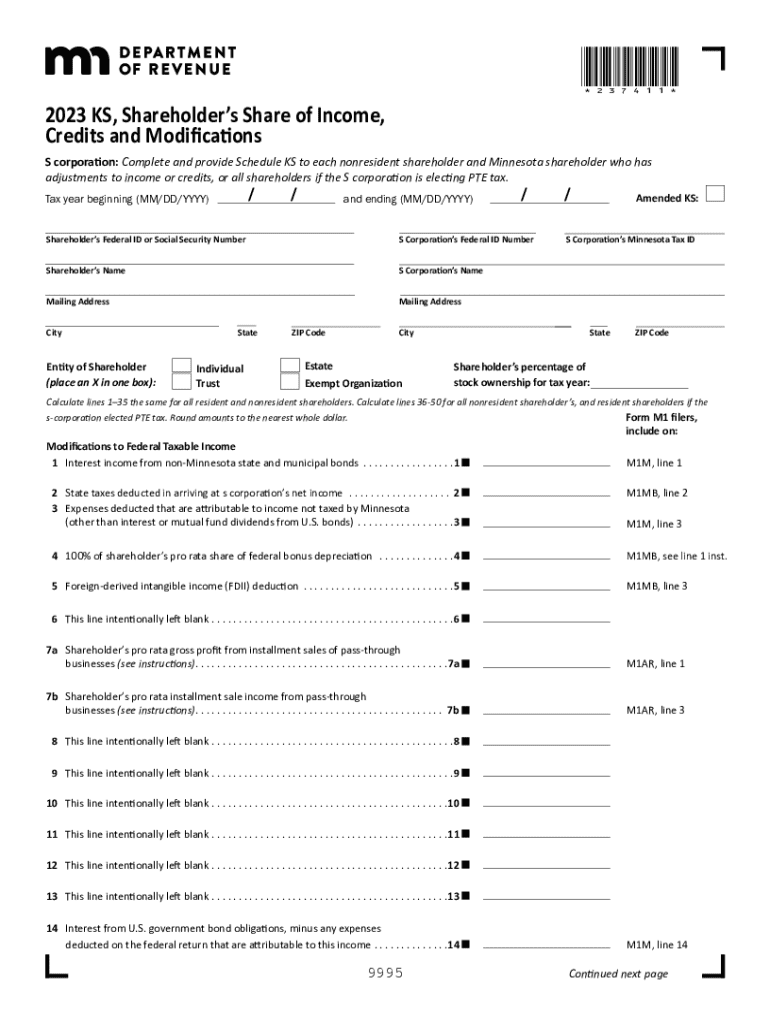

A Comprehensive Guide to the 2023 KS Form

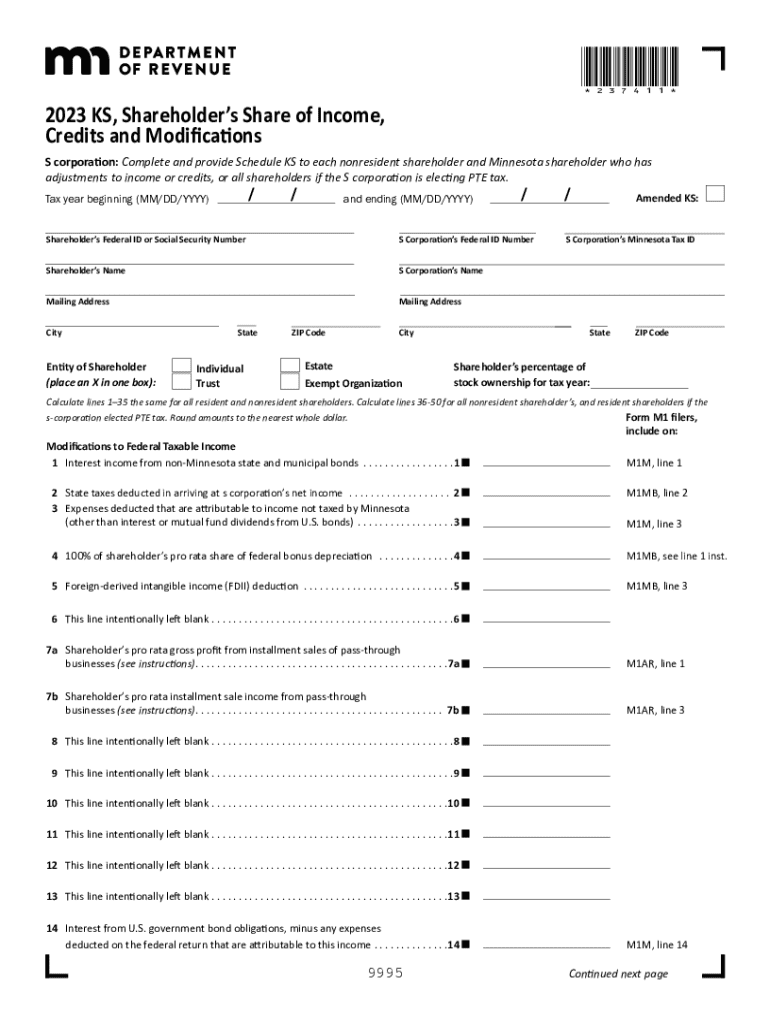

Understanding the 2023 KS Form

The 2023 KS Form is a crucial document for taxpayers in Kansas, designed primarily for reporting individual income and accompanying tax obligations. This form captures comprehensive financial information, enabling state authorities to assess the accurate tax liabilities of residents. Filing this form is not just a legal requirement; it also ensures that taxpayers fulfill their civic responsibilities. Accurate filing is vital for both compliance and to avoid penalties that could arise from errors.

Who needs to file the 2023 KS Form?

All residents of Kansas who have earned income that meets the state’s income threshold are required to file the 2023 KS Form. This includes individuals with income from wages, businesses, rental properties, or investment income. Additionally, certain specific circumstances, such as receiving unemployment benefits or having taxable pensions, may require the submission of this form. Understanding your eligibility and requirement to file can simplify your tax preparation.

Key changes in the 2023 KS Form

Each tax year brings updates to forms to reflect changes in tax laws and reporting requirements. For the 2023 KS Form, there are significant updates compared to earlier versions. Among the highlighted changes are adjustments to income brackets, an updated layout that enhances user-friendliness, and new sections that involve reporting credits or deductions more clearly. Being aware of these changes can significantly ease the process of filing your taxes.

Preparing to complete the 2023 KS Form

Before diving into the 2023 KS Form, it’s essential to gather the requisite documents and information. Typical documentation includes W-2 forms from employers, 1099 forms for freelance income, bank statements, and information regarding any deductions or credits you plan to claim. Preparation is key, and ensuring you have these documents at hand will streamline the filing process, minimizing stress and errors.

Getting started with pdfFiller

pdfFiller is an excellent platform for managing the 2023 KS Form, allowing users to fill, edit, and submit forms with ease. Its features are tailored for convenience, especially for users who prefer an online solution. By utilizing pdfFiller, you can avoid common pitfalls of paper filing, such as misplaced forms or illegible handwriting, ensuring a smoother filing experience with clearer documentation.

Setting up your pdfFiller account

Creating a pdfFiller account is straightforward and can be done in a few simple steps. Follow these instructions: First, visit the pdfFiller website and click on ‘Sign Up.’ You’ll be prompted to provide your email address and create a password. After confirming your email, you can access a suite of features, including templates for the 2023 KS Form, cloud storage options, and collaboration tools that enhance the overall filing process.

Filling out the 2023 KS Form

Completing the 2023 KS Form requires careful attention to detail, as each section serves a specific purpose. Here’s how to navigate the form effectively:

Common mistakes to avoid

Filing errors can lead to delays or audits. Common mistakes include incorrect Social Security numbers, omission of income, or mathematical errors in tax calculations. To avoid these pitfalls, double-check all your entries against your documentation. It also helps to utilize pdfFiller’s validation features, which can alert you to potential errors as you fill out the form.

Using interactive tools on pdfFiller

pdfFiller offers several interactive tools to enhance your experience. Features like auto-fill can save time by pre-populating sections based on your input data from previous forms. Templates specifically designed for the 2023 KS Form ensure that the format is compliant with filing standards, and the platform’s data validation checks will help catch common mistakes before submission.

Editing and reviewing your 2023 KS Form

After filling out the 2023 KS Form, reviewing it carefully is crucial. pdfFiller simplifies this process with various editing functionalities, allowing you to make necessary adjustments easily. You can add comments or notes for personal reminders or to collaborate with others if needed. This collaborative approach can be particularly beneficial if you’re preparing taxes with a partner or seeking advice from a tax professional.

Peer review options

If you want additional eyes on your completed form, pdfFiller offers simple methods for sharing your document. Grant access to peers or tax advisors for their feedback, and utilize electronic signature features to secure necessary approvals. This collaborative process can increase accuracy and confidence in your submission.

Finalizing your document

Before you hit submit, ensure that your form has been thoroughly reviewed. Check for completeness, compliance with the 2023 filing requirements, and mathematical accuracy. A handy checklist can include verifying all personal and income details, ensuring all signatures are present and considering attaching additional documentation if necessary.

Submitting your 2023 KS Form

Submitting the 2023 KS Form can be done online through pdfFiller, which ensures that your submission is sent directly to the appropriate state revenue office. Alternatively, for filers who prefer traditional methods, you can print the form and mail it following the provided instructions. Be mindful of potential delays when mailing, as this could impact your filing status.

Deadlines and important dates

It’s crucial to be aware of the key filing deadlines for the 2023 KS Form. Typically, the deadline aligns with federal tax deadlines, with individual returns due by April 15. If you’re unable to meet the deadline, you can file for an extension; however, any taxes owed will still need to be estimated and paid on time. Always check the most current state revenue resources for any specific updates.

Managing your 2023 KS Form after submission

Once you have submitted your 2023 KS Form, it’s important to track its status. pdfFiller streamlines this process, enabling users to monitor the submission status directly within their account. This monitoring can provide peace of mind, ensuring your documents are being processed as expected.

Keeping records

Maintaining organized records of your tax documents is paramount. Best practices include saving electronic copies of submitted forms as well as any correspondence from tax authorities. Digital storage can streamline access in future audits or inquiries and ensures that you retain a backup in case of any discrepancies.

Addressing issues with your submission

If you face discrepancies post-submission, it’s key to act promptly. Check if the tax authority has sent any notifications or requests for additional information. If a rejection occurs, pdfFiller can assist in making necessary amendments quickly and efficiently, reducing the likelihood of issues arising from the initial filing.

Frequently asked questions (FAQs) about the 2023 KS Form

Navigating the tax landscape can prompt many questions. Here are some common inquiries regarding the 2023 KS Form:

Additional tips for successful filing with pdfFiller

To leverage your experience using pdfFiller for the 2023 KS Form, take advantage of its exceptional customer support offerings. Various support options include live chat and comprehensive online resources. As you navigate the form, remember that assistance is just a click away.

Economical benefits of using pdfFiller

Filing taxes through pdfFiller can lead to significant cost savings. By eliminating the need for printing and postage, tax filers can efficiently manage their documents electronically, often reducing overall expenses compared to traditional filing methods. This economic edge, coupled with the time saved through streamlined processes, makes pdfFiller an invaluable tool for individuals and teams.

Community feedback and user experiences

Users have praised pdfFiller for its user-friendly interface and efficient document management capabilities. Testimonials highlight the ease of collaboration and secure e-signature features. Many filers report a smoother, more enjoyable experience in meeting their tax obligations while using pdfFiller, often sharing success stories about how the platform simplified their workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2023 ks without leaving Google Drive?

How do I edit 2023 ks on an iOS device?

How do I complete 2023 ks on an Android device?

What is ks?

Who is required to file ks?

How to fill out ks?

What is the purpose of ks?

What information must be reported on ks?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.