Get the free fidelity sep ira application

Get, Create, Make and Sign fidelity new account application form

How to edit 18005446666 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fidelity sep ira application

How to fill out new fidelity account applicationsimple

Who needs new fidelity account applicationsimple?

Your Guide to Completing the New Fidelity Account Application Simple Form

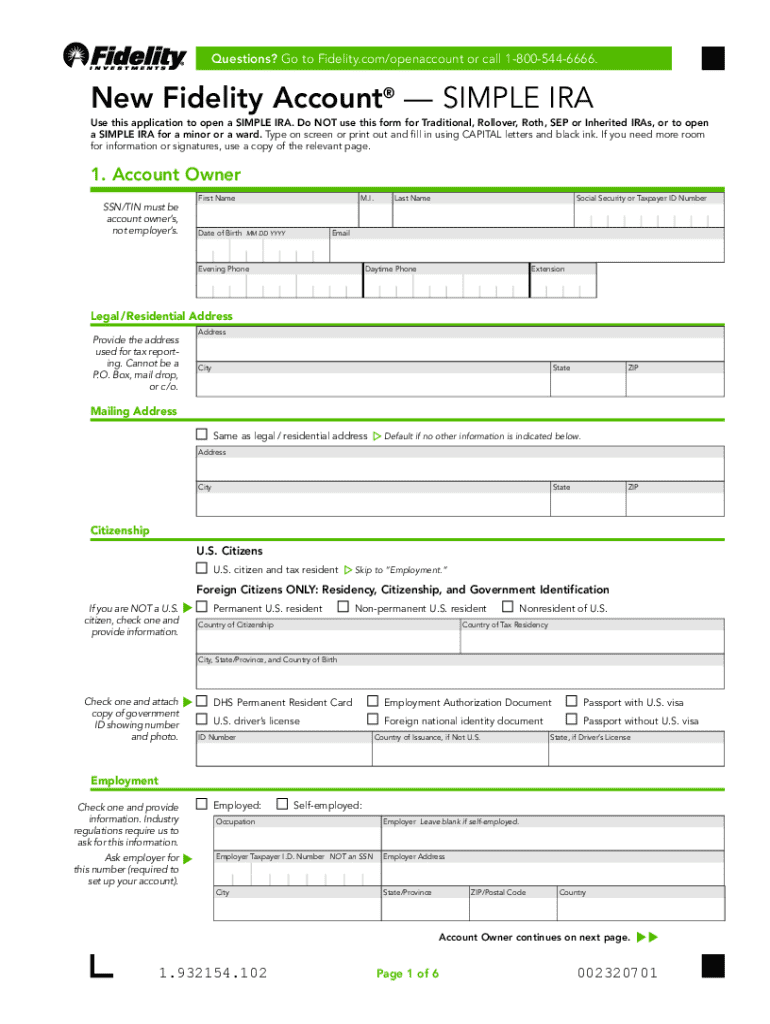

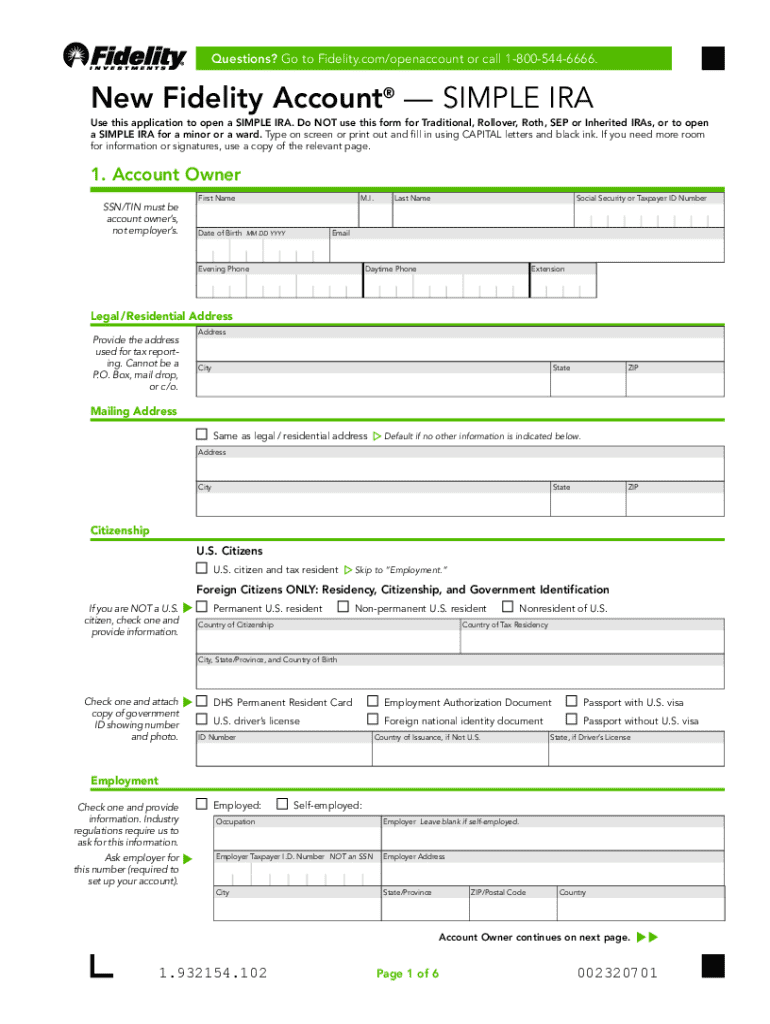

Understanding the new Fidelity account application

Opening a Fidelity account comes with numerous benefits, making it an attractive choice for both novice and experienced investors. Fidelity offers a wide range of investment products, robust research tools, and an intuitive user experience. The new Fidelity account application form has been streamlined, ensuring that users can quickly and efficiently set up their accounts with minimal hassle.

Key features of this new application process include enhanced online access, efficiency, and improved data security. This means applicants can fill out their information securely while receiving assistance via online resources, ensuring a smooth setup experience.

Preparing for your application

Before diving into the application, it's essential to gather all required documents to prevent delays. At a minimum, you will need identification documents, proof of address, and possibly financial information. Having this information ready will save you time and help you complete the application more efficiently.

Additionally, consider setting up a pdfFiller account. This cloud-based platform allows for easier document management, enabling you to upload, edit, and organize necessary files conveniently.

Step-by-step guide to completing the new Fidelity account application form

Completing the Fidelity account application form can be straightforward when you follow these steps: making sure to provide accurate information will facilitate a smoother approval process.

Step 1: Accessing the application form

To begin, visit the Fidelity website and find the section dedicated to new account openings. The form is available in a user-friendly format, easily navigable without requiring excessive searching.

Step 2: Filling out personal information

Enter your full name, address, and contact details precisely. Accuracy in this section is critical, as errors can cause delays in processing your application. Double-check spelling and ensure all information matches your documentation.

Step 3: Financial information requirements

When disclosing your income and investment history, pay attention to what the form designates as optional versus mandatory fields. Financial background can help Fidelity tailor investment options suited to your needs.

Step 4: Beneficiary designation

Choosing your beneficiaries is an important decision. Make sure to select the individuals or entities who will inherit your assets in the event of your passing. Carefully consider your choices, as this can impact your estate planning.

Step 5: Reviewing and submitting your application

Use pdfFiller tools to double-check entries for accuracy. Once you feel confident that all information is correct, submit the form electronically. This reduces paper clutter and expedites the application process.

Editing and signing your application

Before you finalize your application, reviewing is of utmost importance. Mistakes can lead to processing delays or even rejection. Leveraging pdfFiller allows you to edit your documents easily.

Once all entries are accurate, proceed to sign your application. Utilizing pdfFiller's eSignature feature simplifies this process, allowing for a secure and legally binding electronic signature.

Common mistakes to avoid when completing your Fidelity application

Many applicants encounter issues that could have been avoided with simple checks. Misunderstanding financial questions can lead to improperly completed forms, while incomplete beneficiary designations may create unnecessary complications during asset allocation.

Additionally, failing to review your application before submission can result in missed errors. This highlights the necessity of thorough review practices, ensuring your form is ready for approval.

FAQs regarding the new Fidelity account application process

As you embark on your application journey, you may encounter questions. For instance, if you experience issues accessing the form, contacting Fidelity support is vital. You can also inquire about updating your information after submission. Typical processing times for account applications may vary, but generally, you should expect to receive feedback within a few business days.

Managing your Fidelity account after approval

Once your account has been approved, managing it effectively is crucial. Accessing your account online provides real-time oversight and updates. Regular check-ins allow you to stay informed about accounts' performance and any changes in investing strategy.

Leveraging pdfFiller for a seamless application experience

Utilizing a cloud-based document platform like pdfFiller can significantly enhance your experience with financial forms. Easy-to-use features allow you to edit, sign, and collaborate on documents effortlessly. By streamlining the process, pdfFiller encourages accountability and ease of access for both individuals and teams.

User support and resources

Throughout your application process, it's essential to know how to access support. Fidelity offers resources for getting help, while pdfFiller provides a range of help features and tutorials. Familiarize yourself with these resources to ensure a smooth experience when filling out and managing your documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fidelity sep ira application directly from Gmail?

How can I send fidelity sep ira application to be eSigned by others?

How do I make changes in fidelity sep ira application?

What is new fidelity account applicationsimple?

Who is required to file new fidelity account applicationsimple?

How to fill out new fidelity account applicationsimple?

What is the purpose of new fidelity account applicationsimple?

What information must be reported on new fidelity account applicationsimple?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.