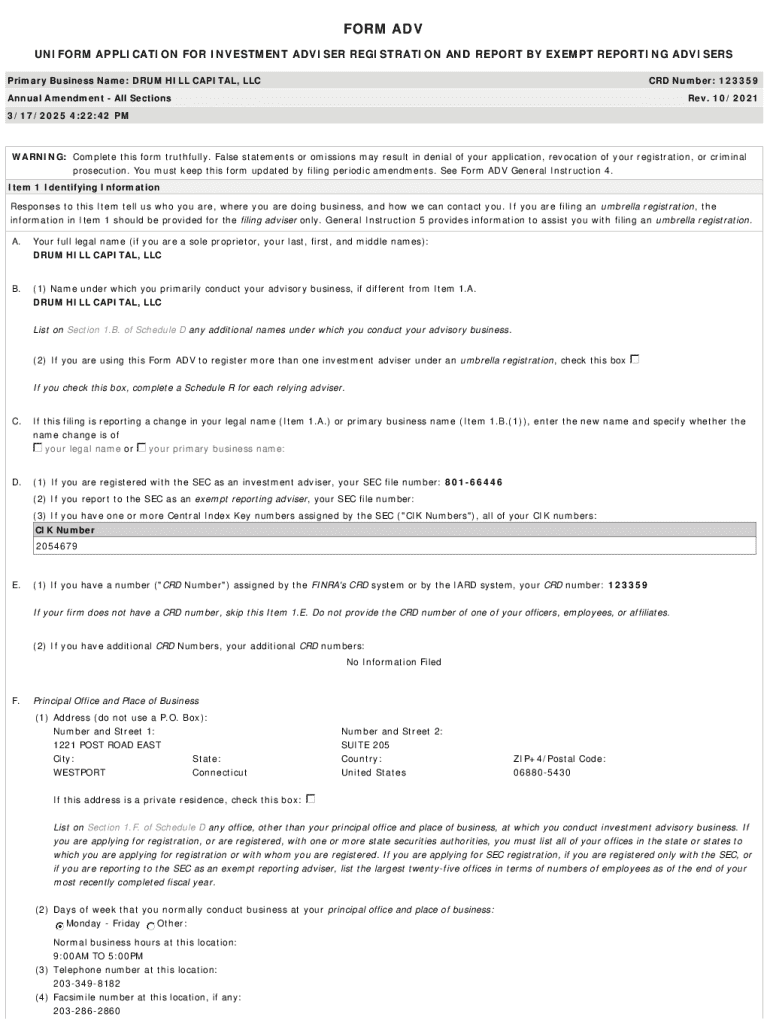

Get the free Form Adv

Get, Create, Make and Sign form adv

How to edit form adv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form adv

How to fill out form adv

Who needs form adv?

Understanding Form ADV: A Comprehensive Guide for Investment Advisors

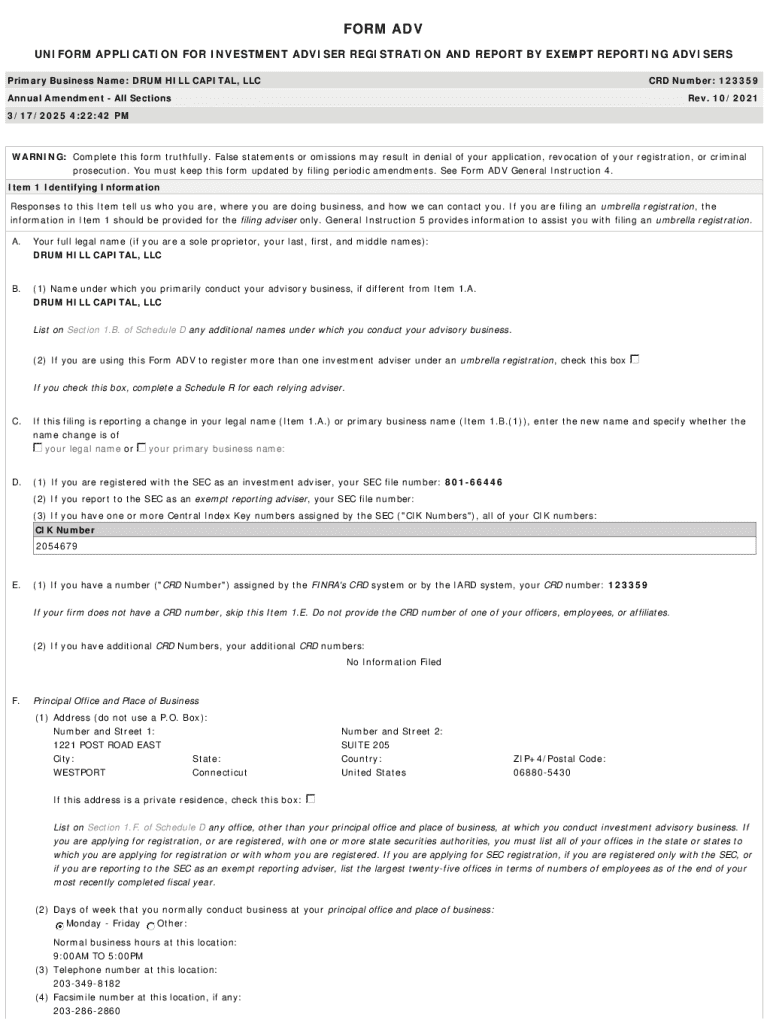

Overview of Form ADV

Form ADV, short for 'Uniform Application for Investment Adviser Registration and Report by Exempt Reporting Advisers,' is a crucial document in the investment management industry. Its primary purpose is to provide a comprehensive profile of an investment advisor's business practices and services offered. By requiring disclosure of critical information, Form ADV plays an essential role in transparency and trust between advisors and their clients.

Investment advisors, including individual professionals and firms, utilize Form ADV to register with the Securities and Exchange Commission (SEC) or state regulators. The information presented not only assures compliance with regulations but also facilitates an informed decision-making process for clients who wish to understand the operations and risk profile of their advisors.

Detailed breakdown of sections

Form ADV consists of several critical sections, each with specific requirements designed to enhance transparency within the investment advisory field. The main components include Part 1A, Part 1B, Part 2A, and Part 2B, which gather essential details about the advisory firm and its personnel.

Part 1A: Basic information

Part 1A of Form ADV collects fundamental information about the advisor and the nature of their business. This section includes identifying details, business structure, ownership, and the services offered. Advisors are urged to provide thorough and accurate information regarding their fee structures and services, as this transparency is paramount for cultivating trust with current and potential clients.

Part 1B: State-specific information

Part 1B addresses additional state-specific requirements that differ from one jurisdiction to another. This section is crucial for ensuring compliance with local regulations, which can vary widely. Understanding these variations helps advisors avoid penalties and stay in good standing with regulatory bodies.

Part 2A: Firm brochure

Part 2A of Form ADV serves as a firm brochure, outlining the advisory firm's services, methodologies, and fee structures in a narrative format. Advisors are encouraged to focus on clarity and detail in this section, as it acts as an informative tool for clients, helping them understand the services provided and any associated charges. This transparency is crucial for maintaining compliance and building client relationships.

Part 2B: Brochure supplement

Part 2B comprises a brochure supplement, which discloses background information on advisory personnel. This includes their qualifications, experience, and any disciplinary history that might impact their advisory capabilities. This section emphasizes the importance of transparency and client education, enabling clients to make informed decisions based on the expertise and background of those managing their investments.

Filing process for Form ADV

Completing and filing Form ADV might seem daunting, but with the right approach, it can be a streamlined process. Here’s a step-by-step guide to ensure accurate and compliant filing.

Tips for a successful Form ADV submission

The success of your Form ADV submission largely hinges on the clarity and thoroughness of the information you provide. Here are best practices to enhance your submission.

Ensuring compliance not only helps maintain regulatory standards but also establishes trust with clients and regulatory bodies. Keeping Form ADV up-to-date demonstrates professionalism and commitment to ethical practices.

Understanding the impact of Form ADV

Form ADV profoundly impacts investment advisors and the trust clients place in their services. By requiring a detailed disclosure of practices, the form influences how advisors operate and engage with clients.

From a regulatory standpoint, Form ADV compliance ensures that investors receive essential information regarding their advisors, aligning with SEC regulations aimed at protecting investor interests. Hence, the impact of Form ADV extends beyond mere compliance—it plays a critical role in building and maintaining a trustworthy advisor-client relationship.

Client perspective

For clients, understanding Form ADV is vital in their decision-making process. The transparency granted by the detailed disclosures allows clients to assess potential advisors based on their qualifications, fees, and services offered. Consequently, a well-prepared Form ADV can significantly influence a client’s decision to hire or continue with an investment advisor.

Advanced features of pdfFiller relevant to Form ADV

Using pdfFiller to navigate the Form ADV process enhances efficiency and accuracy. The advanced features cater specifically to the needs of investment advisors.

Cloud-based document management

pdfFiller’s cloud-based document management system simplifies document handling. Accessing and managing Form ADV from anywhere ensures that advisors can update their filings promptly and maintain compliance without hassle.

eSignature capabilities

With pdfFiller's eSignature capabilities, electronic signing of Form ADV becomes straightforward and legally binding, streamlining the submission process and eliminating the need for paper-based signatures.

Collaboration tools

pdfFiller facilitates teamwork through its collaboration features. Advisors can engage with their teams, ensuring input is gathered efficiently while filling out the form. This collaboration fosters accuracy and compliance.

Historical document management

Lastly, pdfFiller's historical document management capabilities allow users to track submissions and updates over time. These records are invaluable for compliance audits and reviews, serving as a comprehensive log of all Form ADV activities.

Interactive tools and resources

In addition to the capabilities of pdfFiller, several interactive tools can assist in the Form ADV completion process. For instance, utilizing a Form ADV calculator can help advisors estimate their advisory fees effectively.

These resources not only enhance the filing process but also contribute to a deeper understanding of compliance requirements, enabling advisors to maximize the effectiveness of their Form ADV submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the form adv electronically in Chrome?

How can I fill out form adv on an iOS device?

How do I edit form adv on an Android device?

What is form adv?

Who is required to file form adv?

How to fill out form adv?

What is the purpose of form adv?

What information must be reported on form adv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.