Get the free Non-individuals Supplementary Kyc Form

Get, Create, Make and Sign non-individuals supplementary kyc form

Editing non-individuals supplementary kyc form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-individuals supplementary kyc form

How to fill out non-individuals supplementary kyc form

Who needs non-individuals supplementary kyc form?

Non-Individuals Supplementary KYC Form - How-to Guide

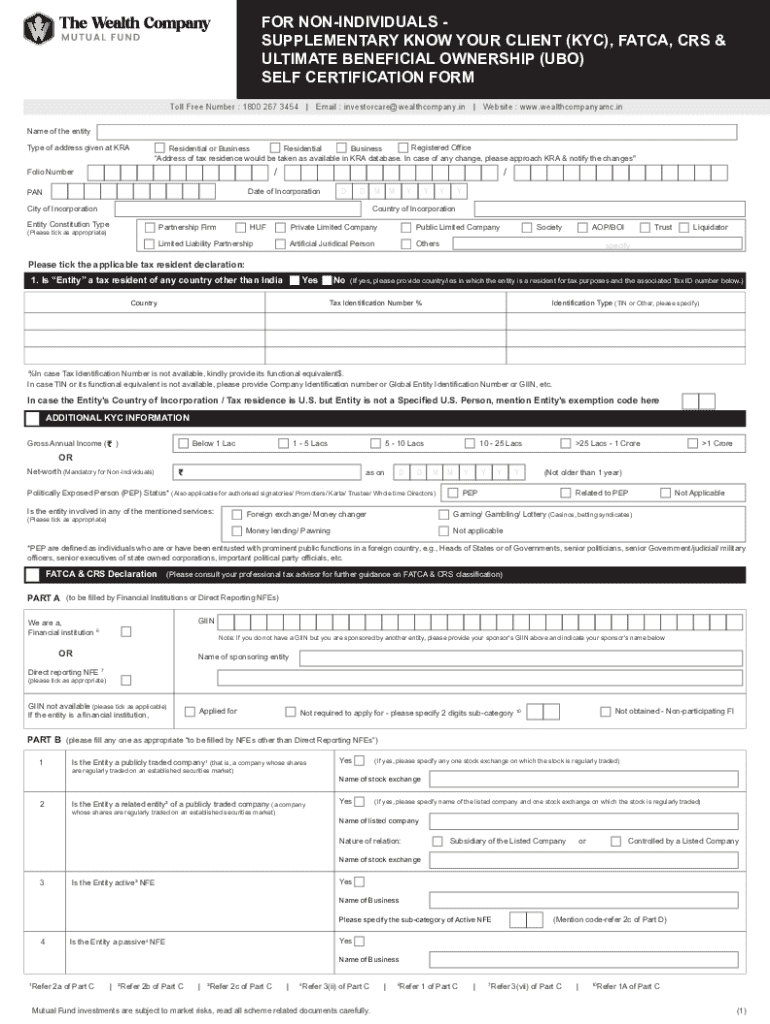

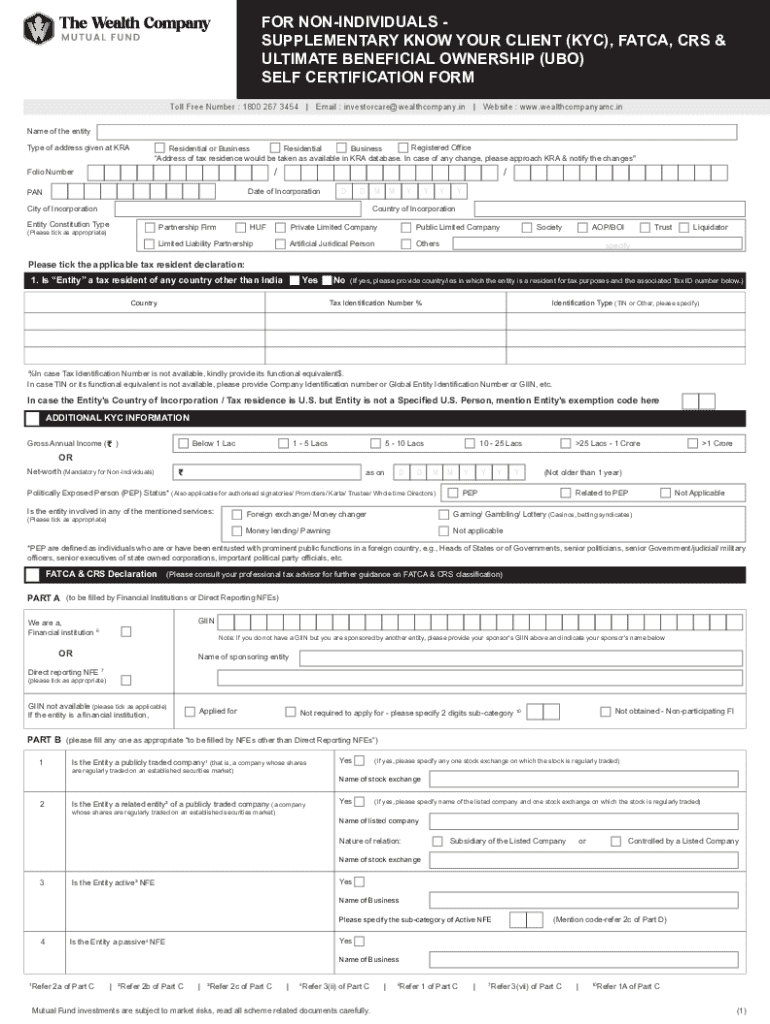

Understanding the non-individuals supplementary KYC form

The non-individuals supplementary KYC form serves as a vital component in the Know Your Customer (KYC) process, which is instituted to prevent fraudulent activities and ensure compliance within financial systems. While KYC typically revolves around individual customers, the non-individuals form is aimed at legal entities such as corporations, partnerships, and trusts. This form is critical in establishing the identity and legitimacy of these entities, facilitating transparency in their operations.

The significance of the non-individuals supplementary KYC form cannot be overstated, especially in industries closely regulated by governments and financial authorities. Regulatory requirements vary by country and financial sector, making it essential for entities to stay informed about their obligations under local laws.

Key components of the form

The non-individuals supplementary KYC form is meticulously designed to gather essential information about entities. Each section plays a critical role in crafting a comprehensive profile of the organization, starting with entity information, which includes the name of the entity, its type, and pertinent registration details. This foundational data sets the tone for all subsequent validations.

Another crucial aspect of the form is the ownership structure. It includes details about key beneficiaries and owners, thereby clarifying any potential conflict of interest or indirect controls that may exist within the organization. Compliance and risk assessment sections require a set of verified documents that substantiate the claims made in the form.

Step-by-step instructions for completing the form

Before starting to fill out the non-individuals supplementary KYC form, gather all necessary information and documents. Preparing beforehand can significantly streamline the completion process and ensure all relevant details are at your fingertips.

When filling out the form, carefully navigate through each section. It’s crucial to enter details accurately, especially regarding the entity and ownership information. Many rejections stem from discrepancies or incomplete data, so attention to detail is paramount. Finally, the signature and declaration section should be completed by an authorized person within the entity, underlining the importance of accuracy and completeness.

Editing and managing your KYC form

After completing the non-individuals supplementary KYC form, it is vital to maintain the ability to edit and manage the document efficiently. Utilizing pdfFiller's editing tools allows users to amend details if errors are spotted post-filling, ensuring that the form remains accurate.

In addition to editing capabilities, pdfFiller offers robust saving and sharing options. Users can save their forms in cloud storage, streamlining access for both internal and external stakeholders. The ability to securely share documents enhances collaboration and compliance, as stakeholders can review or contribute to the KYC process.

Collaboration tools for teams

Collaboration is essential in managing compliance and documentation processes effectively. pdfFiller integrates various tools to facilitate team collaboration on the completion and review of the non-individuals supplementary KYC form. Team members can be invited for input and review, promoting a comprehensive collective effort in compliance documentation.

The platform features real-time collaboration options, allowing team members to work on the document simultaneously. Furthermore, permissions and access control features ensure that only authorized personnel can view or alter specific documents, safeguarding sensitive information and fostering better compliance.

Troubleshooting common issues

It's not uncommon for entities to encounter challenges while completing the non-individuals supplementary KYC form. Some of the most frequent issues leading to form rejection stem from incomplete sections or inconsistencies in the information provided. Understanding these common pitfalls can save time and prevent delays in the compliance process.

For those needing assistance, pdfFiller offers a plethora of support resources. Users can access help articles, tutorials, and customer support directly through the platform, ensuring that any inquiries or issues are promptly addressed.

Finalizing and submitting the KYC form

Before submitting the non-individuals supplementary KYC form, it's essential to conduct a thorough review. Creating a checklist can be beneficial to ensure that all required information is accurate, complete, and supported by the necessary documentation.

Submission can occur via various channels, depending on the requirements of the financial institution or regulatory authority. After initiating the submission, it is advisable to follow up to confirm that the form was received, and to address any potential questions they may have regarding the submission.

Maintaining compliance post submission

After submitting the non-individuals supplementary KYC form, the responsibility of maintaining compliance does not end. It is paramount for companies to periodically revisit their KYC information and update it whenever there are significant changes in ownership or operations.

Additionally, staying informed about updates or changes to KYC regulatory frameworks is vital. This proactive approach ensures that entities do not inadvertently fall out of compliance, thus avoiding potential penalties or issues that can arise from outdated information.

Frequently asked questions

Entities often have queries regarding the nuances of the non-individuals supplementary KYC form. Common questions may include specific clarifications about various sections, document requirements, or timelines for processing. Addressing these queries ensures that both individuals and organizational teams understand the KYC process thoroughly.

By employing best practices tailored to your industry, organizations can effectively navigate KYC compliance issues, thereby reducing the risk of non-compliance and enhancing operational efficiency.

Conclusion: empowering your document management

The non-individuals supplementary KYC form is not just a requirement; it's an opportunity for organizations to build trust through transparency and compliance. By using pdfFiller, you can enhance your document management process, ensuring a smooth and efficient KYC experience.

Leveraging the full features of pdfFiller empowers teams to collaborate seamlessly while preparing their KYC documentation. This platform offers tools that streamline the workflow, reduce processing times, and ultimately contribute to enhanced compliance efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in non-individuals supplementary kyc form?

Can I create an eSignature for the non-individuals supplementary kyc form in Gmail?

Can I edit non-individuals supplementary kyc form on an Android device?

What is non-individuals supplementary kyc form?

Who is required to file non-individuals supplementary kyc form?

How to fill out non-individuals supplementary kyc form?

What is the purpose of non-individuals supplementary kyc form?

What information must be reported on non-individuals supplementary kyc form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.