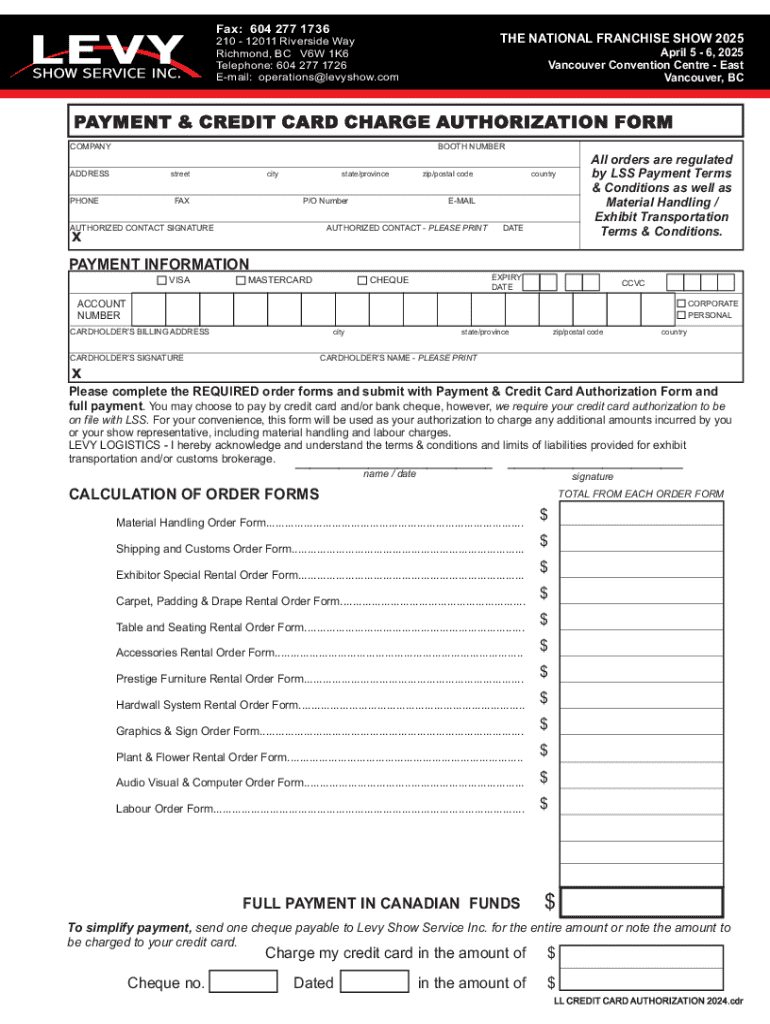

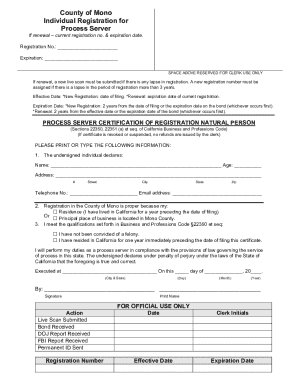

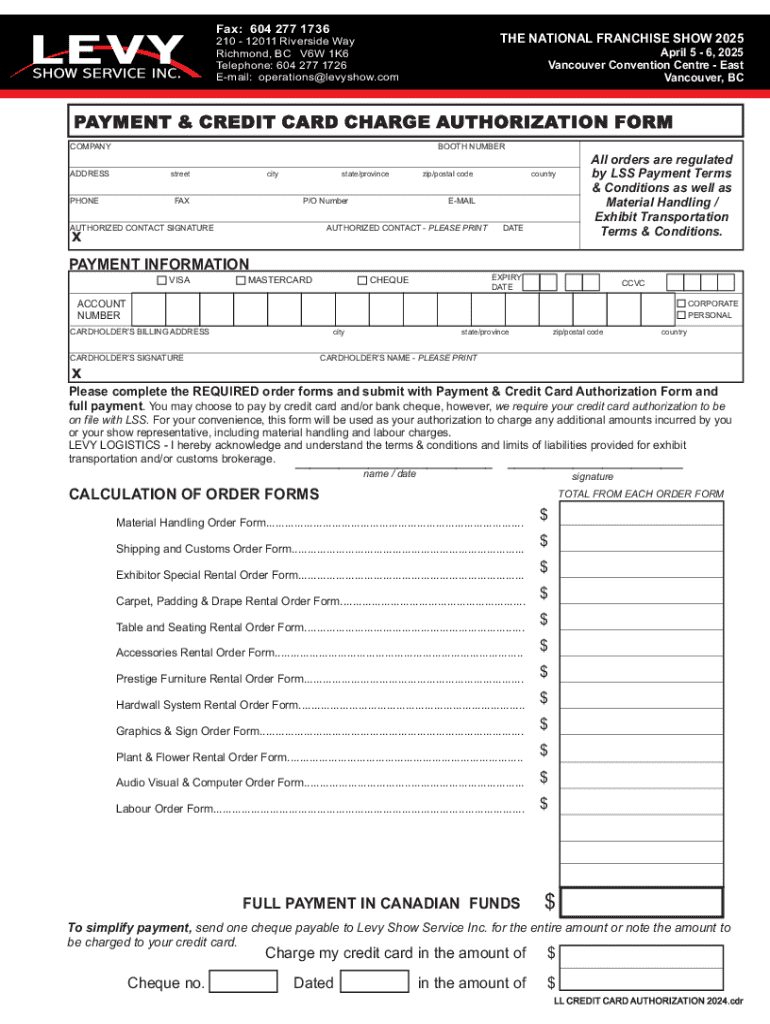

Get the free PAYMENT & CREDIT CARD CHARGE AUTHORIZATION ...

Get, Create, Make and Sign payment amp credit card

Editing payment amp credit card online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payment amp credit card

How to fill out payment amp credit card

Who needs payment amp credit card?

Comprehensive Guide to Payment and Credit Card Forms

Understanding payment and credit card forms

Payment forms serve as the essential interfaces through which customers enter their payment information for online and offline transactions. These forms process a variety of payment methods but primarily focus on credit cards due to their prominence in consumer purchases. Effective payment forms not only streamline transaction processes but also enhance the customer experience, leading to higher conversion rates.

The importance of credit card forms in business transactions cannot be overstated. They embody the trust factor necessary in e-commerce, where customers must feel secure sharing sensitive information. A well-designed credit card form contributes significantly to the operational efficiency of businesses, simplifying transactions and reducing abandonment rates.

Types of payment forms

Different types of payment forms cater to various business needs. Online payment forms are commonly used for e-commerce transactions, allowing customers to make purchases through websites. Mobile payment forms are optimized for smartphones, ensuring that on-the-go users have a seamless checkout experience.

Subscription-based payment forms allow users to set up automatic payments for recurring services, enhancing user retention for businesses. Alternatively, one-time payment forms facilitate single transactions, making them ideal for businesses that do not rely on repeat sales.

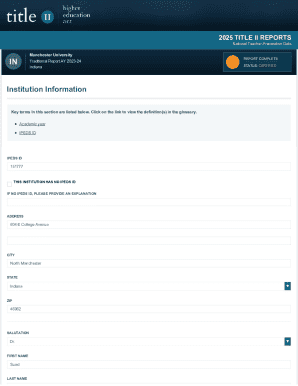

Essential elements of a payment and credit card form

Creating an effective payment and credit card form requires focusing on user-friendly design, which facilitates easy navigation and minimizes user frustration. The inclusion of secure payment processing capabilities is critical as well; today's consumers look for transaction encryption and compliance with regulations to safeguard their financial data.

Input fields should be well-considered, with a clear distinction between required and optional fields to avoid overwhelming users. Moreover, adding eSignature features can enhance the legal enforceability of contracts, while ensuring mobile responsiveness guarantees that forms work well on any device.

Step-by-step guide to creating a payment and credit card form with pdfFiller

Creating a payment and credit card form is simple with the tools offered by pdfFiller. Start by selecting a payment template that fits your business model. pdfFiller provides a variety of templates optimized for different services and product offerings.

Next, customize your form by editing the text and fields according to your requirements. You can even add your company's branding to make the form more recognizable to users. Once you have the basics set, configure your payment processing options by connecting to popular payment gateways like Stripe or PayPal, enabling you to accept payments seamlessly.

Additionally, adding eSignature fields is vital if your transactions require a signature for authorization. Finally, before going live, ensure to rigorously test your form to check that everything functions correctly.

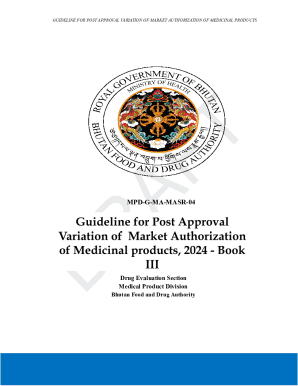

Best practices for securing payment information

Security is paramount when it comes to handling payment information. One of the best practices is implementing SSL certificates, ensuring that communications between the user's browser and your server are encrypted. This acts as a protective barrier against hackers looking to intercept sensitive information.

Compliance with PCI DSS (Payment Card Industry Data Security Standards) is crucial as it sets the requirements for one's security management, policies, procedures, network architecture, and software design. Regular security audits and updates are also imperative to identify and address any new vulnerabilities promptly.

Common mistakes to avoid when creating payment forms

One common mistake is overcomplicating the user experience by asking for excessive information or creating a lengthy process. Users tend to abandon forms if they feel overwhelmed. It's also important not to neglect mobile users; many consumers today shop using smartphones. If a payment form doesn't work well on mobile, it can significantly hinder sales.

Failing to test payment processing before going live is another critical error. Ensure to run several tests to confirm all integrations work seamlessly, reducing the chances of transaction failures.

Analyzing payments and user interaction

Utilizing analytics tools within pdfFiller allows businesses to gain insights into user interactions with payment forms. By tracking metrics such as form completion rates and payment success, businesses can identify pain points in their forms and make necessary adjustments to improve overall user experience.

For example, if users frequently exit the form at a specific field, it could indicate confusion or an unnecessary requirement. Making data-driven decisions helps refine the forms for better user engagement and enhanced conversion rates.

Collaborative tools for teams: Managing payment forms together

Collaboration is vital when managing payment forms, especially in team settings where multiple departments need access. pdfFiller provides features that allow sharing access across departments, enabling team members to contribute and edit forms effectively without confusion.

Real-time collaboration features help teams work together seamlessly, while assigning roles and permissions ensures that control over document access is maintained. This fosters an environment where multiple users can simultaneously make necessary updates without compromising the integrity of the document.

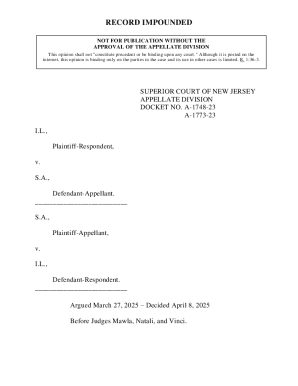

Legal considerations for payment and credit card forms

When creating payment and credit card forms, addressing compliance requirements is necessary to avoid legal pitfalls. Businesses must be aware of data protection regulations such as GDPR that govern how personal data is collected, stored, and processed.

By ensuring user consent and implementing transparent data practices, businesses can build trust with their customers while safeguarding themselves from potential legal complications.

Marketing your payment forms for higher conversion

To effectively increase conversions on your payment forms, creating strategies to promote these forms is essential. Using social proof and testimonials can significantly boost credibility and encourage hesitant users to proceed with the payment process.

Additionally, testing different form layouts to find the optimal design can lead to improvements in conversion rates. Applying A/B testing methods allows you to compare different styles and flows to identify the most effective approach.

Case studies: Successful implementation of payment and credit card forms

Examining successful implementations of payment and credit card forms can reveal valuable insights. For instance, a small business utilizing a straightforward payment process reported a 30% increase in successful transactions after simplifying their payment form layout and reducing the number of required fields.

On an enterprise level, a large company integrated its payment forms with their existing CRM to create a seamless transition from customer query to payment. This integration not only streamlined operations but also enhanced customer satisfaction by minimizing delays.

Future of payment forms: Trends to watch

The future of payment forms is poised for transformation with emerging trends. The rise of contactless payments is accelerating, particularly as consumers demand faster and more convenient ways to pay, while advancements in artificial intelligence are enhancing payment verification processes to prevent fraud.

Moreover, improvements in mobile payment experiences will continue to drive customer engagement. Payment forms will need to evolve accordingly, ensuring they integrate cutting-edge technologies that provide both convenience and security.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit payment amp credit card from Google Drive?

How do I make edits in payment amp credit card without leaving Chrome?

Can I edit payment amp credit card on an iOS device?

What is payment amp credit card?

Who is required to file payment amp credit card?

How to fill out payment amp credit card?

What is the purpose of payment amp credit card?

What information must be reported on payment amp credit card?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.