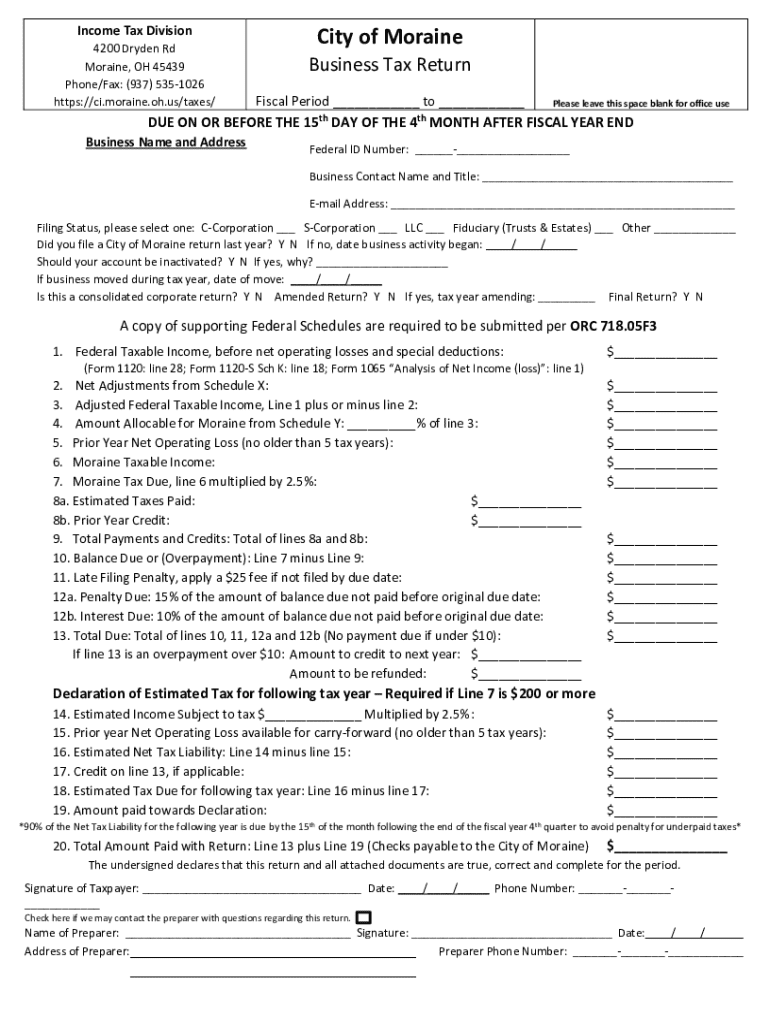

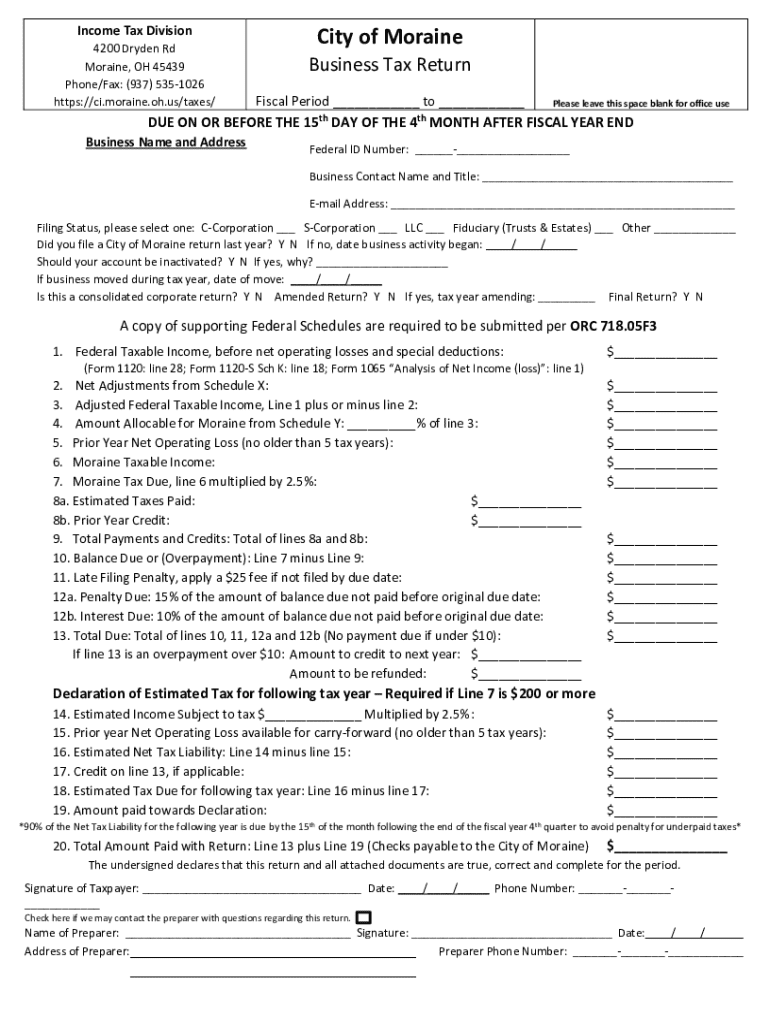

Get the free Business Tax Return

Get, Create, Make and Sign business tax return

Editing business tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business tax return

How to fill out business tax return

Who needs business tax return?

A Comprehensive Guide to Business Tax Return Forms

Understanding business tax returns

Business tax returns are essential documents that businesses must file with the government to report their income, expenses, and other financial information for a specific tax year. These returns are not just a requirement; they represent a pathway for businesses to ensure compliance with tax regulations, ultimately safeguarding their operations against potential penalties.

Filing business tax returns is crucial as it helps determine a business's tax liability and potentially qualify for deductions and credits that reduce overall tax obligations. Not filing can lead to serious consequences, including hefty fines.

Types of business tax return forms

Navigating the various types of business tax return forms is critical for compliance. Different structures, like sole proprietorships or corporations, necessitate distinct forms that reflect their unique financial activities.

The most common federal tax forms include:

Choosing the right form is paramount for accurately representing your business's financial status and ensuring compliance with IRS guidelines.

You can access official tax forms on the IRS website. Another excellent tool for managing forms is pdfFiller, allowing users to edit and fill out various tax documents swiftly.

Step-by-step guide to filling out business tax return forms

Before diving into form completion, gather essential information like financial records and business expenses. Accurate record-keeping is vital in ensuring that your return does not contain discrepancies that could trigger audits.

Filling out Form 1040 Schedule

For sole proprietors, Form 1040 Schedule C is utilized to report business income. Start by filling in basic business information, including your business name, address, and the type of business activity. Then, categorize income in the income section, accurately counting all revenue generated. After income, move on to the expenses section where you detail operational costs such as supplies, utilities, and travel expenses.

Completing Form 1065

When dealing with partnerships, Form 1065 is the requisite form. The initial step involves providing complete information about each partner, including their share of the partnership's profits and losses. Following that, document all income and deductions comprehensively.

Utilizing Form 1120

Corporations must apply Form 1120 to report income and deductions. Start with corporate income, specifying exact figures before moving to list various deductions such as salaries, interest, and other allowable expenses that may help reduce taxable income.

While filling out any form, avoid common errors like misreporting business income or misclassifying necessary expenses as deductions.

Understanding deductions and credits

Business deductions and tax credits can significantly reduce your tax liability. Familiarizing yourself with what qualifies for deduction is crucial for effective tax management.

Common business deductions include operational expenses that involve the costs of running your business, such as rent, salaries, and material fees. Another notable deduction is the home office deduction which benefits remote workers operating from their residence.

Understanding these deductions and credits equips business owners with the tools to minimize tax liability effectively.

Managing and submitting your business tax return

Once your business tax return form is complete, the next step is to choose how you'll file it. You may opt for e-filing or paper submission, each having its pros and cons. E-filing is generally faster, making confirmation of submission easy, while paper submission carries the traditional, slower method.

If you utilize pdfFiller for submissions, the tool enables editing, using the eSign feature for necessary authorizations, and ensuring your forms are accurate and complete before submission. Tracking your submission status is essential to confirm everything was received correctly.

Post-filing considerations

Once your return is filed, proper record-keeping becomes vital. Keeping records for at least three years helps in the event of an IRS audit. Maintain organized financial documents that detail income and expenses to substantiate any claims made on your tax return.

Audits can be daunting for any business owner. Understanding the audit process, including how the IRS selects returns for auditing and what to expect, prepares you for potential inquiries from a government organization. Ensure that all documents related to tax filings are readily available and well organized.

Tools and resources for business tax management

Utilizing online tools for business tax preparation simplifies the process significantly. pdfFiller offers features that make document management accessible and user-friendly. Complete with form editing, eSigning capabilities, and a secure platform for communication, pdfFiller stands out as an essential resource for business owners.

Interactive tools and features on pdfFiller

pdfFiller boasts numerous interactive features that enhance the user experience when managing business tax return forms. Accessing templates for various business tax forms is straightforward, eliminating the need to draft documents from scratch.

Moreover, pdfFiller's document management tools can help you keep all your documents organized and easily accessible, reducing the stress during tax season.

FAQs about business tax return forms

Many business owners have questions about their responsibilities concerning tax returns. Understanding the process can diminish anxiety surrounding filings.

Accessing information through the IRS website or seeking help from tax professionals can assist you in navigating complex situations related to business taxation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business tax return to be eSigned by others?

How do I edit business tax return on an iOS device?

How can I fill out business tax return on an iOS device?

What is business tax return?

Who is required to file business tax return?

How to fill out business tax return?

What is the purpose of business tax return?

What information must be reported on business tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.