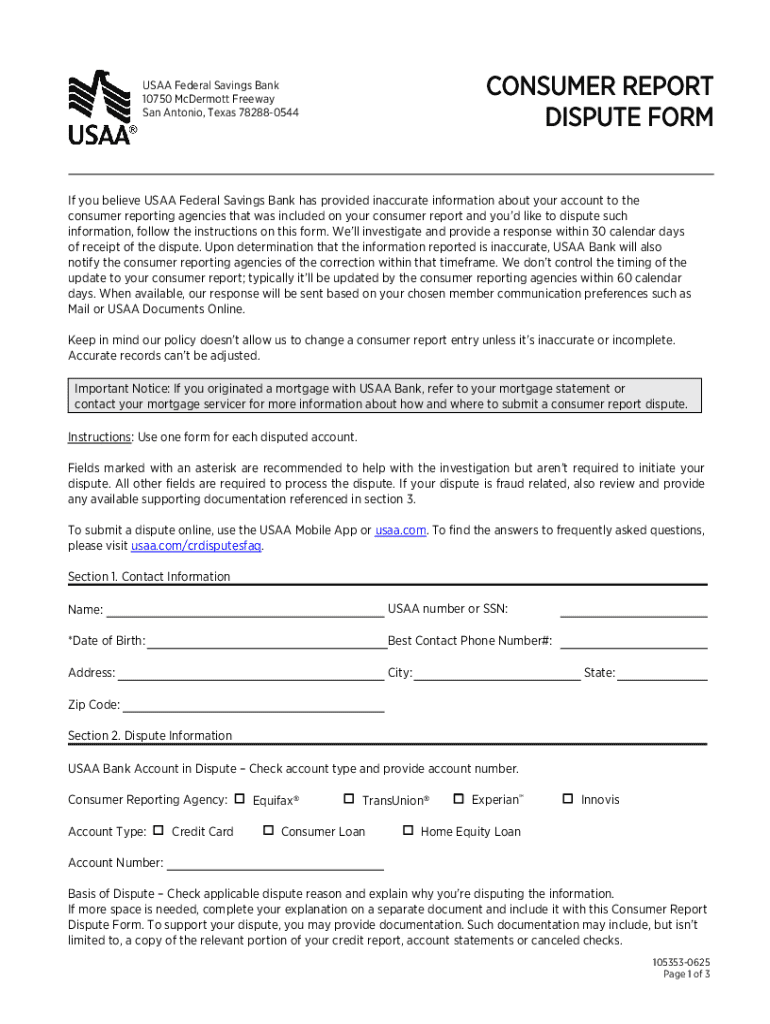

Get the free Consumer Report Dispute Form

Get, Create, Make and Sign consumer report dispute form

How to edit consumer report dispute form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consumer report dispute form

How to fill out consumer report dispute form

Who needs consumer report dispute form?

A Comprehensive Guide to the Consumer Report Dispute Form

Understanding consumer report disputes

Consumer reports are detailed records of an individual's credit history, used by lenders and creditors to assess creditworthiness. They play a crucial role in determining loan approvals, interest rates, and credit limits. Disputing errors in your consumer report is vital; inaccuracies can lead to higher interest rates or loan denials, affecting your financial health.

Common errors include incorrect personal information such as name, address, and social security number; fraudulent accounts stemming from identity theft; and inaccuracies regarding payment history or account balances. Addressing these errors promptly can prevent long-term damage to your credit score.

Preparing for the dispute process

Before initiating a dispute, it’s essential to gather relevant documents. This includes your identification, proof of income, and any supporting evidence that substantiates your claim. Understanding your rights under the Fair Credit Reporting Act (FCRA) is crucial, as it provides guidelines on your right to dispute inaccuracies at no cost and requires credit reporting agencies to investigate your claims.

In addition, it's advisable to check all three major credit bureaus — Equifax, Experian, and TransUnion — since discrepancies can occur across different agencies. Each bureau may have different information, and checking all provides a comprehensive view of your credit status.

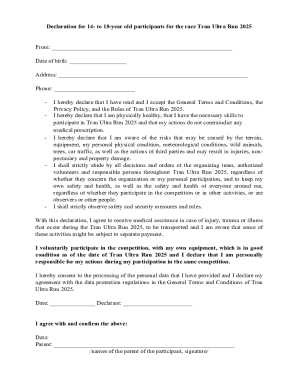

How to use the consumer report dispute form

Accessing the consumer report dispute form on pdfFiller is straightforward. Once you locate the form, a step-by-step guide can ease the completion process. Start with the Personal Information Section, where you’ll input your name, address, and social security number.

Next, identify the specifics of your dispute. Be clear about the errors you are highlighting. If applicable, explain how these inaccuracies have impacted your financial standing or credit score. Effective communication is crucial; use concise language and provide concrete examples to ensure clarity.

Submitting the dispute

Once you've filled out the consumer report dispute form, you can choose how to submit it. Online submissions are often faster, while mailed copies may offer a tangible record. Whichever method you choose, ensure you have a tracking system in place, whether it's a confirmation email or a receipt of mailing. Keeping a log of your submission date and any subsequent communications with the credit bureau is also advisable.

A proactive approach improves the chances of a successful dispute. Set reminders for follow-ups to check on the status of your dispute, depending on the timelines provided by the credit reporting companies.

What to expect after submission

After submission, it’s essential to understand what follows. Credit reporting companies are typically required to respond to disputes within 30 days. You can check for updates through their online portals or customer service lines. If your dispute is denied, request a detailed explanation and verify the accuracy of their response.

Following up is critical. If you find that the error persists post-dispute, you may want to escalate the matter, potentially by directly contacting the creditor in question or seeking additional legal advice if necessary.

Disputing with the reporting company

If the error originated from a lender or creditor, further steps are needed. First, reach out to the reporting company directly. Prepare your case with all supporting documentation, including correspondence and evidence that verifies your claim. It's essential to maintain transparency and clarity in your communications with them to facilitate an effective resolution.

If necessary, you can escalate your issue by filing an official complaint with the Consumer Financial Protection Bureau (CFPB). This involves submitting your documented evidence, outlining your dispute clearly, and detailing your communications. Being persistent is vital when correcting your report.

Testing your document with pdfFiller’s interactive tools

Utilizing pdfFiller's tools allows you to edit, sign, and collaborate on your consumer report dispute form in real-time. This cloud-based solution ensures that you can work from anywhere, a key feature for busy individuals and teams who may need to collaborate on sensitive matters. The real-time editing capabilities allow for immediate feedback and revisions, securing document accuracy and ensuring thoroughness.

Furthermore, storing documents securely in the cloud offers peace of mind. Backing up sensitive documents reduces the risk of loss and enables easy retrieval for future needs, especially if disputes arise.

Beyond the dispute: protecting your credit report

After successfully disputing an error, it's crucial to manage your credit proactively. Regularly check your credit report, ideally once a year through sites that offer free reports from the major bureaus. This vigilance allows you to identify potential issues before they become larger problems. Consider signing up for credit monitoring services for real-time updates.

In addition, best practices such as paying bills on time, reducing outstanding debts, and avoiding unnecessary credit inquiries will contribute positively to your overall credit health. If additional assistance is needed, legal resources are available for those facing persistent credit issues or severe inaccuracies.

Frequently asked questions about consumer report disputes

Understanding the timeline for a dispute's resolution can be vital for planning. Typically, credit reporting companies respond within 30 days, though complex disputes may take longer. If you lack all necessary documents, you can still initiate a dispute; however, providing as much evidence as possible enhances your chances of a favorable outcome.

If your dispute isn’t resolved satisfactorily, you have the right to request that the creditor or reporting agency provide a statement reflecting your position on the matter. This ensures that your perspective is included in your credit history, protecting your interests.

Legal considerations for credit report disputes

Understanding your legal rights under the FCRA is paramount. If you experience systemic inaccuracies or unresolved disputes, seeking legal assistance may be necessary. Legal experts can guide you on filing complaints with the CFPB or pursuing additional recourse through litigation.

Additionally, ensure that your credit bureaus adhere to the regulations; failure to do so can lead to penalties or lawsuits. Staying informed about your rights allows you to advocate effectively for yourself and address any inaccuracies in the services provided by credit reporting agencies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my consumer report dispute form in Gmail?

How do I edit consumer report dispute form straight from my smartphone?

How do I edit consumer report dispute form on an Android device?

What is consumer report dispute form?

Who is required to file consumer report dispute form?

How to fill out consumer report dispute form?

What is the purpose of consumer report dispute form?

What information must be reported on consumer report dispute form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.