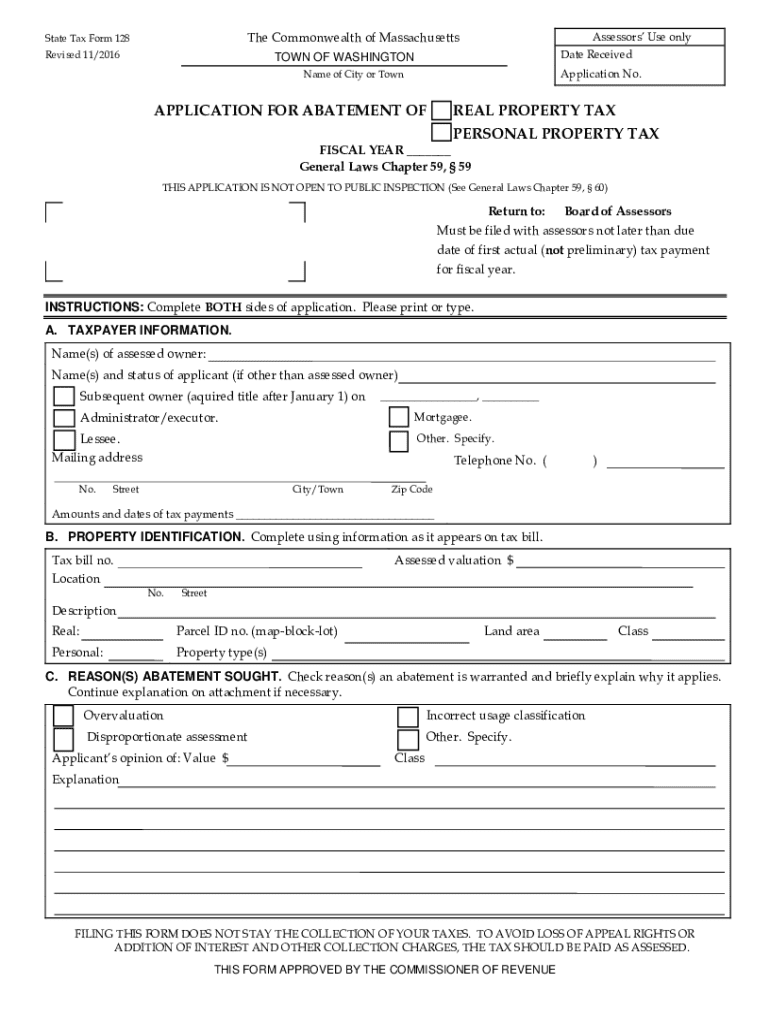

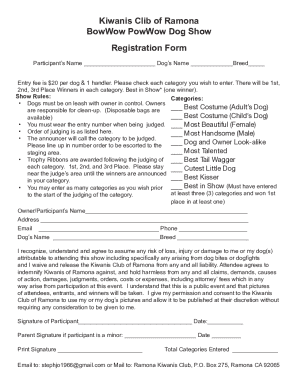

Get the free State Tax Form 128

Get, Create, Make and Sign state tax form 128

Editing state tax form 128 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state tax form 128

How to fill out state tax form 128

Who needs state tax form 128?

Comprehensive Guide to State Tax Form 128 Form

Understanding State Tax Form 128

State Tax Form 128 is a crucial document that residents of certain states must file as part of their tax obligations. This form typically pertains to individuals or businesses, depending on specific state requirements. Understanding the nuances of this form is essential for accurate tax filing and compliance with state tax regulations.

Filing State Tax Form 128 accurately can greatly impact one’s financial situation. It serves to report income, claim deductions, and ultimately determine tax liability. As such, familiarity with this form can minimize errors and ensure that taxpayers take advantage of available credits or deductions.

Key components of State Tax Form 128

The State Tax Form 128 consists of several key components that guide taxpayers through reporting their financial details comprehensively. Each section has its specific purpose and facilitates the accurate capture of relevant information.

Essential sections include personal information to confirm identity, income reporting detailing all sources of income, and sections for claiming deductions and credits to reduce taxable income. By breaking down these sections, taxpayers can ensure a more efficient filing process.

Common terminology within the form needs proper understanding. Terms like 'taxable income,' 'deductible expenses,' and 'adjusted gross income' frequently appear and are pivotal for a clear comprehension of what each component entails.

Step-by-step instructions for completing State Tax Form 128

Completing State Tax Form 128 requires careful preparation of necessary documentation. Taxpayers should start by gathering financial documents such as W-2 forms, 1099s, previous tax returns, and relevant receipts for deductions. Having these readily available will streamline the filling process.

Next, refer to the guidelines provided by the state taxing authority, which offer specific instructions tailored to your region. With all documents at hand, proceed with filling out each section of the form. Address each component methodically, checking against your financial documents to ensure data accuracy.

Before submitting, reviewing the form is critical. Utilize a checklist to confirm completeness, ensuring that no fields are left unattended. Common pitfalls include skipping necessary signatures or omitting critical tax deductions, so scrutiny is essential.

Interactive tools for form completion

Modern filing of State Tax Form 128 can be enhanced through the use of interactive tools available online. Online calculators allow taxpayers to determine their tax deductions rapidly. These tools often offer guidance in identifying eligible deductions, ensuring that users can maximize their returns.

Additionally, platforms like pdfFiller provide interactive templates that make filling out Form 128 a user-friendly experience. Users can edit, sign, and collaborate directly within the platform to maintain all documents in a centralized location, reducing the burden of managing multiple paper records.

Managing & submitting your State Tax Form 128

Once completed, State Tax Form 128 needs to be filed correctly either electronically or via traditional mail. E-filing is often the more efficient method, as it allows for quicker processing and confirmation of receipt. However, some may prefer paper submission for various reasons, like maintaining a physical copy in their records.

Understanding the key deadlines for filing the form is imperative. Each state has specific cut-off dates, and late submissions can lead to significant penalties. For most states, the deadline aligns with the federal tax return due date. After submission, tracking your form ensures transparency and provides verification that the state has received your documents.

Frequently encountered issues with State Tax Form 128

Common errors can emerge during the completion of State Tax Form 128, with frequent missteps including misreporting income or incorrectly claiming deductions. These discrepancies can lead to audits, additional taxes owed, or penalties, underscoring the importance of meticulousness.

Should a mistake occur, knowing how to amend your form is crucial. Most states provide a streamlined process for correcting filed returns, typically involving a separate amendment form. Keeping records of all previous submissions assists in preventing future misreporting.

Resources for additional support

If you encounter difficulty or uncertainty during your filing process, don’t hesitate to reach out to state tax authorities for support. They often provide resources and helplines for taxpayers to clarify specific concerns.

In some cases, professional tax assistance might be warranted. Tax preparers or accountants offer valuable services, ensuring that your submission adheres to current laws. Community-based resources such as workshops or tax preparation days can also enhance understanding and provide hands-on assistance.

Advantages of using pdfFiller for State Tax Form 128

Utilizing pdfFiller for State Tax Form 128 provides a multitude of advantages, beginning with the accessibility of a cloud-based platform. No matter where you are, you can seamlessly edit, sign, and manage your tax forms, reducing complications associated with physical documentation.

The eSignature capabilities inherent in pdfFiller also simplify the process, facilitating faster approvals without the hassle of printing. The document collaboration features further enhance the user experience by allowing accountants and team members to work together on the same document, ensuring all inputs are captured effectively.

Conclusion of key takeaways

Filing State Tax Form 128 is not only a regulatory requirement but an opportunity to ensure tax savings through correct deductions and credits. By understanding each component of the form and following diligent filing practices, individuals and businesses can mitigate risks associated with inaccurate submissions.

Leveraging tools like pdfFiller can streamline this process, making tax preparation accessible and efficient. Remember to stay informed about filing methods, deadlines, and available resources to support your tax journey effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the state tax form 128 in Chrome?

How do I edit state tax form 128 on an iOS device?

How do I edit state tax form 128 on an Android device?

What is state tax form 128?

Who is required to file state tax form 128?

How to fill out state tax form 128?

What is the purpose of state tax form 128?

What information must be reported on state tax form 128?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.