Get the free Mgt 9

Get, Create, Make and Sign mgt 9

How to edit mgt 9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mgt 9

How to fill out mgt 9

Who needs mgt 9?

MGT 9 Form - How-to Guide

Understanding the MGT 9 Form

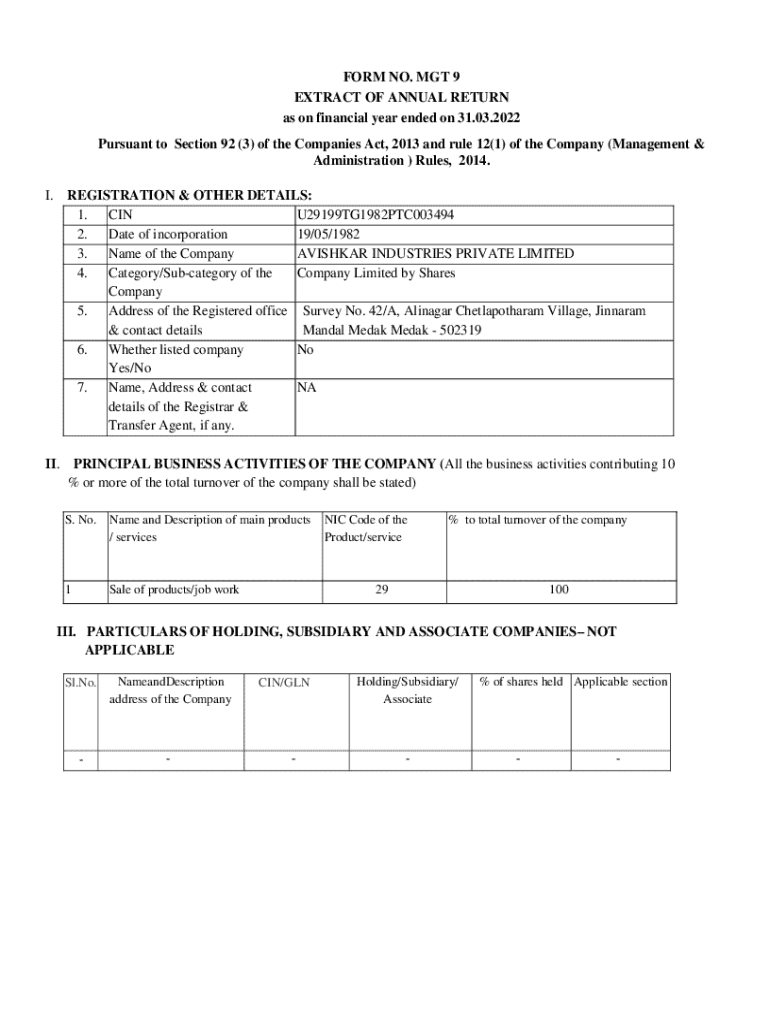

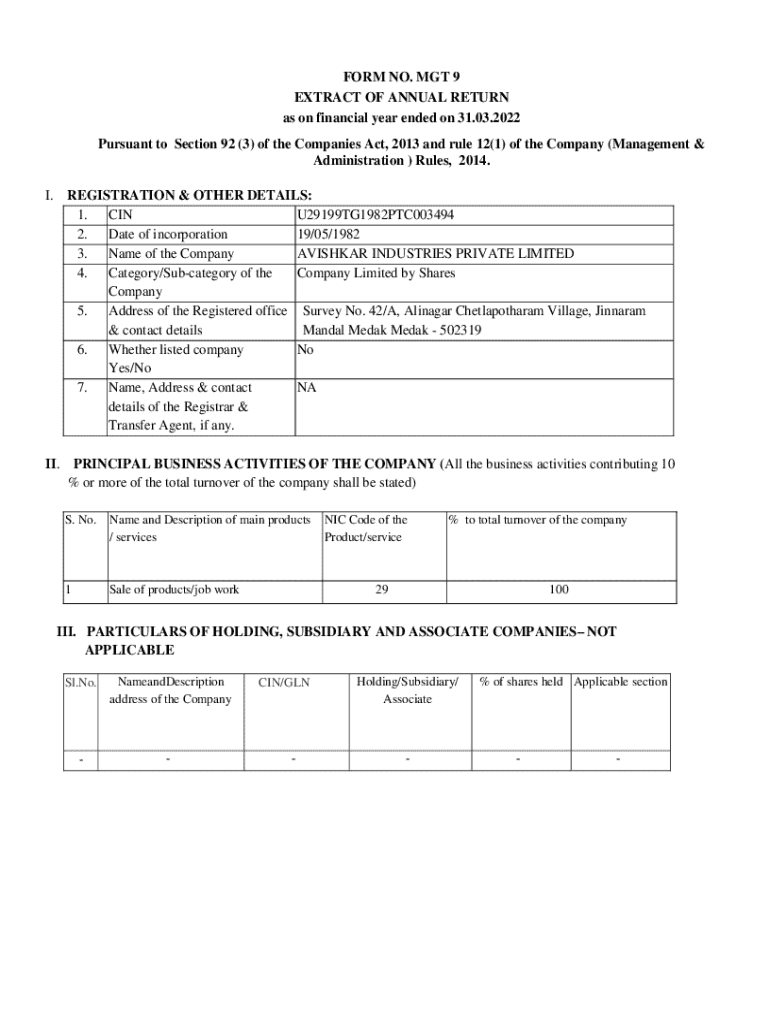

The MGT 9 Form is a crucial document for companies in the corporate governance landscape. It serves as a report detailing the company’s shareholding structure, information about shareholders, and any changes that occurred during the financial year. This form is mandated by regulatory authorities to promote transparency and compliance, making it essential for companies to maintain accurate and up-to-date records to avoid potential penalties.

Compliance with the MGT 9 Form is important for annual filings, as it helps stakeholders understand the distribution of shareholding and the owner’s influence on company decisions. Furthermore, it builds trust and ensures that stakeholders, including investors, can make informed decisions based on accurate data.

Who needs to fill out the MGT 9 Form?

Entities, primarily public and private companies, are required to submit the MGT 9 Form. This includes companies that have issued shares to the public as well as those with a limited number of shareholders. Moreover, directors and stakeholders of the company are also responsible for ensuring the accuracy of this documentation, as discrepancies can lead to questions from regulatory authorities.

Shareholders, particularly those who hold significant stakes, should also engage with the MGT 9 form, as it reflects their equity ownership and can affect their voting power at shareholder meetings. Understanding the responsibilities tied to the MGT 9 Form is vital for all these parties to maintain compliance and transparency.

Key components of the MGT 9 Form

The MGT 9 Form is divided into several sections, each requiring specific information. Understanding these sections is critical for complete and correct submission. Common sections include details about the company, shareholder information, and disclosures on changes to shareholding. Each section involves providing details such as names of shareholders, their addresses, the number of shares held, and any changes in shareholdings during the financial year.

Furthermore, attention to detail is paramount. Accurate data submission not only facilitates compliance but also avoids unnecessary queries from regulatory authorities. Inaccuracies can lead to rejections or further investigations, complicating the filing process.

How to fill out the MGT 9 Form

Filling out the MGT 9 Form can seem daunting, but breaking it down into manageable steps makes the process easier. Begin with gathering all necessary information about the company and its shareholders before starting the form. Accurate data entry is key, as mistakes may lead to compliance issues.

Step-by-step instructions include: Start with the company details section, continue to the shareholder information, and finish by completing the changes section. Using checklists can help ensure no step is missed. Furthermore, clarity of presentation is vital; employing consistent formatting standards can enhance readability.

Tools for facilitating filling

Utilizing platforms like pdfFiller can significantly streamline the process of filling the MGT 9 Form. With pdfFiller, users can edit, sign, and share documents seamlessly from their cloud-based accounts. The tool also features interactive components that allow for real-time collaboration, ensuring all stakeholders can contribute accurately.

Additionally, pdfFiller offers templates and tools that can further simplify the filling process for the MGT 9 Form, allowing for efficient document management without the usual hurdles.

Filing the MGT 9 Form

After completing the MGT 9 Form, knowing where and how to file it is the next step. Generally, the form is submitted to the Registrar of Companies (RoC), adhering to specific deadlines set by regulatory authorities that are often tied to the company’s financial year-end.

Electronic filing options are available and offer several benefits including faster processing times and reduced paperwork. Companies should familiarize themselves with the digital platforms available for submission, including permitted file formats and compliance with submission guidelines.

MGT 9 Form and other regulatory requirements

The MGT 9 Form holds significance beyond its immediate filing as it often needs to accompany the Directors' Report during annual general meetings. It is pivotal to ensure that the MGT 9 document is correctly attached and referenced within the Directors' Report for regulatory compliance.

Furthermore, a careful balance between MGT 9 and the MGT 7 form, which deals with annual returns, is essential. Companies must ensure that these documents are not only properly completed but also accessible on the company’s website for stakeholder review and due diligence.

Interactive tools and resources

Leveraging digital platforms like pdfFiller provides a wealth of interactive tools specifically geared toward facilitating the MGT 9 Form. Key features such as electronic signatures, real-time editing capabilities, and cloud storage ensure that users can manage their documents efficiently while maintaining compliance.

The platform also includes a robust FAQ section and customer service support, addressing common concerns or queries that may arise during the filing process. This resource availability enhances user experience and assists in maintaining high compliance standards.

Navigating challenges with MGT 9 Form

In the event of rejections or queries regarding an MGT 9 submission, companies need to act promptly. A clear set of steps includes reviewing the feedback received, gathering any additional required documentation, and resubmitting the form in adherence to the specified guidelines.

Creating an internal process for monitoring submissions can provide significant foresight and facilitate efficient handling of any arising issues, ensuring ongoing compliance and smooth operations for the company.

Engaging with the community

Being part of forums and discussion boards focusing on MGT 9 filings can provide insights and collective knowledge sharing among business peers. Engaging in dialogue around experiences, challenges, and solutions related to the MGT 9 Form not only fosters a sense of community but also aids in collective learning.

Staying connected and updated with the latest posts and regulations regarding MGT compliance is crucial for companies. Encourage the participation in sharing trends and best practices to enhance the understanding of the changing regulatory landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mgt 9 to be eSigned by others?

Where do I find mgt 9?

How do I make changes in mgt 9?

What is mgt 9?

Who is required to file mgt 9?

How to fill out mgt 9?

What is the purpose of mgt 9?

What information must be reported on mgt 9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.