Get the free 2024 Declaration of Personal Property – Short Form

Get, Create, Make and Sign 2024 declaration of personal

How to edit 2024 declaration of personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024 declaration of personal

How to fill out 2024 declaration of personal

Who needs 2024 declaration of personal?

Navigating the 2024 Declaration of Personal Form: A Comprehensive Guide

Understanding the 2024 declaration of personal form

The 2024 Declaration of Personal Form serves as an essential document for individuals and teams to report their financial status and tax obligations to the government. This form simplifies the filing process, allowing individuals to understand their tax categories while ensuring compliance with various tax regulations. By completing this declaration, users provide necessary figures on income, deductions, and applicable tax credits, which can significantly impact their financial standings.

Its importance extends beyond mere compliance; the form enables residents to claim tax credits such as the child care tax credits and program contributions tax credits, which can alleviate financial burdens. In an ever-evolving tax landscape, understanding how to accurately complete this form becomes paramount for effective financial planning.

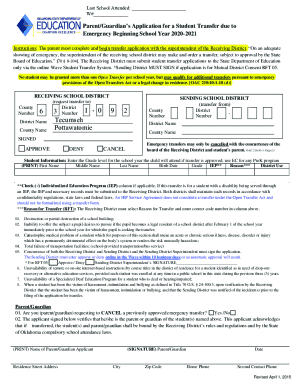

Who needs to file the 2024 declaration of personal form?

The requirements for filing the 2024 Declaration of Personal Form vary based on resident status and other circumstances. Generally, anyone who earns income, including wages, self-employment, or rental income, is required to complete this form. Key eligibility criteria can include residency in a certain jurisdiction, such as Florida, where residents are required to report ad valorem tax, sales tax, and various utility services.

Additionally, students and seasonal workers may also need to file if their earnings exceed specific thresholds. Understanding these requirements is crucial to avoid penalties and ensure that individuals benefit from available tax deductions, such as the unemployment tax and insurance premium tax.

Preparing to complete the form

Before starting the declaration, it is critical to gather all necessary information. Essential documents include previous tax returns, W-2 forms, and 1099 statements, which outline earned income and applicable taxes withheld. Having your personal identification items, such as Social Security numbers and driver's licenses, at hand is equally important. This preparation will streamline the filing process, making it less daunting.

Common doubts surrounding the 2024 Declaration of Personal Form often include confusion about which income sources to report. Many residents mistakenly think that only traditional employment income needs to be disclosed. This misconception can lead to incomplete submissions, potentially resulting in audits or fines. Additionally, inquiries about tax residency status and the applicability of various tax categories should be clarified before submission.

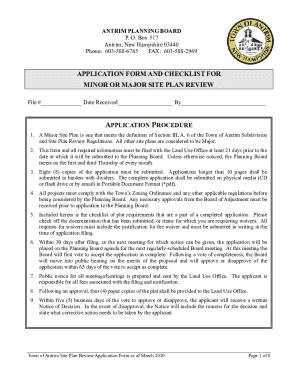

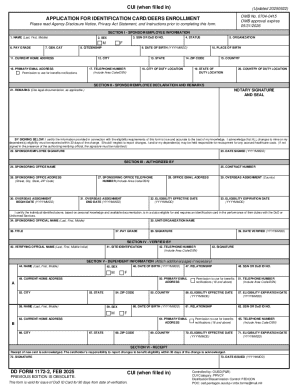

Step-by-step guide to filling out the form

Accessing the 2024 Declaration of Personal Form via pdfFiller is a straightforward endeavor. Simply visit pdfFiller's website, where you can create, edit, and manage your forms seamlessly. Using this platform offers several benefits, including easy navigation and user-friendly tools that simplify document preparation.

When filling out the various sections, start with personal information; ensure to include full names, addresses, and Social Security numbers accurately. In the financial section, it’s crucial to report your income comprehensively, which includes wages, rental earnings, and any other income under applicable tax laws. Understanding your tax residence is vital here, especially if you are living in different states or jurisdictions. Deductions and credits should also be carefully considered; many residents miss out on potential savings through accurate claims.

Review and edit your declaration

Reviewing your completed form is a critical step that can make a significant difference in your filing experience. Common errors to look out for include misreported income, missing signatures, and failing to use proper forms for deductions. Thorough checks can prevent costly issues down the line, such as audits or fines from the government.

With pdfFiller's editing features, users can easily make interactive corrections. The collaborative options available also allow team members to work together on necessary amendments, ensuring that all contributors can engage without confusion. The ease of making edits directly within the platform means you can turn potential mistakes into well-informed corrections before submitting the form.

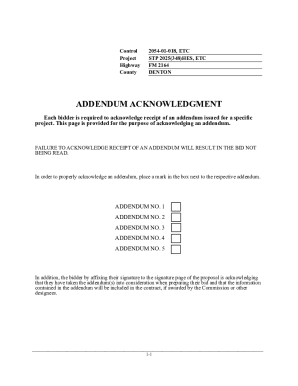

Signing and submitting your declaration

E-signing your form adds a layer of convenience that traditional methods lack. Using pdfFiller, you can electronically sign the 2024 Declaration of Personal Form with ease—allowing for a quicker turnaround. Benefits of electronic signatures extend beyond convenience, as they also enhance document security and authentication.

Once signed, submission methods vary; you can either submit online through pdfFiller, which will guide you step-by-step, or print and mail your form as traditional routes. Always keep an eye on submission deadlines, which can differ by jurisdiction, to ensure timely compliance.

Post-submission process

After submitting your 2024 Declaration of Personal Form, tracking its status should be on your radar. PdfFiller provides tools that enable users to monitor the progress of their submission, offering peace of mind as you wait for processing feedback. Knowing how to check the status can help alleviate anxiety and answer any further questions you may have about your tax obligations.

If amendments to your declaration are necessary after submission, know that you have options. Resources are available to guide you through the amendment process effectively, ensuring you can manage updates to your filing efficiently.

Resources and tools available

pdfFiller offers an array of interactive tools designed to benefit users as they prepare the 2024 Declaration of Personal Form. These tools include various forms and templates that can assist with tax documentation, while additional resources aid in overall document management. Learning how to navigate these options can make each filing season easier and more organized.

Furthermore, users can access customer support through pdfFiller by utilizing the help center. This section provides guides and contact information, enabling you to seek assistance from experts when needed, ensuring all questions are addressed, and your declarations are flawlessly submitted.

Common issues and solutions

Filing the 2024 Declaration of Personal Form may present several challenges. One of the biggest issues is ensuring that all income, including earnings from secondhand dealers and gross receipts tax, is accurately reported. Mistakes in reporting can lead to improper tax calculations and potential legal repercussions.

Avoiding these issues in the future can often stem from education and actively keeping up with new tax regulations that could affect your filing status. Engaging with continuous learning will prepare users for changing requirements in the tax landscape.

Frequently asked questions about the 2024 declaration

Addressing common questions regarding the 2024 Declaration of Personal Form can ease the minds of many filers. Questions may revolve around filing timelines, documentation needs, or understanding tax residency implications. One critical question is often about what to do in the event of an overpayment; knowing the procedures for refunds can save significant time and frustration.

Expert insights emphasize the importance of meticulous record-keeping throughout the year to simplify the filing process. Having a clear understanding of your financial situation will aid in identifying applicable tax credits, such as government assessments of tourist development tax and utility services.

Utilizing pdfFiller for future declarations

Planning ahead with pdfFiller can drastically improve your experience with future form submissions. By leveraging the platform's document management capabilities, users can easily maintain records for various forms, ensuring smooth processing for future requirements. pdfFiller's tools can facilitate the filing of not only the 2024 Declaration of Personal Form but also other essential documents related to taxes, including personal property tax filings, reemployment paperwork, and power of attorney requirements.

Ongoing use of pdfFiller for document management means that users not only benefit from streamlined processes but can also collaborate easily with team members. This collaboration ensures that future declarations and forms are timely and accurate, positioning users to take full advantage of available tax incentives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 2024 declaration of personal without leaving Google Drive?

How can I send 2024 declaration of personal for eSignature?

How can I fill out 2024 declaration of personal on an iOS device?

What is declaration of personal?

Who is required to file declaration of personal?

How to fill out declaration of personal?

What is the purpose of declaration of personal?

What information must be reported on declaration of personal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.