Get the free Ptax-260-a

Get, Create, Make and Sign ptax-260-a

Editing ptax-260-a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ptax-260-a

How to fill out ptax-260-a

Who needs ptax-260-a?

A Comprehensive Guide to the PTAX-260-A Form

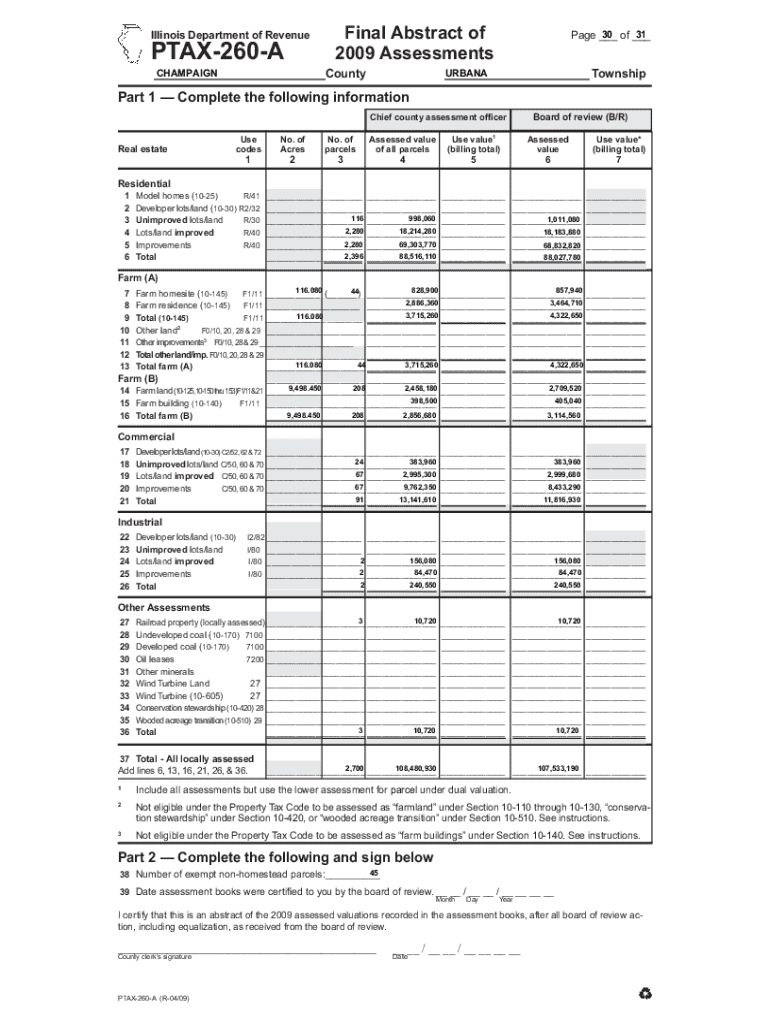

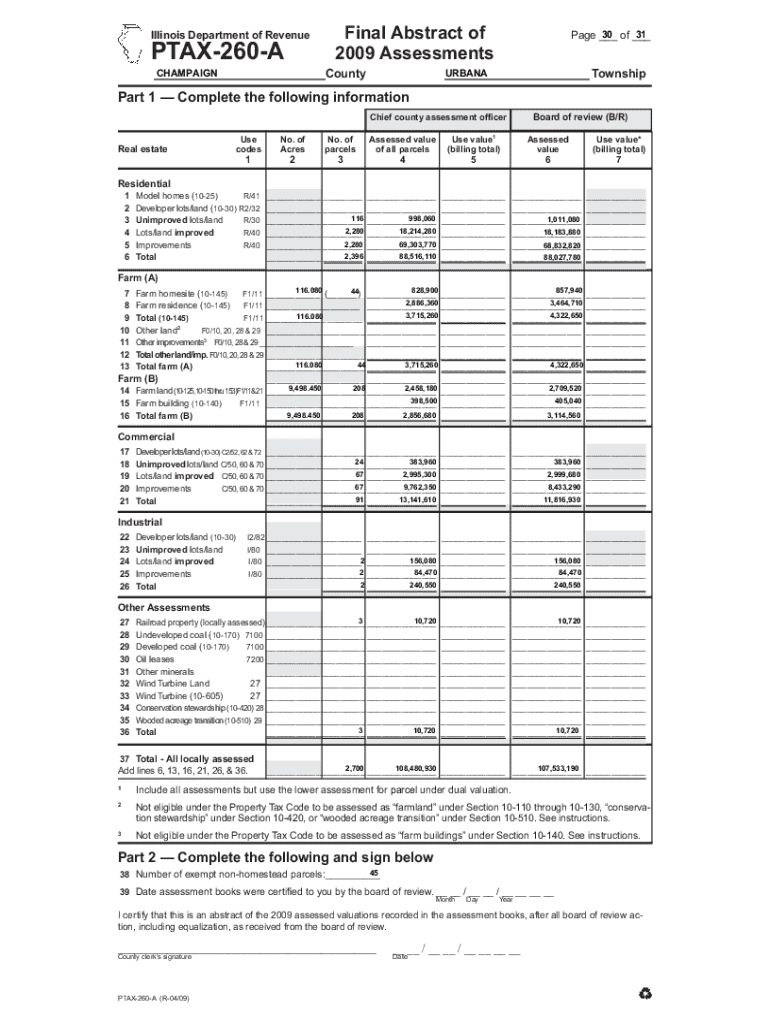

Understanding the PTAX-260-A form

The PTAX-260-A form is a crucial document used in property tax assessment, primarily utilized by property owners and assessors to report the value of property and details pertinent to property taxation.

Its significance emerges in the context of facilitating fair taxes based on property valuations, thus ensuring equity within counties. Anyone holding ownership or interest in property, including residential and commercial entities, should familiarize themselves with this form.

Key features of the PTAX-260-A form

The PTAX-260-A form consists of specific sections designed to collect essential information regarding the property and its value. These sections typically include basic property details, ownership particulars, and an assessment of the property's current market value.

As of the current tax year, users should be aware of recent updates that may affect the filing requirements and documentation necessary for effective completion. Always check with your local assessor’s office for the latest guidelines and modifications concerning the form.

Preparing to complete the PTAX-260-A form

Before diving into the completion of the PTAX-260-A form, it is vital to gather all required information and documents. Items needed include previous tax statements, property deeds, recent appraisals, and any correspondence related to property assessments.

Organizing this information efficiently will not only speed up the process but also ensure accuracy, reducing the risk of errors that could lead to issues with your property assessments.

Understanding the terminology used within the PTAX-260-A form is essential for accurate completion. Some terms may be complex, and it’s recommended to review the instructions carefully to familiarize yourself with the language to avoid confusion.

Step-by-step guide to completing the PTAX-260-A form

Filling out the PTAX-260-A form entails several steps, beginning with your basic contact information. This includes your name, mailing address, and contact details. Accuracy in this section is paramount, as errors can delay processing or lead to miscommunication.

The next step involves detailing your property information. This section requires comprehensive descriptions, such as the property's location, size, and any distinctive characteristics. Common mistakes include neglecting to specify lot numbers or failing to mention property features that might influence valuation.

Then you will move on to the declaration of value, where determining the fair market value is crucial. Utilize resources like online appraisal tools or local real estate listings to aid in making a realistic assessment of your property’s value.

Finally, you must sign the form. If completing it digitally, ensure you follow through with the electronic signature options that may be available to streamline the submission process.

Editing and managing your PTAX-260-A form with pdfFiller

Using pdfFiller to edit the PTAX-260-A introduction provides an intuitive experience for users. The platform allows for easy error correction and form updates without the hassle of printing and scanning.

Additionally, pdfFiller’s collaboration features allow users to share the form with team members or advisors effortlessly. This means you can receive feedback or have others review your entries in real-time, ultimately enhancing the accuracy of your submission.

Organizing your forms on pdfFiller is also straightforward. By categorizing and utilizing tags, users can simplify the retrieval process for future reference, ensuring ease of access, especially during busy tax periods.

Common issues and troubleshooting

Many users encounter challenges while filling out the PTAX-260-A form, including misunderstandings regarding valuation and deadlines. Some may fail to submit the required documentation alongside the form, leading to delays in processing.

If persistent issues arise, it is advisable to contact your local tax assessor's office as soon as possible. Furthermore, pdfFiller provides support options such as live chat assistance, user guides, and a help center, allowing for quick resolutions to user queries.

Related forms and templates

In addition to the PTAX-260-A form, there are several other property tax forms that individuals commonly use, including the PTAX-300 for property assessment appeals and PTAX-310 for specific property classification applications.

Exploring pdfFiller’s Document Center ensures you find essential forms that complement your needs while staying informed about any file changes or filing requirements.

Best practices for effective document management

Effective electronic record-keeping can significantly ease the burdens of managing property tax documents. Digitizing your property tax-related papers not only saves physical storage space but also enhances accessibility and security.

Regularly updating your knowledge on property tax matters is vital. Utilizing pdfFiller allows you to stay updated on form changes and deadlines, helping you to avoid missed submissions or penalties.

Accessibility and security considerations

One significant advantage of pdfFiller is its cloud-based platform, enabling users to access documents from any device, wherever they may be. This accessibility is crucial for property owners that need to manage documents promptly and efficiently.

On the security front, pdfFiller is committed to protecting sensitive information through advanced encryption and user authentication measures. To maintain privacy during form completion and submission, users are encouraged to follow best practices, such as logging out from devices and updating passwords regularly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ptax-260-a?

How can I edit ptax-260-a on a smartphone?

How do I fill out the ptax-260-a form on my smartphone?

What is ptax-260-a?

Who is required to file ptax-260-a?

How to fill out ptax-260-a?

What is the purpose of ptax-260-a?

What information must be reported on ptax-260-a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.