Get the free Merchant Application Form

Get, Create, Make and Sign merchant application form

Editing merchant application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out merchant application form

How to fill out merchant application form

Who needs merchant application form?

A Comprehensive Guide to the Merchant Application Form

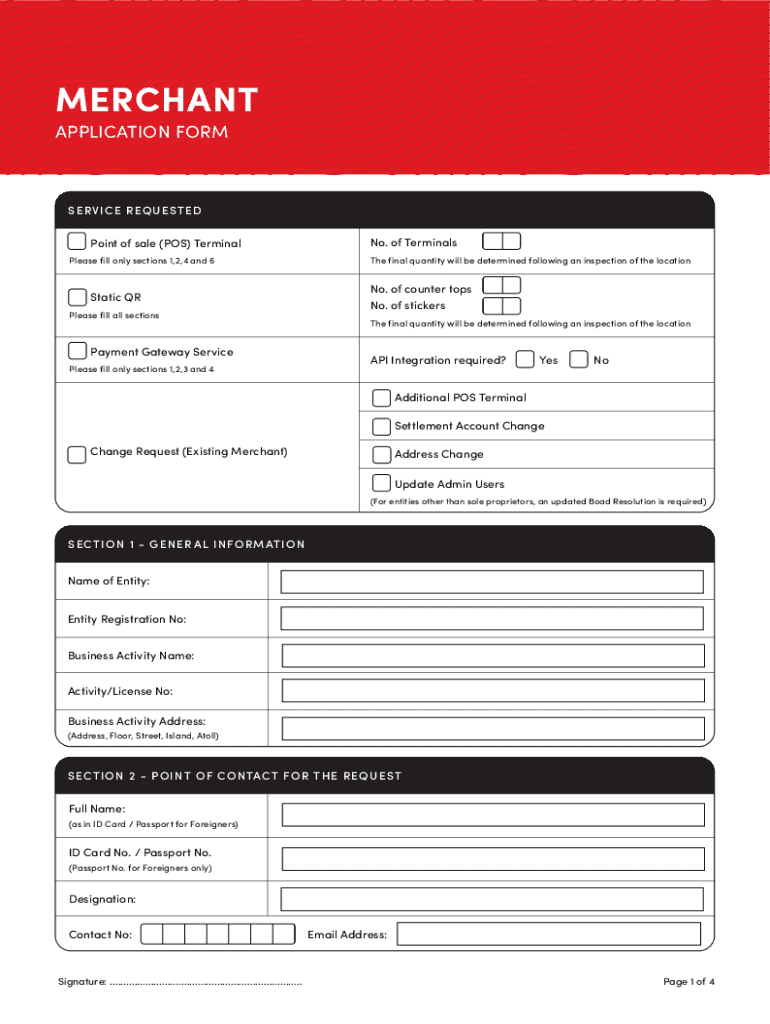

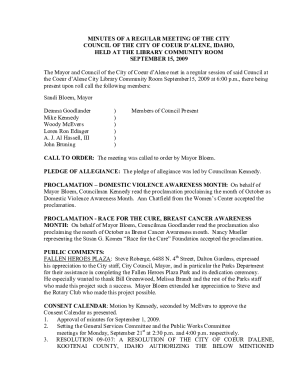

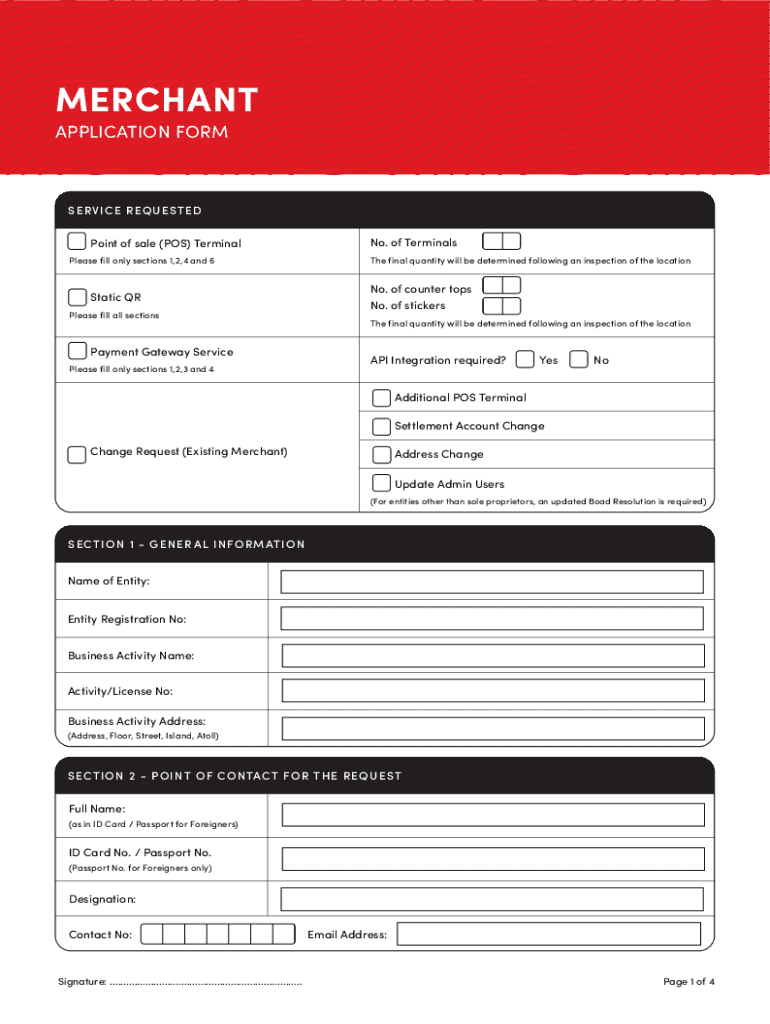

Understanding the merchant application form

A merchant application form is an essential document that businesses submit to payment processors to establish a merchant account, which allows them to accept card and electronic payments. This form outlines various details about the business, including its structure, financials, and ownership. For merchants, it's crucial for navigating the complexities of payment processing; for processors, it serves as a means of assessing the risk and legitimacy of the business.

By accurately compiling information within a merchant application form, businesses can effectively communicate their financial status and payment processing needs. It establishes a foundation for the operational relationship between the merchant and the processor. Without it, businesses may risk delays or denials in acquiring the ability to accept crucial revenue streams.

Context of use

Merchant application forms come into play in various scenarios—primarily when a new business is looking to process payments for the first time or when an established business seeks to change its payment processor. Industries such as retail, hospitality, online e-commerce, and service providers regularly rely on merchant applications to facilitate their payment transactions.

Moreover, B2B companies also engage in merchant application processes to expand their payment options and enhance client satisfaction. Regardless of the specific industry, a functioning merchant application form is fundamental in building a seamless payment experience for customers.

Components of a merchant application form

A well-structured merchant application form consists of several key components that provide payment processors with a comprehensive view of the business. Each section is designed to gather vital information that can impact approval chances.

In addition to these key components, merchants typically need to submit various supplemental documents. This may include a business license, tax identification number, and potentially financial statements. Providing thorough documentation can expedite the approval process significantly.

How the merchant application form works

The submission process for a merchant application form typically follows a clear pathway. First off, it's vital for business owners to gather all pertinent information before attempting to fill out the form. Ensuring that accurate and complete details are provided will save time and prevent complications down the line.

After submission, the review and approval stage commences. Payment processors typically assess the application to determine if the business qualifies for a merchant account. This evaluation phase can last anywhere from a few days to a couple of weeks, depending on the processor's workload.

Once approved, businesses can activate their merchant account and begin integrating payment processing solutions. This step may involve software installations, setting up payment gateways, and ensuring compliance with PCI DSS (Payment Card Industry Data Security Standard) requirements for handling credit card information.

Pros and cons of using a merchant application form

Using a merchant application form has its fair share of advantages. For starters, by establishing a merchant account, businesses can enjoy streamlined payment processing that simplifies sales transactions. This efficiency can enhance customer experience, resulting in higher satisfaction and loyalty.

Additionally, a formal merchant account facilitates better financial management and tracking. Merchants gain access to various payment options, including credit cards, debit cards, and digital wallets, thereby accommodating different customer preferences.

However, there are downsides to consider. One significant drawback is the potential delays in approval, especially for businesses that may not have extensive processing histories. Additionally, the need for specific documentation can complicate the application process, causing further delays that impact when a merchant can start accepting payments.

It’s vital for merchants to weigh these pros and cons against their specific business needs before proceeding.

Tips for successfully completing a merchant application form

To enhance the chances of approval, businesses should ensure accuracy and completeness within their applications. This involves careful review of all entries, confirms that correct details are provided, and even consulting with a financial advisor if necessary to guide through the nuances of the form.

Overall, meticulous attention to detail can go a long way in ensuring that the application process is as smooth and quick as possible.

Common mistakes to avoid

Several common pitfalls could hinder the approval process for a merchant application form. Incomplete information is a top concern; missing key details can lead to automatic rejections. Always ensure that every section of the form is thoroughly filled out.

Being aware of these common mistakes can help business owners navigate the application process more effectively, providing a better chance of approval.

Frequently asked questions (FAQ)

Related topics you may be interested in

Interactive tools

To ensure that potential applicants are fully prepared, interactive tools can enhance the experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit merchant application form from Google Drive?

How do I make edits in merchant application form without leaving Chrome?

How do I fill out merchant application form on an Android device?

What is merchant application form?

Who is required to file merchant application form?

How to fill out merchant application form?

What is the purpose of merchant application form?

What information must be reported on merchant application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.