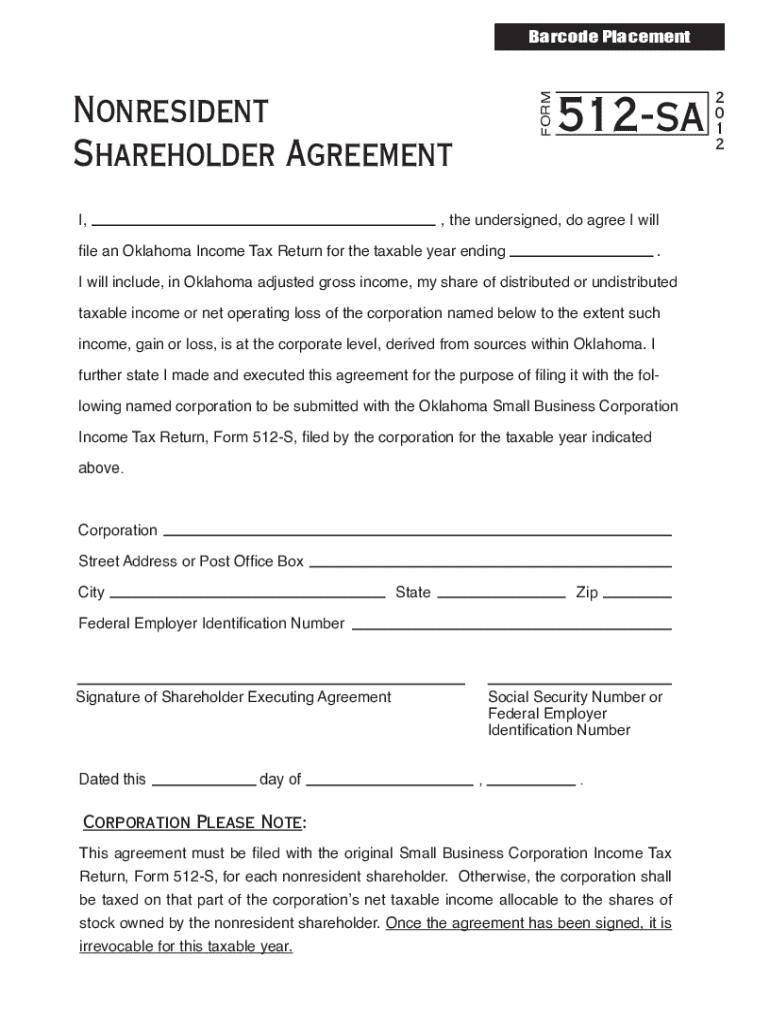

Get the free Nonresident Shareholder Agreement

Get, Create, Make and Sign nonresident shareholder agreement

How to edit nonresident shareholder agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonresident shareholder agreement

How to fill out nonresident shareholder agreement

Who needs nonresident shareholder agreement?

The Nonresident Shareholder Agreement Form: A Comprehensive How-to Guide

Understanding nonresident shareholder agreements

A nonresident shareholder agreement is a crucial legal document that delineates the rights, responsibilities, and relationships among shareholders in a corporation where one or more of the shareholders reside outside of the country in which the corporation is based. These agreements are essential for clarifying expectations and obligations, particularly in cross-border business transactions where legal complexities and different regulatory environments can arise.

The increasing globalization of business demands that entrepreneurs and investors safeguard their interests while navigating various markets. Without a clear agreement, shareholders may face significant risks, including misunderstandings about profit distribution and control over the company. Therefore, a well-structured nonresident shareholder agreement is not merely a formality; it is a foundational element of successful international business ventures.

Legal considerations for nonresident shareholders

Understanding the legal landscape surrounding nonresident shareholders is paramount. There are various international laws and regulations that can impact shareholder agreements due to the cross-border nature of many of these arrangements. Nonresident shareholders may be subject to different tax obligations based on their country of residence as well as the jurisdiction of the company. Ignorance of these laws and regulations can lead to costly penalties and legal disputes.

Choosing the appropriate governing law is another significant consideration. Each jurisdiction has specific compliance requirements that must be met, and understanding them can help avoid disputes and operational challenges. It is advisable for nonresident shareholders to consult with legal experts who specialize in international business laws to ensure full compliance and protection of their interests.

Drafting your nonresident shareholder agreement

Crafting a nonresident shareholder agreement requires careful attention to detail. Identification of the parties involved is the first step, followed by a clear outline of the terms of the investment which includes the amount invested, the ownership percentage each shareholder holds, and any specific conditions tied to the investment. Additionally, it’s crucial to outline voting rights and preferences for shareholders, ensuring that their input and decisions are represented fairly within the management structure.

Effective drafting is also about clarity in language. Since these agreements involve parties from different legal backgrounds, using clear and unambiguous language is critical. Collaborative drafting is often beneficial; thus, involving all stakeholders in the process can help surface important concerns and streamline agreement on terms. Seeking input from all parties can lead to a more balanced and comprehensive agreement.

Utilizing interactive tools for agreement creation

In today's digital landscape, leveraging technology can significantly simplify the process of creating and managing nonresident shareholder agreements. pdfFiller offers robust features that empower users to edit documents, eSign, and ensure smooth collaboration from anywhere. This cloud-based platform allows users to manage their agreements all in one place, fostering efficiency and accessibility.

Among its many capabilities, pdfFiller provides seamless editing tools for nonresident shareholder agreement forms. Users can access templates, fill in required fields, and utilize various editing options to personalize their documents, which can be particularly advantageous for those needing quick iterations or revisions.

Managing and maintaining your nonresident shareholder agreement

Once your nonresident shareholder agreement is in place, regular updates and amendments are crucial for ensuring that the document remains relevant and effective over time. Business conditions evolve, and so too might the relationships among shareholders, necessitating changes to the agreement. Knowing when to revise your agreement is key; typically, this should occur whenever there is a significant shift in ownership, management, or overall business strategy.

Utilizing pdfFiller simplifies this process, allowing users to manage amendments effectively. The platform’s version control feature ensures that previous iterations of documents are maintained for reference while allowing for easy updates, thus ensuring all parties stay informed and compliant with the latest terms.

Common pitfalls and solutions

Navigating the intricacies of nonresident shareholder agreements can be fraught with challenges. Common mistakes often arise from overlooking tax obligations specific to nonresident shareholders or from drafting inadequate conflict resolution clauses that fail to provide a clear path to resolving disputes. Each of these oversights can lead to costly disputes and complications at critical moments.

To avoid these legal issues, it is strongly advisable for all involved stakeholders to consult with legal professionals who specialize in international business law. Additionally, utilizing the resources available on pdfFiller can prove beneficial, as they offer guidelines and templates that can aid in understanding the nuances of shareholder agreements.

Collaboration with stakeholders

Engaging all stakeholders in the agreement process fosters consensus and strengthens the foundation of the nonresident shareholder agreement. It's not merely about drafting the document but ensuring each party feels their interests are represented, which enhances overall trust among shareholders. Tools available on pdfFiller facilitate collaborative editing, providing a platform where stakeholders can contribute suggestions and modifications.

Managing feedback effectively is crucial; incorporating clear methodologies for tracking changes and suggestions ensures that all voices are heard. After gathering input, finalizing the document becomes a streamlined process, ultimately investing everyone in the agreement's success and the business's future.

Finalizing and signing your agreement

After drafting and discussing the nonresident shareholder agreement, preparing for signatures is the final crucial step. Ensure that a final checklist is completed, encompassing all necessary elements and that all parties clearly understand their commitments before signing. These final preparations help eliminate any ambiguity and facilitate a smoother finalization process.

Using pdfFiller for eSigning introduces numerous advantages over traditional signing methods. The platform streamlines the signing process, allowing multiple parties to sign documents quickly and securely without the need for physical meetings. This convenience, coupled with the document's traceability, enhances the integrity of the agreement.

FAQs about nonresident shareholder agreements

As more businesses engage in international ventures, questions surrounding nonresident shareholder agreements frequently arise. Common queries often pertain to the complexities of cross-jurisdictional agreements, particularly concerning tax obligations and compliance with local laws. Addressing these inquiries fosters understanding and clarity, which is vital for all stakeholders involved.

Additionally, troubleshooting document-related issues is an essential consideration for users. Having clear solutions and answers to FAQs ensures smoother navigation through the document creation and management process on pdfFiller, reinforcing user confidence in utilizing the platform effectively.

Enhancing your document management skills

Continuing education on international business agreements enhances your ability to manage nonresident shareholder agreements effectively. Various resources, including books, workshops, and online courses, are available to deepen your knowledge about international laws, shareholder rights, and best practices.

Leveraging pdfFiller’s learning tools, such as tutorials, webinars, and template resources, can significantly enhance your document management skills. By making use of these tools, you can not only create effective agreements but also ensure that your documents remain compliant and up-to-date, empowering you and your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out nonresident shareholder agreement on an iOS device?

How do I edit nonresident shareholder agreement on an Android device?

How do I complete nonresident shareholder agreement on an Android device?

What is nonresident shareholder agreement?

Who is required to file nonresident shareholder agreement?

How to fill out nonresident shareholder agreement?

What is the purpose of nonresident shareholder agreement?

What information must be reported on nonresident shareholder agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.