Get the free Sec Form 4

Get, Create, Make and Sign sec form 4

Editing sec form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sec form 4

How to fill out sec form 4

Who needs sec form 4?

Understanding Sec Form 4: A Comprehensive Guide for Insiders and Investors

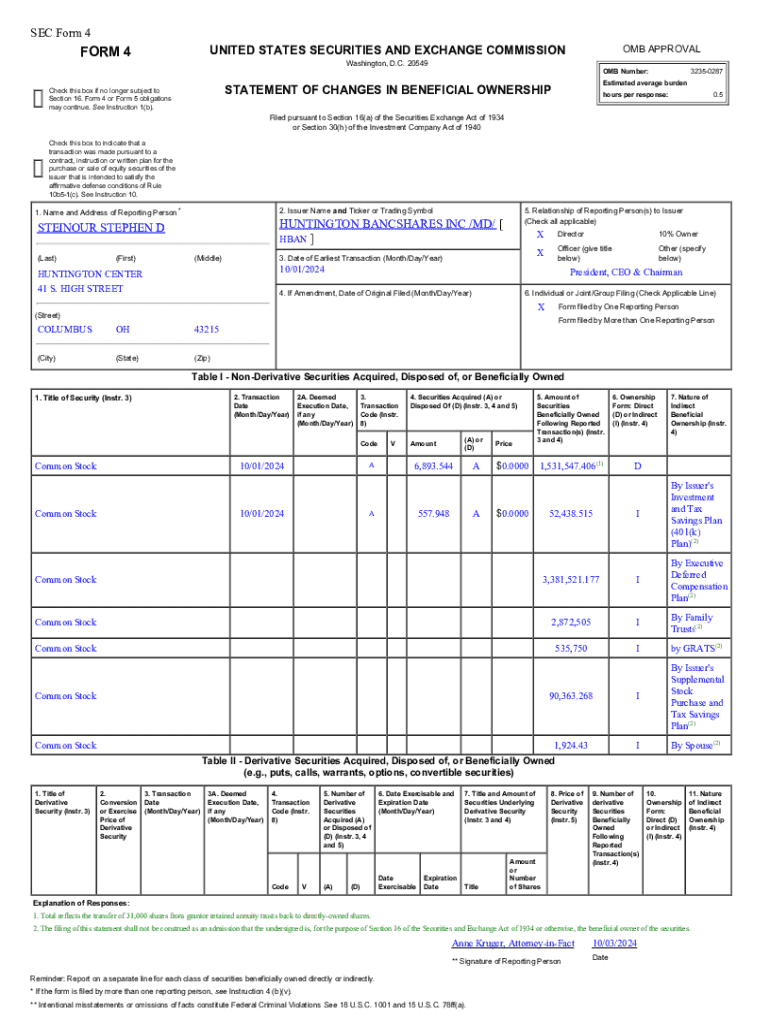

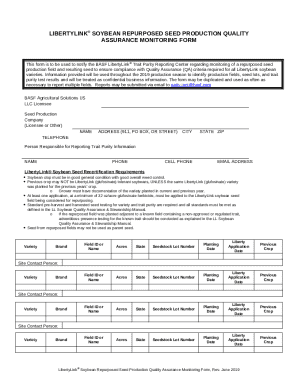

Overview of Sec Form 4

Sec Form 4 is a required filing with the United States Securities and Exchange Commission (SEC) that details changes in beneficial ownership of equity securities. This form plays a critical role in maintaining transparency in the financial markets, particularly concerning insiders such as executives, directors, and significant shareholders. Its significance lies in facilitating informed investment decisions by providing timely information about ownership changes, thereby fostering trust in the issuer's governance and operations.

All insiders, which include corporate officers, directors, and shareholders with at least 10% ownership, are mandated to file Sec Form 4 whenever they engage in a transaction involving the purchase or sale of the issuer's securities. The form helps to ensure that the SEC and the public are aware of these critical changes, therefore aiding in market integrity.

Purpose of Sec Form 4

The primary purpose of Sec Form 4 is to provide a transparent view of changes in beneficial ownership, enabling stakeholders, particularly investors, to make informed decisions based on the latest insider transactions. When insiders buy or sell shares, it may indicate their confidence or lack of confidence in the company’s future prospects. Therefore, securing detailed and timely reports of these transactions is essential for market participants.

Additionally, the filing of Sec Form 4 fulfills various legal implications and compliance requirements set forth by the SEC. Failure to comply can result in significant implications, including penalties and loss of investor trust. For investors, timely and accurate reporting can help identify trends in insider trading, potentially impacting investment strategies.

Background information

Sec Form 4 emerged from the broader regulatory framework established by the SEC to enhance financial reporting and transparency. In the 1960s, the SEC recognized the need for more stringent disclosure requirements, leading to the introduction of various forms, including Form 3 (initial ownership) and Form 5 (for annual reports of transactions not previously reported).

Key statutory requirements governing Form 4 submissions include detailed disclosure of transaction types, transaction dates, share amounts, and the relationship of the filer to the issuer. Understanding how Sec Form 4 interacts with related forms can help insiders stay compliant and informed about their reporting obligations.

Filing requirements and deadlines

All insiders, including officers, directors, and significant shareholders, are required to file Sec Form 4 upon any transaction resulting in a change in beneficial ownership. The critical filing deadline is within two business days of the transaction date. This tight timeframe emphasizes the importance of diligent record-keeping and immediate action following any transaction to remain compliant with SEC regulations.

Determining the number of shares to report requires careful attention to detail. Only transactions that result in a change in ownership must be reported, and insiders must accurately calculate their holdings post-transaction to ensure correct reporting.

Step-by-step guide to completing Sec Form 4

Filling out Sec Form 4 can seem daunting at first, but breaking it down into manageable steps simplifies the process. Here's a detailed step-by-step guide:

Editing and managing Sec Form 4 submissions

After submitting Sec Form 4, it’s crucial to establish a process for managing and editing submissions, especially if errors arise. If you notice an error post-submission, the SEC allows for amendments to be filed, which is crucial for maintaining compliance. Keeping a personalized filing record can significantly alleviate some stress linked with potential audits or inquiries from the SEC.

Filing amendments involves submitting a new Sec Form 4 with corrected information, clearly labeling it as an amendment to the original submission. This action not only appeases regulatory requirements but also maintains transparency.

Understanding potential impact of non-compliance

Failing to file Sec Form 4 or submitting inaccurate filings can lead to severe consequences. The SEC may impose substantial penalties, both financial and legal, which can harm the issuer's reputation and investor trust. Understanding these repercussions is essential for insiders to grasp the importance of timely and accurate reporting.

Best practices for maintaining compliance include maintaining an organized filing system, regularly updating transaction records, and working closely with compliance officers or legal advisors to mitigate risks effectively.

Frequently asked questions (FAQs)

Navigating the requirements of Sec Form 4 can lead to several questions. Below are some frequently asked questions to assist insiders and investors alike:

Interactive tools and resources

Utilizing interactive tools and resources can enhance the efficiency of managing filings like Sec Form 4. Tools such as pdfFiller’s document editing platform offer robust capabilities for filling out, managing, and tracking your filings with ease.

Interactive checklists ensure that all necessary information is included in your filing, while example filled-in forms serve as an excellent reference point for beginners or those unfamiliar with the process.

Using pdfFiller to manage your SEC filings

pdfFiller presents a seamless solution to manage SEC filings, including Sec Form 4. Its cloud-based document management capabilities allow users to access, edit, and store documents from any device, making it a flexible choice for busy professionals.

With features for collaboration and eSigning, users can ensure that all relevant parties can review and approve submissions promptly. pdfFiller streamlines the entire filing process, enabling users to submit their documents with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the sec form 4 in Chrome?

How do I edit sec form 4 on an iOS device?

How do I complete sec form 4 on an iOS device?

What is sec form 4?

Who is required to file sec form 4?

How to fill out sec form 4?

What is the purpose of sec form 4?

What information must be reported on sec form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.