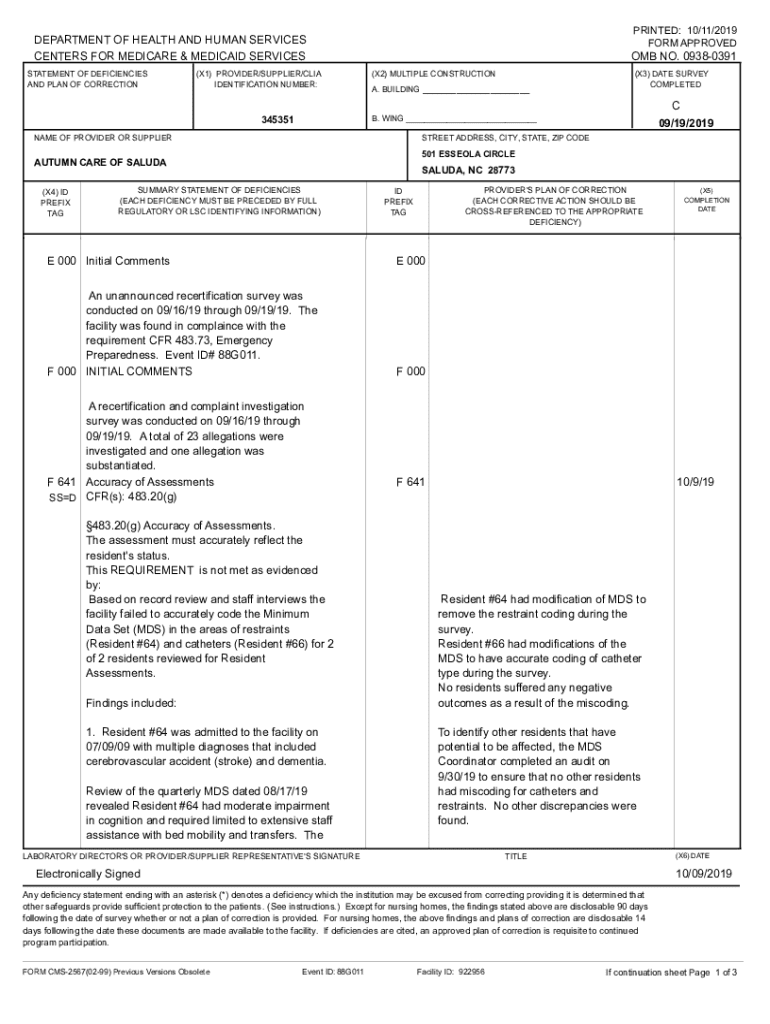

Get the free printed: 01/04/2024 form approved

Get, Create, Make and Sign printed 01042024 form approved

Editing printed 01042024 form approved online

Uncompromising security for your PDF editing and eSignature needs

How to fill out printed 01042024 form approved

How to fill out printed 01042024 form approved

Who needs printed 01042024 form approved?

Your Comprehensive Guide to the Printed 01042024 Form Approved Form

Overview of the printed 01042024 form approved form

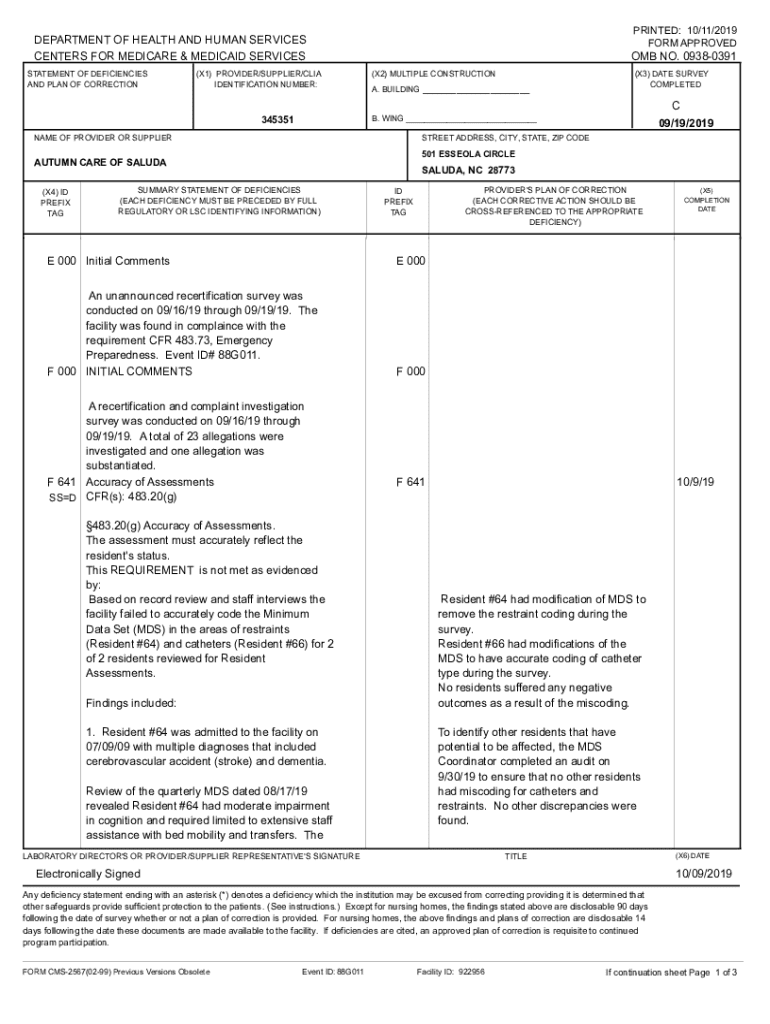

The printed 01042024 form approved form serves a vital role in a variety of administrative processes across multiple sectors. This form is crucial for ensuring compliance with specific regulatory requirements, particularly for residents in regions such as Colorado. Its design aims to collect relevant data efficiently while adhering to the guidelines set forth by the Department of Revenue.

The approved version of the form includes several key features that distinguish it from earlier iterations or alternative digital formats. Notably, it simplifies data input, enhances clarity, and minimizes the risk of errors, which is essential for income tax returns and other official submissions. Understanding the differences between the printed and digital versions helps users choose the appropriate method based on their specific needs.

Understanding the printed 01042024 form approved form

Delving deeper into the structure of the printed 01042024 form reveals a well-organized layout designed for user convenience. The form typically comprises several sections, including personal information, tax details, and necessary declarations. Each section is intricately designed to facilitate accurate reporting without overwhelming the user.

Notably, certain fields in the form are mandatory while others are optional. Mandatory fields usually encompass vital information such as identification numbers and income levels, which are crucial for calculating tax liabilities. Optional fields may include additional information that can, however, enhance the accuracy of the submission when provided.

Step-by-step guide to filling out the printed 01042024 form

Completing the printed 01042024 form involves a few essential steps to ensure accuracy and compliance. The first step is gathering all necessary information. Commonly required details may include your personal identification, income sources, and any previous filing history. Having recommended documents such as your previous income tax return can streamline this process.

Once you have your information ready, the next step is filling out the form. For each section, start with clear entries, ensuring that you adhere to character limits where applicable. One key tip to avoid common mistakes is to double-check that fields meant for numerical input only contain numbers. It’s also critical to take your time with optional fields; while they’re not required, they can provide valuable context.

In the final step, reviewing and finalizing your form is non-negotiable. Always proofread for any typographical errors or omissions. Check all required fields to ensure they are complete and accurate before submission, as overlooking minor details could lead to processing delays. This thoroughness will contribute to a smoother experience with your tax filings or other official submissions.

Options for editing and managing the printed 01042024 form

Editing the printed 01042024 form has never been easier, thanks to tools like pdfFiller. These tools allow users to enter information, adjust layouts, or even erase errors with remarkable ease. New features on this platform enhance the overall user experience by allowing interactive edits, unlike traditional methods where paper and pen reign supreme.

For users looking to modify a physical copy of the printed form, uploading a scanned version to pdfFiller can be an efficient route. Once uploaded, users can employ the editing tools available in pdfFiller to make necessary changes. Compared to editing a digital form, printed forms require a slightly different approach, emphasizing the importance of having access to quality scanning tools to preserve the integrity of the original document.

eSigning the printed 01042024 form

The eSigning process has streamlined the way individuals complete the printed 01042024 form. After filling out the necessary information, users can easily apply electronic signatures using pdfFiller's platform. This process is not only efficient but also integrates well with legal requirements across many institutions.

To eSign the form, start by uploading your completed document on pdfFiller. The platform will prompt you to create or select an existing signature. After placing your eSignature on the designated area, ensure you save the document to reflect these changes. Importantly, eSignatures hold legal significance and are widely accepted across various sectors, mitigating the need for physical presence during transactions.

Interactive tools to enhance your experience

Utilizing interactive tools in pdfFiller can significantly improve your experience with the printed 01042024 form. One notable feature is real-time collaboration, enabling users to share their progress with teammates for feedback or additional input. This can be particularly beneficial for teams preparing government submissions where accuracy is paramount.

Moreover, automated reminders are another perk of using pdfFiller, ensuring you never miss critical deadlines. These automated notifications help users manage their documents more effectively, allowing for timely submissions and communication with relevant parties. Incorporating templates designed specifically for the printed 01042024 form can further expedite the editing process, ensuring repeated accuracy and efficiency.

Troubleshooting common issues

While utilizing the printed 01042024 form may seem straightforward, users can encounter some challenges. A common issue is the misinterpretation of sections within the form, leading to errors in filling out critical information. Understanding the form's layout and purpose for each section can alleviate some of these misunderstandings.

Additionally, technical difficulties when editing or signing the form may arise, especially for those unfamiliar with digital tools. To resolve these issues, take time to familiarize yourself with the editing features on pdfFiller. If problems persist, consulting the help resources or customer support available on the platform can guide you in troubleshooting and resolving these concerns effectively.

Real-world applications and success stories

To underline the efficacy of the printed 01042024 form, several real-world success stories demonstrate how individuals and teams have navigated the intricacies of form completion. For instance, a resident in Colorado shared their experience of successfully using the revised form to manage income tax returns after a recent job change, which streamlined their process and ensured compliance.

Additionally, a division within a state government reported a marked improvement in processing speed after adopting pdfFiller for form submissions. This success was attributed to the ease of electronic signatures and the elimination of physical paperwork, which often led to delays. Testimonials like these showcase not only the functionality of the printed 01042024 form but also its wider implications across various sectors.

FAQs about the printed 01042024 form approved form

Addressing concerns regarding the printed 01042024 form can help users navigate its complexities. Frequent questions include: 'What should I do if the form gets rejected?' In this case, reviewing the rejection reason and making the required changes before resubmitting is critical to compliance.

Another common inquiry is about saving progress while filling the form in pdfFiller. Users can conveniently save their progress and return to complete it later, ensuring no information is lost. Additionally, many users wonder about the acceptable formats for submission alongside the printed form; typically, accompanying documents should also be in PDF or other recognized formats to ensure compatibility.

Final tips for using the printed 01042024 form effectively

To maximize your experience with the printed 01042024 form, consider implementing best practices such as keeping your personal information organized in a centralized location for easy access during form completion. Regularly revisiting the pdfFiller platform can provide insights into updates or new features that may streamline your documentation processes further.

Moreover, utilizing additional resources or tools available through pdfFiller can enhance your form-filling experience significantly. Engage with user tutorials, participate in forums for shared experiences, and explore the extensive support options offered by the platform to complement your journey with the printed 01042024 form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute printed 01042024 form approved online?

Can I create an electronic signature for the printed 01042024 form approved in Chrome?

How do I complete printed 01042024 form approved on an iOS device?

What is printed 01042024 form approved?

Who is required to file printed 01042024 form approved?

How to fill out printed 01042024 form approved?

What is the purpose of printed 01042024 form approved?

What information must be reported on printed 01042024 form approved?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.