Get the free Loan Document Checklist

Get, Create, Make and Sign loan document checklist

How to edit loan document checklist online

Uncompromising security for your PDF editing and eSignature needs

How to fill out loan document checklist

How to fill out loan document checklist

Who needs loan document checklist?

The ultimate loan document checklist form guide

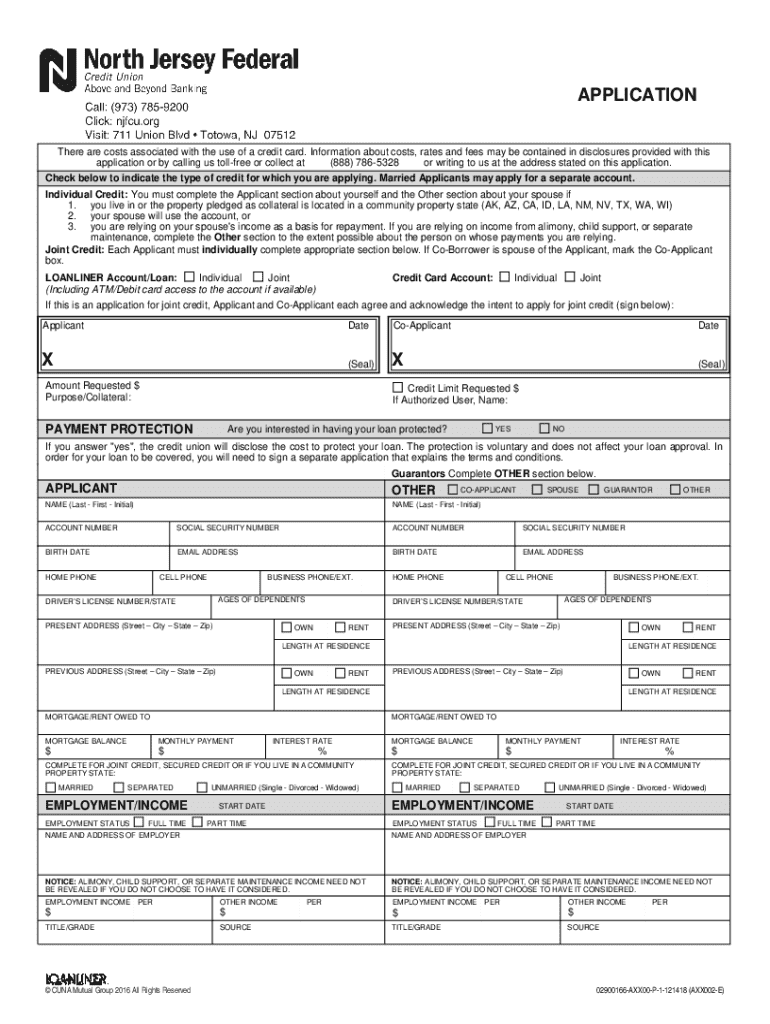

Essential documents for your loan application

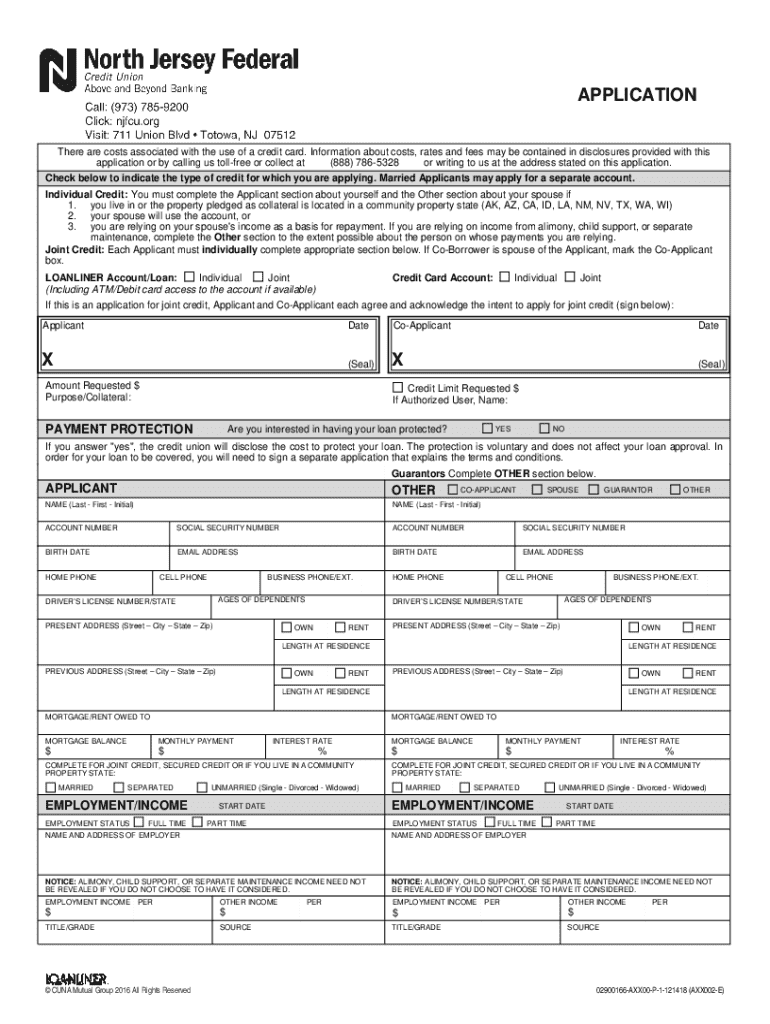

When applying for a loan, whether it’s a personal loan, mortgage, or any other type, understanding the essential documents required can significantly streamline the process. Different loan types have unique documentation needs, but certain key documents are universally required across all categories. Familiarizing yourself with these requirements can make your application smoother and faster.

Types of loans vary widely, each with its own regulatory and informational prerequisites. For instance, personal loans typically require proof of income and identification, while mortgages necessitate detailed property documentation and the borrower’s credit history. Having an organized approach to gathering your documentation will not only enhance your chances of approval but also keep stress levels to a minimum.

Detailed checklist: Required documents

To further empower your loan application process, utilize this detailed checklist of essential documents. This systematic guide encompasses every document you might need, ensuring that nothing slips through the cracks during the application process.

Additional documents you might need

Depending on the specific type of loan you're seeking, several other documents may be required. Understanding these additional needs can prepare you for any situation that might arise throughout the application process.

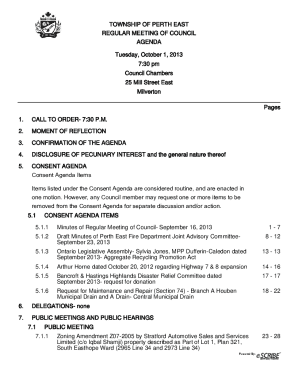

How to organize your loan documents

Organizing your loan documents is just as crucial as gathering them. A clear and systematic organization will streamline your submission process. You can create a dedicated folder, whether physical or digital, where you will store all necessary documents categorized logically.

Use separate folders for income verification, identification, assets, and debt information. This allows for a quicker retrieval when your lender requests documentation. Additionally, utilize digital tools that can help you scan, store, and track your documents efficiently, ensuring nothing is missed.

Filling out the loan document checklist form

Now that you’re aware of the documents you need, utilizing a loan document checklist form will significantly enhance your application process. Accessing the checklist on pdfFiller allows you to fill it out in a user-friendly manner, ensuring that you capture all required information accurately.

To complete the checklist, simply locate the specific form on pdfFiller’s platform, carefully fill out each section as detailed guidance. This ensures that you do not miss any critical information. Remember to review your entries for completeness and accuracy before finalizing.

Common mistakes to avoid when preparing your loan documents

In the rush to collect documentation for your loan application, it’s easy to make mistakes. However, avoiding these common pitfalls can save you significant time and negations down the line.

Expert tips for a smooth loan application process

Conducting your application with insight can revolutionize the experience, making it seamless from start to finish. Leveraging advice from experts and utilizing technology creates a more straightforward route to loan approval.

Looking for more tips on home buying?

Navigating the complexities of home buying can be daunting, especially for first-time buyers. Resources available through pdfFiller can help you educate yourself on the buying process by providing educational materials and guides tailored to common questions and concerns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send loan document checklist to be eSigned by others?

How do I edit loan document checklist online?

How can I edit loan document checklist on a smartphone?

What is loan document checklist?

Who is required to file loan document checklist?

How to fill out loan document checklist?

What is the purpose of loan document checklist?

What information must be reported on loan document checklist?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.