Get the free Financing the Future: Lessons from Sierra Leone's ...

Get, Create, Make and Sign financing form future lessons

Editing financing form future lessons online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financing form future lessons

How to fill out financing form future lessons

Who needs financing form future lessons?

Financing Form Future Lessons Form

Understanding the context: Financing forms in a digital world

Digital documentation has revolutionized how we manage paperwork, bringing both efficiency and accessibility to a wide range of processes, from everyday tasks to complex business transactions. Financing forms play a crucial role in both personal and professional contexts, serving as the backbone of agreements, applications, and approvals that involve financial commitments.

As businesses and individuals move towards a more digital-first approach, understanding future trends in document management becomes essential. The demand for streamlined, user-friendly financing forms is growing, and the integration of technology in these forms is increasing as well.

What is the financing form?

A financing form is a structured document designed to collect and present information necessary for evaluating a financial transaction or opportunity. Aiming to simplify the application and approval process for loans, credit, and other forms of financial assistance, these forms can take various shapes depending on the specific needs of the financial institution or individual.

Typically, a financing form includes personal information, financial history, and details about the transaction being requested. Its design is crucial not only for gathering needed information but also for ensuring compliance with regulatory and legal standards.

Navigating the financing form: User-friendly tools and features

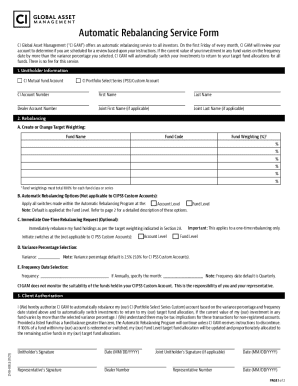

To provide a seamless user experience, modern financing forms often come equipped with various interactive tools. Such features enhance efficiency by guiding users through the data entry process. For example, step-by-step guidance is often available, simplifying the overall task of filling out the form. Additionally, many systems offer auto-fill features that can import data from existing records, saving time and reducing errors.

Collaboration tools also play a vital role when multiple parties are involved in the financing form process. Real-time editing and commenting capabilities allow teams and stakeholders to communicate and make decisions promptly. Version control features ensure that all parties are working from the latest document, preventing any miscommunication.

Step-by-step instructions for completing the financing form

To effectively complete a financing form, start by gathering all required information. This often includes your personal details, financial history, and documentation supporting your application. Identify key data, such as income statements, debts, and collateral, which will be necessary in filling out the form accurately.

After preparing your information, fill out each section of the form systematically. Take care to provide accurate information and avoid common mistakes like misreporting financial figures or omitting required disclosures. Once completed, review the entire form for accuracy before submission. Always make use of any draft-saving features available to avoid data loss.

Enhancing the financing form: Tips for personalization and optimization

One way to stand out in financial communication is by customizing your financing form experience. Many platforms allow users to add branding elements such as logos and change field options to meet specific needs. This personalization helps create a connection with stakeholders and adds a professional touch.

Another significant feature is the integration of eSignature capabilities, which expedites the signing process. Digital signatures not only speed up approval times but also add an extra layer of security. Familiarizing yourself with how to utilize electronic signatures within your financing form can lead to a more efficient workflow.

Managing and storing your completed financing form

After completion, storing your financing form securely is crucial. Best practices for document management include organizing your digital files in a systematic way, which can enhance retrieval and access. Consider implementing folders or tags for quick locating of completed forms. Using cloud-based solutions ensures that your documents are accessible from anywhere while maintaining security.

Understanding security features is equally important. Many platforms offer encryption and other privacy settings, which protect sensitive information from unauthorized access. Staying compliant with legal standards not only safeguards your data but also ensures smoother interactions with institutions in the long run.

Troubleshooting common issues with financing forms

While using financing forms, you might run into technical issues that can be frustrating. Common errors include problems with uploading documents or submitting the completed form. It’s essential to know simple solutions, like ensuring your browser is up-to-date or checking your internet connection first. If problems persist, don’t hesitate to reach out for help from customer support.

Another proactive approach is to anticipate frequent questions you may have during the process. Familiarizing yourself with FAQs can clarify user concerns ahead of time. Platforms like pdfFiller often provide extensive support resources, ensuring that help is always available in moments of need.

Future-proofing your use of financing forms

As technology evolves, it’s crucial to anticipate future trends in document management. The integration of AI and automation into financing forms promises enhanced functionality, such as predictive text suggestions during data entry and improved compliance tracking. Keeping an eye on these advancements can help in adapting your workflow for greater efficiency.

Ongoing learning and support are essential components in this continuous evolution. Subscribing for updates on new features or participating in training webinars can empower users with knowledge, ensuring that you are always equipped to make the most of your financing forms. Staying updated is key to maintaining a competitive edge.

Interactive features for enhanced user experience

To improve your experience with financing forms, platforms like pdfFiller offer various interactive tools designed to aid users significantly. Quick access to ready-made templates can significantly cut time spent on form preparation. Furthermore, integrating with other software solutions guarantees a seamless workflow across all your digital operations.

Engagement within a community also contributes to user experience. Participating in forums and discussions allows users to share best practices and learn from one another, enhancing both individual and collective knowledge. These interactions can also spark innovative ideas and solutions based on varied experiences.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find financing form future lessons?

How do I make changes in financing form future lessons?

Can I edit financing form future lessons on an iOS device?

What is financing form future lessons?

Who is required to file financing form future lessons?

How to fill out financing form future lessons?

What is the purpose of financing form future lessons?

What information must be reported on financing form future lessons?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.