Get the free Case 20-12313-tbm

Get, Create, Make and Sign case 20-12313-tbm

Editing case 20-12313-tbm online

Uncompromising security for your PDF editing and eSignature needs

How to fill out case 20-12313-tbm

How to fill out case 20-12313-tbm

Who needs case 20-12313-tbm?

A Comprehensive Guide to the case 20-12313-tbm Form

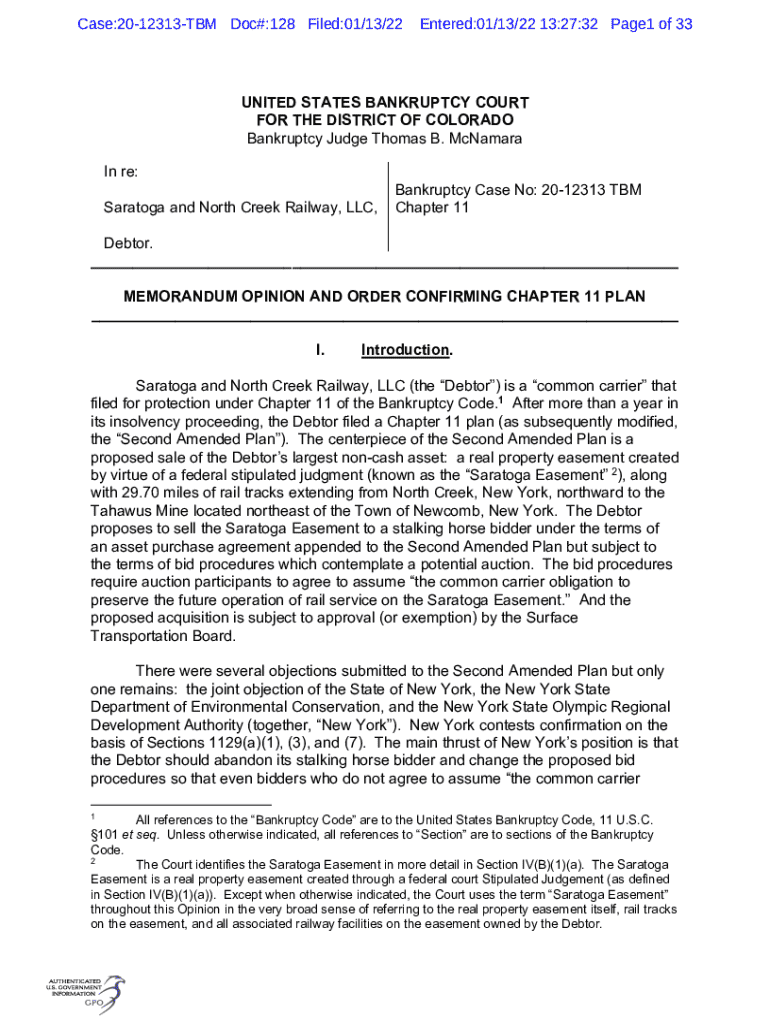

Overview of the case 20-12313-tbm form

The case 20-12313-tbm form serves a critical function within various administrative and judicial frameworks. Primarily, it is utilized to document information relevant to specific legal proceedings or administrative processes, ensuring that all necessary details are recorded accurately. The importance of this form cannot be understated, as even minor errors can result in delays or miscommunication within the handling of a case.

Accurate completion of the case 20-12313-tbm form is essential not only to facilitate smooth processing by relevant authorities, but also to uphold the integrity of the documentation involved. Key users of this form typically include individuals or teams involved in legal matters, such as attorneys, paralegals, and administrative staff who are engaged in compiling case-related documentation.

Understanding the layout of the case 20-12313-tbm form

The case 20-12313-tbm form is designed with a clear layout that facilitates easy navigation and completion. Understanding the distinct sections can greatly enhance the user’s efficiency in filling out the form accurately. Typically, the form is structured into three main areas: header information, body sections, and signature/submission areas.

It is critical to differentiate between required and optional fields within the form. Required fields often contain an asterisk (*) and must be filled out completely for the form to be valid, while optional fields may enhance the information provided but are not mandatory.

Step-by-step instructions for filling out the case 20-12313-tbm form

Filling out the case 20-12313-tbm form can seem daunting, but breaking it down into manageable steps simplifies the process significantly. The first step involves gathering all required information, which may include identification documents, previous court filings, or correspondence related to the case.

Throughout these steps, maintain a focus on accuracy and completeness, as errors can lead to significant delays in processing your case.

Editing the case 20-12313-tbm form

Editing forms is a critical aspect, especially if changes are needed after initial completion. Using tools designed for PDF editing can help streamline this process significantly. pdfFiller offers user-friendly functionality specifically tailored for handling the case 20-12313-tbm form.

Editing via pdfFiller also enables users to save variations of the form, making it simple to track changes or revert to previous versions as necessary.

eSigning the case 20-12313-tbm form

The digital signing of documents has become a standard practice, particularly in legal contexts such as the case 20-12313-tbm form. Understanding the importance of eSigning ensures that your form is legally binding and compliant with current regulations.

By eSigning the case 20-12313-tbm form within pdfFiller, users can enhance the efficiency of document workflows, allowing for quicker submissions and processing.

Collaborative features of pdfFiller for the case 20-12313-tbm form

Collaboration is vital when multiple stakeholders are involved in legal cases. pdfFiller provides robust features that enable users to share the case 20-12313-tbm form with team members or legal advisors effortlessly.

These collaborative features not only reduce the chances of miscommunication but also help maintain the integrity and accuracy of the case-related documents.

Managing the case 20-12313-tbm form post-submission

After submitting the case 20-12313-tbm form, effective management ensures that users can track progress and retrieve information as necessary. By leveraging pdfFiller’s organizational tools, users can maintain a systematic approach to document management.

This comprehensive management strategy can make a significant difference in effectively navigating the complexities of legal documentation.

Troubleshooting common issues with the case 20-12313-tbm form

Encountering issues while filling out or submitting the case 20-12313-tbm form is not uncommon. Some common mistakes include incomplete fields and errors in data entry. By recognizing and addressing these potential pitfalls, users can avoid unnecessary delays.

A frequently asked questions (FAQ) section can also provide valuable insights into common concerns users may have, fostering better understanding and navigation of the process.

Additional tips for success with the case 20-12313-tbm form

Navigating the case 20-12313-tbm form can be streamlined by implementing best practices throughout the process. Start by creating a checklist of all necessary documents and information to ensure efficiency when filling out and submitting the form.

Following these strategies helps create a streamlined workflow and enhances accuracy in handling case documentation.

Legal and compliance considerations

Understanding legal and compliance considerations surrounding the case 20-12313-tbm form is paramount. It is essential for users to be aware of regulations governing electronic submissions, which can vary by jurisdiction.

By adhering to these legal standards, users can ensure their documentation remains valid and recognized within the necessary legal frameworks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send case 20-12313-tbm to be eSigned by others?

How do I complete case 20-12313-tbm online?

How do I fill out case 20-12313-tbm using my mobile device?

What is case 20-12313-tbm?

Who is required to file case 20-12313-tbm?

How to fill out case 20-12313-tbm?

What is the purpose of case 20-12313-tbm?

What information must be reported on case 20-12313-tbm?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.