Get the free Form 10-q

Get, Create, Make and Sign form 10-q

Editing form 10-q online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-q

How to fill out form 10-q

Who needs form 10-q?

Form 10-Q Form: A Comprehensive Guide

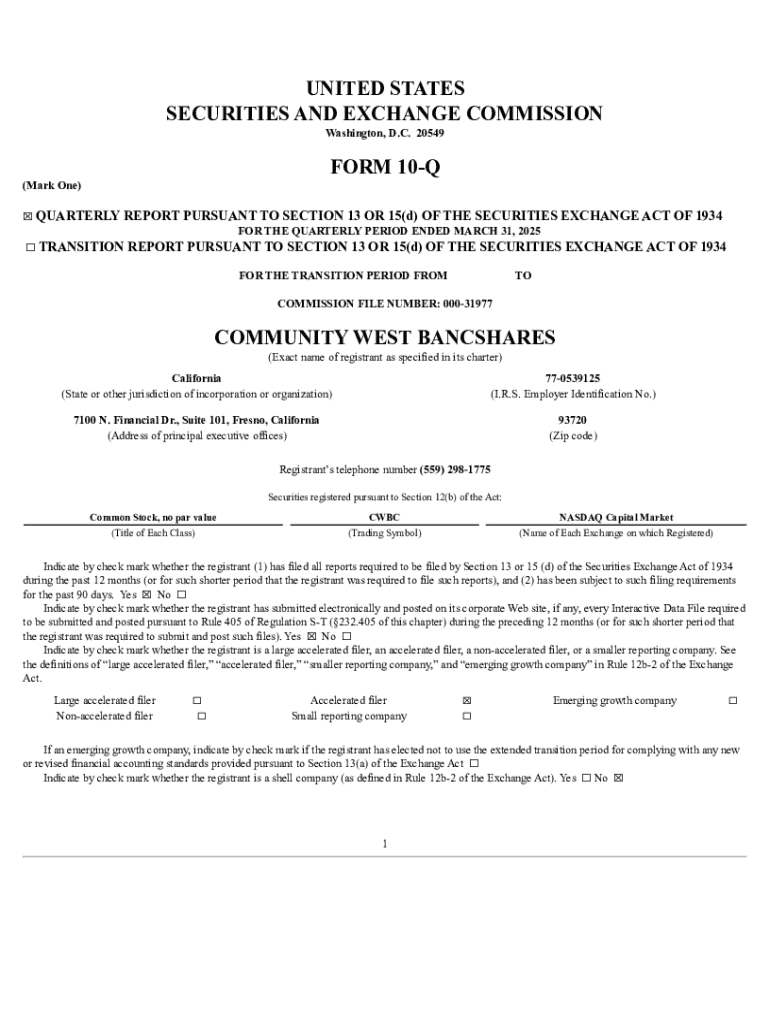

Understanding the Form 10-Q

The Form 10-Q is a quarterly financial report that publicly traded companies in the United States must file with the Securities and Exchange Commission (SEC). This form provides a comprehensive overview of the company's financial condition and operational performance over the past quarter. Each Form 10-Q contains unaudited financial statements, management’s discussion and analysis, and important disclosures about material changes in the company’s business.

The Form 10-Q plays a crucial role in regulatory compliance, enabling the SEC and shareholders to monitor the financial health of public companies. Unlike the Form 10-K, which is filed annually and includes a comprehensive overview of an entire year, the 10-Q focuses specifically on quarterly performance, highlighting key changes and trends.

Components of a Form 10-Q

A Form 10-Q consists of several critical sections that collectively provide a snapshot of a company's current financial status and operations. Understanding these components is crucial for investors, analysts, and compliance officers.

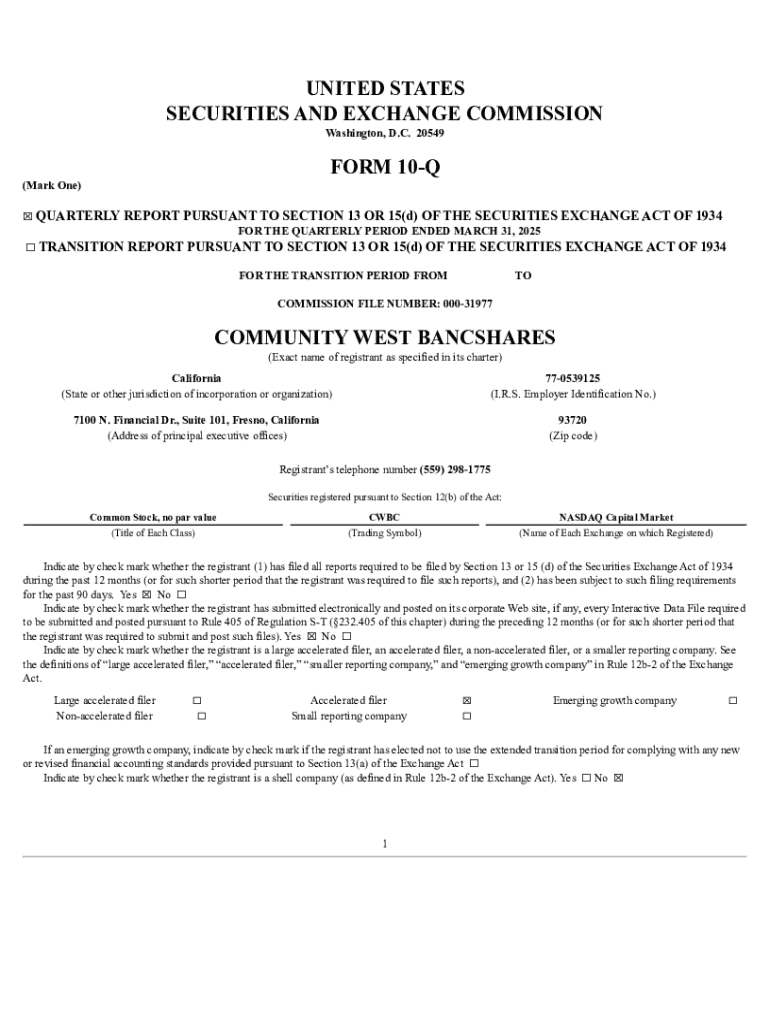

Cover page

The cover page of the Form 10-Q typically contains essential information such as the company’s name, the SEC file number, and the reporting period. This page ensures that the report is easily identifiable and properly associated with the company.

Financial statements

The financial statements section includes the balance sheet, income statement, and cash flow statement. Each of these statements is designed to inform stakeholders about various aspects of the company’s financial health. The balance sheet outlines what the company owns versus what it owes, the income statement provides a summary of revenues and expenses, and the cash flow statement delivers insights into the liquidity and cash management of the business.

Management’s discussion and analysis (&A)

The MD&A section accompanies the financial statements, providing management's perspective on performance and significant trends affecting the company. It often includes analyses of current market conditions, operational strategies, and anticipated future results. This section allows management to address potential concerns and explain how external factors may impact company performance.

Disclosures and notes

Associated notes and disclosures provide context for the financial statements and management’s discussion. This includes details on material events, operational risks, legal uncertainties, and any other relevant information that can affect stakeholder decisions. Proper documentation here is essential to fulfill regulatory expectations and maintain shareholder trust.

Filing requirements and regulations

Filing a Form 10-Q is not just a best practice; it is a regulatory requirement governed by the SEC. Understanding the filing requirements helps companies to comply fully and avoid penalties for non-compliance.

Who must file a Form 10-Q?

All companies that are publicly traded and that have to file with the SEC must submit a Form 10-Q. This includes large corporations as well as smaller reporting companies that meet the SEC's criteria for public companies.

Filing deadlines

The SEC mandates that Form 10-Q must be filed within 40 to 45 days after the end of each fiscal quarter, depending on the size of the company. Therefore, knowing the specific quarterly timeline is pivotal for financial departments.

Consequences of late filings

Late filings can result in significant consequences, including monetary fines, enhanced scrutiny from regulators, or even legal repercussions. Public trust can diminish as well if companies fail to provide timely disclosures.

How to access Form 10-Qs

Accessing Form 10-Q reports is straightforward, thanks to online resources that have made them easily available to the public. Stakeholders, including investors and analysts, should know where to look to find these critical documents.

Online resources for locating forms

The SEC’s EDGAR database provides access to all filed forms, including Form 10-Q. Users can search for specific companies and retrieve their most recent filings, making it an invaluable tool for research and due diligence.

Using pdfFiller to access, edit, and manage your forms

pdfFiller offers a streamlined process for finding and handling Form 10-Qs. With its user-friendly interface, you can quickly search for specific forms related to your needs. Additionally, pdfFiller’s tools allow users to edit, collaboratively manage, and eSign documents, making it an indispensable resource.

Step-by-step: how to fill out a Form 10-Q

Completing a Form 10-Q accurately is crucial for compliant reporting. It requires a systematic approach to gather and organize all necessary information effectively.

Gather necessary information

Start by gathering all financial statements, including audited figures from the previous quarter, along with current operational data. Documentation such as contracts, market analyses, and relevant company policies may also be necessary for comprehensive reporting.

Prepare financial statements

Ensure that your financial statements are accurate, consistent, and adhere to GAAP or IFRS as applicable. This entails cross-checking figures and validating calculations to avoid discrepancies that could lead to compliance issues or misinterpretation.

Craft the management discussion

The MD&A should communicate clearly about business performance over the past quarter. Articulate successes, address challenges faced, and provide a forward-looking analysis that reflects potential impacts on future results.

Review and compliance check

Prior to submission, conduct a thorough compliance check. This includes ensuring alignment with SEC standards and that all necessary disclosures are complete. Consider having a second set of eyes review the document for clarity and accuracy.

Collaborative features of pdfFiller

The collaborative features of pdfFiller significantly enhance the process of managing Form 10-Qs. Users can work efficiently in real-time, making changes and adjustments as required by internal stakeholders.

Real-time document editing

Multiple team members can simultaneously access and edit the Form 10-Q, ensuring that the most current information is always available. This feature minimizes bottlenecks in the documentation process.

eSigning capabilities

pdfFiller allows users to eSign documents securely, streamlining the approval process. Add signatures remotely, eliminating delays associated with in-person meetings.

Document management and storage

With cloud-based management, pdfFiller allows users to store, access, and retrieve Form 10-Qs easily. This means that teams can ensure they are always working with the most up-to-date documents without the risk of version control problems.

Common mistakes to avoid when filing a Form 10-Q

Avoiding common pitfalls while preparing and filing a Form 10-Q is essential for compliance and maintaining investor confidence. Familiarizing yourself with these mistakes can enhance the efficiency and accuracy of the filing process.

Key takeaways for users

Understanding the importance of compliance and timely filing is crucial for any public company. Staying informed about deadlines and filing requirements will help mitigate risks associated with late submissions.

Leveraging technology, such as that offered by pdfFiller, can simplify the document management process significantly. Utilizing the platform enhances collaboration among teams and promotes continuous improvement in reporting standards. Remaining proactive in monitoring and refining these practices ensures that your company maintains its reputation and safeguards against regulatory challenges.

Interactive tools available on pdfFiller

pdfFiller enhances the filing process with a suite of interactive tools designed for ease of use and functionality. These tools support individuals and teams in navigating the complexities of Form 10-Q submissions.

Templates for Form 10-Q

pdfFiller offers templates specifically designed for Form 10-Q, allowing users to work from a structured format that ensures compliance with SEC regulations while saving time.

Customization options for different industries

Different industries may require unique disclosures and considerations in their Form 10-Qs. pdfFiller provides customization options that let companies tailor their filings to meet specific operational needs and regulatory requirements.

Tracking and analytical tools for reviewing filings

Utilizing pdfFiller's tracking and analytical tools allows users to monitor changes made to Form 10-Qs. Teams can analyze filings over time to identify trends, helping improve future reports and responses to shareholder inquiries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 10-q?

How do I edit form 10-q straight from my smartphone?

How do I edit form 10-q on an Android device?

What is form 10-q?

Who is required to file form 10-q?

How to fill out form 10-q?

What is the purpose of form 10-q?

What information must be reported on form 10-q?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.