Get the free Cscl/cd 543

Get, Create, Make and Sign csclcd 543

How to edit csclcd 543 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out csclcd 543

How to fill out csclcd 543

Who needs csclcd 543?

A comprehensive guide to the CSCL/-543 form

Understanding the CSCL/-543 form

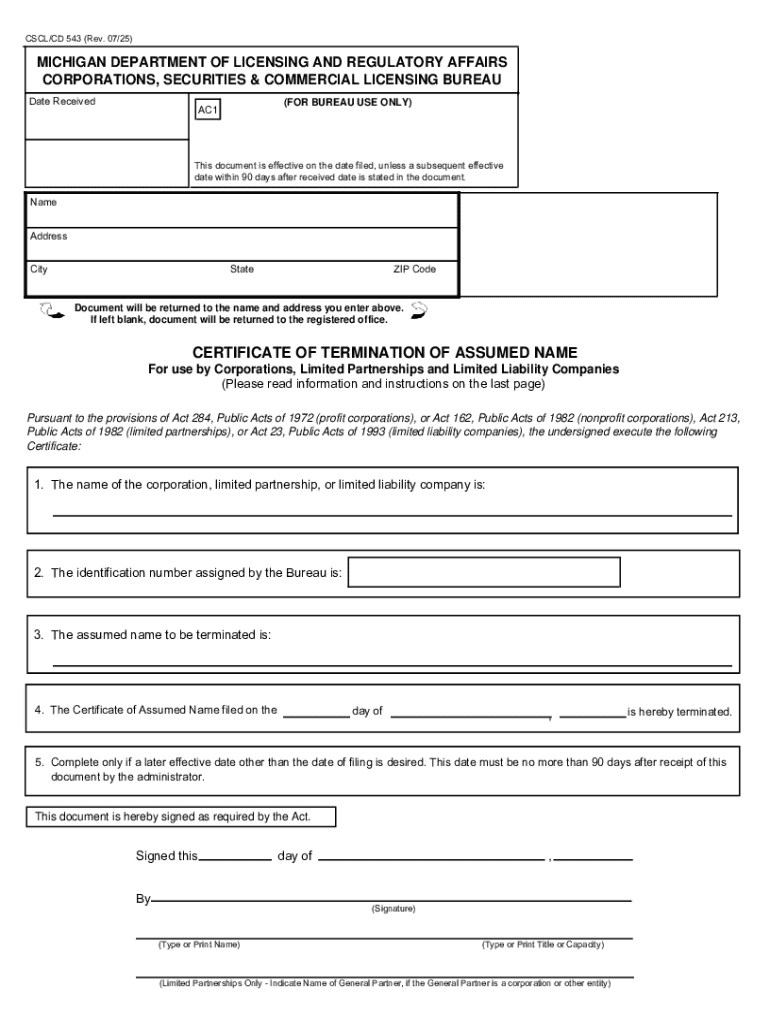

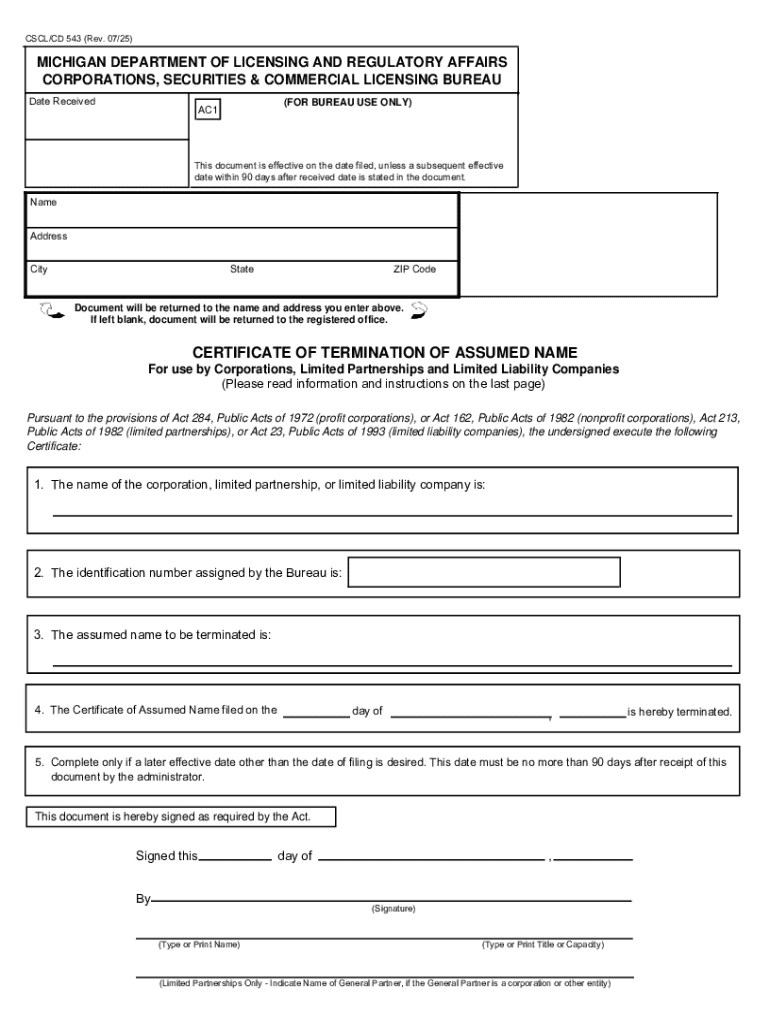

The CSCL/CD-543 form is a crucial document for businesses operating within Michigan. It serves as the 'Notice of Intent to Dissolve' for corporations and limited liability companies (LLCs). Its primary purpose is to notify the Michigan Department of Licensing and Regulatory Affairs (LARA) of a company’s intent to terminate its existence. This form is essential as it outlines the necessary steps for properly dissolving a business entity in compliance with state regulations.

Filing the CSCL/CD-543 form ensures that all business owners take the necessary legal measures before dissolving their company. This is important because it protects businesses from potential liabilities and ensures an orderly wind-up of the company's affairs. The importance of this form cannot be overstated; it is a required step in the dissolution process which prevents the automatic conversion of the business into a different corporate structure.

Key features of the CSCL/-543 form

The structure of the CSCL/CD-543 form is designed to capture the essential information needed for the dissolution process. Typically, it includes sections for the company's name, the address of the principal office, and the details of the registered agent. Each of these elements is critical, as they ensure that LARA has the correct details to process the dissolution efficiently.

Moreover, the form specifies the effective date of dissolution and outlines the reasons for termination. It's important for filing entities to pay close attention to the language and instructions outlined on the form. Failing to include all required details can lead to delays or rejection of the filing, making it vital to understand each section thoroughly before submission.

Importance of the CSCL/-543 form in document management

The legal significance of filing the CSCL/CD-543 form cannot be understated. It is a necessary compliance requirement under Michigan LLC regulations. Failure to submit the form appropriately can result in unforeseen legal complications, including continued liability for taxes and debts associated with the business even after operations have ceased. This can create long-term financial obligations that may affect the personal finances of the business owners.

The CSCL/CD-543 form is required in specific situations — most notably when a company has ceased operations and wishes to formally dissolve. It is also necessary for companies wishing to restructure or merge before terminating their existing structure. Business owners must understand these scenarios to ensure traditional or new business practices align with legal obligations. Common mistakes include using outdated forms, neglecting to sign the form, or failing to notify all necessary parties before submitting.

Filling out the CSCL/-543 form

Completing the CSCL/CD-543 form requires careful attention to detail. Here’s a step-by-step guide to assist you in filling out this critical document:

To avoid common pitfalls in filing, it’s helpful to verify that all sections of the CSCL/CD-543 form are complete and free of errors. Common errors include typographical mistakes or entering incorrect information about the registered agent. Keeping a checklist during preparation can improve accuracy, ensuring a smooth submission.

Editing and managing your CSCL/-543 form

Utilizing tools like pdfFiller can simplify editing and managing the CSCL/CD-543 form. This platform allows users to modify PDF documents easily, eliminating the need for physical paperwork in many cases. Key features include the ability to fill fields, add text, and adjust formatting to meet your needs directly within the form.

To edit your CSCL/CD-543 form using pdfFiller, follow these steps: upload the PDF to the platform, utilize the editing tools to modify the text fields, and save the corrected document. The seamless integration of these features allows users to maintain control of the content while ensuring compliance with the statutory requirements.

Collaborating with team members

Collaboration is essential when completing the CSCL/CD-543 form, especially for teams. Within pdfFiller, users can share documents easily with colleagues to gather input or additional information. Its eSignature features allow parties to sign the document electronically, streamlining the approval process and minimizing delays.

To share and collaborate effectively, users can send a link to the form or invite team members directly through the platform. Ensuring each stakeholder has access to the latest version of the CSCL/CD-543 minimizes the risk of miscommunication or outdated information.

Filing the CSCL/-543 form

Once the CSCL/CD-543 form is appropriately completed, the next step is submission. You have several options for filing: physical submission or electronic filing. Electronic communication is convenient and usually results in quicker processing times, whereas physical submissions can be sent via standard mail to LARA’s office.

For mailing, ensure to include all required documents and clearly mark the envelope. Using a reliable service that offers tracking will help confirm receipt of the submission. Remember to check LARA’s website for any changes to filing guidelines and requirements as they can affect the submission process.

Tracking the status of your filing

Once filed, it’s essential to track the status of your CSCL/CD-543 form submission. You can do this by visiting the Michigan LARA website and utilizing their business entity search feature. This tool can confirm if your dissolution has been processed. If there are issues with filing, such as missing information or errors, LARA will typically notify the designated contact.

Proactively checking the status can prevent potential legal complications. If you encounter problems, addressing them promptly ensures compliance and protects business owners from unwanted liabilities.

Revising the CSCL/-543 form

There are various scenarios that necessitate revisions to the CSCL/CD-543 form. Common reasons for making changes include errors in the original filing, changes to the effective date of dissolution, or adjustments in the contact information. Whatever the reason, it’s important to act quickly to file revisions, as delays may result in additional complications or fines.

To revise the CSCL/CD-543 form, submit a new form with the necessary corrections or notify LARA directly if instructed. Clearly indicate that the new submission is a revision to maintain clarity in the processing of your business records. Ensure that all associated forms are also updated as necessary.

Related documents to consider

When filing the CSCL/CD-543 form, businesses should be aware of other related documents that may also need to be submitted. This can include tax clearance forms or changes in corporate structure documentation, which are often required for the complete dissolution process. Linking your filings with other corporate documents helps maintain accuracy in regulatory compliance.

Reviewing other required records ensures that your dissolution is processed smoothly and that all relevant obligations are addressed satisfactorily before finalizing the termination. This comprehensive approach minimizes the risk of oversight during what can be a complex administrative process.

Frequently asked questions (FAQs)

Business owners often have questions about the CSCL/CD-543 form and related filing processes. Here are common queries that arise:

These FAQs help clarify common misconceptions or uncertainties regarding the CSCL/CD-543 form, guiding users towards accurate compliance.

Real-life scenarios: success stories and challenges

Many businesses have successfully navigated the dissolution process using the CSCL/CD-543 form. For example, a local Michigan restaurant effectively utilized the form to dissolve its corporate structure after ceasing operations, ensuring it was compliant with all tax and legal obligations, and avoiding potential liabilities. This success was achieved through thorough documentation and attention to detail.

However, challenges can arise. Some businesses have faced issues related to improperly filled forms or failed to provide adequate follow-up information, resulting in delays or complications in the dissolution process. By learning from these experiences, future filers can adopt more robust strategies to avoid similar problems. Utilizing tools like pdfFiller can also mitigate these challenges by providing an accessible platform for document creation and management.

Related topics to explore

When considering the CSCL/CD-543 form, it’s also beneficial to explore other essential business forms in Michigan, such as the CSCL/CD-540 for annual reports or CSCL/CD-550 for registrations, which are crucial for maintaining compliance. Understanding these documents can provide a more comprehensive view of the regulatory environment.

Additionally, exploring different business structures, including LLCs, corporations, and partnerships, offers insights into the benefits associated with each entity type. Tailoring your business approach using the right forms and understanding the corporate landscape can optimize operational efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send csclcd 543 to be eSigned by others?

Can I sign the csclcd 543 electronically in Chrome?

How do I edit csclcd 543 on an Android device?

What is csclcd 543?

Who is required to file csclcd 543?

How to fill out csclcd 543?

What is the purpose of csclcd 543?

What information must be reported on csclcd 543?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.